China’s GDP growth will help other Asian economies to different degrees, but virus containment is key

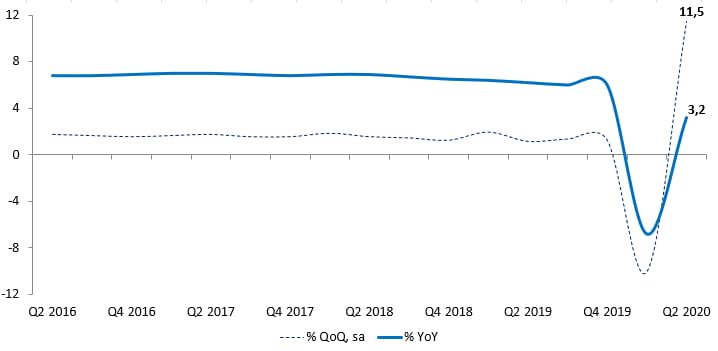

China’s growth has rebounded sharply following the first-quarter downturn prompted by the Covid-19 pandemic (see Chart 1). We believe China’s recovery will continue, though at a more moderate pace than was seen in 2Q20. The successful containment of the outbreak was the biggest factor in sustaining a functioning economy, though the government’s swift and targeted stimulus measures also helped. We think the Chinese authorities will continue to keep interest rates low and implement other accommodative policy measures to support a steady economic recovery, though rates may not move much lower.

China’s ongoing recovery should be good news for several other Asian economies – primarily those that are most closely linked to China and have had similar success in containing Covid-19.

Chart 1: China’s growth rebounded sharply in 2Q20

Source: NBS, CEIC, AllianzGI Economics & Strategy, as at June 2020.

Hong Kong and Taiwan are likely to benefit most from mainland China’s recovery

According to the Trade-in-Value-Added database compiled by the OECD (Organisation for Economic Co-operation and Development) and WTO (World Trade Organization), 9.6% of Hong Kong’s GDP is generated by demand from mainland China. This means a 10% increase in mainland Chinese demand, everything else being equal, would likely lift Hong Kong’s GDP by just under 1 percentage point. The sensitivity of Taiwan’s GDP to mainland Chinese demand is even higher.

As Chart 2 shows, a recovery in domestic demand in mainland China would likely benefit economies like Taiwan, Hong Kong, Malaysia, Singapore and South Korea the most. This is thanks to the close trade links in goods and services that these economies have established with mainland China relative to the size of their own GDPs. For example, China imports from South Korea, Taiwan and Malaysia many technological items such as semiconductors and other intermediate components which underpin its rapid technological advances, and much of Hong Kong’s revenue from tourism and trade services comes from mainland China.

Chart 2: Export exposure in value added terms (% of GDP)

| Destination of final demand | |||||||

|

|

China |

Us |

EU28 |

Japan |

ASEAN |

RoW |

World |

| Taiwan | 13,4 | 6,7 | 4,2 | 2,8 | 3,2 | 10,5 | 40,6 |

| Hong Kong | 9,6 | 3,0 | 4,3 | 1,3 | 2,6 | 8,3 | 29,2 |

| Malaysia | 9,6 | 6,1 | 4,9 | 4,2 | 6,8 | 16,1 | 47,6 |

| Singapore | 8,1 | 7,0 | 10,4 | 4,3 | 8,0 | 20,1 | 57,8 |

| South Korea |

7,7 | 5,6 | 3,3 | 1,8 | 2,2 | 10,0 | 30,6 |

| Thailand | 7,2 | 6,1 | 4,9 | 3,6 | 5,1 | 16,0 | 42,9 |

| Vietnam | 6,2 | 9,4 | 5,7 | 4,2 | 3,5 | 14,4 | 43,3 |

| Philippines | 4,1 | 4,7 | 2,6 | 2,4 | 1,9 | 6,2 | 21,8 |

| Japan | 2,9 | 3,2 | 1,7 | N.A. | 1,4 | 5,1 | 14,3 |

| Indonesia | 2,7 | 2,4 | 1,8 | 1,8 | 1,8 | 7,4 | 17,9 |

| India | 1,1 | 4,1 | 2,7 | 0,5 | 0,9 | 5,9 | 15,2 |

| China | N.A | 4,0 | 2,7 | 1,3 | 1,0 | 7,1 | 16,0 |

Source: OECD-WTO TiVA indicators (2018 edition), AllianzGI Economics & Strategy, as at December 2016.

India and Indonesia may see less of a benefit from China’s rebound, especially since the number of Covid-19 cases is still growing in both

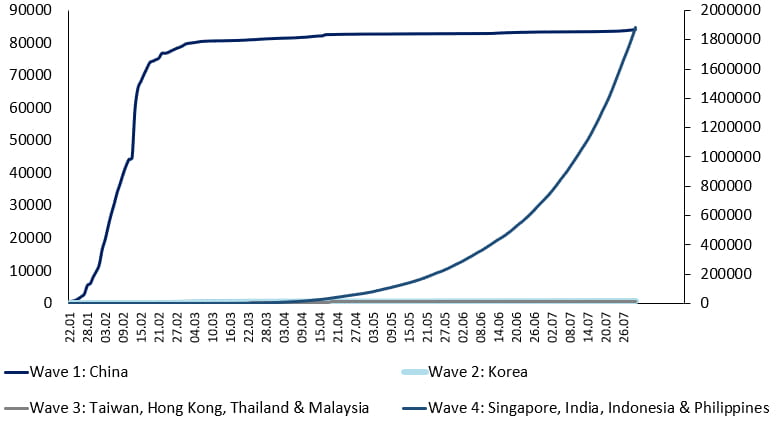

Domestically oriented economies such as India and Indonesia are relatively less sensitive to a recovery in Chinese domestic demand. This is because of the comparatively smaller weight of trade with mainland China-as a proportion of their own GDP. In addition, the Covid-19 pandemic isn’t yet abating in India, Indonesia and the Philippines (see Chart 3). This is subduing economic activity.;

Chart 3: India, Indonesia and the Philippines are still seeing rising Covid-19 infections

Covid-19 confirmed cases to date

Source: Johns Hopkins University, Morgan Stanley Research, AllianzGI Economics & Strategy, as at July 2020.

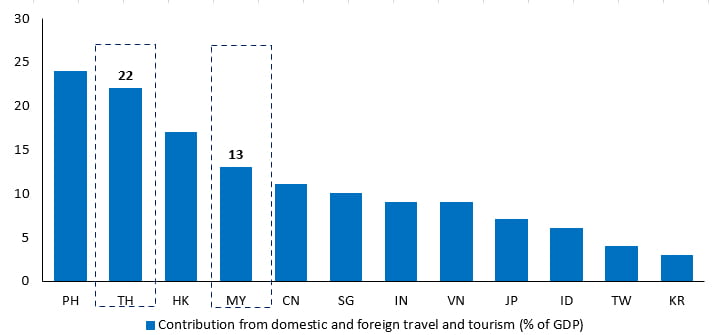

Thailand and Malaysia rely on tourism, which will take time to return to usual levels

Both the Thai and Malaysian economies have so far controlled Covid-19 better than their peers, successfully flattening the new infection curves. But we do not expect a swift recovery since both Thailand and Malaysia rely greatly on tourism (see Chart 4) – a sector that is likely to continue to be hampered as a result of reduced international travel.

Chart 4: Thailand and Malaysia rely greatly on tourism revenues

Source: CEIC, HSBC, AllianzGI Economics & Strategy, as at December 2019.

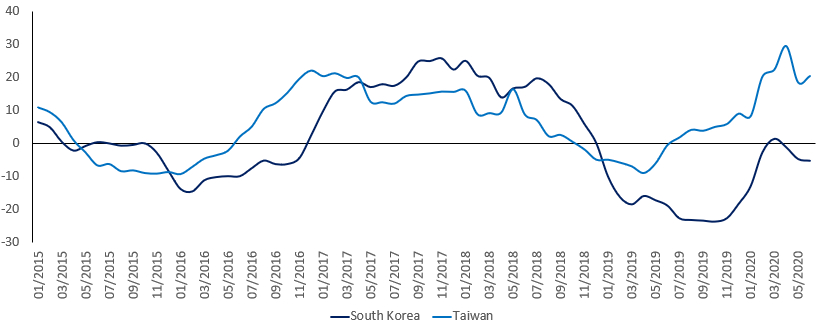

South Korea and Taiwan are in a much better position than their south Asian peers thanks to their progress so far in controlling Covid-19 and their economies’ focus on technology exports

Export growth has been recovering faster than anticipated, due to the world’s increased reliance on technology during the pandemic. The increase in working from home has helped drive demand for servers, laptops and other communication technology products (see Chart 5).

Chart 5: South Korea and Taiwan’s exports are supported by technology products

Electronics & Electronic product exports (% yoy, 3mmav)

Source: CEIC, AllianzGI Economics & Strategy, as at June 2020.

Investment implications

In equities, consider North Asia over South and South-East Asia

We suggest staying overweight in North Asian equity markets (mainland China, Hong Kong, Taiwan and South Korea) versus the South and South-East Asian markets (India, Indonesia, Philippines, Thailand and Malaysia).

- The fact that the North Asian economies were typically more advanced in containing Covid-19 is key. Assuming there is no second-wave outbreak, these economies are likely to be at the end stage of the pandemic, moving towards economic recovery.

- We remain cautious on South and South-East Asian economies, in particularly India, Indonesia and the Philippines, as they are still fighting the spread of Covid-19. Keeping growth going may require increased fiscal stimulus, which will put pressure on central banks to deliver. Persistent growth is likely to require greater fiscal stimulus support, which in turn puts pressure on central banks to ease excessively and help finance government bond issuance.

In fixed income, consider more exposure to Asian corporate credit for better yield enhancement

With the very strong stimulus responses from the Fed and the resumption of growth in Asia, we think the risk of credit defaults in Asia should reduce considerably. This may prompt corporate credit spreads to tighten much more than sovereign and quasi-sovereign credit spreads, which we think have pretty much priced in the current circumstances.

1296538

Active is: Thinking long term, today

3 policy differences for investors to watch in the US presidential race

Summary

President Trump and former Vice President Biden have notably different views about corporate taxes, energy and US-China trade, which may have a substantial impact on markets and portfolios.

Key takeaways

|

-

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security. The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted.

This material has not been reviewed by any regulatory authorities. In mainland China, it is for Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations and is for information purpose only. This document does not constitute a public offer by virtue of Act Number 26.831 of the Argentine Republic and General Resolution No. 622/2013 of the NSC. This communication's sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of his document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Brazil, Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Pacific Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional/professional investors only, and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide financial services to retail clients in Australia. AllianzGI AP is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of financial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which differ from Australian laws.

This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG; in HK, by Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; in Singapore, by Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; in Japan, by Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424], Member of Japan Investment Advisers Association, the Investment Trust Association, Japan and Type II Financial Instruments Firms Association; in Taiwan, by Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan; and in Indonesia, by PT. Allianz Global Investors Asset Management Indonesia licensed by Indonesia Financial Services Authority (OJK).