Transforming Infrastructure

3 key takeaways from the power cut in Iberia for energy infrastructure

In Europe, 11.3 million km of electricity lines and cables deliver electricity to 266 million EU customers.¹ Ensuring the maintenance, enhancement, and expansion of the electricity grid is essential to meeting the EU’s energy and climate objectives – particularly in securing energy supply, keeping prices affordable, and enabling the integration of renewable energy sources.

One month ago, Spain, Portugal, and parts of France experienced a massive power outage, affecting major cities like Madrid, Barcelona, and Lisbon, disrupting everyday life. From noon to late night millions of people were left without electricity. While the cause of this “blackout” isn´t clarified yet, several scenarios are being investigated which underline the importance of energy infrastructure.

These are our three key takeaways of the power cut in Iberia that underline that it has become essential to handle the increased and more variable power supply.

Urgent need to modernise and upscale electricity grids

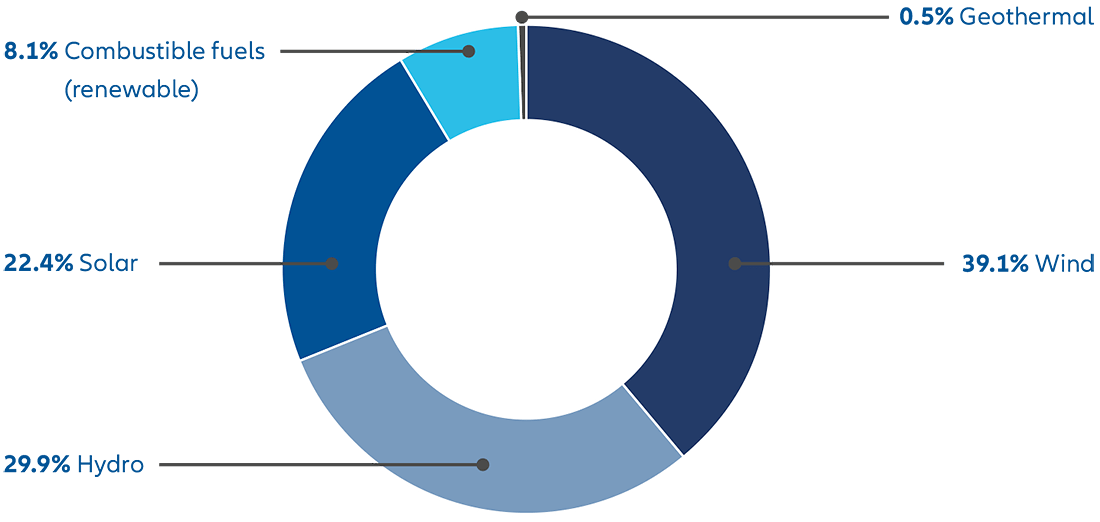

The demand for electricity is projected to increase by 60 % by 2030.2 The share of electricity produced by renewables such as wind and solar farms is expected to grow from 37% in 2020 to more than 60% by 2030.3

Renewable energy such as photovoltaic and wind increase the volatility energy grids have to be able to manage. This is even more challenging the more renewable energy you rely on in your energy mix. The goal of many countries is to increase their rate of renewable energy which goes hand in hand with further requirements to the energy grids. With most of the European grids being over 40 years4 old this is not an easy task, and significant investments are needed to update and further develop the energy grids of today to be able to balance the system and avoid power cuts with more volatile energy sources. The investment plans of grid operators at the current pace shall amount to EUR 1.9trn until 2050.4 This is below the investment need according to estimates by the European Commission which ranges between EUR 2-2.3trn.4

Importance of cross-border energy infrastructure

Accelerated investments in energy storage and green molecules

Exhibit 1: Renewable energy generation sources in the EU, 2024 (%)

Source: Electricity from renewable sources reaches 47% in 2024 – News articles, Eurostat

Did you know that…?

- 40% of Europe’s distribution grids are over 40 years old4

- Cross-border energy infrastructure projects can decrease generation costs by EUR 9 billion annually until 20404

- At least 3000 gigawatts (GW) of renewable power projects, of which 1,500 GW are in advanced stages, are waiting in grid connection queues6

- Electricity outages already cost around USD 100 billion a year, or 0.1% of the global GDP6

1 Review 01/2025: Making the EU electricity grid fit for net-zero emissions, European Court of Auditors

2 https://energy.ec.europa.eu/news/focus-eu-investing-energy-infrastructure-2024-10-15_en

3 https://energy.ec.europa.eu/topics/markets-and-consumers/electricity-market-design

4 NEWS-RV-2025-01, European Court of Auditors

5 Electricity – Energy System, IEA

6 Executive summary – Electricity Grids and Secure Energy Transitions – Analysis, IEA