Navigating Rates

US investment grade bonds: a promising outlook

With supportive market fundamentals and bumper issuance last year, US investment grade bonds are offering yields well above the 10-year average. That could make them a rewarding asset class in 2025.

Key takeaways

- The US investment grade market continues to offer a good entry point for long-term investors. Falling rates provide an upside scenario to returns, while still elevated yields provide a cushion against wider credit spreads.

- Market fundamentals remain stable due to improved earnings, positive ratings trends and continued discipline among company management teams.

- Risks we are monitoring include slower macro and earnings growth, rising geopolitical tensions and uncertainties around the timing and prioritisation of policy changes introduced by the Trump administration.

Despite some volatility, fixed income markets delivered strong returns over the course of 2024.

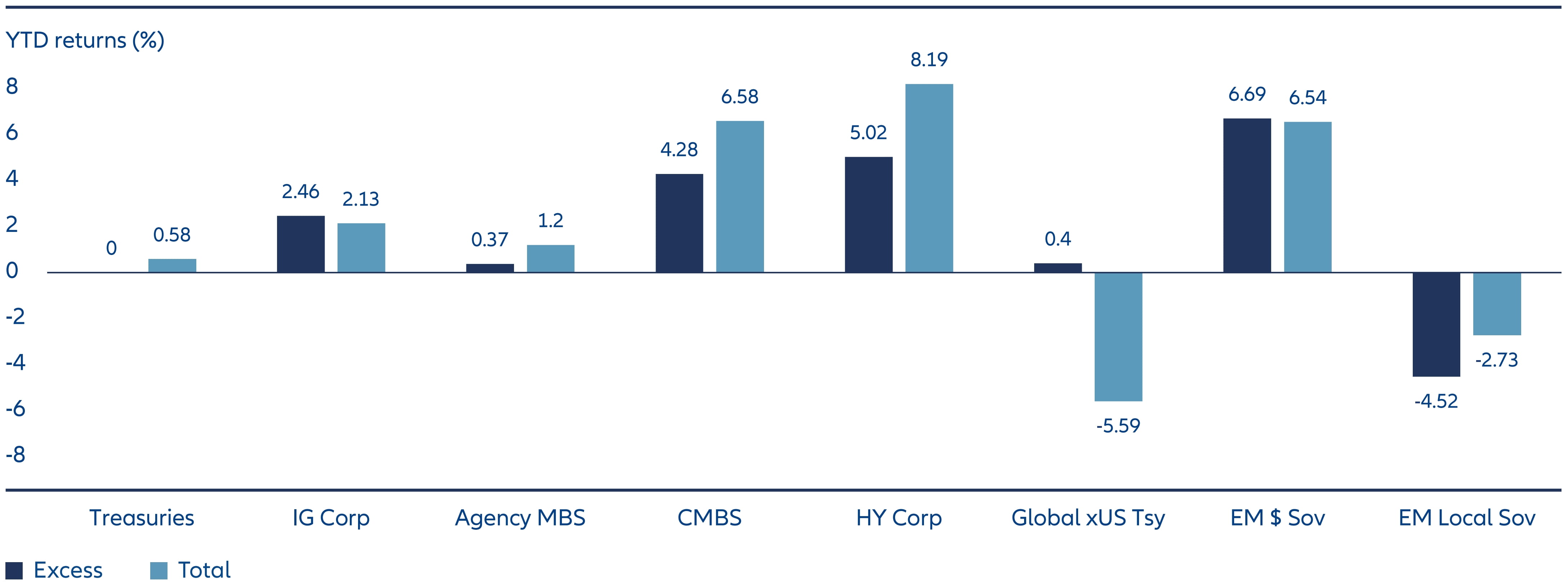

A soft-landing scenario continued to remain the central market theme despite no shortage of evolving – and, at times, conflicting – economic signals. As a result, US risk assets broadly delivered positive returns (see Exhibit 1), boosted by falling Treasury yields and tighter spreads.

Exhibit 1: Risk assets have performed well

As of 31/12/24. Source: Bloomberg Index Services Limited, J.P. Morgan, Voya IM. Excess returns for the US Agg, Treasuries, IG Corp, Agency MBS, CMBS, HY Corp and Global ex-US Treasuries are represented by the excess returns for the respective Bloomberg indexes. Excess return for EM sovereign (US $) is represented by the spread return for the J.P. Morgan EMBI Global Diversified Index. Excess return for EM sovereign (local currency) is represented by the total return for the J.P. Morgan GBI-EM Global Diversified Index (Tax-Adjusted Local Return) less the total return of the Bloomberg US Treasury 3-7 Year Index. See endnotes for index definitions and additional disclosures. Past performance does not predict future returns. If the currency in which the past performance is displayed differs from the currency of the country in which the investor resides, then the investor should be aware that due to the exchange rate fluctuations the performance shown may be higher or lower if converted into the investor’s local currency.

Spreads have remained resilient in the investment grade (IG) corporate space across 2024 and early 2025. Once the markets digested the US presidential election outcome – anticipating higher growth, tax cuts and deregulation – spreads moved to the tightest levels seen since the late 1990s, reaching the mid-70 basis point range in November.1 We attribute these tight spreads primarily to supportive technicals, given strong demand from yield-based buyers, the healthy economic backdrop and stable issuer fundamentals. While spreads aren’t historically cheap, current market dynamics could continue to keep them in a relatively tight range. Strong demand, positive ratings trends and modestly positive economic growth should benefit spreads. Historically, credit has done well when growth is 1-2%, as excessive growth raises monetary policy uncertainties, while insufficient growth widens spreads due to heightened recession risk.

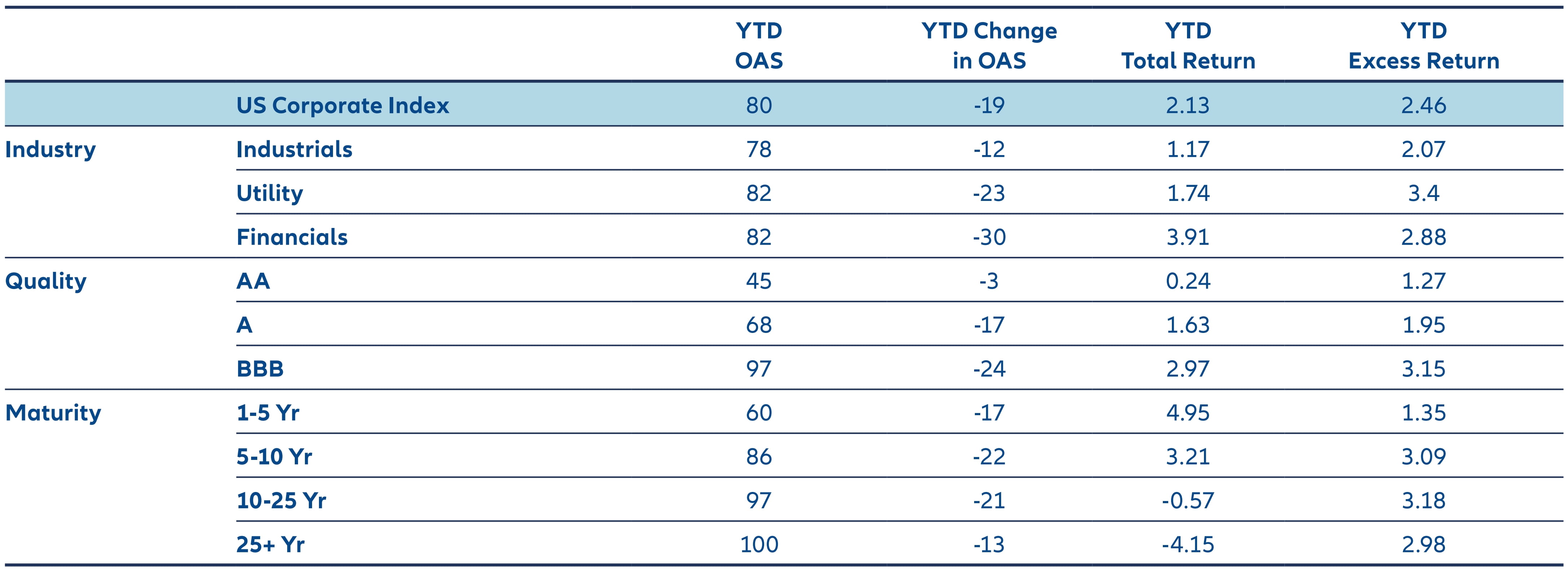

Digging into market subcategories, several themes emerged in 2024 (see Exhibit 2). BBB-rated bonds outperformed higher-quality issues, benefiting from the positive economic backdrop. Across the curve, the ong end lagged the front and intermediate segments from a total return perspective as the yield curve steepened.

Exhibit 2: Positive macro backdrop has been supportive for BBB rated corporate issuers

Returns for 2024 (%); option-adjusted spread (basis points)

As of 31/12/24. Source: Barclays, Bloomberg. See endnotes for index definitions and additional disclosures.

High yields may offer a good entry point

Looking ahead, US corporate bonds seem appealing in the current environment, which may offer a good entry point for long-term investors. While downside risk exists, elevated starting yields provide protection. Despite recent declines, US IG corporate bond yields remain above 5% and are more than 140 basis points above their 10-year average.2

If we consider a worst-case scenario of slower-than-expected growth and aggressive Fed rate cuts, total returns from lower rates would offset some potential spread widening – however, we view this outcome as unlikely. On the other hand, if inflation stays high, higher yields should continue attracting strong inflows into IG, supporting valuations.

Technicals should remain supportive, driven by investor flows

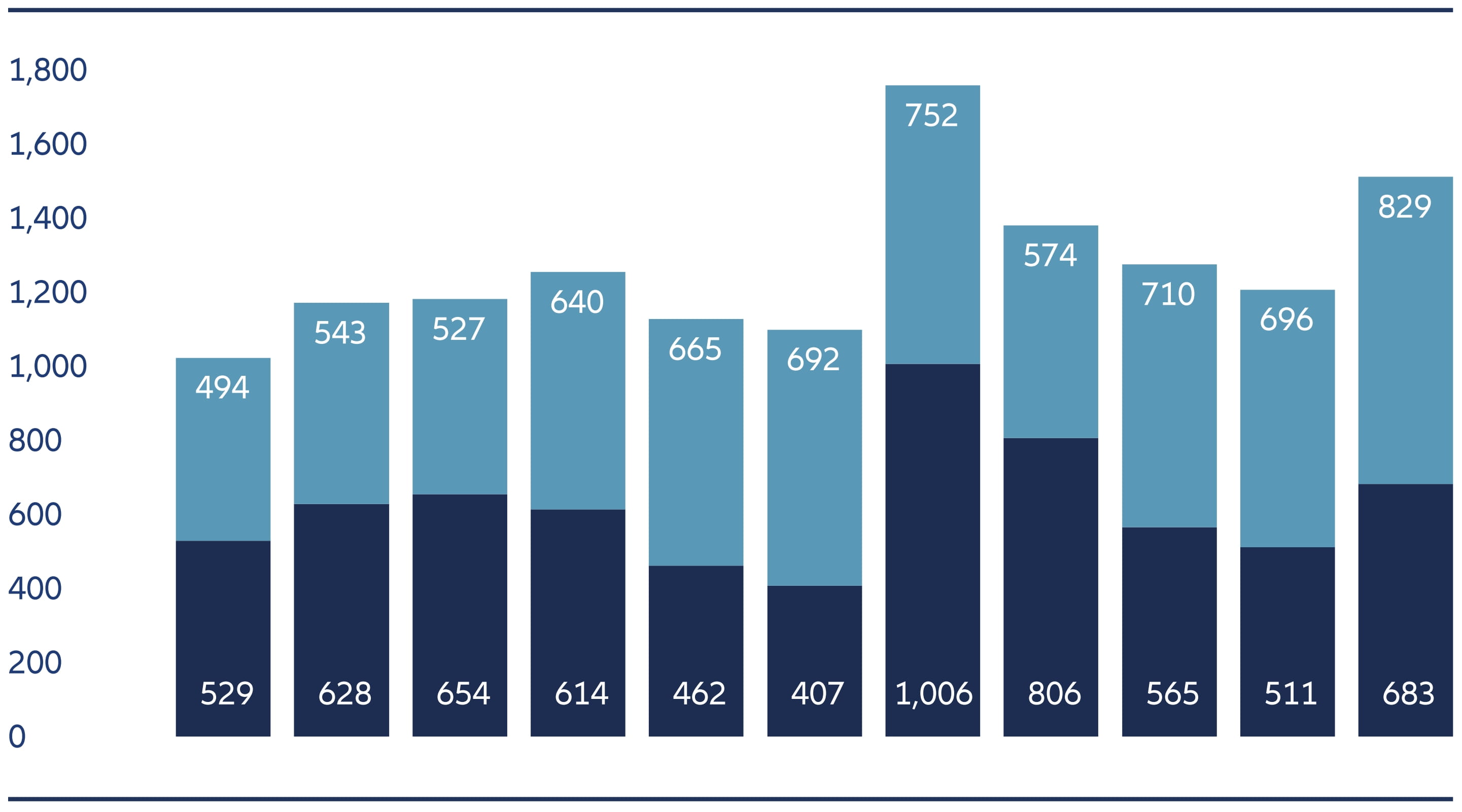

Throughout 2024, the IG market saw near record-breaking gross issuance, offering new supply and buying opportunities for managers. For context, overall gross volume exceeded USD 1.5 trillion in 2024, surpassing any calendar year outside of 2020 (see Exhibit 3). While banks were heavy issuers early on, non-financials accounted for approximately 60% of total volume. M&A issuance, representing 13%, partially drove the increase.3 Lower funding costs led to more opportunistic issuance. Looking ahead, falling rates should support M&A supply, but we don’t anticipate a significant near-term pickup. Additionally, net issuance is expected to remain low given the large number of 2025 maturities. This should be supportive for spreads.

Exhibit 3: Gross issuance set to reach highest level since 2020

(in USD billions)

As of 31/12/24. Source: J.P. Morgan.

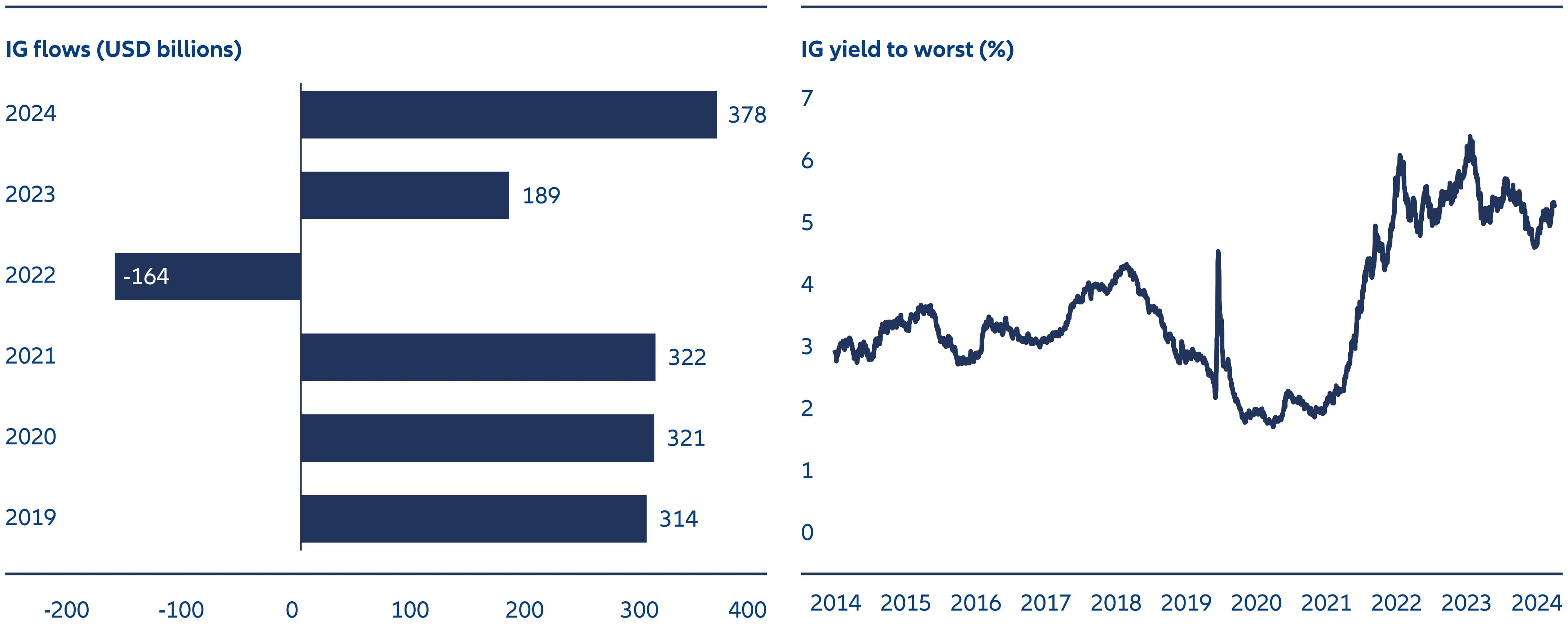

Despite elevated new issuance, spreads have remained relatively stable due to strong investor demand. Investment grade mutual funds and exchange-traded funds (ETFs) have seen significant inflows this year (see Exhibit 4). With the start of the Fed cutting cycle, we believe the IG market is set to attract more flows as investors seek to secure appealing yields and add duration. Additionally, a steeper Treasury curve should enhance hedging costs, potentially boosting demand from overseas investors. These factors should continue to support demand despite falling rates.

Exhibit 4: Flows into IG have been robust as investors look to lock in long-term yields

As of 31/12/24. Source: J.P. Morgan, EPFR, Barclays, Bloomberg. Right side: IG represented by the Bloomberg US Corporate Index. See endnotes for index definitions and additional disclosures.

Fundamentals have remained healthy

In the post-Covid tightening cycle, corporate fundamentals have remained robust, bolstered by a strong starting position. Companies built substantial cash reserves during a period of exceptional economic growth and secured low long-term financing costs. This provided a lengthy runway for issuers and a buffer against slower earnings growth. Although recent quarters saw some decline in credit metrics – such as lower EBITDA growth, primarily in commodity sectors, and reduced interest coverage due to higher rates – companies have reacted by cutting shareholder payouts and moderating capex spending, both of which are favourable to creditors.

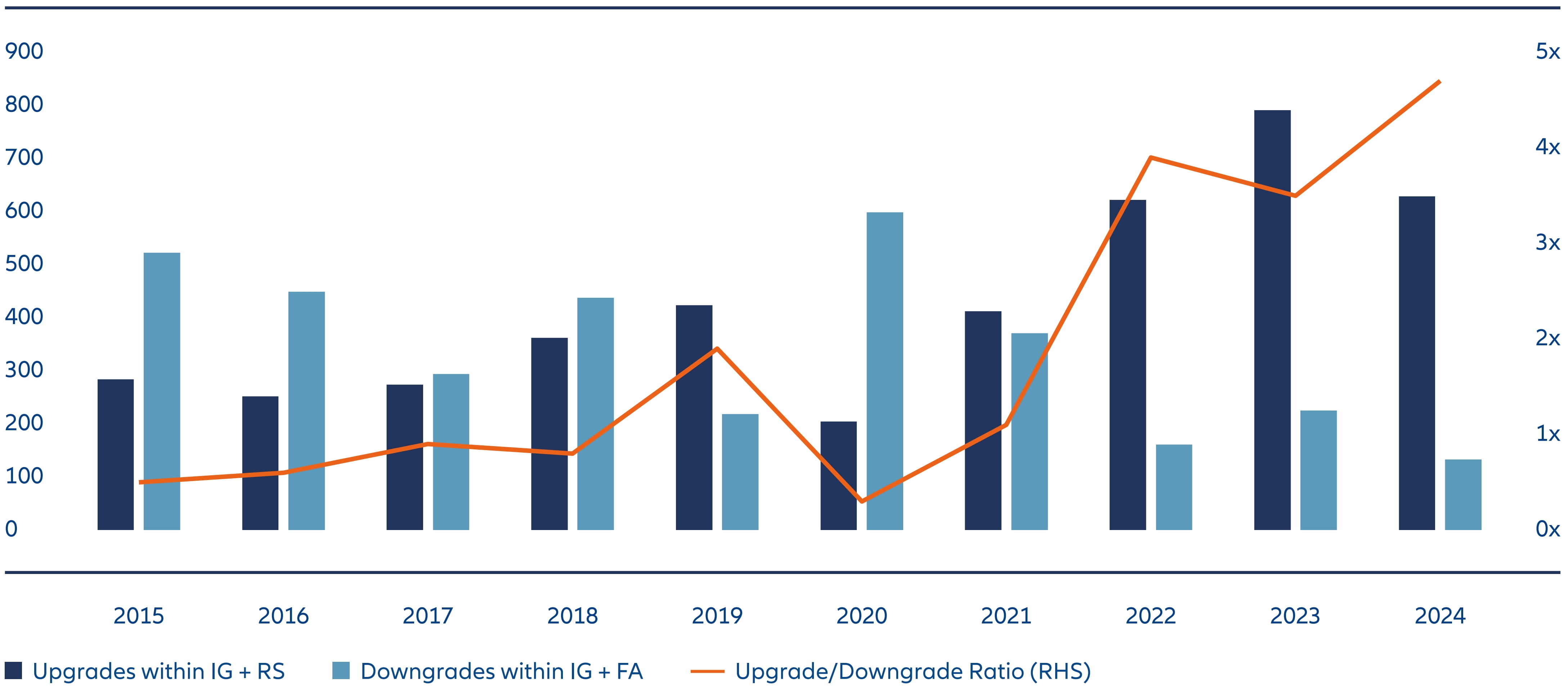

Fundamentals have been further supported by positive credit ratings trends (see Exhibit 5), enhancing the ratings skew of the investment grade market. Upgrades surpassed downgrades by USD 496 billion in 2024, with modest fallen angel activity. Leverage continues to decline as management teams gain confidence in the economic outlook. Companies reported solid earnings in the third quarter, as S&P 500 earnings grew by 8.7% on 5.4% revenue growth.4 Technology firms were the main driver, while financials and utilities also saw steady earnings growth. With above-trend growth expected, year-over-year earnings growth rates should continue to rise in the coming quarters.

Exhibit 5: Upgrades have exceeded downgrades at an increasing pace

IG upgrades and downgrades (left axis in $ billions)

As of 31/12/24. Source: J.P. Morgan.

Key risks we’re monitoring

The macro environment remains supportive, with our base-case view calling for a gradual slowing of economic growth towards trend levels and a more balanced labour market. This should alleviate inflation pressures without a significant rise in unemployment, allowing the Fed to continue cutting rates closer to the terminal rate, which will benefit both consumer spending and business investment. Consequently, the outlook for the near term is positive for IG, with spreads expected to remain relatively tight.

With that said, we’d be remiss to not acknowledge potential risks that could raise near-term volatility – primarily a sharper-than-expected growth slowdown due to lagged monetary policy effects, which could strain earnings and fundamentals. On the other hand, there is a risk the US economy could overheat, causing inflation to rise and further limiting the Fed’s room to lower rates. Finally, although election cycles typically have minimal impact on investment grade corporates, the arrival of the new US administration – alongside ongoing geopolitical tensions – has implications for fiscal and trade policy. This may cause modest spread widening.

The election outcome could benefit some sectors over others

The new US administration has an impact on every industry within IG credit, and each will face its own challenges and opportunities. The uncertainty in the timing and prioritisation of any changes is key. For example, although deregulation may initially be positive for corporate credit, it could also increase risk over the long term.

Nonetheless, we view certain industries to be potential beneficiaries of the incoming administration’s policies. Among them include energy and airlines, thanks to a more favourable regulatory environment. Meanwhile, retail and building products could come under some pressure from the impact of tariffs. Another area we’re watching is banking, where potential regulatory relief and tax cuts may be outweighed by concern about aggressive growth strategies from lower capital environments and the uncertain impact of tariffs. Similar offsetting factors are contributing to a more mixed outlook for some sectors – such as technology, media, telecom, healthcare, utilities and autos.

To summarise, we remain constructive on investment grade credit, based on attractive starting yields and our expectations for a modest growth environment. We expect fundamentals to remain healthy, as earnings continue to benefit from the stable backdrop. Any episodes of spread widening would, in our view, provide attractive opportunities to add risk.

1 Bloomberg, 30/11/24

2 Bloomberg, 30/11/24

3 J.P. Morgan, 30/11/24

4 Bloomberg, 30/11/24