The India Briefing

From utility to identity: India’s love affair with Swiss watches

This month, we take a look at complexities in the consumer outlook and highlight distinct pockets of opportunity as young Indians look to assert their identities as consumers. These include areas like consumer durables, eco-friendly products, and Swiss watches.

Please find below our latest thoughts on India:

- Indian equities have consolidated in July after an impressive second quarter return of nearly 10% in USD terms.1 This is despite more supportive macroeconomic tailwinds in the form of domestic policy stimulus and robust global trade developments, especially relative to expectations earlier in the year.

- Corporate activity in India has been particularly vibrant, with deals exceeding USD 9 billion in June, reflecting confidence among both corporates and investors.2

- Although the cost of living has been rising across India, inflation pressures have moderated in recent prints, with data hinging heavily on food inputs that are seasonally volatile due to weather. Improving monsoon conditions and a subsiding heatwave should keep broad inflation pressures in check this summer.

- One of the most complex narratives in India today is the consumption story. 2025 is shaping up to be a year of contrasts for the Indian consumer – between urban and rural and between aspiration versus affordability.

- Even though India remains one of the fastest-growing consumer markets globally, the backdrop for consumer businesses has not been without its challenges.

- Fierce price competition, especially in the fast-moving consumer goods (FMCG) sector, is forcing some companies to burn through cash to stay relevant.

- It is increasingly clear that while urban consumers are being more careful with their wallets, they are willing to pay up for premium features. Aspirational lifestyle purchases across categories like autos, fashion, hospitality/travel, and real estate are reshaping the consumer landscape.

- Evidence from the bottom up suggests that Indian households are increasingly shifting from necessity-based to more discretionary spending. Consumer durables, ranging from lighting fixtures to air conditioners and electronics, have seen particularly robust growth, driven by rising aspirations and increased home ownership.

- As an example, at the extreme high end, India’s imports of luxury watches from Switzerland surged nearly 30% during the first quarter of 2025 compared to the same period in 2023.3

- India represents the world’s fastest-growing end market for Swiss watches as affluent young Indians look beyond gold and property as stores of wealth and identity.

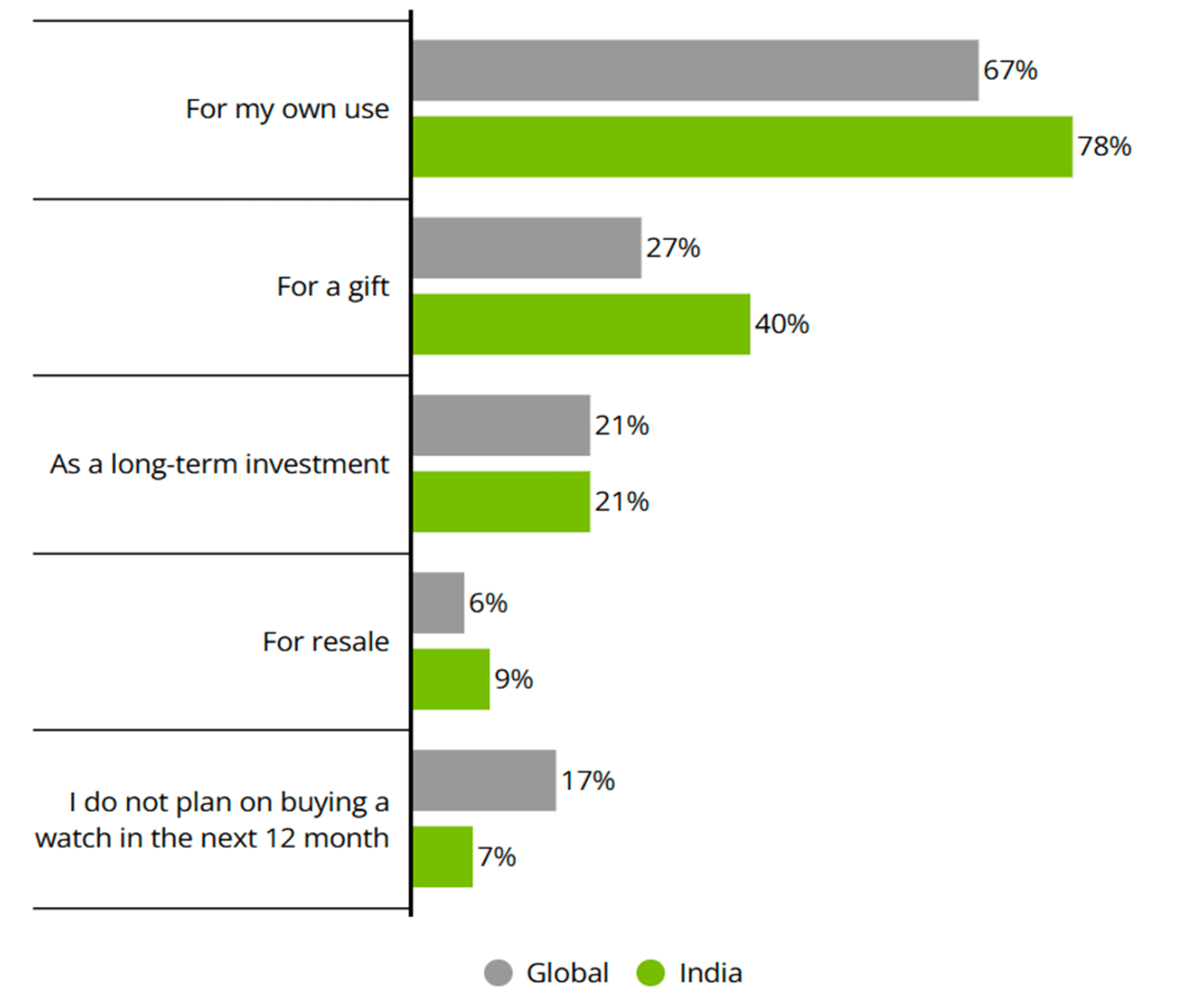

Chart 1: If you plan to buy a watch in the next 12 months, what would be the purpose? Multiple selections possible.

Source: Deloitte Swiss Watch Industry Insights 2024: Spotlight on India, as of 3 July 2024.

- Another aspect of this shift in behavioural spending is the propensity for millennials and Gen Z consumers to target brands offering eco-friendly packaging, cruelty-free products, and ethical sourcing. Subscription-based models are also growing in popularity, offering convenience, personalisation, and a lower carbon footprint.

- Rural consumption appears to be turning a corner after a period of weakness, supported by improved agricultural output, rising real rural wages, and government welfare schemes such as free power allowances and cash transfers to women farmworkers.

- A lower interest rate cycle, prompted by the Reserve Bank of India’s (RBI’s) larger-than-expected 0.5% cut in its repo rate and 1% cut in the cash reserve rate held by banks, should also serve to boost consumption, though transmission typically takes 12–24 months to be fully reflected in spending behaviour.

- While low compared to global standards, India’s household debt levels have been rising as mobile penetration and digital literacy have made access to small-ticket loans (less than USD 6,000) more accessible. These loans typically support spending on weddings, medical expenses, motorbikes, or higher education, for example, and tend to be repaid within 12-36 months.

- Rural communities are also benefitting from businesses offering cheaper, value-for-money brands; smaller package sizes; or direct-to-consumer digital models that are more nimble than some established players.

- While digital infrastructure has vastly improved, and India boasts more than 950 million internet subscribers, physical infrastructure such as logistics, warehousing, and last-mile delivery remains uneven. This affects the scalability of consumer businesses, especially in rural and semi-urban markets.4

- The good news is that corporates understand these nuances and are executing to better tackle modern consumption challenges. Many of India’s mid- and small-cap companies are led by second- and third-generation entrepreneurs with strong academic and industry pedigrees. They understand the importance of credibility and corporate governance along with business acumen.

1 IDS, Allianz Global Investors, as of 28 July 2025.

2 Citibank, India Mutual Funds snapshot - June 2025, as of 15 July 2025.

3 The Economic Times, Swiss check their watches, it shows India's time, as of 28 April 2025.

4 India Ministry of Communications, as of 2 August 2024.