Active is: Seeing opportunity where others see challenge

With so much for markets to digest, investors need to be agile

Summary

Markets are off to a rocky start to 2022, as challenges ranging from a more hawkish Fed to sabre-rattling in Ukraine test investors’ resolve. Despite fading support from central banks, investors can find opportunities by staying agile and focusing on companies with resilient earnings.

Key takeaways

|

After a relatively calm holiday break, the first weeks of the year have already confirmed our assumption that 2022 would not be a “straight line”, to say the least. The latest weakness in quite a few markets, especially in the US, led to some technical support levels being broken, as some indexes fell below what were assumed to be price “floors”.

As January tends to be a robust month for risky assets, the retreat comes at an unusual point in time. The fact that many investors still have relatively long exposures or overweights likely explains part of the profit-taking. But the bigger issue may be that markets simply have too much to digest.

While market participants can take one problem at a time in their stride, they came back from the holidays to face several issues, including:

- A more hawkish Federal Reserve (Fed) narrative and the fiscal challenges in the US.

- Sabre-rattling in Ukraine. The prospect of war in Ukraine is understandably weighing on investors’ minds, and the probability of conflict may have worsened in recent days. But the market impact could be short-lived based on the experience of the Russia-Ukraine conflict in 2014, when equity indices recovered rapidly. This time, however, already-high commodity prices and bottlenecks could have a stronger economic impact on the European economy.

- Renewed tensions in China’s real estate market. Our base case remains that the Chinese government manages to control the timing of the real estate slowdown, but even so the probability of a bursting of the debt bubble has slightly increased.

Should investors buy the dip?

Should we fear a repeat of the 2018 market dive that saw US stocks drop 19%? Or is this just another short-lived correction and investors should “buy the dip”?

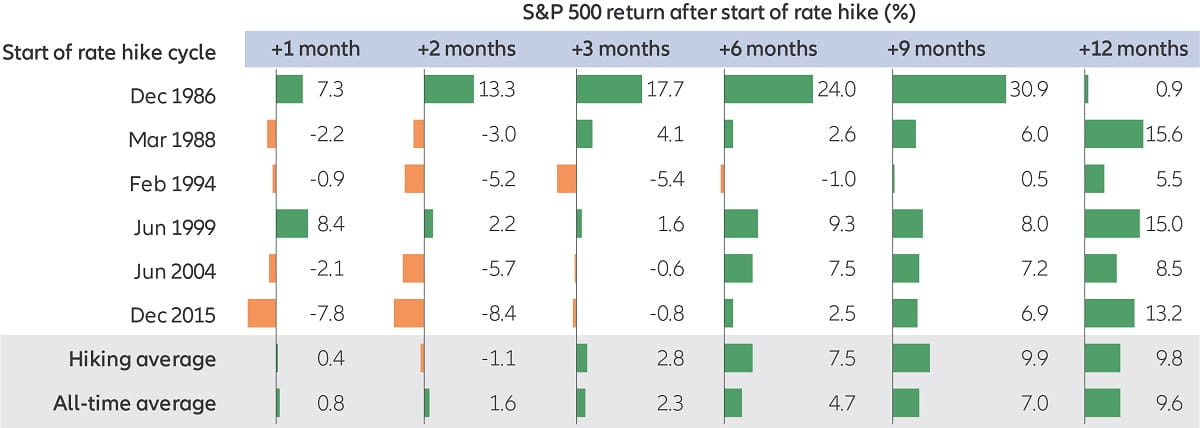

Despite what we are hearing in the press, it is not entirely true that the market has run out of breath. Indeed, while low-quality stocks have suffered, the equal-weighted US equity markets have remained pretty much aligned with the capital-weighted market. Remember as well that, based on past experience, a Fed rate hike “per se” is not always negative on stocks (see Exhibit 1). This is even less so for stocks outside the US. Since markets have been digesting Fed rate hikes for months, a lot of negativity should already be priced in.

Exhibit 1: US stocks have historically shrugged off Fed rate hikes within a year

Average S&P 500 Index returns during Fed rate-hike cycles (1986-2015)

Source: Bloomberg, Allianz Global Investors. Data as at 17 January 2022. All-time average performance based on rolling overlapping observation period; rate hike period performance based on mid-month observations (15th). Past performance is not indicative of future results.

But we could imagine a secondary scenario, where falling inflation later this year coincides with slower economic growth caused by the impact of earlier price rises on consumers. This may force the Fed to put its rate hikes on hold. Similarly, if inflation starts to impact wages and rents, the European Central Bank (ECB) could turn out to be surprisingly hawkish – resulting in higher or faster rate hikes than the markets expect. This would detract from our positive view on the US dollar.

Overall, however, we must recognise that the overall long-term environment of excess liquidity – with central banks greatly increasing the economy’s money supply – is morphing into a more hawkish, restrictive one. The fight against inflation will be the focus of the Fed’s attention for at least the coming month. As central banks tighten up the money supply, it will likely remove one of the pillars that have supported the strong performance of risky assets like stocks.

Strangely enough, the “good news” about Omicron’s rapid fading and relative lack of fatality could provide comfort to central banks in their new “reaction” function. So it will be a fine balance: good news from the trade logistics and supply chain front could be negated by stricter central bank policies.

Watch for earnings

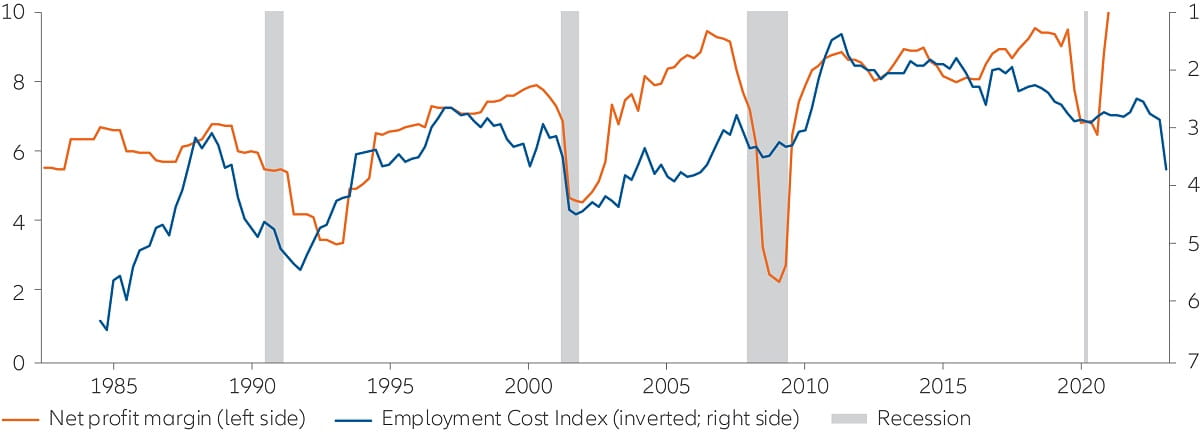

All of this should encourage us to look even more carefully than in the past at earnings, especially as valuations remain stretched (especially in the US, although arguably less so in Europe and Japan). And here the picture could also start deteriorating as employment and commodity costs start biting into companies’ profit margins (see Exhibit 2).

This trend will likely affect smaller US companies that have trouble finding staff, while larger companies should continue to profit from the “oligopolisation” that has taken place over the last decade in many sectors of the economy. This should allow them to pass on some of the higher costs of producing their goods or services, even though this would be to the detriment of consumers.

Exhibit 2: employment and commodity costs could start shrinking profit margins

Net profit margins vs employment costs (1984-2022)

Source: Refinitiv Datastream, Allianz Global Investors. Data as at 18 January 2022.

What does this mean for asset allocation?

Investors should keep a calm head and observe the situation carefully. As the fundamental picture weakens, and the excess liquidity and support of central banks fades, the resilience of corporate earnings should be the key focus.

Considering the relative valuations, the US stockmarket might be a notch more affected than Europe or Japan. This differential is beginning to be reflected in the relative preference of our Multi Asset expert group.

We continue to support value stocks (whose prices appear to be lower than what the financials support) as opposed to growth stocks (which carry higher prices in exchange for the potential for more growth down the road). More to the point, we prefer cyclical value stocks in particular – those whose prices tend to move in tandem with the economy. And, despite a short-term topping-out, we continue to see valuations as attractive in the longer term (see Exhibit 3).

We expect US Treasuries to fall in value in the short term, as we still expect inflation to surprise on the upside. But with Fed interventions, we could pretty soon be in a position to be more positive about Treasuries if markets move ahead of themselves.

And finally, commodities continue to represent an attractive hedge in this environment if one considers that the inflation risk remains underestimated.

To summarise: agility will be required in the coming weeks.

Exhibit 3: value is still depressed in the long term, though prices may hit a “ceiling” in the short term

Performance of MSCI World Value vs MSCI World Growth stocks (1995-2021; indexed to 100)

Source: Bloomberg, Allianz Global Investors. Data as at 21 January 2022. Past performance is not indicative of future results.

The MSCI World Value Index captures large- and mid-cap securities exhibiting overall value-style characteristics across 23 developed-markets countries. The MSCI World Growth Index captures large- and mid-cap securities exhibiting overall growth-style characteristics across 23 developed-markets countries. The Standard & Poor’s 500 Composite Index (S&P 500) is an unmanaged index that is generally representative of the US stock market. Investors cannot invest directly in an index.

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Equities have tended to be volatile, and do not offer a fixed rate of return. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bond prices will normally decline as interest rates rise. The impact may be greater with longer-duration bonds. Past performance is not indicative of future performance.

This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security.

The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted.

This material has not been reviewed by any regulatory authorities. In mainland China, it is used only as supporting material to the offshore investment products offered by commercial banks under the Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations. This document does not constitute a public offer by virtue of Act Number 26.831 of the Argentine Republic and General Resolution No. 622/2013 of the NSC. This communication’s sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of his document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Brazil, Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Pacific Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional/professional investors only, and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide financial services to retail clients in Australia. AllianzGI AP (Australian Registered Body Number 160 464 200) is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of financial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which differ from Australian laws. This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors U.S. LLC, an investment adviser registered with the U.S. Securities and Exchange Commission; Allianz Global Investors Distributors LLC, distributor registered with FINRA, is affiliated with Allianz Global Investors U.S. LLC; Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG; Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424, Member of Japan Investment Advisers Association and Investment Trust Association, Japan]; and Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan.

2004276 | 5993

About the author

Summary

Disruption has always been around us, but we are moving to a new “survival of the fittest” digital era. We’ve identified key themes – from climate tech to AI – that are driving this new shift in a profound way, making disruption a critical factor for investors to build into their portfolios.

Key takeaways

|