Active is: Thinking long term, today

3 policy differences for investors to watch in the US presidential race

Summary

President Trump and former Vice President Biden have notably different views about corporate taxes, energy and US-China trade, which may have a substantial impact on markets and portfolios.

Key takeaways

|

Corporate taxes, energy and US-China trade could affect portfolios the most

As the 3 November US presidential election draws closer, the race is tightening between Mr Trump and Mr Biden. While much is at stake in this election cycle, the three policy areas noted below could have a large impact on the markets and portfolio allocations. Investors should plan to adjust portfolios depending on the direction of policy after election day – though emerging technology and infrastructure may be winners regardless of the outcome.

The two candidates have similar views on drug pricing, tech giants and infrastructure

Despite their many differences, Mr Biden and Mr Trump are aligned in some areas that markets may not appreciate. For example, both candidates support some form of lowering pharmaceutical drug prices. Both also favour more regulation of – and have even called for breaking up – certain large US tech firms. And both hope to pass substantial US infrastructure packages, supporting areas like smart cities, roads and airports – though Mr Biden also supports developing clean-energy infrastructure.

The global pandemic is the big wild card in this election year

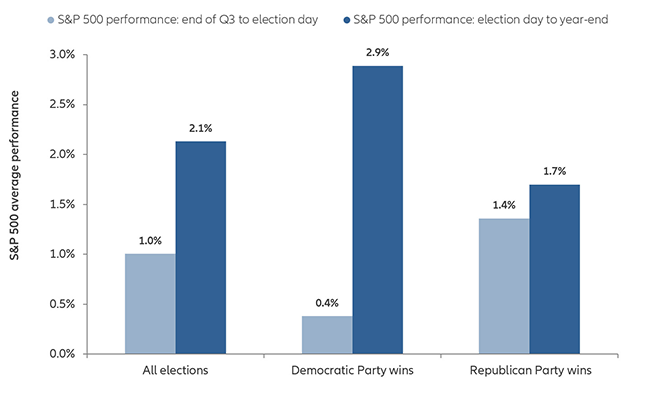

Historically, markets have done worse in the weeks before election day than in the period from election day to year-end (see chart). This is likely because the markets don’t like uncertainty: once an election is over, the markets are able to start factoring in the next president’s policies.

Equity performance has historically been stronger after presidential elections

Average S&P 500 performance before and after presidential election years (since 1970, excluding 2008)

Source: FactSet as at September 2020. The above chart is illustrative in nature and not indicative of future results. It is not possible to invest directly in an index.

At the same time, the global Covid-19 pandemic makes this a very unusual election year for the markets. While the presidential candidates spar over how they would approach the pandemic, the markets are processing new data points about regional outbreaks, vaccines, drug therapies and the pace of economic recovery – in addition to the level of monetary and fiscal support that has provided a floor for markets so far.

If the global economy does rebound in the next 12-18 months, we expect to see broader sector and geographical participation in the market’s upside – beyond the large-cap US technology stocks that have led through the crisis. Investors may want to factor this in, along with the candidates’ proposals, to consider allocations to select sectors. Cyclicals (such as select industrials, energy and financials), emerging technology with long-term growth potential (such as 5G, AI and cybersecurity), infrastructure and clean energy may all be potential winners in a post-2020 US election era.

1321342

Summary

The European Green Deal outlines the ambition of the European Commission to transition towards a more sustainable and digital economy; which themes are most likely to benefit from this shift?

Key takeaways

|

-

Investing involves risk. Equities have tended to be volatile, and do not offer a fixed rate of return. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security.

The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security.

The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted.

This material has not been reviewed by any regulatory authorities. In mainland China, it is used only as supporting material to the offshore investment products offered by commercial banks under the Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations. This document does not constitute a public offer by virtue of Act Number 26.831 of the Argentine Republic and General Resolution No. 622/2013 of the NSC. This communication's sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of his document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Brazil, Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Pacific Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional/professional investors only, and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide financial services to retail clients in Australia. AllianzGI AP (Australian Registered Body Number 160 464 200) is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of financial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which differ from Australian laws.

This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors U.S. LLC, an investment adviser registered with the U.S. Securities and Exchange Commission; Allianz Global Investors Distributors LLC, distributor registered with FINRA, is affiliated with Allianz Global Investors U.S. LLC; Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG; Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424, Member of Japan Investment Advisers Association and Investment Trust Association, Japan]; and Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan.

Corporate tax policy: while Mr Trump’s corporate tax policies are ostensibly more market-friendly, Mr Biden’s plan may be offset by other growth initiatives

Energy policy: a Biden presidency could create opportunities for clean energy, while another Trump term would support the existing energy regime

US-China trade policy: both candidates would be “tough on China” and aim to strengthen US tech leadership over China

Mr Biden proposes spending on climate change, infrastructure and “buy American” support for tech

Key components of Biden’s spending proposal (in USD billions)

Source: Biden for America as at September 2020.