Summary

Europe can’t compete with the high-flying US tech sector, but perhaps that isn’t a bad thing. Europe is a region with decent growth, strong macroeconomic data and many healthy companies trading at a discount – which makes the market’s worries appear overdone.

Key takeaways

|

European equity indices once again started to lag their US counterparts over the course of the summer, and investors have been steadily moving away from Europe for most of the year. Yet Europe is a region with solid growth, strong macroeconomic data and many healthy companies trading at a discount – which, in our view, makes worries about Europe appear overdone.

Recently, investors have preferred the US over Europe in large part because of the high-flying dominance of the US tech sector. Tech constituted more than 25% of the overall US market on 12 June, according to Bank of America Merrill Lynch, while the euro-zone market had a tech component of just under 10%. Europe has more balanced sector exposure, with the largest representation by “old” business such as industrials or financials.

But this is not necessarily a bad thing, particularly considering what happened during periods of excess sector concentration in the past – including the tech sector during the dot-com bubble, financials during the 2006 housing bubble and energy back in the 1970s.

Moreover, some portfolio manager surveys show that the most overbought area of the market is US tech, while European financials are among the most oversold. So while Brexit continues to weigh on investors’ minds, it may be time to take another look at Europe.

Europe shouldn’t be so unloved

Investors generally have an extremely poor view of Europe. Its equity markets recently registered their 24th consecutive week of outflows, effectively removing all inflows seen over the course of 2017.

However, although second-quarter economic growth hit a soft patch, primarily due to France and Italy, euro-zone GDP growth is expected to remain above-potential at around 2% this year. This should support local stock markets. In addition, the latest batch of macroeconomic data out of Europe contains many highlights:

- Industrial production and export activity have recovered from temporary low points.

- GDP growth in the UK recovered in the second quarter, supported by construction and industrial production.

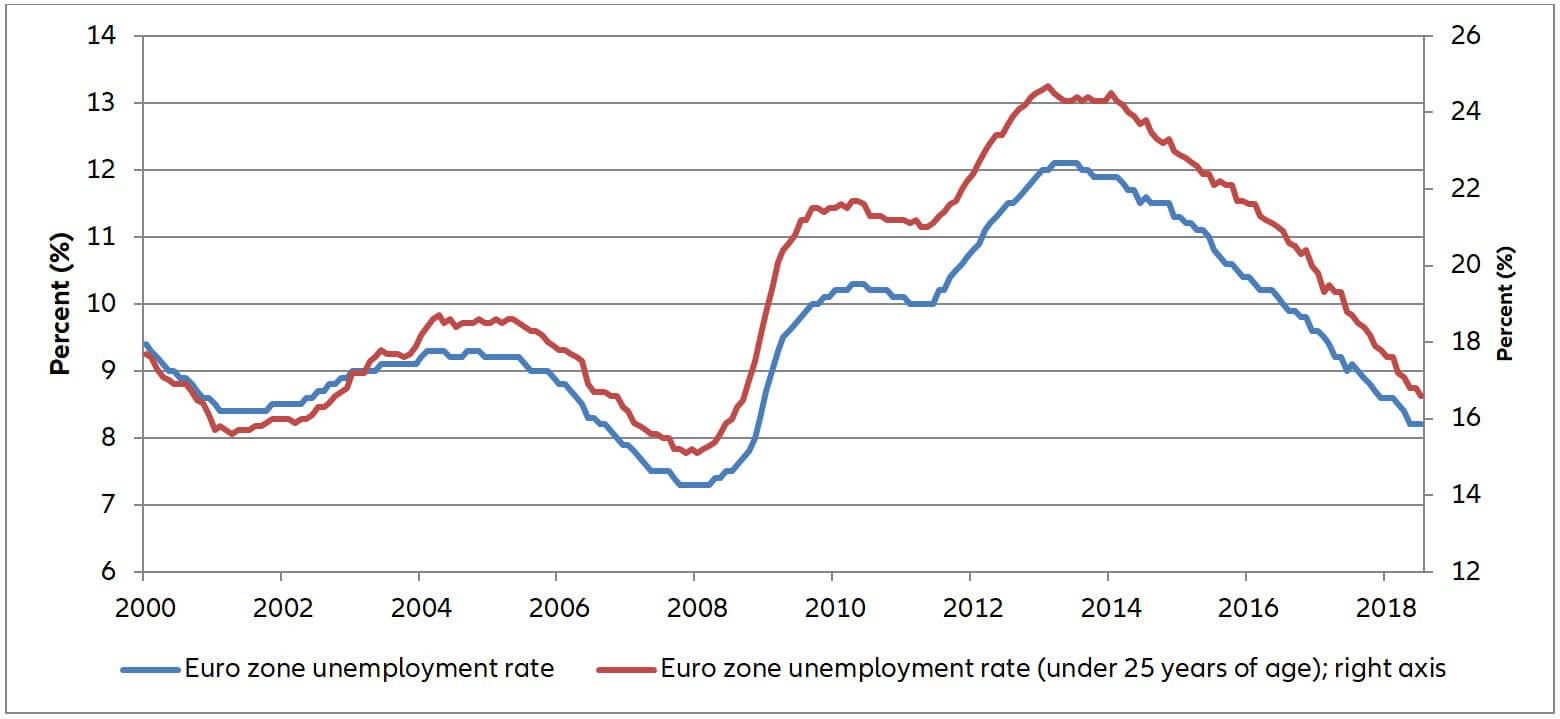

- Unemployment continues to decline in the euro zone; the latest numbers are the lowest since December 2008.

- Overall employment is at a record high and wage growth has picked up notably; labour shortages can even be felt in the more buoyant countries, such as Germany.

Despite a temporary GDP slowdown, unemployment is falling

Source: Eurostat, AllianzGI Global Economics & Strategy. Data as at 31/7/2018.

As a result, household consumption in the euro zone – which accounts for well above 50% of GDP – is set to remain a key driver of Europe’s ongoing solid economic performance. Strong domestic demand has also shielded Europe from the impact of trade tensions so far.

An active approach to investing in Europe

Because Europe is a very open economy, the region and its stock markets get hit hard when investors worry about global trade or emerging-market issues. Yet some of the concerns around these issues appear overdone, with the market frequently deciding to shoot first and ask questions later. The Brexit vote on 23 June 2016 was a good example of this. After the initial panic and strong volatility, markets returned to focusing on the fundamentals, which were supportive. In fact, European markets have moved up more than 25% since the initial post-vote turmoil.

As an active asset manager, we focus on the fundamental facts. Panic moments often lead to mistakes, costing real money. We take a more considered approach, starting with frequent interactions with European companies. We’ve discovered numerous firms that are financially sound, have full order books and have even started to complain about a lack of capacity.

This leads us to emphasise a dividend-focused, value-based approach to European equities. Yields in Europe are high, confirming the discount applied to European stocks. In our view, there is an undue neglect of companies with well-supported dividend payments. Moreover, modestly rising interest rates and a continued, gentle economic expansion make the value side of Europe appealing. Such an environment typically translates into better earnings – for example, for financials, many of which are strong dividend-payers. In addition, ongoing restructuring efforts by European energy companies can translate into strong cash generation and dividends.

While large parts of the global stock markets trade on elevated valuations despite recent volatility, we believe Europe remains attractively priced. Investors should of course be prepared for even more noise and volatility in the run-up to the mid-term elections in the US. But buying good European companies at good prices may be able to shield investors from some of this impact. In a world driven by high-tech flash, consider using Europe's “substance and value” to balance an otherwise growth- and tech-biased portfolio.

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security. The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted. This material has not been reviewed by any regulatory authorities. In mainland China, it is used only as supporting material to the offshore investment products offered by commercial banks under the Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations. This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors U.S. LLC, an investment adviser registered with the U.S. Securities and Exchange Commission; Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG, licensed by FINMA (www.finma.ch) for distribution and by OAKBV (Oberaufsichtskommission berufliche Vorsorge) for asset management related to occupational pensions in Switzerland;

597634

A confident ECB wants to keep its options open

Summary

We don’t expect much news from the communications surrounding the European Central Bank’s next meeting. But we do expect them to balance expressions of confidence in the euro-zone economy with a cautious approach to rate hikes.

Key takeaways

|