The China Briefing

The 20th Party Congress – what not to expect

Please find below our latest thoughts on China:

- All eyes are on the Party Congress in coming days. It kicks off on 16 October with a speech from President Xi Jinping laying out his broad agenda for the next five years.

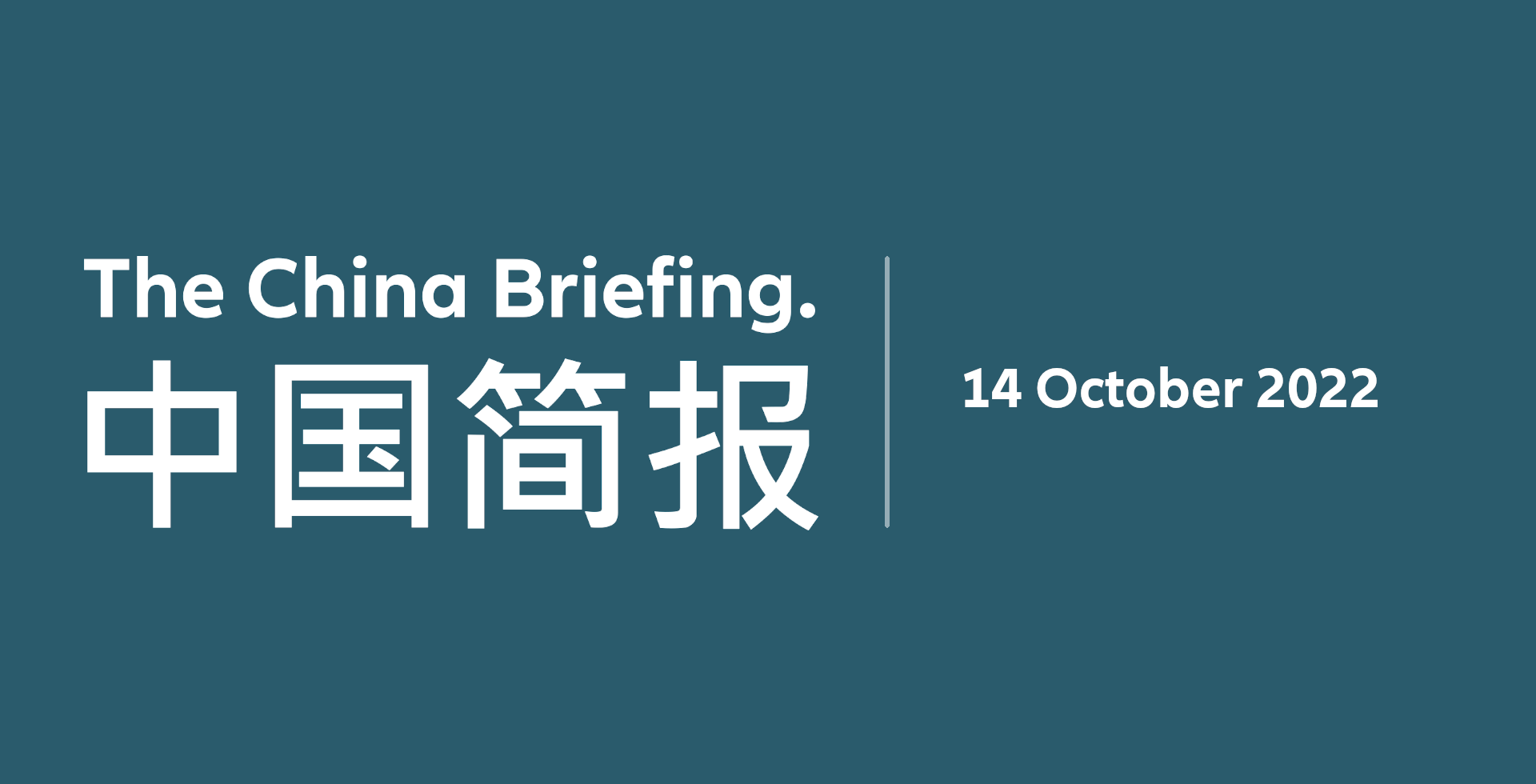

- And after the close of the Congress, about a week later, the new members of the Party’s top leadership bodies – the Politburo (25 members) and its Standing Committee (currently seven members) will be announced. This is the group of the most senior Communist Party leaders in China, who will be in office for the next five years until late 2027.

- The full reshuffling of other party and government offices takes around six months and will be completed only after the so-called “Two Sessions” in March 2023.

- Will the Congress be a game changer for markets? Our view is yes in some senses, but no in others.

Chart 1: China national political organisation structure

Source: Cheng Li, Brookings Institution. February 2022

- To explain further – we do not expect to hear new policy stimulus measures or changes to Covid policies over the next week. The Party Congress is not a policy-making body. It sets the overall guidelines for politics, the economy and foreign policy.

- As such, President Xi’s speech will likely be peppered with phrases such as dual circulation, high-quality development and common prosperity. The initial market response may therefore be quite muted.

- However, if we reflect on the previous Party Congress in 2017, we can see how it can be a game changer over a medium to longer-term perspective.

- In 2017 the theme was all about “security” and de-risking the economic system. And with the benefit of hindsight, that’s where policy makers have put a lot of emphasis in the last five years.

- This includes the crackdown on shadow banking as well as the anti-monopolistic policies aimed at the tech giants, highly leveraged property developers and so on. Indeed, this was the Congress where the mantra “housing is for living, not for speculation” was first heard.

- Of course, the interpretation of these events from an international perspective looks quite different. And this has led to questions about whether China continues to prioritise growth, particularly given the emphasis on maintaining zero-Covid policies when the rest of the world has long moved on.

- So, something to watch for during the Congress are signs of a move away from this de-risking theme, and more emphasis on growth and development. We believe economic growth continues to be the top priority for China’s leaders, not least because of the importance of economic growth for social stability.

- While any change of broad emphasis may not lead to an immediate market rally, it will be an important signal that this is where we can expect to see the focus of policy in the coming years. And in turn this should start in time to rebuild confidence, both domestically and also among the foreign investment community.

- In terms of equity market catalysts, the key issue at the moment is the zero-Covid policy.

Chart 2: Daily reported new Covid cases in mainland China

Source: Wind as of 12 October 2022

- It is certainly true that since the end of the extended lockdown in Shanghai, manufacturing supply-chain issues have eased. Tesla sales in China, for example, hit a new monthly high of 83,000 cars in September, up 8% from the previous month.1

- However, in aggregate, Covid-related restrictions are severely hampering the economy, by as much as 4-5% of GDP according to some estimates.2

- A key issue remains low vaccination rates. While most countries prioritised the elderly in their vaccination rollouts, China’s elderly vaccination rate remains low.

- As of 7 September, only 67% of the >250 million people aged 60+ in China had received three vaccine doses (regarded as the equivalent of two doses of mRNA vaccines for protecting against hospitalisation).3

- Reopening will therefore be difficult and costly. Having said that, once the Party Congress is finished, policy makers will have more flexibility to start making adjustments. It will take considerable time to get to anything like “normal” post-Covid conditions again, but the equity market will inevitably move more quickly to price in recovery potential.

- Finally, a comment on the US Department of Commerce announcement of a swathe of tough new restrictions controlling the export of chips and chip-making equipment to China.

- Over the longer term, this move clearly represents a step-change in US efforts to constrain China’s technological progress and marks another low point for US-China relations. It is too early to tell whether the US will be successful and also to see how China reacts.

- The primary objective of US policy is to contain China’s advance in areas related to military uses such as AI and high-performance computing. As such, many commercial businesses will see little impact, at least in the near term.

- In practice, the outcome will be very different from company to company. For example, while some China semiconductor equipment manufacturers may be impacted as they are unable to source US-produced components going forward, other companies will benefit as China accelerates its push for greater self-sufficiency in semiconductors.

1 Source: China Passenger Car Association, 9 October 2022

2 Source: Goldman Sachs, 12 October 2022

3 Source: Goldman Sachs, 12 October 2022