Embracing Disruption

The investment implications of a slimmer world

Hailed in some quarters as “wonder drugs” and popularized by celebrity endorsements from the likes of Oprah Winfrey and Elon Musk, glucagon-like peptide-1 (GLP-1) receptor agonists are a class of medicines that has taken both the healthcare and investment worlds by storm over the past year. Better known to the public under several proprietary names, these drugs are already disrupting the pharmaceuticals and MedTech sectors, and we believe their impact beyond these is likely to be broad and profound.

A pharmaceutical breakthrough

Simply put, GLP1s are a class of drugs that make recipients feel sated for longer, eat less, and thus lose weight. These drugs were originally intended to stimulate insulin production, reducing blood sugar levels and serving as an effective treatment for type-2 diabetes; however, weight loss came as a serendipitous side effect and is now becoming what GLP1s are best known for. And there is growing evidence that these drugs can also have other positive outcomes, such as a reduction in cardiovascular events – for instance, heart attacks and strokes – as well as serving as an anti-addiction treatment.

These clinical effects are certainly impressive in themselves, but the hype around these drugs can only be fully understood by considering the demographic trends which they may help address. Studies estimate that around 70% of the US population is overweight, with 40% being obese and 10% severely obese. This means that around 120 million of the current US population is considered obese, a number forecast to rise to 150 million by 2030. Moreover, around one in ten Americans are currently diabetic, with over 90% of these having type-2. And while this is traditionally a disease affecting the over45s, we are increasingly seeing its development in young adults and even children. While the described trends pertain to the US, the global situation is similar. In 2020, it was estimated that around 38% of the world’s population aged five or over was overweight, a number expected to increase to over 50% by 2035.

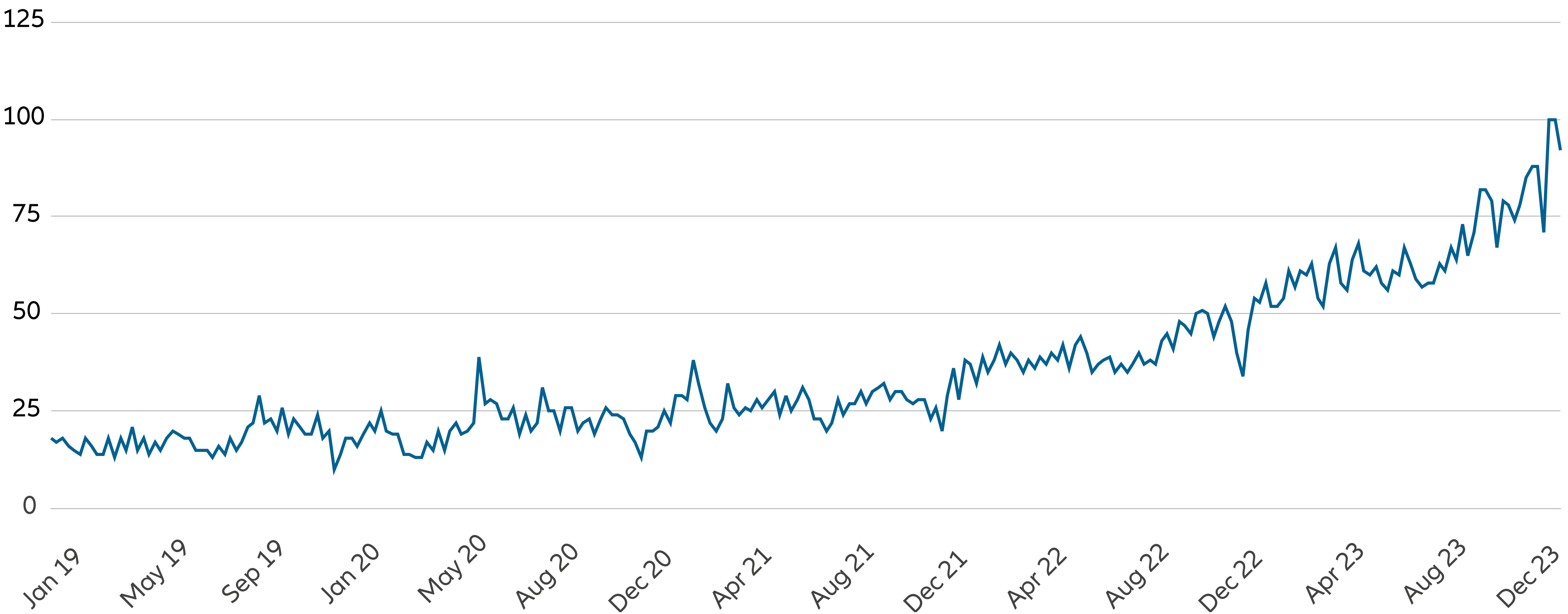

Exhibit 1: Interest over time

Source: Google, 17.01.23

Of course, excessive weight and obesity are linked to a range of comorbidities that impose significant costs on both individuals and healthcare systems, and it is thus clear why the potential of drugs such as GLP1s have been so extensively hyped. And thanks to the type of celebrity endorsements mentioned above, the growing proliferation of these drugs has reached into the popular consciousness in an unprecedented way.

Upsetting the pharma sector

It is becoming increasingly clear that GLP1s, and their potential impact on long-term health outcomes, is causing one of the most disruptive paradigm shifts – in terms of healthcare and healthcare investing – in recent memory.

The impact is already trickling over and being felt in other sectors. So, given that GLP1s have already been about for some time, why has attention suddenly exploded over the past year?

The use of these drugs was previously concentrated around treating diabetes, with the breakthrough into the weight loss/obesity market coming more recently as evidence to support their broader utilization has grown. Indeed, the growing strength of this data led to the first approval of a semaglutide (a type of GLP1 receptor agonist) by the US regulator FDA specifically for the purpose of weight loss. Given the potential size of the market for such drugs, both in the US and globally, it is clear why their introduction has caused such excitement in the market.

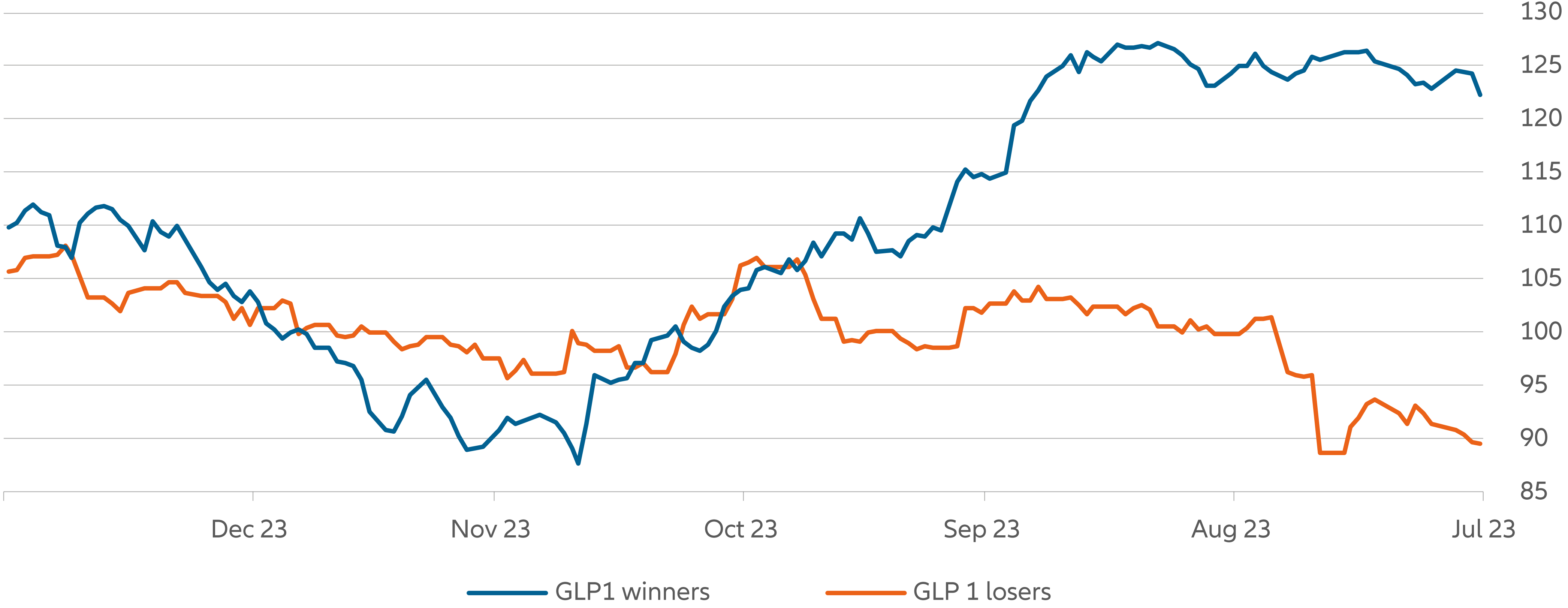

Unsurprisingly, the two main players in this area have been highly vocal regarding the impact their drugs will have on preventing comorbidities associated with obesity, contributing to a sector-wide sell-off in medical technology. Indeed, as the growth engines of the leading lights in GLP1 have roared, concerns around potentially shrinking total addressable markets (TAMs) have hit providers in a range of areas, including, among others, cardiovascular treatments, orthopedics, sleep apnea, and bariatric surgery.

Exhibit 2: GLP1 Winners and Losers

Source: Bloomberg, 16.01.23

Of course, as in any new and lucrative therapeutic area with a vast TAM (estimated at USD 100 billion plus), fierce competition is likely to be attracted. As such, the key players are erecting “data walls” around completed – and ongoing – studies, many of which are of the type that competitors have not yet even started. Given that efficacy has now been established, these ongoing trials are aimed at further enhancing physician adoption and payer coverage, and should serve to provide a further marketing advantage to the first movers and sector leaders. Competitors will increasingly have to conduct head-tohead trials versus the existing players – a high bar to clear, and one that will be both costly and time consuming for newcomers to this space.

Adoption is, and will continue to be, strongly linked to payer coverage and developments in the health insurance sector should thus be keenly observed. At present, obesity coverage in the US is concentrated in the commercial market with much lower levels available through Medicare; a recent estimate indicated that coverage for obesity treatment in the US currently reaches around 50 million people. While Medicare plans are, since 2003, statutorily prevented from covering medications for weight loss, a bipartisan bill – the Treat and Reduce Obesity Act (TROA) – currently progressing through Congress seeks to repeal this law and enable coverage. While potential coverage is likely to broaden in the future, some employers have recently opted out of this provision and hurdles to long term adoption, such as cost, remain. However, ongoing and future comorbidity trials are likely to improve the cost-benefit profiles of these medications.

The disruptive potential of a slimmer population

Even on conservative estimates, the proliferation of GLP1s is likely to represent a significant boon for the market leaders. Assuming a 10% penetration of the obese population at a per year cost of USD 5,000 per patient suggests a market worth USD 60 billion in the US alone, not including potentially promising further uses such as the treatment of alcoholism and other addictions. Furthermore, we estimate that the two main players are likely to maintain a combined 80%+ share of this market over the long-term.

Yet the effect of widespread adoption of GLP1s will go much further than the bottom line of a handful of pioneering pharmaceutical companies. The disruptive potential across the rest of the MedTech sector is clear, in terms of reducing treatment demand for comorbid complaints across a swathe of areas, but the effect of a widespread reduction in consumed calories will be much more profound, affecting food and beverages, agribusiness, tobacco, and beyond. For instance, in the US soft drinks market, over 50% of consumption is undertaken by around 7% of consumers, with this demographic being firmly in the sights of GLP1.

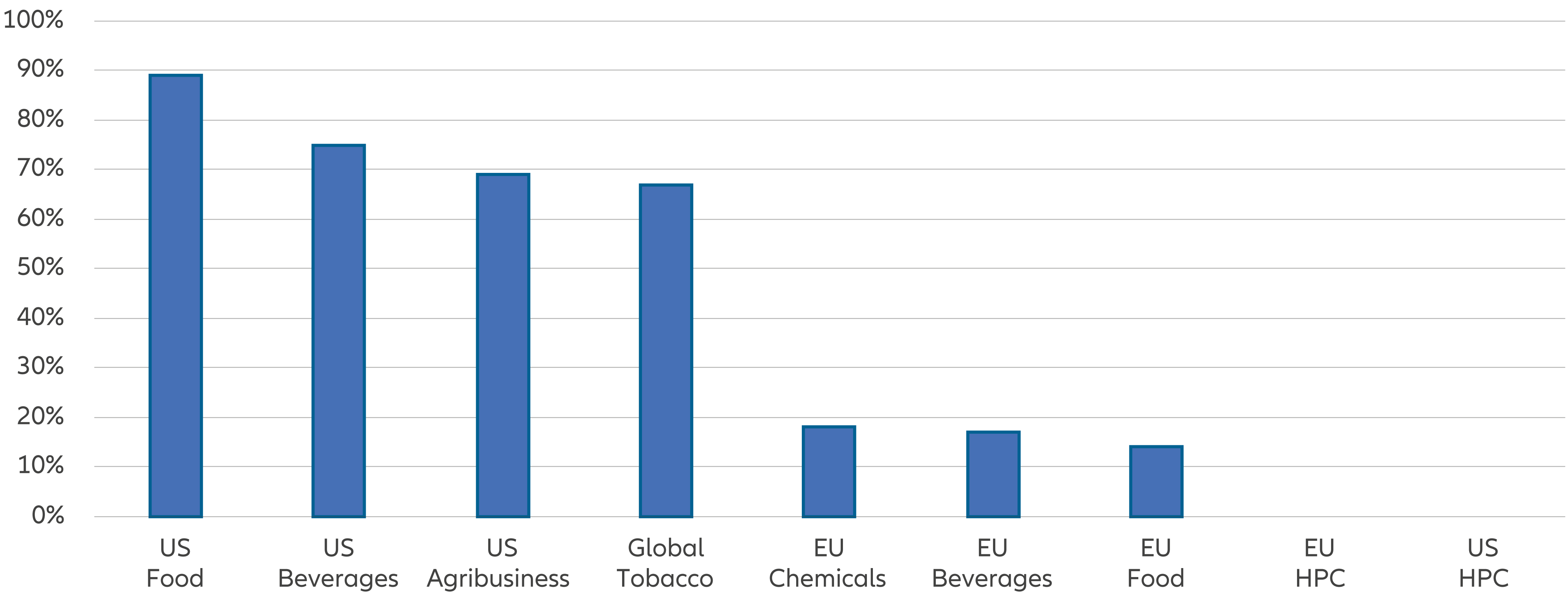

Exhibit 3: The proportion of names that are ‘highly exposed’ to GLP-1 drug penetration varies across staples sector

Percentage of companies within sector with a BMI Index value score of 27+ Source: World Health Organisation, company reports, Barclays Research

GLP1 drugs are having a material and disruptive impact not just across healthcare services and MedTech, but also a range of consumer sectors, especially snacks, soft drinks, and higher carbohydrate options. While we are in the early days of assessing and forecasting this impact, the coming months and years will bring further clarity, and maintaining an active approach to these sectors will thus be key. Indeed, while the future trajectory for these drugs is anything but clear or straightforward, we believe this breakthrough is well worth tracking as the disruptive effects of these drugs is likely to have a reverberating impact across the world – with notable winners and losers in the financial markets and beyond.

-

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security. The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted. This material has not been reviewed by any regulatory authorities. In mainland China, it is for Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations and is for information purpose only. This document does not constitute a public offer by virtue of Act Number 26.831 of the Argentine Republic and General Resolution No. 622/2013 of the NSC. This communication’s sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of this document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced, except for the case of explicit permission by Allianz Global Investors. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Brazil, Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Pacific Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional /professional investors only, and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide financial services to retail clients in Australia. AllianzGI AP is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of financial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which differ from Australian laws.

This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG; Allianz Global Investors UK Limited, authorized and regulated by the Financial Conduct Authority; in HK, by Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; in Singapore, by Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; in Japan, by Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424], Member of Japan Investment Advisers Association, the Investment Trust Association, Japan and Type II Financial Instruments Firms Association; in Taiwan, by Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan; and in Indonesia, by PT. Allianz Global Investors Asset Management Indonesia licensed by Indonesia Financial Services Authority (OJK).

Admaster 3327633