Active is: Investing with conviction

Expect US market momentum to continue – but watch for inflation

Summary

Investors can start the year with a positive outlook for the markets thanks to three drivers: higher spending from the new Biden administration, wider uptake of vaccines and continued Fed support. Consider layering in exposure to value and cyclical stocks, small cap and international assets – but keep an eye on rising inflation.

Key takeaways

|

US markets have largely shrugged off the political volatility of the new year, continuing the momentum with which they ended 2020. Looking at different market sectors, value stocks continue to largely outperform growth stocks, and small caps are playing catch-up to large caps. At the same time, international and emerging-market equities are outpacing their US counterparts, driven by ongoing US dollar weakness, the prospects for stronger global growth and generally better valuations.

The financial markets are also counting on additional fiscal and monetary stimulus in 2021, as indicated by the Biden administration and the US Federal Reserve, even as economic growth has already started to rebound. Against this backdrop, investors can start the new year with a positive outlook for the markets. Investors may want to tactically add to or diversify risk in portfolios, but it will be important to be vigilant as the year progresses – including watching for higher inflation down the road.

Three factors driving renewed momentum in the market shift towards value stocks

While keeping this positive outlook in mind, watch for inflationary pressures

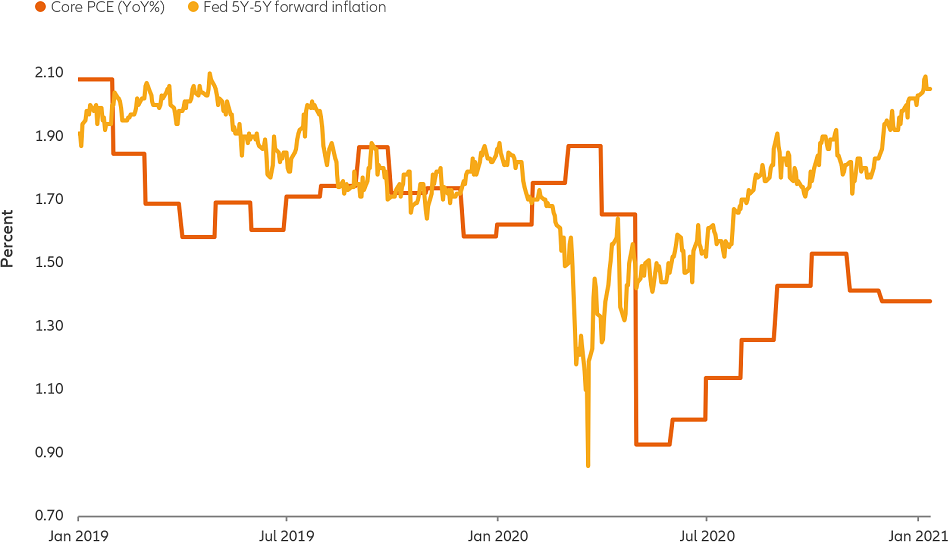

While the economic and market outlook for 2021 is solid, there are some accompanying risks. One is that rebounding growth and stimulus could push up the prices of goods and services – driving up inflationary pressures. So far, inflation has been relatively contained, with core PCE – personal consumption expenditures, the Fed’s preferred indicator – still below the Fed’s 2.0% target. However, some forward-looking indicators (which measure the market’s inflation expectations) call for higher inflation, as Chart 3 shows.

Chart 3: core PCE remains below the Fed’s 2.0% target, but the inflation outlook is rising

Source: Bloomberg, Allianz Global Investors. Data as at 11 January 2021. The 5-year/5-year swap is a measurement of medium-term inflation expectations. Low numbers indicate that the markets are doubtful about a central bank’s ability to push inflation higher.

If inflation does accelerate, we see three key risks for investors:

- The Fed is now targeting an average inflation rate regime – meaning it will tolerate a period of higher-than-2.0% inflation without raising rates. But a sustained or rapid rise in inflation may cause the Fed to rethink its approach. Historically, bear markets have begun when Fed rate-hike cycles are on the horizon.

- If higher inflation leads to higher yields, longer-duration assets could suffer. These include certain government and corporate bonds, but also some sectors like technology and healthcare, which tend to be longer duration and could be punished by markets that fear higher inflation.

- Given that some stock valuations may already be stretched, particularly in certain growth areas, higher inflation and higher yields could push down these valuations over time.

Consider tactical shifts towards cyclicals and emerging markets

The global economy is recovering – in part thanks to “reflation” policies, such as fiscal stimulus and low rates, designed to boost demand and spending – and we expect it to enter a true reopening period later this year.

As such, we expect markets will continue to favour the reflation theme – but for how long? Perhaps until the economy either reaches peak reopening growth rates or enters a sustained period of inflation, which makes slowing growth or mounting inflationary pressures key indicators to watch.

Given such strong upwards movement already, periods of consolidation or market pullbacks should be expected in the weeks ahead. But investors can largely use these as tactical opportunities to add to or diversify risk. Consider adding incremental exposure by “layering in” cyclical and value stocks, small-cap stocks and non-US assets. Select areas of infrastructure, 5G technology and clean energy may also continue to do well in a post-election world.

In fixed income, prepare for somewhat higher rates and steeper yield curves. Long rates (which are generally determined by market forces) may rise alongside growth and inflation expectations, while short rates remain anchored by central banks. More stimulus could also mean a marginally weaker US dollar, which would continue to benefit emerging-market assets, gold and those industrial commodities (including copper) that are tied to the reopening.

1474317

Summary

China’s nascent STAR market provides a platform for the technology and science firms that increasingly underpin the country’s growth story.

Key takeaways

|

-

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Equities have tended to be volatile, and do not offer a fixed rate of return. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bond prices will normally decline as interest rates rise. The impact may be greater with longer-duration bonds. Emerging markets may be more volatile, less liquid, less transparent, and subject to less oversight, and values may fluctuate with currency exchange rates. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security.

The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted.

This material has not been reviewed by any regulatory authorities. In mainland China, it is used only as supporting material to the offshore investment products offered by commercial banks under the Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations. This document does not constitute a public offer by virtue of Act Number 26.831 of the Argentine Republic and General Resolution No. 622/2013 of the NSC. This communication's sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of his document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Brazil, Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Pacific Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional/professional investors only, and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide financial services to retail clients in Australia. AllianzGI AP (Australian Registered Body Number 160 464 200) is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of financial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which differ from Australian laws.

This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors U.S. LLC, an investment adviser registered with the U.S. Securities and Exchange Commission; Allianz Global Investors Distributors LLC, distributor registered with FINRA, is affiliated with Allianz Global Investors U.S. LLC; Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG; Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424, Member of Japan Investment Advisers Association and Investment Trust Association, Japan]; and Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan.

The Democrats’ “blue sweep” became reality

Following the US election results in November, it appeared likely that incoming President Joe Biden would face a “divided” US Congress and gridlock in the US government, putting most of his agenda in peril. But the resolution of Georgia’s Senate races ultimately ceded control of both the House and Senate to the Democrats, although they still have only slim majorities. That makes a “Biden-lite” agenda likely: for example, tax increases will be less than initially outlined and may not be a year-one priority. Instead, we expect the new administration to first pursue policy items that have more bipartisan support from both Democrats and Republicans, such as stimulus packages and fiscal spending:

Vaccines are finally here, despite the slow rollout

Stimulus is certainly a helpful bridge for consumers and small businesses, but as long as the pandemic is ongoing, economic activity is likely to remain depressed. Fortunately, vaccine distribution has begun in the US and globally. If it’s effective, the subsequent economic reopening will likely be the biggest market driver in the US and globally in 2021.

In such a scenario, we expect pent-up consumer demand to be unleashed – particularly in sectors such as travel and leisure that would benefit from the reopening economy. This is already reflected in strong economic and earnings forecasts, as Chart 1 shows, although they could move higher in future earnings revisions if more progress is made fighting the pandemic.

So far, however, the US rollout of the vaccines has been slower than anticipated. But this may turn around based on a few factors: states will learn how to make distribution more effective; the Biden administration will focus on increasing the number of doses available; and new vaccines from other companies should reduce supply constraints.

Barring any severe shocks or setbacks – including new variants of the virus – 2021 is likely to be a year of reaccelerating economic growth. For investors, this may mean that a bear-market selloff, which often occurs ahead of recessions, appears unlikely in the near term. As a result, market corrections could largely be used as tactical buying opportunities.

Chart 1: earnings growth is set to reaccelerate in 2021

S&P 500 earnings growth by quarter (year over year)

Source: FactSet, Allianz Global Investors. Data as at January 2021.

The Fed will continue to support markets in 2021

In its final meeting of 2020, the Fed released an updated set of economic projections (see Chart 2). Through 2023, rates are expected to remain near zero and inflation below the US central bank’s 2.0% target. Growth and unemployment expectations were also upgraded, and the Fed is committed to maintaining its monthly asset purchases. This will continue to expand the Fed’s balance sheet and provide liquidity to markets.

Overall, central banks in the US and around the world continue to provide strong support for risk assets against what was already expected to be a recovery year.

Chart 2: the Fed expects near-zero rates through 2023, and an improving growth and unemployment outlook

Source: Federal Open Market Committee. Data as at December 2020.