Summary

The recently announced Regional Comprehensive Economic Partnership will likely enhance China’s continued growth story – and will help boost global GDP.

Key takeaways

|

Following eight years of negotiations, the Regional Comprehensive Economic Partnership (RCEP) was officially signed by 15 Asia-Pacific countries in November 2020. Significantly, it creates a new economic bloc that covers about a third of the world’s population, and almost a third of global GDP and trade. To put this in context, it is bigger than both the US-Mexico-Canada Agreement and the European Union.

The pact will progressively remove both tariff and non-tariff barriers on trade in both goods and services. According to the Center for Strategic and International Studies, it will lower tariffs on imports by up to 90% within 20 years. On top of this, the RCEP also sets common trade rules within the bloc.

The RCEP unites the 10 members of ASEAN (Association of South-East Asian Nations) – which first proposed the RCEP idea about a decade ago – along with China, Japan, South Korea, Australia and New Zealand as free trade agreement (FTA) partners.

Chinese growth will have global impact

China is likely to benefit strongly from the deal, as it will face fewer barriers to exports into the rest of Asia. But other members within the RCEP may benefit even more. The ASEAN countries, together with South Korea and Japan, will likely find it easier to build their value chains.

According to a recent report from the Peterson Institute for International Economics, Japan and South Korea are also the two countries most likely to benefit in real GDP terms, each enjoying a near 1% boost to GDP. China and ASEAN members meanwhile are forecast to see a smaller 0.3% impact. The report also predicts that by 2030, the RCEP will boost global GDP by USD 186 billion.

What does this mean for investors?

The RCEP represents an important step towards broader regional integration within Asia, helping to strengthen the regional supply chain over the medium-term and setting the stage for closer economic integration. This translates into several key implications for investors:

- The RCEP should foster deeper trade integration – and bring associated economic benefits. As a result, the systems involved in a cross-border production network will likely become more flexible, helping to enhance productivity, accelerate structural shifts and spur growth across the region in the medium term.

- The closer relationship between trade and investment is expected to deepen financial market integration in the Asia-Pacific region. This should help ensure China’s trade with ASEAN member nations continues to outpace trade with other regions. ASEAN members will likely become further integrated into China’s supply chain.

- The world’s dependence on Asia – and mainland China in particular – for components of all sorts, has only increased; simplified trade will mean both Chinese and US importers may import more from third parties such as ASEAN member states.

- A unified “rules of origin” system under the RCEP should help reduce time and transaction costs as producers need fill out only one document to certify the origin of their products. This could also encourage firms to outsource some production to other countries within the RCEP for cost savings.

Perhaps most significantly, the RCEP signals that Asia is moving ahead with trade liberalisation. And from a global perspective, it reinforces the trend of the world’s centre of economic gravity continuing to shift eastward.

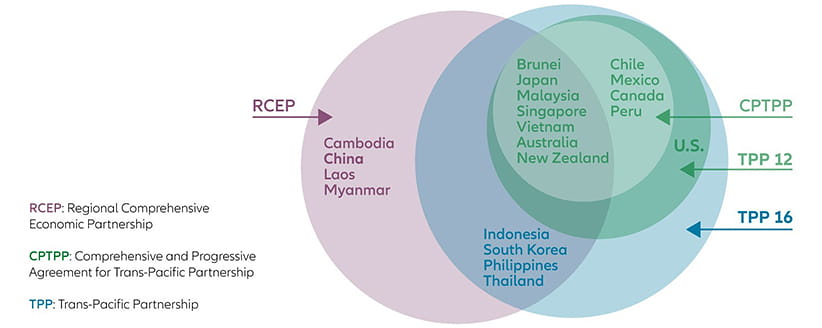

Chart: RCEP vs existing trade deals

Asia-Pacific countries sign world’s biggest free-trade deal

Source: Allianz Global Investors Global Economics & Strategy, November 2020.

1439160

Active is: Challenging convention

Brexit done, Covid continues: what’s next for the UK?

Summary

The UK market has been deeply out of favour for some time now. The agreement of a UK-EU trade deal marks an essential step towards making the UK “investable” again but several other factors – not least the ongoing Covid-19 pandemic – will continue to weigh on sentiment.

Key takeaways

|

-

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security. The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted.

This material has not been reviewed by any regulatory authorities. In mainland China, it is for Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations and is for information purpose only. This document does not constitute a public offer by virtue of Act Number 26.831 of the Argentine Republic and General Resolution No. 622/2013 of the NSC. This communication's sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of his document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Brazil, Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Pacific Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional/professional investors only, and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide financial services to retail clients in Australia. AllianzGI AP is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of financial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which differ from Australian laws.

This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG; in HK, by Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; in Singapore, by Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; in Japan, by Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424], Member of Japan Investment Advisers Association, the Investment Trust Association, Japan and Type II Financial Instruments Firms Association; in Taiwan, by Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan; and in Indonesia, by PT. Allianz Global Investors Asset Management Indonesia licensed by Indonesia Financial Services Authority (OJK).