Two-Minute Tech

Artificial Intelligence moves from generation to reasoning

Generative artificial intelligence is entering a new chapter—one where machines can reason through complex problems, approaching human-level capabilities. This leap will drive significant AI infrastructure expansion as workload demands grow exponentially. Moreover, we believe it will fundamentally reshape the AI landscape across sectors by enabling unprecedented automation.

- “Reasoning AI” is the next major evolution of generative AI, advancing beyond one-shot inferences to emulating human-like, step-by-step logic and decision-making.

- This shift dramatically increases compute intensity, driving a new wave of infrastructure investment in chips, data centers, and power systems.

- Even as enterprise adoption is still in its early stages, the potential productivity gains of AI agents and reasoning workflows represent a transformative platform shift.

- For investors, reasoning AI offers a generational opportunity to capitalize on emerging winners across hardware, software, and AI-enabled execution.

We can look at the evolution of generative AI through the lens of Nobel laureate Daniel Kahneman’s framework for breaking down human thinking into “system 1” and “system 2”: system 1 is fast and relies on intuition, while system 2 is a deliberate and conscious mental process.

In 2022, the initial wave of generative AI models mimicked system 1 thinking. These models required relatively little compute but often suffered from inaccuracies and hallucinations. They were good at simple tasks, simply regurgitating what they know, but fell short of replicating human-like system 2 reasoning.

The new class of AI reasoning models approach tasks through step-by-step logic, self-questioning, iterative analysis, and triple-checking answers. Rather than producing a single, fast response, they break down problems into sequential parts, improving accuracy and reliability. This type of AI inferencing is computationally intense and mimics the logical and high-effort characteristic of system 2 thinking.

This evolution isn’t simply a technical upgrade—it introduces entirely new capabilities. Reasoning AI can better understand nuance. It can handle ambiguous queries. And it can troubleshoot its own output and ask humans for clarification. These capabilities pave the way for more advanced enterprise applications, from legal contract reviews to advanced scientific research, autonomous decision-making, and even complex medical diagnosis.

Scaling the AI ecosystem?

The infrastructure needs to support the new AI models are staggering. Reasoning AI is proving far-more compute-intensive than expected, with Nvidia estimating that the models may require 100 times more computational power than traditional generative models.1

To meet this demand, hyperscalers, chipmakers, and data center operators are racing to build out next-generation AI compute platforms. This includes specialized hardware such as Nvidia’s Grace-Blackwell system and its next-generation Vera-Ruben system, along with custom AI silicon and increasingly dense and energy-efficient data centers. Power grid requirements and cooling innovations are also becoming investment focal points. Indeed, the Dell’Oro Group predicts that AI data center spending could reach $1.1 trillion a year by 2029.2

Further, we believe there is massive latent demand for reasoning AI capabilities to drive the investment wave. A clear example of this is the launch of DeepSeek, a highly efficient AI model with reasoning capabilities.

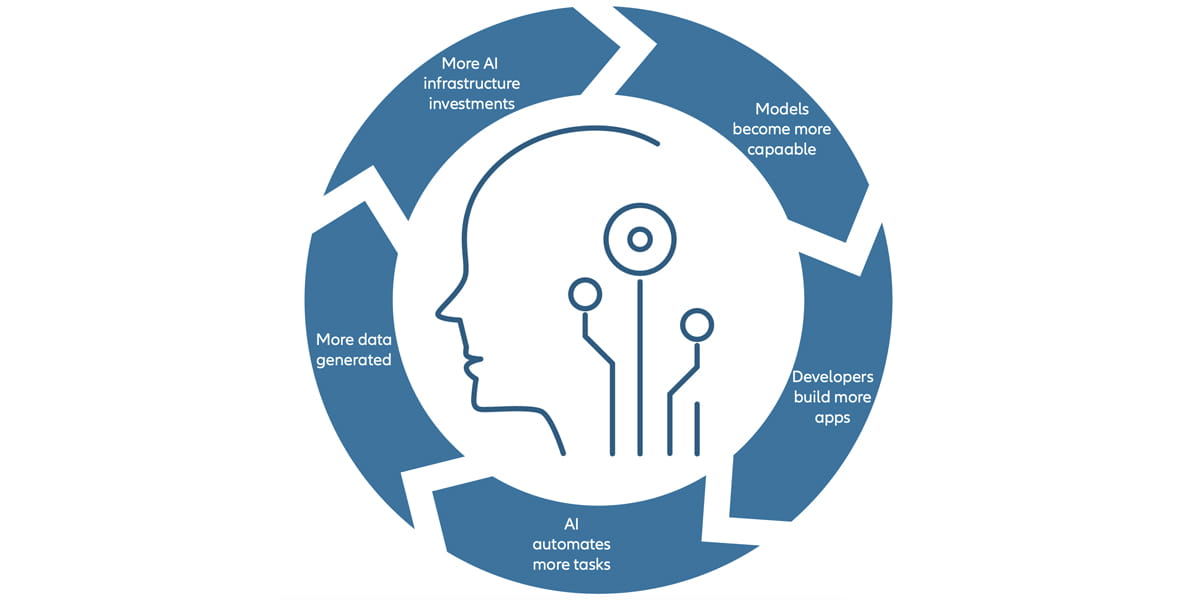

Contrary to fears that more efficient models would reduce compute usage, DeepSeek’s debut led to a surge for more workloads across inference platforms. This underscores a powerful dynamic—better and more efficient reasoning capabilities amplify usage. As models become more capable, developers build more applications, automate more tasks, and push models into more complex domains, leading to an exponential rise in demand. This trend follows Jevons’ Paradox: increased efficiency drives greater consumption.

The adoption curve is just ramping up

We believe the largest and most impactful deployments are still to come. A recent BCG report shows that nearly 75% of companies are still in the exploration and experimentation stage for AI.3 To adopt reasoning AI, enterprises must address a variety of challenges: securing customer data, hiring AI specialists, redesigning operational workflows, and justifying the investment to various committees. This process is reminiscent of the early cloud era, when full-scale migration took years to materialize.

Looking ahead, we see a future where companies stitch together complex workflows using reasoning AI to unlock significant productivity gains. These applications, often referred to as “AI agents,” act as autonomous digital workers that operate on top of existing software stacks, datasets, and tools to carry out business objectives.

This transformation is still in its early stages, but the trajectory is clear. Companies that effectively augment their human workforce with AI agents will likely achieve a powerful multiplier effect—streamlining operations, accelerating decision- making, and gaining a competitive edge in their markets.

The investment implications are far-reaching

In short, demand for AI compute is climbing—driven by both the technical intensity of reasoning models and the anticipated explosion of real-world use cases.

For investors, this represents a generational opportunity to position ahead of true industry transformation. This includes companies that build the infrastructure, companies that leverage reasoning AI to create new intelligent applications, and companies that can extend industry leadership through AI-enabled execution.

The race is on. And those who understand the difference between today’s AI and tomorrow’s reasoning AI may stand to gain the most.

1Nvidia CEO Jensen Huang’s keynote presentation at NVIDIA’s GTC event, 03/18/25.

2Dell’Oro Group analysis as reported in “Data center spending to top $1 trillion by 2029 as AI transforms infrastructure,” NetworkWorld, 02/18/25.

3“Where’s the value in AI?” BCG, 10/24/24.