Shaping pathways to a sustainable future

Welcome to the Allianz Global Investors Sustainability and Stewardship Report 2021.

Our ambition is to help our clients be informed and position themselves for the opportunities of sustainable investing and the outcomes they seek. Reflecting on our progress in 2021, this report explores Allianz Global Investors' approach to sustainability and our evolving offering. It shows how we are shaping sustainable pathways with our clients through a focus on research capabilities, active stewardship and industry engagement. The report also explores our own journey as a sustainable business.

View our download area or explore the report highlights below.

Matt Christensen, Global Head of Sustainable and Impact Investing, Allianz Global Investors

Highlights of our year

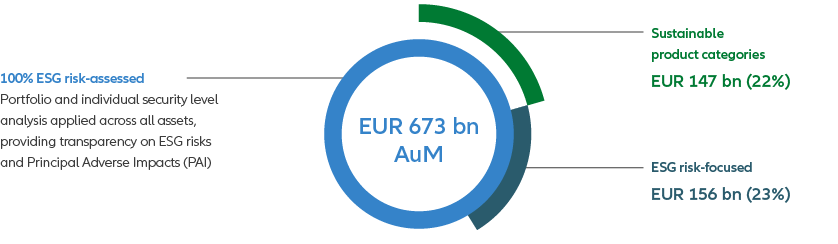

1 This figure includes EUR 156 billion of integrated ESG assets that are not considered sustainable according to EU Sustainable Finance Disclosure Regulation.

2 Reporting period January 2019 – December 2019. PRI reporting has been delayed by the PRI Association by one year. Ratings for the reporting period January 2020 – December 2020 are expected to be available by June 2022, while ratings for the reporting period January 2021 – December 2021 will not be available at all.

Insights from our Sustainability and Stewardship Report 2021

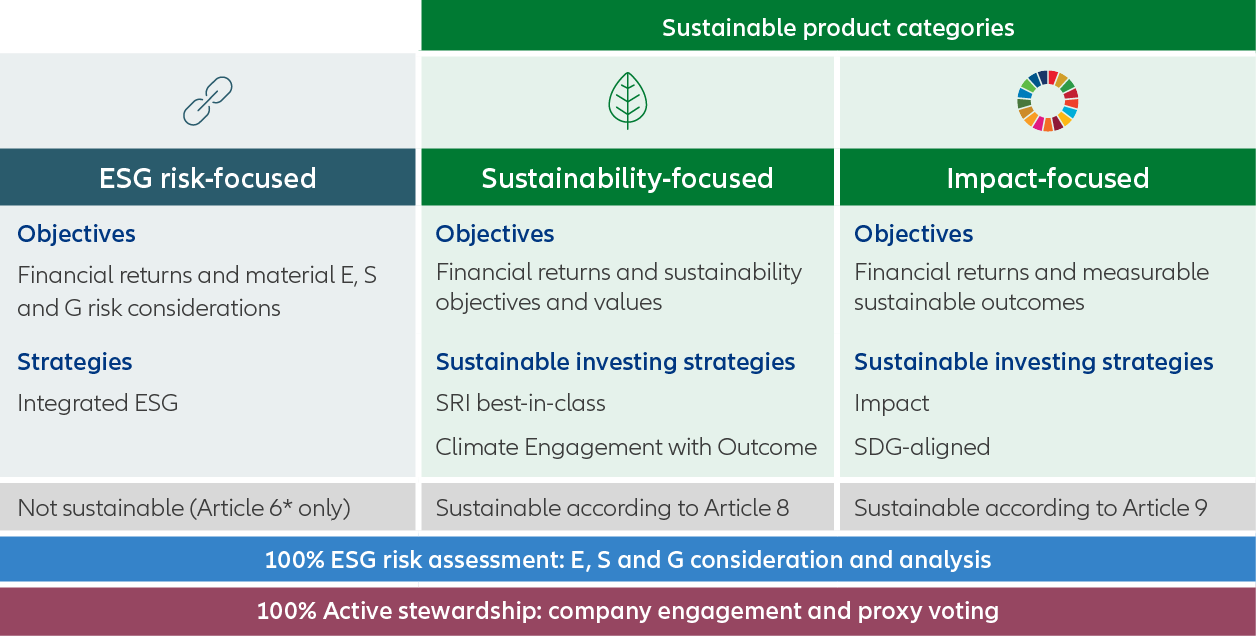

As an active manager asset manager, we aim to give investors access to a broad range of sustainable investment strategies. In 2021 we reviewed our definition of sustainable investments to align with the EU Sustainable Finance Disclosure rules.

We categorise our strategies globally into three different types, depending on clients’ sustainability objectives.

See our categorisation below.

|

|

Sustainable investing requires a lateral approach, interconnecting focus areas to achieve the highest impact. We have identified three strategic sustainability themes: climate change, planetary boundaries and inclusive capitalism. We believe these are critical to society, our investors and AllianzGI.

These themes guide our targeted, themed engagement and research designed to ensure the most material risks and opportunities for our business and clients, and to make a positive impact.

Learn more about these themes.

Climate change |

Planetary boundaries |

Inclusive capitalism |

|

Key ESG issues |

|

|

|

Beliefs |

Climate change is one of our planet's most pressing challenges, AllianzGI takes an active role in shaping our future | There is a risk of irreversible and abrupt environmental and social changes | "Inclusion" will become the next big wave after climate change and requires innovative thinking and solutions that meet the demands of younger generations |

Examples |

|

|

|

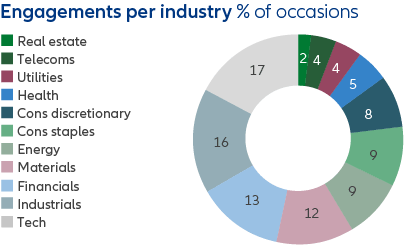

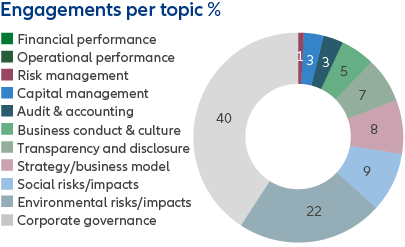

We believe that constructive engagement dialogue is essential. During 2021 we transitioned our engagement strategy towards a greater emphasis on thematic analysis aligned with our three themes of climate change, planetary boundaries and inclusive capitalism. Our Sustainability and Stewardship Report 2021 details a number of the engagement topics that were in focus throughout 2021.

Influencing companies through proxy voting at shareholder meetings is our fiduciary responsibility to our clients. It is a core part of our role as an active investor and allows us to have a say on some of the most important issues affecting the long term-term development of investee companies. Consequently we have a robust voting process reviewed at least once a year.

View a snapshot of our engagement activity in 2021

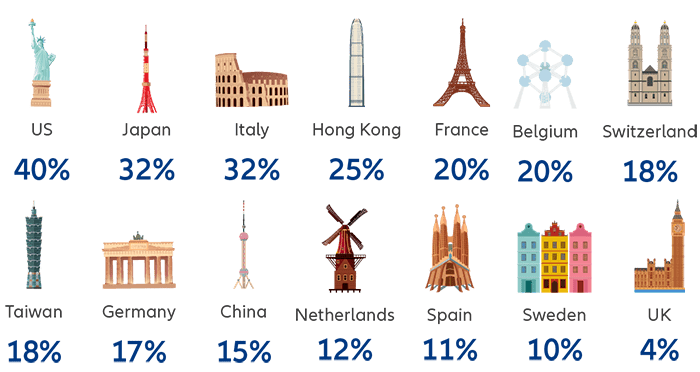

Selected voting data in key markets 2021

Total votes against all management proposals by location in 2021

Trust in our company is based on the integrity, resilience and competency of how we do business, as well as our culture and our people.

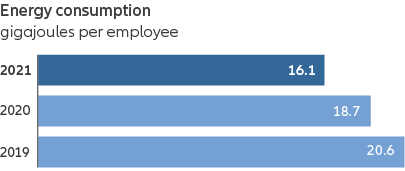

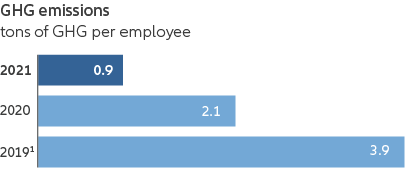

We are shaping pathways to a more sustainable future through our workplace culture, inclusion and diversity, our flexible working as well as a focus on our business conduct. Our efforts range from reducing our environmental impacts, securing our systems and data, to creating an inclusive workplace and supporting our colleagues’ health and wellbeing.

Take a look at our progress on reducing negative environmental impacts.

Our TCFD Report 2021

In recent years, AllianzGI has laid strong foundations for its climate change strategy by becoming an official supporter of the Task Force for Climate-related Financial Disclosures (TCFD) recommendations in 2019 and started implementing them. AllianzGI published its second standalone TCFD report, which highlights our progress in implementing the TCFD recommendations and demonstrates our commitment to providing clients with transparency around our climate change considerations.

|

Document

|

Date

|

Actions

|

|---|---|---|

|

04/05/2022

|

|

|

|

04/05/2022

|

|

|

|

12/05/2022

|

|