Summary

Armed conflict, financial woes and inflation shocks have contributed to a tricky 2022 so far for emerging markets. But a broader, systemic crisis is not anticipated for emerging-market debt, and there might be reasons for optimism about a recovery.

Key takeaways

|

Emerging markets suffered a terrible start to 2022. Inflation shocks, the invasion of Ukraine, as well as crises in Russia (a result of the invasion of Ukraine) and Sri Lanka have raised fears of a domino effect of debt defaults. Nevertheless, now that the US Federal Reserve is raising interest rates, if history is our guide, there may be reason for optimism.

The JPMorgan Emerging Market Bond Index Global (EMBIG) was down just over 16% year-to-date through to 4 May. That poor performance has been led largely by an inflation spike that hit developing economies in 2021 and this year has spread to industrialised economies. Inflation coupled with the situation in Ukraine has sparked a commodity shock, driving the prices of everything from oil to wheat higher.

However, the decision by the US central bank to raise rates modestly in March and then on 4 May with a more aggressive 50 basis points hike – its largest change in two decades and the first back-to-back increases since 1994 – may mark a potential turning point for emerging-market (EM) debt investors.

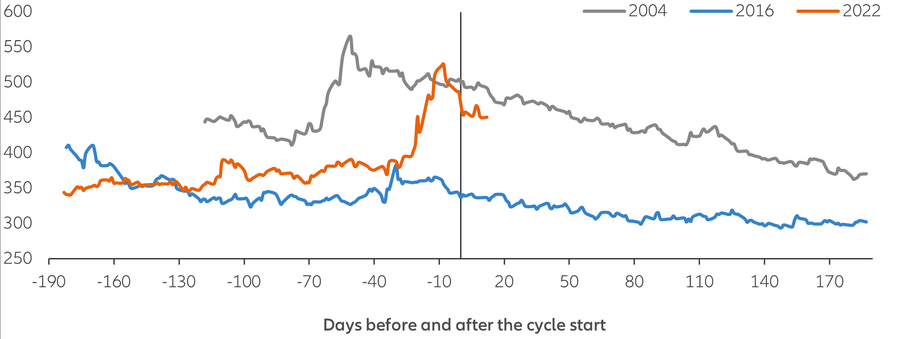

Our analysis of the Fed’s previous two interest rate increase cycles (in 2004 and 2016) and the impact of those actions on EM debt reveals that the asset class tends to perform poorly in the months leading up to the first Fed hike. That dynamic played out as expected in the first months of 2022, with the JPMorgan Emerging Markets Bond Index Global Diversified down about 10% from the start of the year to mid-March. However, EM debt performed quite strongly in the three quarters following the first Fed move in both 2004 and 2016 (see Exhibit 1). That suggests that by the end of the year, EM debt may reverse losses from before the Fed’s first hike. So far, spreads against comparable US Treasuries have already moved lower from recent peaks, declining from about 525 basis points just before the Fed’s March move to about 450 basis points in May.

Exhibit 1: emerging-market debt has performed well after previous rate hikes

Source: Allianz Global Investors, Bloomberg, JPMorgan. Data as at 9 May 2022. Chart depicts the J.P. Morgan Emerging Markets Bond Index Global spread-to-worst. Investors cannot invest directly in an index. Past performance is no guarantee of future results. For illustrative purposes only.

Reasons to be anxious

Of course, there are reasons why some investors remain understandably anxious. Russia is expected to default in what would be the first-ever delinquency by an investment-grade EM sovereign issuer. However, given Russia’s ample foreign reserves and that fact that its crisis was caused by its government’s decision to invade Ukraine, it’s reasonable to expect that this unprecedented credit event is unlikely to be repeated by other investment-grade sovereign credits.

Similarly, Sri Lanka’s debt and political crisis is not a sign of broader systemic EM challenges but rather the result of poor policy choices, notably maintaining a soft currency peg – a foreign exchange regime that has been out of favour since Argentina’s 2001 default – coupled with very loose fiscal policy that was financed via central bank money creation.

Another reason to be constructive on EM debt is the fact that the asset class has significantly matured. Large current accounts coupled with the pegged exchange-rate systems that were common at the time were the primary causes of several crises in the 1990s. Now, EM economic metrics have improved. For example, in 2021, the aggregate current account among 69 of the 73 countries in the EMBI index (excluding four countries classified by the International Monetary Fund as special situations) was a surplus of 0.5% of economic output, a positive result not seen in the prior seven years, according to IMF data.

Current accounts have fallen in step with increased savings rates, implying a diminished need to borrow in US dollars. The number of issuers has grown from about a dozen issuers two decades ago to more than 80 countries now issuing US-dollar debt. At the same time, the majority of EM debt is now issued in local currencies, making these issues less vulnerable to volatile exchange fluctuations.

Selectivity can reveal opportunities

Still, selectivity is key, as evidenced by the hit index-tracking strategies took when Russia was removed from indices. Today, emerging markets are largely split evenly between commodity exporters and importers as well as between investment-grade and high-yield issuers. Investors may favour commodity exporters in Latin America and oil producers in Africa and the Middle East, while underweighting commodity-importers in Asia, particularly China, in our view. Countries such as Ecuador, Costa Rica and Mozambique, undertaking IMF structural reform programs, are also worth consideration, in our view.

Investors would also be wise to track environmental, social and governance (ESG) data, which could help spot potential opportunities and risks. For example, Turkey’s governance scores fell the most among EMs in the past five years, foreshadowing a subsequent asset price decline. Likewise, deteriorating ESG metrics over the past year in such places as Kazakhstan and Belarus showed that these countries’ debt issues would fare poorly.

While EM debt has underperformed in 2022, there is reason for optimism that the asset class could recover as the year progresses. The combination of economic fundamentals that have significantly improved over the past decade and favourable valuations (both in terms of absolute yields and spreads) set the stage for opportunities for investors willing to take a selective approach.

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security.

Emerging markets may be more volatile, less liquid, less transparent, and subject to less oversight, and values may fluctuate with currency exchange rates.

The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted.

This material has not been reviewed by any regulatory authorities. In mainland China, it is for Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations and is for information purpose only. This document does not constitute a public offer by virtue of Act Number 26.831 of the Argentine Republic and General Resolution No. 622/2013 of the NSC. This communication's sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of his document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Brazil, Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Pacific Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional/professional investors only, and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide financial services to retail clients in Australia. AllianzGI AP is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of financial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which differ from Australian laws.

This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors U.S. LLC, an investment adviser registered with the U.S. Securities and Exchange Commission; Allianz Global Investors Distributors LLC, distributor registered with FINRA, is affiliated with Allianz Global Investors U.S. LLC; Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG; in HK, by Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; in Singapore, by Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; in Japan, by Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424], Member of Japan Investment Advisers Association, the Investment Trust Association, Japan and Type II Financial Instruments Firms Association; in Taiwan, by Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan; and in Indonesia, by PT. Allianz Global Investors Asset Management Indonesia licensed by Indonesia Financial Services Authority (OJK).

2219219

The crisis on our plates: finding potential in failing food systems

Summary

The war in Ukraine has highlighted that the current way of producing and consuming food is unsustainable. As the rising global population places greater demands on our food system, there is an urgent need to build a resilient and inclusive food ecosystem, meeting both planetary and social needs. Opportunities exist for investors across the value chain of global food production and distribution to help mitigate these risks.

Key takeaways

|