AllianzGI insists EU large caps link exec pay to ESG KPIs

Summary

Allianz Global Investors, one of the world’s leading active investment managers, has today published its annual analysis of how it voted at AGMs around the globe, with figures from 2021, covering nearly 110,000 shareholder and management proposals, revealing a continued and stark disparity in corporate governance standards across the world.

- AllianzGI will vote against European large caps that do not include ESG KPIs in executive remuneration policies

- Compensation-related proposals most contentious area globally

Allianz Global Investors, one of the world’s leading active investment managers, has today published its annual analysis of how it voted at AGMs around the globe, with figures from 2021, covering nearly 110,000 shareholder and management proposals, revealing a continued and stark disparity in corporate governance standards across the world.

AllianzGI adopts a highly active, globally consistent approach to stewardship and has a track record of voting against proposals that do not meet its expectations of investee companies as well as fulfilling its duty to act in the interests of clients by considering each proposal on merit. Over the course of 2021, AllianzGI participated in 10,190 (2020: 10,183) shareholder meetings and voted against, withheld or abstained from at least one agenda item at 68% (2020: 72%) of all meetings globally. It opposed 21% (2020: 23%) of all resolutions globally.

AllianzGI has made several amendments to its voting policy in 2022, including strengthening its Global Corporate Governance guidelines with regards to sustainability related issues. It expects European large-caps to include ESG KPIs in executive remuneration policies and will vote against pay policies in 2023 if this is not included. AllianzGI also strengthened its voting rules with respect to ethnic diversity in the UK and US, making it clear that it expects companies in these countries to come up with a diversity approach beyond gender.

Commenting, Matt Christensen. Global Head of Sustainable and Impact Investing at Allianz Global Investors, said:

“As an active investor, exercising our voting rights is one of the most powerful tools we have to effect change. In keeping with our desire to shape a more sustainable future with measurable positive outcomes, we want to ensure that our investee companies align their executive remuneration policies with ESG KPIs and we will vote against those that don’t. “

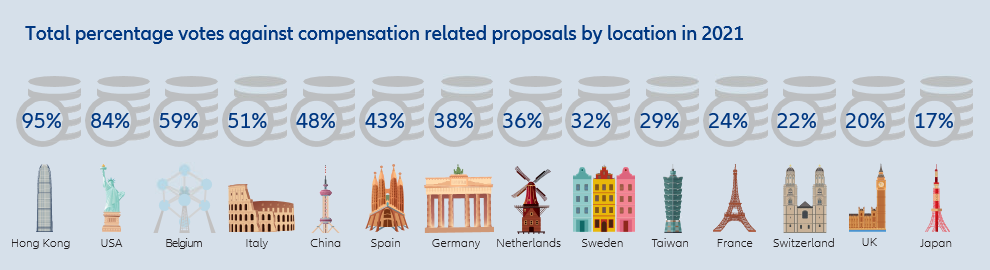

Executive compensation

Compensation-related proposals once again stood out as the most contentious area globally, with AllianzGI voting against 47% (2020:49%) of all compensation related management proposals during the year. AllianzGI’s abstentions on compensation proposals globally remained broadly unchanged at 6% which reflects a growing number of engagements with investee companies seeking improvements in compensation plans.

In 2021, AllianzGI amended its Proxy Voting Guidelines, scrutinizing generous pay proposals on a case-by-case basis whenever companies received substantial direct state aid, substantial lay-offs were recorded or dividends were cut (not prescribed by regulators) as a result of the Covid-19 pandemic.

As in 2021, AllianzGI continues to closely monitor companies’ renumeration policies in the context of the Covid-19 Pandemic.

Environmental and social factors in focus

2021 was the first year that companies tabled resolutions seeking shareholder consent on their climate strategy. Consequently, AllianzGI developed specific voting guidelines mapping out its expectations that a company provide clear targets and milestones and commit to reporting annually, following established reporting frameworks for investors to judge progress. AllianzGI’s voting decision on climate was often taken after engagement with the company where it clarified the details of the climate strategy being put to vote, its ambition level and whether companies would commit to annual updates for investors to judge progress. AllianzGI voted on 31 climate-related resolutions raised by management at 30 companies. It supported all of them, acknowledging that the companies tabling these resolutions were first movers in 2021. AllianzGI will be applying more rigorous benchmarking going forward as ‘say on climate’ resolutions become more prevalent and market standards on these votes evolve.

As part of its encouragement of high-emitting companies to put their climate strategy to vote, AllianzGI supported all shareholder resolutions requesting non-binding advisory votes on climate action plans. It also supported 83% of proposals requesting improved reporting on climate change and 100% of proposals on community environmental impact.

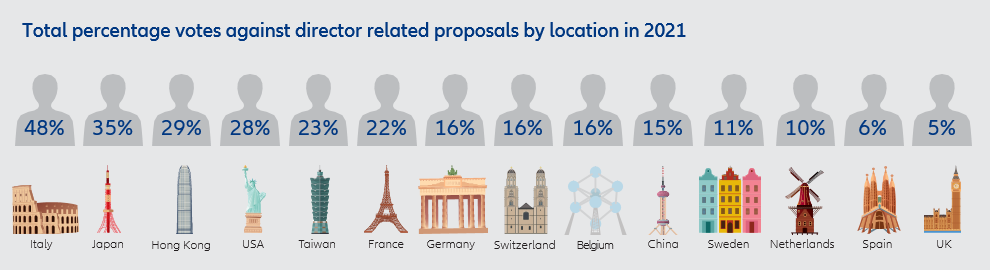

Promoting high-quality boards

Despite a slight decrease in votes against director related proposals, (23% in 2021 vs. 26% in 2020), major concerns remain with respect to a balanced set-up of many boards. AllianzGI voted against many companies where the board of directors and/or board committees were not sufficiently independent because of directors with long tenure or who are representatives from major shareholders. This was a particular concern in the US.

Over-boarding also remains a major issue. AllianzGI decided to scrutinize director commitments in particular where companies were hit strongly by the economic implications of COVID and directors had a high number of commitments or were in an executive position at the same time.

Total percentage votes against all proposals by location in 2021

|

United Kingdom |

4% |

|

Sweden |

10% |

|

Spain |

11% |

|

Netherlands |

12% |

|

China |

15% |

|

Germany |

17% |

|

Taiwan |

18% |

|

Switzerland |

18% |

|

Belgium |

20% |

|

France |

20% |

|

Hong Kong |

25% |

|

Italy |

32% |

|

Japan |

32% |

|

USA |

40% |

Total percentage votes against compensation related proposals by location in 2021

|

Japan |

17% |

|

United Kingdom |

20% |

|

Switzerland |

22% |

|

France |

24% |

|

Taiwan |

29% |

|

Sweden |

32% |

|

Netherlands |

36% |

|

Germany |

38% |

|

Spain |

43% |

|

China |

48% |

|

Italy |

51% |

|

Belgium |

59% |

|

USA |

84% |

|

Hong Kong |

95% |

Total percentage votes against director related proposals by location in 2021

|

United Kingdom |

5% |

|

Spain |

6% |

|

Netherlands |

10% |

|

Sweden |

11% |

|

China |

15% |

|

Belgium |

16% |

|

Switzerland |

16% |

|

Germany |

16% |

|

France |

22% |

|

Taiwan |

23% |

|

USA |

28% |

|

Hong Kong |

29% |

|

Japan |

35% |

|

Italy |

48% |

Source: AllianzGI proxy voting data.

For further information please contact

Sarah Einig +44 203 246 7846 sarah.einig@allianzgi.com

Notes to editors

AllianzGI provides real time disclosure of all votes cast, including commentary on votes against management and abstentions. To view AllianzGI’s Global Proxy voting tool, please visit https://vds.issgovernance.com/vds/#/MjQwMQ==/

For more information on AllianzGI’s approach to active stewardship, please visit: https://www.allianzgi.com/en/our-firm/esg/documents#keypolicydocumentsandreports

About Allianz Global Investors

Allianz Global Investors is a leading active asset manager with over 700 investment professionals in 23 offices worldwide and managing EUR 647 billion in assets. We invest for the long term and seek to generate value for clients every step of the way. We do this by being active – in how we partner with clients and anticipate their changing needs, and build solutions based on capabilities across public and private markets. Our focus on protecting and enhancing our clients’ assets leads naturally to a commitment to sustainability to drive positive change. Our goal is to elevate the investment experience for clients, whatever their location or objectives.

Active is: Allianz Global Investors

Data as at 30 September 2021

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security. The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed, and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction, or transmission of the contents, irrespective of the form, is not permitted. This material has not been reviewed by any regulatory authorities. In mainland China, it is used only as supporting material to the offshore investment products offered by commercial banks under the Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations. This document does not constitute a public offer by virtue of Act Number 26.831 of the Argentine Republic and General Resolution No. 622/2013 of the NSC. This communication's sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of his document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Brazil, Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Pacific Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional/professional investors only, and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide financial services to retail clients in Australia. AllianzGI AP (Australian Registered Body Number 160 464 200) is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of financial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which differ from Australian laws. This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors U.S. LLC, an investment adviser registered with the U.S. Securities and Exchange Commission; Allianz Global Investors Distributors LLC, distributor registered with FINRA, is affiliated with Allianz Global Investors U.S. LLC; Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG; Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; Allianz Global Investors Japan Co., Ltd., registered in Japan.

Admaster: 2037884

AllianzGI announces succession plan for leading Global Technology team

Summary

March 30, 2022 – NEW YORK – Allianz Global Investors (“AllianzGI”), one of the world’s leading active asset managers, announced today succession plans for its Global Technology investment team, which has been led by Walter Price since inception.