Navigating market concentration as sustainable investors

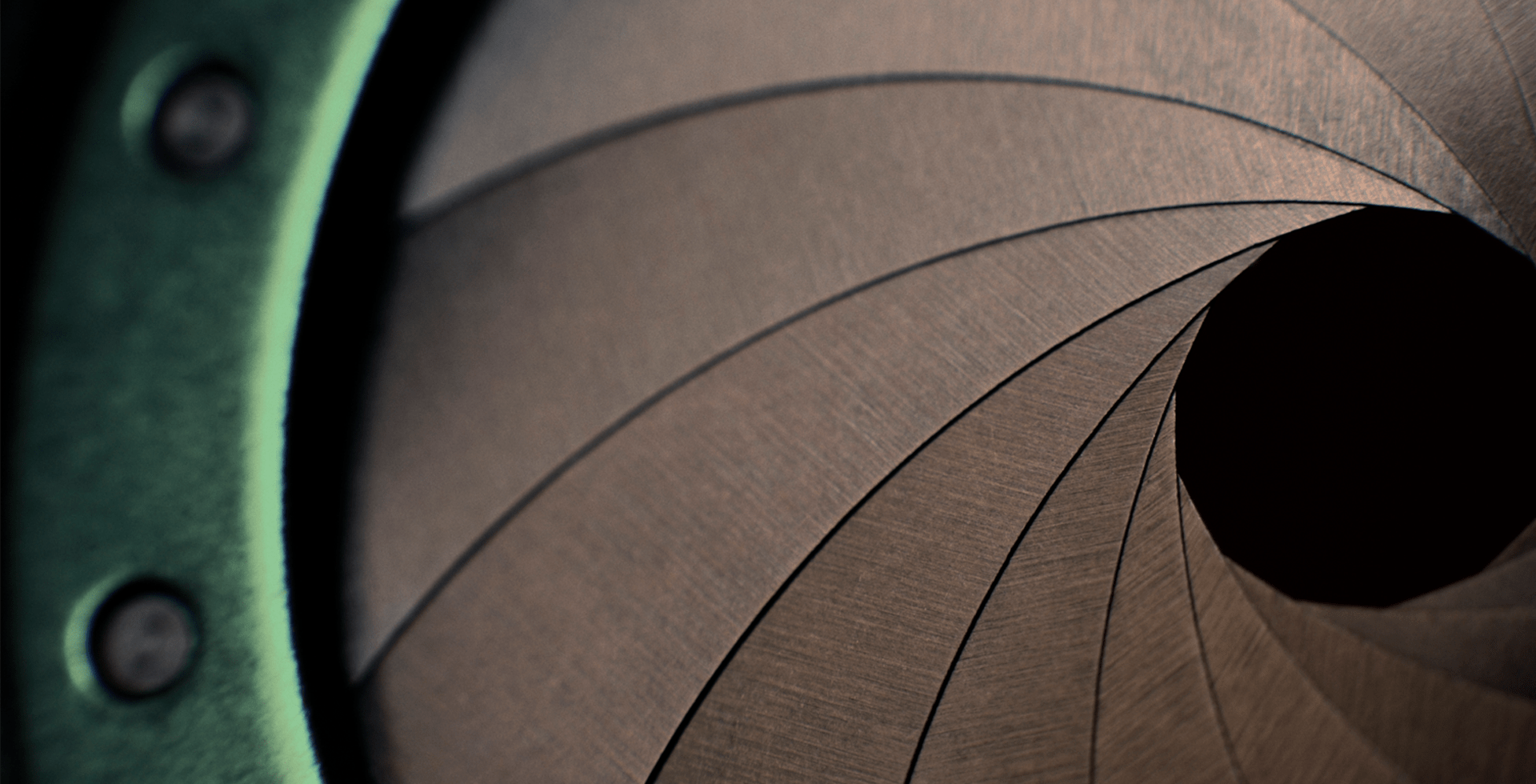

One of the defining features of equity markets over recent years has been extremely high levels of index concentration, with the so-called “Magnificent Seven” making up around a third of the total market capitalization of the S&P 500.

And while we have previously seen similar levels of concentration, never before have we seen such high correlation between the largest players – for instance, at present, eight of the top ten largest constituents of the S&P 500 represent a similar bet on the future of artificial intelligence (AI) and related technologies.

Of course, we remain very bullish on AI, yet the current situation, in terms of market concentration, means that portfolio managers would need to give away around 40% of their fund just to remain neutral on this theme. And, given our approach is very much a bottom-up one designed to generate returns across sectors, we do not want to relinquish our opportunities to generate alpha, wherever in our investable universe we believe this may come from.

Figure 1: We are at unprecedented levels of index concentration

Source: Allianz Global Investors, DataStream, S&P500 as of 20 September, 2024. Displayed values are data for 20 September, 2024.

Sticking with the US market, but looking more broadly, we are coming out of a period of unprecedented stimulus, coupled with high immigration, which has driven economic and stock market growth. Of course, growth is now softening and there are other signs – for instance, rising personal credit delinquencies – that the tide is turning in the US economy. These changes are likely to lead to more market breadth, with both the performance of the top names softening, as well as opportunities for alpha emerging elsewhere in the market.

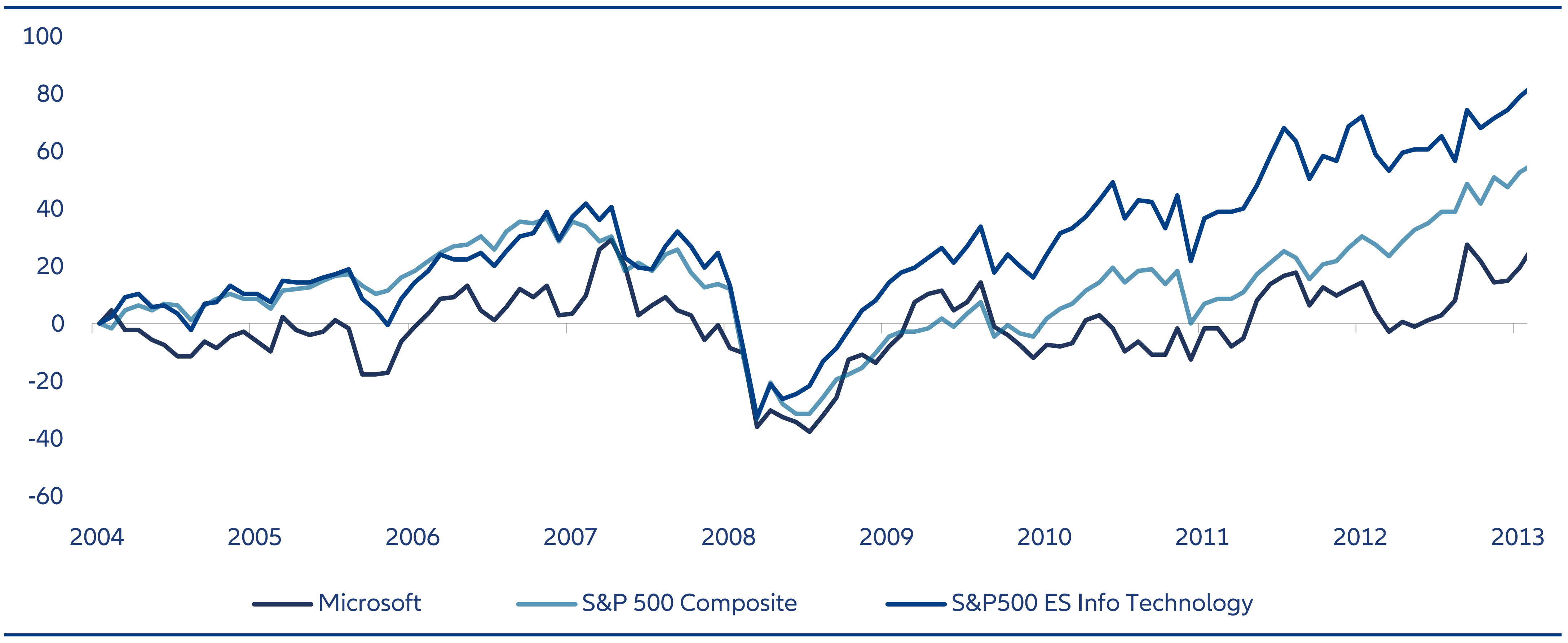

This feeds into a further trend that we may see developing in the coming months. Large and rapid expansions of market capitalization – such as we have recently seen, for instance, with Nvidia – have happened before, yet often result in several years of horizontal movement afterwards. For instance, the performance of Microsoft for several years post-2004 serves as a cautionary tale.

Figure 2: This much market cap grab has happened before

Source Alllianz Global Investors, Datastream. September 2024.

Of course, while there is no certainty that history will repeat itself in the same way, we believe there are strong indications that we may now be facing a sea change in terms of the trajectories of some of the biggest tech players that currently dominate US equity markets.

Outlook

While the economic and market outlook remains complex and uncertain, some solid conclusions and inferences can still be drawn from recent events and the current global economic and political situation. With rates and inflation coming down, we are now certainly seeing some weakness in the US economy, but this is a weakness that was needed in light of the danger of overheating. Yet, even given this weakness, it seems the US economy is likely facing a soft landing of some kind with the threat of recession being averted, for now at least.

We had expected a very close US election and the financial markets and betting markets had moved aggressively towards a Republican win in October, with a meaningful impact on the bond markets along the curve. Both the short end and long end expectations were higher on both the expectation of more volatility in policy, and also higher inflation expectation as tariffs and tax cuts take centre stage. We concur with the probability of both being higher now. There are offsetting factors, however, with lower fuel prices as well as the efficiency efforts led by the newly formed Department of Government Efficiency. Immigration has been a significant component of recent economic momentum in the US and this will clearly look different under Trump 2.0, which would also lead to a raised inflationary expectation.

Nevertheless, it should be noted that the political agenda doesn’t always translate easily to a view on how sustainable assets and investment flows actually perform. In fact, the sustainable asset management industry thrived under Trump 1.0 as many of the investments required to mitigate and adapt to climatic challenges are beneficiaries of more positive economic impulses. Investors will have to be very alert to any new policies (of which we expect many). Still, we see a good slate of strong investment cases in the US that we feel could deliver in any economic scenario. We also continue to favour AI, as we see the roll-out of tools that create the efficiency advantages. We expect there to be plenty of beneficiaries of this monumental capital deployment and platform change that IT is going through.

Overall, we expect recent economic developments to work in our favour as markets broaden opportunities emerge across sectors that may have been neglected by many investors over recent years. Alongside this, key megatrends – such as the energy transition and, indeed, AI – remain intact, providing significant tailwinds for sustainable assets across all sectors.