Navigating Rates

Time to consider emerging-market fixed-income?

The potential for attractive returns, strong economic growth prospects and selectively cheap valuations may boost the appeal of emerging-market debt. With lower inflationary pressures than developed markets, now may be the time to take a closer look at the asset class.

Key takeaways

- Emerging-market bonds may offer a sufficient cushion to offset market volatility, even after stripping out struggling countries offering the highest yield.

- Investors may take heart from the potential for growth, with emerging-market debt historically performing well during changes in US interest rate policy.

- Economic prospects for many emerging markets have improved – with the growth gap between emerging and developed markets remaining wide – while inflation is slowing.

1. Carry potentially high enough to offset market volatility

Yields for emerging-market bonds are nearing 10-year highs, offering a sizeable “carry buffer”. In other words, even without changes in bond pricing, investors may still be rewarded with an increase in the value of their investment. And the potential increase may still be sufficient to offset any market volatility induced by changes in US interest rates and other potential shocks.

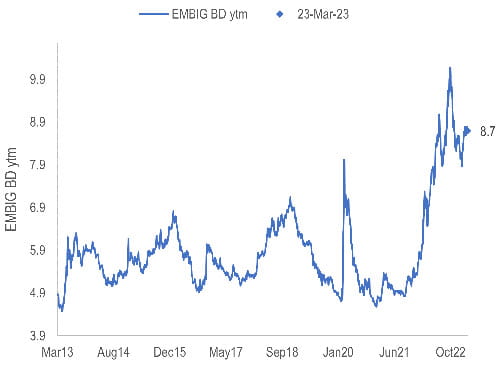

The JPMorgan Emerging Market Bond Index Global (EMBIG), a common benchmark for emerging market hard currency sovereign bonds, currently has a yield of 8.7% -- a level that was exceeded during the past decade only when geopolitical risks escalated after Russia invaded Ukraine in February 2022 (see Exhibit 1).

Exhibit 1: yields for hard-currency bonds are at 10-year highs when removing the geopolitical spike

JPMorgan Emerging Market Bond Index Global Broad Diversified yield-to-maturity

Source: JPMorgan, Allianz Global Investors as at March 2023

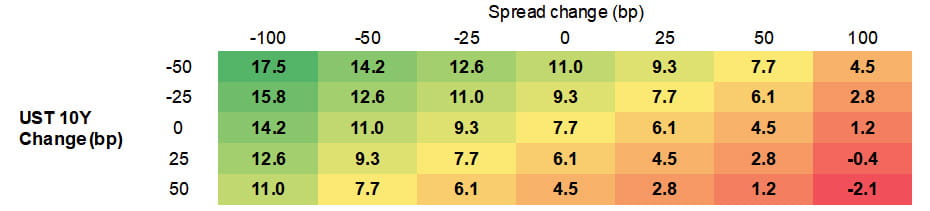

In our view, this allows for a significant “carry buffer”, even when excluding several emerging market countries offering the highest yield because of the challenges they face. A scenario where US Treasury rates are rangebound – meaning they stay within certain upper and lower limits – and spreads remain at current levels could offer a potential carry of 7.7% per year (see Exhibit 2).

Exhibit 2: breakeven scenarios for emerging-market hard-currency bonds, stripping out several countries with challenging macroeconomics

EM hard currency sovereign return expectations (12m)

Source: JPMorgan, Allianz Global Investors, as at March 2023

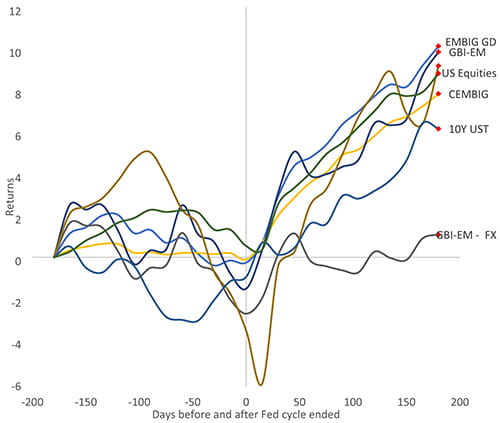

2. Fed cycle ends have historically offered a buying opportunity for emerging markets

It is uncertain when the US Federal Reserve (Fed) will end its current cycle of raising interest rates. However, in our view, investors should be prepared for a pivot in the months ahead. US swap markets have priced in a pause in rate hikes about three months from now. History shows that Fed pivots have provided a significant buying opportunity for emerging markets (see Exhibit 3). On average, emerging market hard currency sovereign bonds have delivered double-digit (10.1%) returns for the last two Fed monetary policy tightening cycles, which ended in June 2006 and December 2018, according to our analysis of performance (proxied by using JPMorgan’s emerging market indices) in the six months before and after Fed cycles ended.

Exhibit 3: emerging market performance six months before and after the Fed ended tightening cycles in 2006 and 2019

Total returns in percentage. Base 0% six months before the Fed cycle’s end day

Source: Allianz Global Investors, Bloomberg, as at March 2023

3. Emerging market fundamentals are strong, with improving prospects for economic growth and peaking inflation

Prospects for economic growth in emerging markets have improved. The outlook for economic growth has improved since the start of 2023 and is currently at 4% for the year. That forecast is based on our emerging market economic growth indicator that weights the Bloomberg consensus gross domestic product growth expectations for 34 emerging market countries (see Exhibit 4). In particular, the reopening of China after Covid-19 lockdowns should give a significant boost to the economic recovery across emerging markets.

Exhibit 4: 2023 growth prospects for emerging markets have improved

Weighted average of 2023 gross domestic product (GDP) growth expectations for 34 emerging market countries based on Bloomberg consensus estimates, using 2021 USD GDP weights

Source: JPMorgan, Allianz Global Investors, as at March 2023

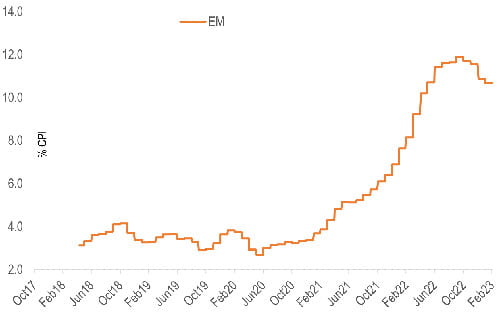

Another encouraging indicator is that inflation in emerging markets is decelerating. Emerging market central banks were overall significantly more aggressive than their developed market policymakers, delivering earlier interest rate hikes and with larger magnitudes in response to inflationary pressures. In our view, the response has enabled a better control of inflation and, consequently, yearly average metrics for emerging market consumer price indicators (CPI) are already showing visible signs of deceleration from their peak. Core CPI has been sticky in many countries and the downward trend is uneven. But the inflationary outlook is less strong for emerging markets than developed markets, in our view.

Our emerging market CPI indicator has fallen to 10.7% in March, down from 11.88% in October of 2022 (see Exhibit 5).

Exhibit 5: consumer price indicators (CPI) in emerging markets have moved off their highs

Weighted average of 2023 CPI year on year expectations for 27 emerging market countries based on Bloomberg consensus estimates, using 2021 USD gross domestic product weights

Source: Bloomberg, Allianz Global Investors, as at March 2023

4. Valuations for many sovereign bonds are cheap by historical standards

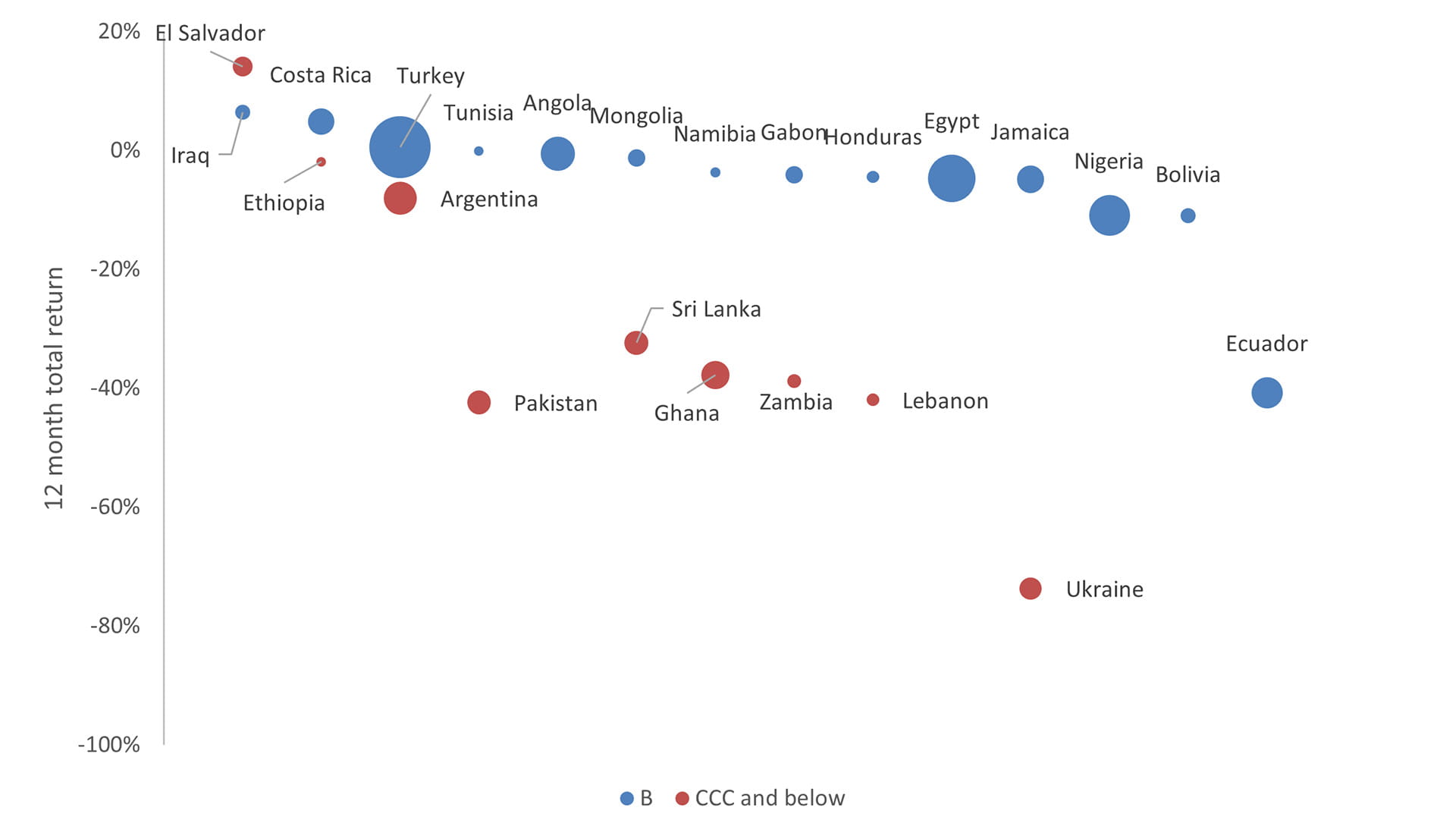

We believe, the poor performance in recent quarters of several distressed emerging market countries (Lebanon, Pakistan and Sri Lanka, for example) have eroded appetite for other nations with stronger macroeconomic prospects – and higher credit ratings (see Exhibit 6). The sovereign bonds of several non-distressed countries have performed relatively well in recent months, while others with similar credit ratings have not. We see potential opportunities for value in the latter, with careful asset selection.

Exhibit 6: large market differentiation with uneven performance of high yielders

Last 12-month return for sovereign credit rated in the Bs and CCCs

Source: Bloomberg, Allianz Global Investors, as at December 2022

Overall, we see reasons for optimism for emerging markets. The combination of improving economic fundamentals and favourable valuations may set the stage for opportunities for investors willing to take a selective approach.