The China Briefing

Waiting for the consumer

Please find below our latest thoughts on China:

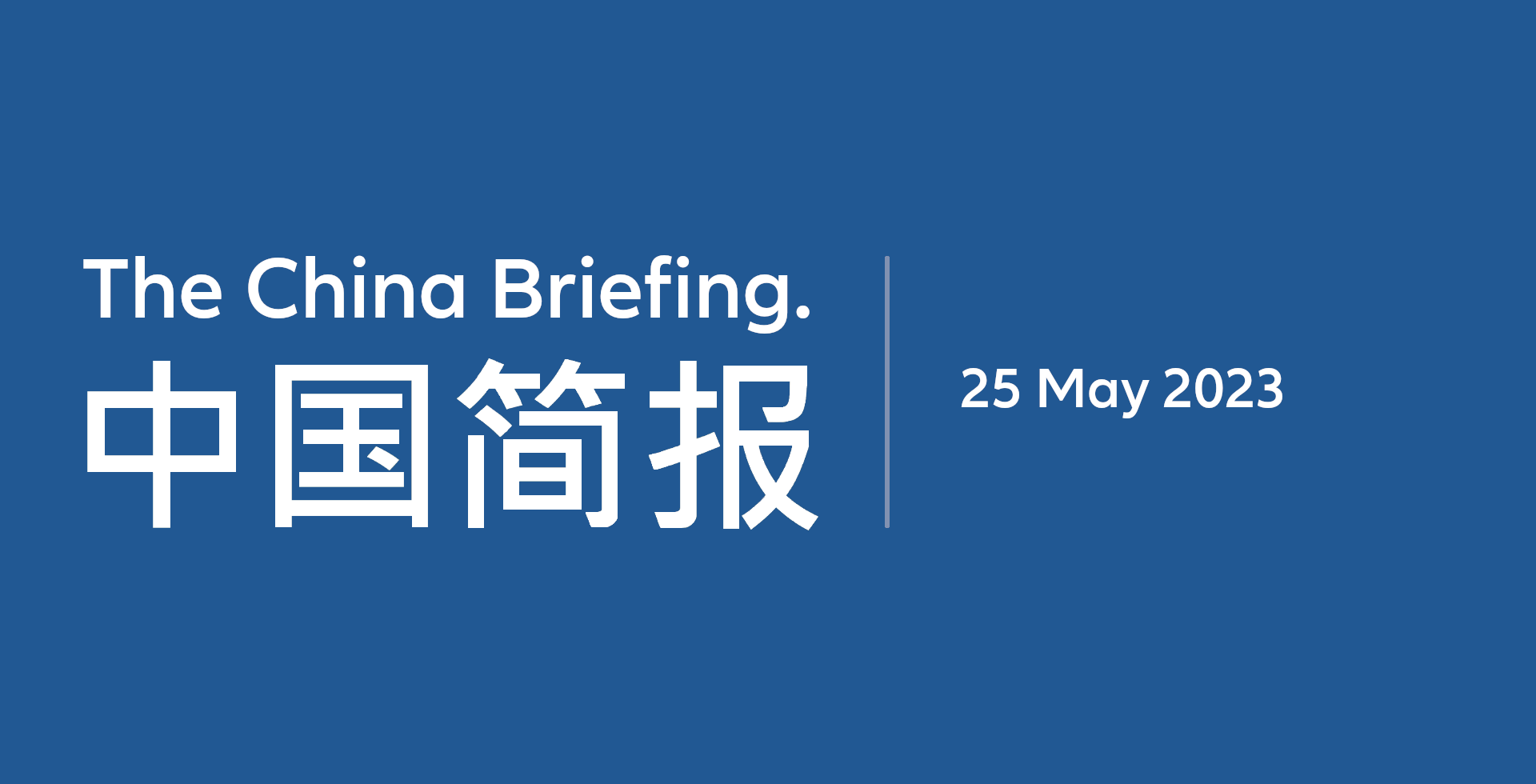

- Financial markets are clearly losing confidence in China’s economic recovery. This doesn’t go just for equities – in recent weeks China’s government bond yields have declined, the currency has been weaker and the prices of many commodities, including iron ore and copper, have also fallen.1

- After a generally strong Q1, the catalyst has been a significant weakening of growth momentum in April with the Manufacturing Purchasing Managers’ Index (PMI) falling back below 502 – a figure that suggests the sector is contracting.

- There are also jitters in the housing market. While completions of suspended home-construction projects have accelerated – spurred by government support targeted at an area of social sensitivity – overall property sales in April 2023 were only 63% of the level in April 2019. Sales in March were 95% of those seen four years before.3

Chart 1: Copper price since China reopening at end October 2022

(rebased to 100)

Source: Allianz Global Investors, Bloomberg, as at 22 May 2023

- The question, therefore, is whether this is the end of the recovery, or merely a soft patch. Our view is the latter.

- As such, while equity markets were overly optimistic about the recovery earlier this year, now we see a mirror image with markets in danger of becoming overly pessimistic.

- There is a different dynamic to this economic cycle, at least from a China perspective.

- Previous recoveries have been reliant on property and infrastructure spending, where policy changes can be reflected rapidly in the macro data.

- This time in China, the pick-up is being led by the consumer. And here the restoration of confidence – with the normalisation of spending patterns after the end of the Covid restrictions – is taking longer to happen.

- Having said that, the increase in travel and domestic tourism during the recent Labour Day holiday suggests that consumer confidence is still improving, just at a lower rate than earlier in the year when “Covid relief” was in full swing.

- One commonly asked question is whether we should expect significant further government stimulus.

- With the Politburo meeting in April signalling little change to either fiscal or monetary policies, we think this is unlikely – at least for now. But some more targeted policy response does seem likely in two important areas – the first being property, and the second being youth unemployment.

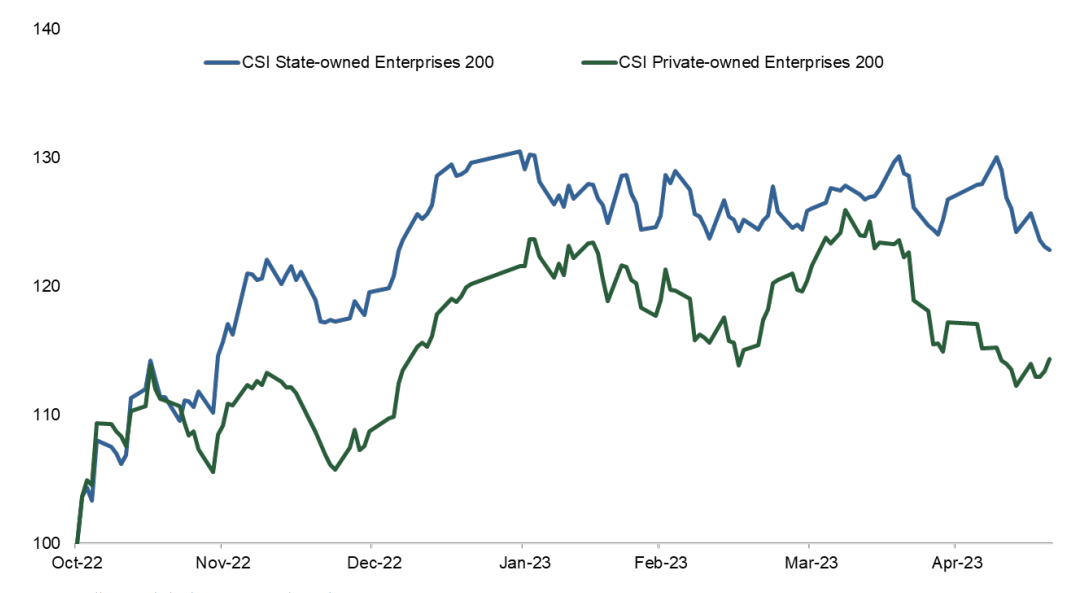

Chart 2: CSI – performance of State Owned Enterprises (SOEs) compared to private companies since October 2022 (rebased to 100)

Source: Allianz Global Investors, Bloomberg, as at 19 May 2023

- Youth unemployment hit a historic high of 20.4% in April – roughly double pre-Covid levels – and is likely to rise further with around another 11 million graduates in the months ahead.4 Not only does this impact overall consumer spending, it could even pose a risk to social stability.

- The reason for the high youth unemployment is mainly cyclical. The service sector is a big employer of graduates. In 2020-21, this sector added only 3 million new jobs compared to 16 million in 2018-19. And while the data in 2022 is not available, very likely there was an overall contraction.5

- The recovery in the service sector year to date should lead to more job creation as we move through the year. And the importance of this issue was highlighted by a recent announcement that stateowned enterprises (SOEs) would create 1 million internship positions for jobless graduates.6

- On the topic of SOEs, one of the features of the China A market this year has been the significant outperformance of SOEs compared to private enterprises.

- In total, SOEs account for around 43% of the MSCI China A Onshore Index.7 But within this, it is the “central” SOEs – those controlled by the national government such as large banks and telecom operators – which have been the strongest performers.8

- The initial trigger for the current round of SOE outperformance was a speech in November by Yi Huiman, China’s chief securities regulator, in which he called for a “valuation system with Chinese characteristics”.

- This was taken as code that the market should not put such a low valuation on central SOEs, which mostly trade well below stated book value. Yi also urged SOEs to increase their competitiveness and improve communication to shareholders.

- While this official rhetoric provides a theme for local market participants, in practice we see SOE outperformance as primarily a reflection of the increasingly loose liquidity conditions combined with the uncertain macro environment.

- Total credit growth has accelerated sharply so far this year and bank deposit levels continue to

rise.9 This indicates that companies and households generally have plenty of cash to deploy. - And in an uncertain economic environment, the perceived safety of SOE stocks with their lower valuations and higher dividends is seen as providing a low risk way to play the recovery.

- The SOE trend may have further to run. Bloomberg users can type in “central SOE” to get a flavour of the different indexes and ETFs – indeed, three central SOE shareholder returns ETFs were launched on 15 May.10

- The takeaway for global investors is that domestic liquidity looks to be in good health – now the equity market needs an injection of macro confidence to produce broader based returns.

2 Source: China Federation of Logistics and Purchasing, 30 April 2023

3 Source: Gavekal, 16 May 2023

4 Source: Macquarie, 19 May 2023

5 Source: Macquarie, 19 May 2023

6 Source: Goldman Sachs, 22 May 2023

7 Source: Wind, 31 March 2023

8 Source: Bloomberg, 22 May 2023

9 Source: Gavekal, 10 May 2023

10 Goldman Sachs, 22 May 2023