Access to healthcare – more important than ever

We are now in the 3rd year of the COVID-19 pandemic and are approaching a time of the year when health services will again face significant pressure. This coincides with a cost of living crisis and looming recession, where hard choices are being forced upon consumers, some of which could add to these pressures. Solutions are needed to address the rising complexity and costs of healthcare, deriving from an ageing population and higher incidence of multimorbidity. This topic is evolving quickly and the implications for modern society and the economy may be far reaching – we explore ways investors could direct capital to products, services and solutions in the healthcare sector.

Key takeaways

- We believe there is urgency to address a steadily growing health crisis. Climate and planetary changes could accelerate its impacts

- The COVID-19 pandemic has reminded us not only of the scale of healthcare challenges but also the breadth of the healthcare divide. While finding solutions to emerging healthcare threats, we need to ensure broader and more equitable access to medicine, intensive care and vaccines

- Climate Change risks further stretching resources as we contend with heatwaves, respiratory illnesses due to higher pollution and broader transmission of diseases like Dengue and West Nile fever1

- In addition to the human costs, the financial burden is expected to continue rising. Over 10% of GDP is spent on healthcare in many countries and investments in key enablers could present exciting opportunities in new medicines, solutions and services to help meet existing and future needs

- The topic extends into biodiversity and natural capital, where healthy biological diversity creates a natural defence against the spread of certain diseases2

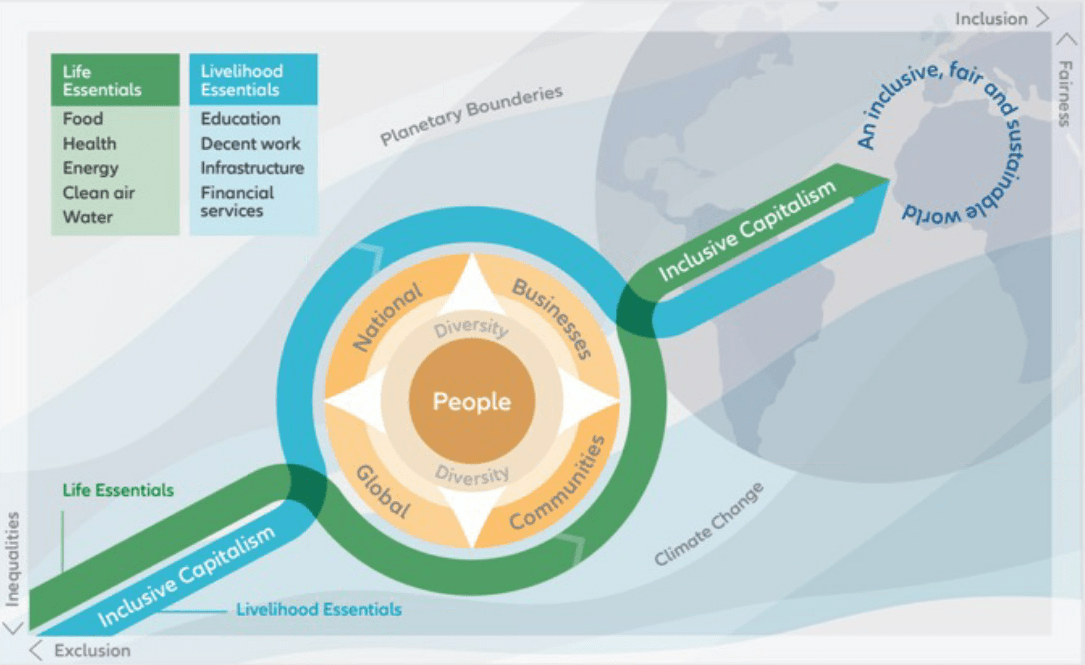

AllianzGI framework for Inclusive Capitalism

Inclusive Capitalism

Healthcare is part of our Sustainability Research Theme of Inclusive Capitalism3 at AllianzGI. Inclusive Capitalism aims to reduce inequality. We define access to healthcare as a life essential, as it is core to existence, alongside food, water, clean air, energy, safety and housing.

Did you know?

- In 1994, the Centers for Disease Control and Prevention declared that diabetes had reached epidemic proportions and should be considered a major public health problem. It is estimated that ca. half a billion people have diabetes worldwide. This number is expected to increase by around 50% to 783 million by 2045.4

- The geographical range of the Dengue virus is expected to further expand due to ongoing global phenomena including climate change and urbanization. It is estimated that more than 6 billion people will be at risk for dengue by 2080, an increase of 2.25 billion compared to 2015.5

- The US is the only developed country whose average life expectancy stopped increasing after 2014.6

Turning COVID-19 response into structural positioning

The COVID-19 crisis underscored underinvestment in protecting against pandemics, but also highlighted how a targeted and collaborative global approach could be effective. In a relatively short period of time, vaccinations were developed, rolled out and strategies put in place to minimise the global impact.

There is a risk of rising incidence of pandemics with rising populations, loss of biodiversity and resource constraints in healthcare systems.

Underscoring the evident healthcare divide

Despite the ability to mobilise at the company and government level, this does not translate into broader availability or reach of healthcare.

There is a significant divide in COVID-19 vaccination rates between the West and developing economies – while in early 2022 just under 60% of the global population has received at least one vaccine dose, it was only 9.5% in low-income countries.7 There is a strong link between a country’s wealth and its vaccination rates. Delayed vaccinations are set to impact the global economy by trillions in GDP, but will be particularly impactful in developing economies.8

COVID-19 is not an exception

While very evident in COVID-19, it would be a mistake to view this an exceptional case of healthcare inequality. Access to quality healthcare is often a function of wealth at the sovereign or individual levels.

Long term impacts of this virus could still arise over time. For example, Long Covid is becoming better understood and could become relevant for the longer-term labor market and productivity trends.

In addition to the direct impact of COVID-19, lockdowns impact mass vaccination campaigns for measles, polio, meningitis and other deadly but preventable diseases.9 More recently, rising cases of monkeypox in an increasing number of countries can be linked to routine smallpox vaccinations having stopped.

Healthcare is a rising problem in developed regions

Separate but possibly aligned to wealth, is education, especially in the developed world. Chronic diseases10 such as heart disease, cancer and diabetes remain among the leading causes of disability and death in US.11 – while these occur more frequently in an aging population, they are correlated with the level of education.12

A combination of both education and wealth lead into lifestyle choices, and these can play a major role, especially from an early age. Lifestyle factors can include nutrition, exposure to alcohol and tobacco and physical activity, which can have meaningful implications for both physical and mental welfare.13

Leading causes of death in the US in 2020 and 2019:

The link to Climate and Planetary Boundaries

There is a real risk that climate change and reduced biodiversity could worsen the problem. Emissions and pollution could raise the incidence of respiratory diseases, heavy rains and higher temperatures could raise occurrence of fevers (e.g. Dengue, West Nile), while challenges to food availability and affordability could impact healthy nutrition.

Healthcare costs are escalating quickly as multimorbidity worsens

Historically there has been a focus on the link between health and mortality, but there is now a heightened awareness of multimorbidity which is defined as the presence of two or more long-term health conditions. Multimorbidity is a major contribution of the sustained increase in healthcare costs as a share of GDP in OECD countries. Among OECD Member countries, the United States has the highest percentage of GDP spent on healthcare – 16.8% in 2020. For context, US Military expenditure was 3.7% of GDP in the same year. While lower than US, the figures for UK, France and Germany are still above 12%.14

While life expectancy has risen in recent decades, this has not been aligned to higher life quality or health, but an ability to address or delay terminal disease. Age is a driver of health spending which is partly due to the prevalence of multimorbidity also rising with age.15

A combination of an ageing population and an increase in long-term conditions means multimorbidity is set to rise. Costs increase significantly with each additional condition and a near exponential relationship between the number of conditions and costs will play out.16

Healthcare and military expenditure as a percentage of GDP in select countries worldwide in 2020

The role of pharmaceuticals and the funding of healthcare

According to the OECD, pharmaceuticals are the third largest healthcare expenditure item after in-patient and out-patient care, accounting for 16% of average health spend, even before including in-hospital pharmaceuticals costs17. These are costs predominantly covered by government financing or compulsory insurance schemes. However, the WHO estimates that over 800 million people are spending over 10% of household budgets on health for themselves, a sick child or family member – these can result in “catastrophic expenses” that can lead to severe poverty.18

The situation is particularly acute for innovative remedies and solutions. A survey by our Grassroots Research® team showed around 40% of US diabetes educators surveyed highlighted that new oral (not injected) diabetes drug were very attractive but could be prohibitively expensive without insurance.

The UK is an example of where private health insurance is not standard due to its broad and free access to healthcare. However, the UK Healthcare system is underfunded, preventing every new therapy being supported and a divide has developed where those with better financial means can go externally for better or quicker treatment.

Investing in Health

Investors could play a critical role by contributing to Inclusive Capitalism via investing in health. In the US alone health spending is projected to grow at an average annual rate of 5.4 percent for 2019-28 and to reach USD 6.2 trillion by 2028.19

1 Extreme temperatures and health — European Environment Agency (europa.eu)

2 More species means less disease | Nature

3 Unlocking the “S” in capitalism (allianzgi.com)

4 IDF_Atlas_10th_Edition_2021.pdf (diabetesatlas.org)

5 Microsoft PowerPoint - 02 Dengue Adams Oct 2022 (updated)_to post (cdc.gov)

6 The Role of Alcohol, Drugs, and Deaths of Despair in the U.S.’s Falling Life Expectancy - PMC (nih.gov)

7 Coronavirus (COVID-19) Vaccinations - Our World in Data. Pandemic exposes a world of healthcare inequalities | Financial Times (ft.com)

8 Delayed vaccination timelines will cost the global economy US$2.3trn - Economist Intelligence Unit (eiu.com)

9 How COVID hurt the fight against other dangerous diseases (nature.com)

10 Chronic diseases are defined broadly as conditions that last one year or more and require ongoing medical attention or limit activities of daily living or both (About Chronic Diseases | CDC)

11 About Chronic Diseases | CDC

12 Health Disparities | DASH | CDC

13 Global Risks Report 2022 | World Economic Forum (weforum.org)

14 Health expenditure as share of GDP by country | Statista

15 Ageing and health expenditure - UK Health Security Agency (blog.gov.uk)

16 The health and social care costs of a selection of health conditions and multi-morbidities (publishing.service.gov.uk)

17 Home | OECD iLibrary (oecd-ilibrary.org)

18 World Bank and WHO: Half the world lacks access to essential health services, 100 million still pushed into extreme poverty because of health expenses

19 NHE Fact Sheet | CMS

20 Take Action for the Sustainable Development Goals - United Nations Sustainable Development

21 The climate crisis and COVID-19—A major threat to the pandemic response – C-CHANGE | Harvard T.H. Chan School of Public Health

For investors there are potential opportunities to invest in health via the following themes:

Materiality of non-financial information

For investors seeking unconstrained universes, it will be important to identify evolving material ESG risks relating to the healthcare companies, including:

UN Sustainable Development Goals (SDGs):

Over 190 countries adopted the UN Sustainable Development Goals (SDGs) in 2015 which aim to achieve a better and more sustainable future for all. The goals relate to poverty, income, employment and good health; education; environment (including climate, water, oceans and biodiversity); reducing inequalities, including gender; and peace, security and cooperation.20 In aligning with the SDGs not only nations but also companies can contribute to solving part of these issues with their products and services.

Impact-focused investing

Healthcare companies play an important role in helping to achieve targets included in the UN SDG Goal 3 - Good Health and Well-being – and there is a high interdependence of Good Health with Quality Education (SDG 4), Zero Hunger implying Nutritious Food (SDG 2) and Climate Action (SDG 13):