The China Briefing

Is the rally sustainable this time?

Please find below our latest thoughts on China:

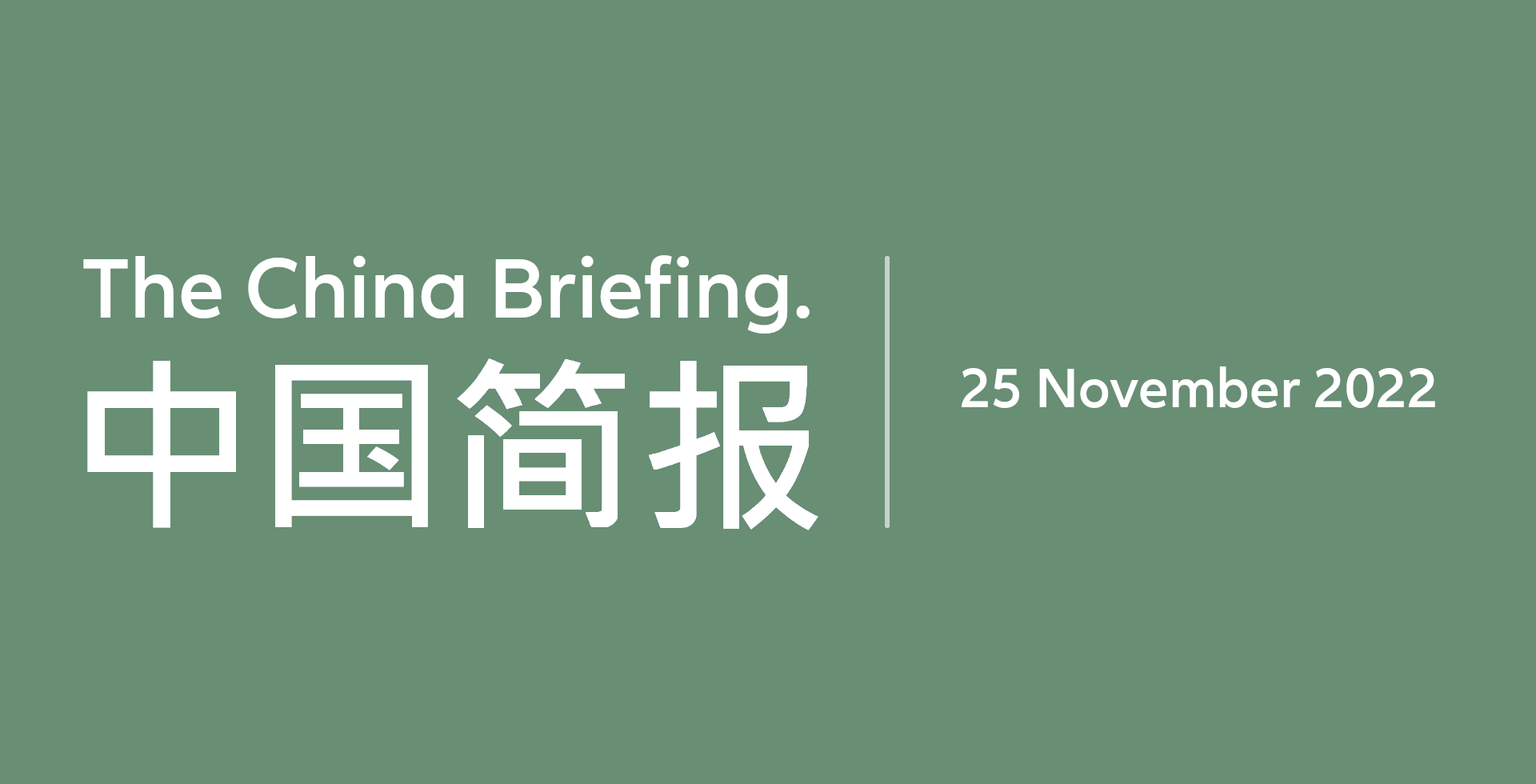

- It has been a proverbial rollercoaster ride for China equities in the last few weeks

- First there was the reaction to the Party Congress with offshore markets in particular experiencing a ‘reality check’ in response to the consolidation of power and the message of policy continuity.

- The weakness didn’t last long, however, as markets subsequently rallied sharply on the first glimmers of light at the end of the dark Covid tunnel, and additional support for the property sector.

- The question now is whether this recent rally is sustainable or if it is another false start like we saw in Q2 after the easing of the Shanghai lockdowns.

- One clear takeaway from the market reaction is that, cutting through all the noise on China (geopolitics, Taiwan, US tech sanctions etc), it is weakness in the domestic economy which has been weighing most heavily on markets.

- And therefore, the answer to the question on market outlook lies in whether policy changes will feed through into actual improvements in the real economy.

Chart 1: MSCI China A Onshore and MSCI China performance since Party Congress

Source: Bloomberg, as at November 23, 2022

- Our view is to expect that 2023 will see improvement in economic momentum (most likely in contrast to much of the rest of the world) and also corporate earnings. But growth will not be on a steady footing until the Covid situation stabilizes.

- And the road to reopening in China is likely to be bumpy – as demonstrated by recent events.

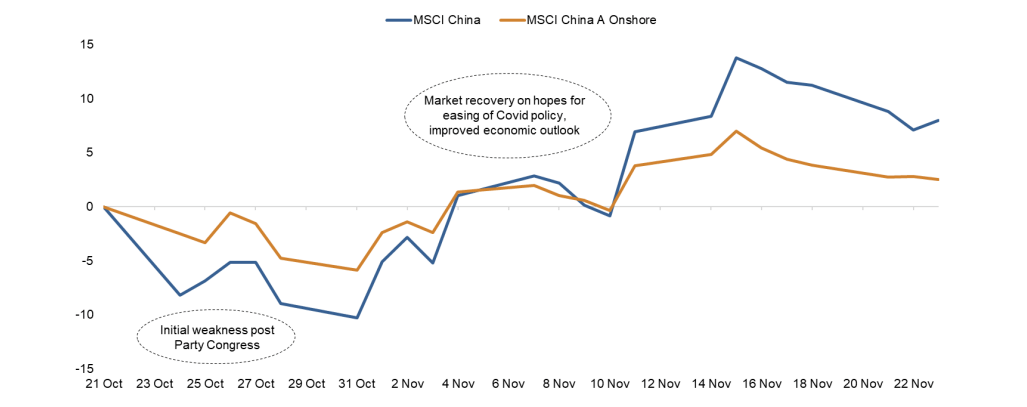

- Earlier this month, the central government published “20 measures” to optimise Covid containment policies, aimed at reducing the burden on local governments and the economy.

- However, this high-profile policy relaxation – which triggered the market rally – meant that local governments no longer tried to stamp out the localized Covid outbreaks in the same way as before.

- The number of reported Covid cases had already been on the rise, and as a result of the policy relaxation they now running at the highest levels since the Shanghai lockdowns.1

Chart 2: Daily new Covid-19 cases in Mainland China

Source: Wind, Allianz Global Investors, as of November 22, 2022

- The initial response by the central government has been to send signals that it still wants to continue the containment strategy. Beijing, Shanghai and Guangzhou have all reintroduced controls.

- The government’s aim has been for a controlled reopening with one of the initial priorities being to change the narrative around Covid, with a large proportion of the population still fearful of high mortality rates.

- Only recently, images flooded social media of an exodus of hundreds of workers from the huge Foxconn compound, Apple’s biggest iPhone manufacturing facility in China. Covid had been detected in the walled campus which consists of around ten densely populated square kilometers housing nearly 350,000 people.2

- At some stage, China will need to move to a de facto policy of tolerating Covid like the rest of the world, which should be positive for the economy and for equity markets. Indeed the clear signal from the “20 measures” was that China is preparing its exit strategy. In practice, however, the path to getting there is still unclear.

- The other key issue depressing economic activity relates to property. Here the recent policy action – in this case “16 measures” co-ordinated by the PBOC and CBRIC (the banking and insurance regulator) – seems more decisive.

- The measures included banks extending maturing loans to developers and providing additional funding to ensure completions of pre-sold homes (which account for around 90% of total activity in the housing market).3 At worst the outcome should be a further reduction of a property hard landing tail risk.

- Another fillip to markets recently has been a respite in US-China strategic rivalry. As Churchill once remarked, ‘jaw-jaw is better than war-war’.

- With both Presidents Biden and Xi bolstered by recent domestic political events, their meeting at the G20 summit – described by China’s foreign minister as ‘auguring a new starting point’ for the two countries – suggests the downward spiral of US-China relations has paused, at least for the time being.

- In this area, there is expected to be an announcement soon by US regulators regarding the onsite audit inspections of China ADRs. The audit inspectors finished their work in Hong Kong earlier this month, ahead of expectations. A positive outcome would help to reduce the risk of China ADRs being forced to delist from US markets.

- In summary, we see recent events as increasing the likelihood of a more positive scenario for the new year. The renewed focus on pro-growth economic policies so soon after the Party Congress is no coincidence. And as this eventually translates into a more sustainable economic upturn, we expect market confidence to also recover.

1 Source: Wind, 22 November 2022

2 Source: Nomura, 21 November 2022

3 Source: Gavekal, 27 July 2022