Navigating Rates

The case for high yield bonds amid macro uncertainty

Markets are navigating a highly uneven economic outlook as the turning points of the rate and credit cycles approach. With credit fundamentals looking sound, high yield bonds could be a useful income proposition while we wait for more clarity.

Key takeaways

- High yield bond spreads may struggle to tighten further in the medium term, but current yields can help compensate investors for the risk of economic slowdown.

- Credit fundamentals such as leverage and interest coverage are set to deteriorate, but from a healthy starting point that should keep defaults contained.

- In our view, macro uncertainty means careful credit selection in high yield will be an important driver of returns in the coming months.

- Higher rated companies look to be trading at expensive levels, but we see value in “second tier” BB and B rated names that we think can withstand economic pressures.

As investors begin to think about asset allocation for 2024, they face an uncertain economic outlook.

On the face of it we are in the latter stages of a classic inflation-busting interest rate tightening cycle, where higher funding costs ought to suppress economic growth and push up corporate default rates. But developed economies led by the US have continued to defy predictions of recession, such that a growing number of market participants now believe central banks may achieve a “soft landing” after one of the sharpest rate hike cycles in history.

Multiple factors are blurring the outlook. Some of today’s economic drivers are unprecedented and not necessarily permanent, such as inflated household savings and corporate balance sheets in the wake of the Covid-19 pandemic. China looks set to disappoint as an engine of global post-pandemic recovery, though that could change, and energy security remains a potential source of volatility given conflicts in Ukraine and the Middle East.

For fixed income investors, valuations are complicating the picture further. With higher rates, the yields on highly rated sovereign and investment grade corporate bonds look more competitive than they have in years. The temptation may be for investors to focus on these more defensive assets while they wait for more clarity on the economic outlook, but that could mean missing out on potentially higher risk-adjusted value in areas like high yield.

Are high yield bonds attractive today?

High yield corporate bonds pay investors a spread over “risk-free” assets (such as US Treasuries) to compensate for expected losses stemming from defaults plus an extra amount to reflect the greater volatility of the asset class. Investors can benefit from the carry offered by this spread, and by the capital appreciation which accrues when a company’s fundamentals improve and the spread falls. Of course, selectivity is an important factor here as the risks in high yield can vary significantly by credit rating, with a significant step-up in risk having been observed in past cycles where bonds are rated B- or lower.

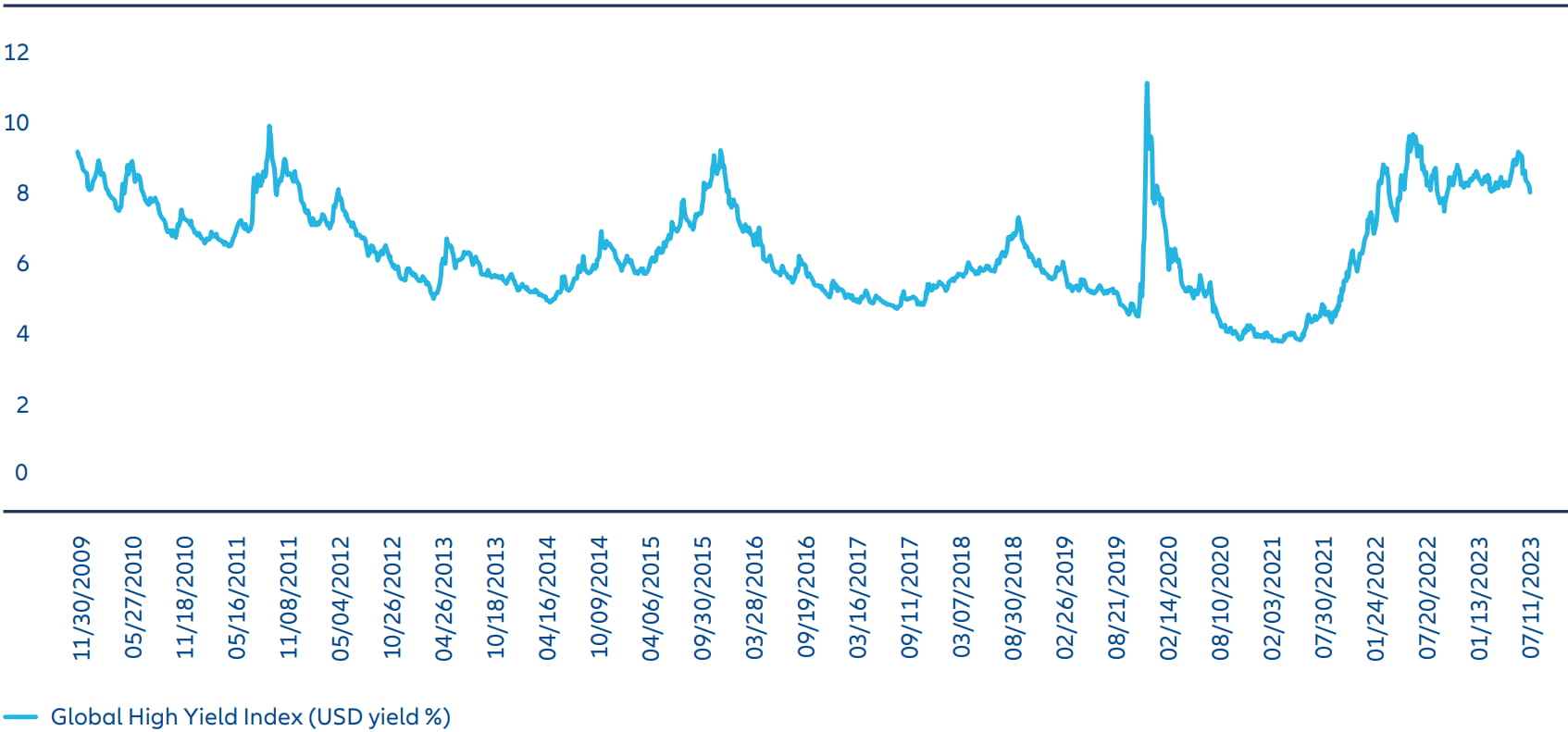

After a good year for high yield spread tightening, we think they may struggle to fall much further in the medium term, but current all-in yields – over 8% in USD-equivalent terms on global high yield at the index level and potentially higher on a single-name basis1 – can compensate investors for the risk of economic slowdown.

In this context, we think high yield bonds can play an important role in portfolios at this stage of the cycle. They can provide income, diversification and access to healthy yields at relatively short maturities – attractive features as we navigate high macro uncertainty and a range of potential “landing” scenarios.

Credit fundamentals look solid, “soft landing” or not

So where are we now in terms of credit fundamentals? Under classic “late cycle” conditions, investors become wary of high yield bonds as lower quality credits are more vulnerable to rising funding costs and a pick-up in default rates. However, on several metrics today’s high yield market appears to be in a reasonably balanced position:

- Leverage – Debt as a proportion of equity or earnings is a key measure of financial strength for high yield issuers. Today, net leverage (a measure of debt divided by cash profit) across US high yield issuers is around 3.6x, above the lows of late 2022 but also well below previous peaks of around 5x in 2021 and 4.7x in 2016-17.2

- Interest coverage – The amount of cash firms have on hand to pay the interest on their debt can be expected to deteriorate given higher refinancing costs, but it is starting from a healthy level as issuers did an impressive job of extending maturities on attractive terms in 2020 and 2021. At around 4.7x today, interest coverage across US high yield remains well above dips below 3.5x in 2011, 2013 and 2016.3

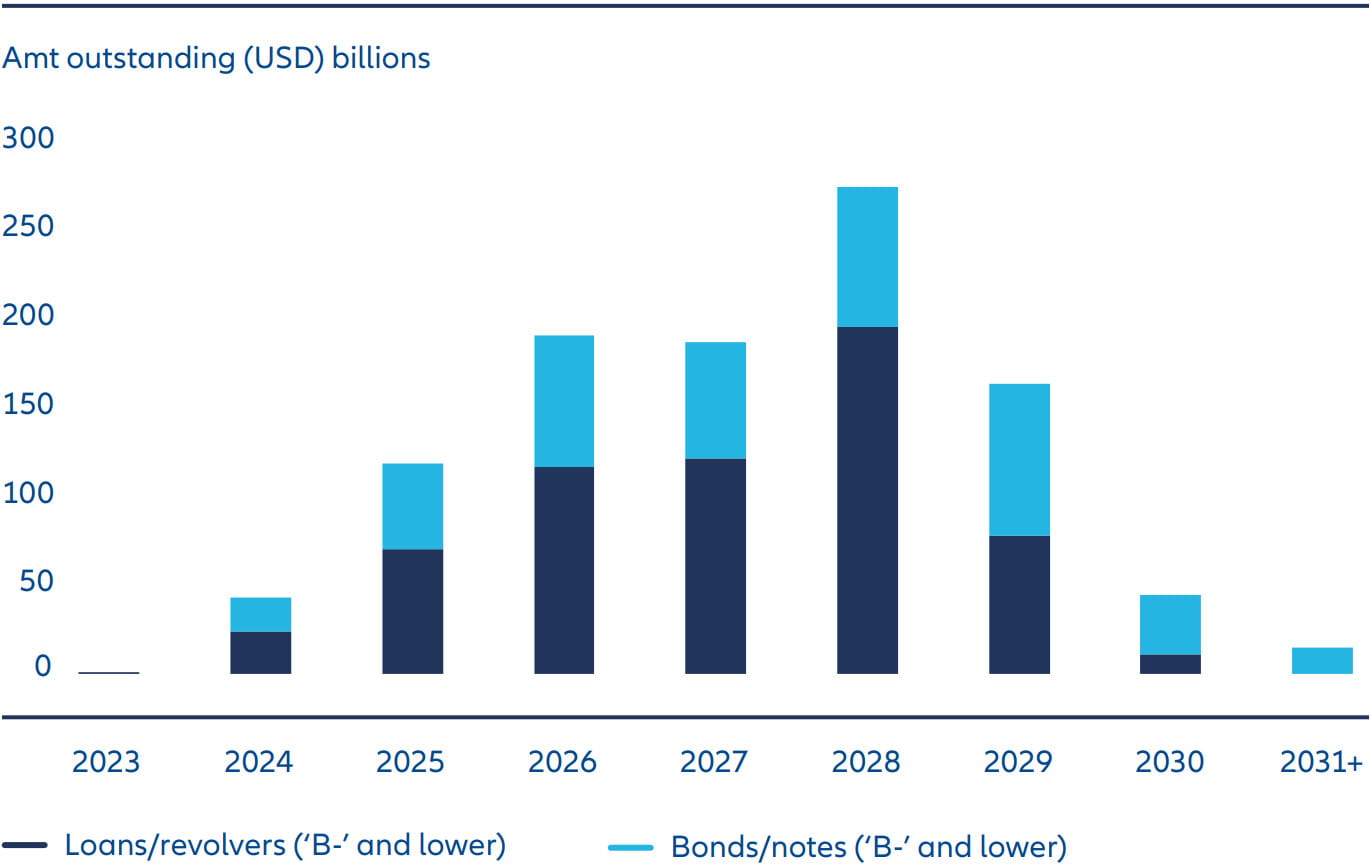

- The maturity wall – High yield investors keep a close eye on when maturing bonds will require issuers to refinance at current market levels (widely known as the “maturity wall”). Today’s maturity wall is reasonably high by historical standards but there appears to be plenty of liquidity to refinance solid businesses either via the high yield or loan markets according to our discussions with banks and financial sponsors. For weaker credits, liquidity cannot be guaranteed, and any investment needs significant scrutiny.

Exhibit 1: The global high yield “maturity wall” looks manageable for solid businesses

Source: AllianzGI, data as at 30 November 2023.

Defaults will rise but peak should be moderate

Clearly, we would expect the high yield default rate to pick up in the coming months. The raft of refinancing done in that postpandemic window was at terms far more favourable than can currently be achieved in the new issue market, and an economic slowdown will put further pressure on firms with weak earnings and heavy debt burdens.

However, even in our base case scenario that sees the US and other developed economies ultimately slipping into mild recession, we would expect default rates to remain relatively contained. That view reflects the healthy starting point for fundamentals and a higher-thanaverage credit quality in the global high yield index as many weaker credits have chosen to refinance in the loan market.

There are more bearish default projections out there (ratings agency Moody’s expects a peak speculative grade default rate of 4.7% in Q1 2024) but even these are far short of levels associated with severe stress. For context, defaults peaked at 15.25% in September 2009 in the wake of the global financial crisis, which clearly reflects a worst-case scenario.

Yields offer income – and some protection if conditions worsen

Given solid fundamentals but rising default rates, the key question becomes value – are yields compensating investors for owning high yield?

The current yield-to-worst on the global high yield index is 8.22% in USD terms, with an option-adjusted spread of 424bp and an effective duration of around 3.35 years.4

Overall yields look competitive – they are high relative to history as Exhibit 2 shows – but increased dispersion is becoming apparent as earnings become more mixed and consumer spending patterns shift. US retail firms have seen weak numbers, for example, while the US leisure sector has been stronger.

Therefore, the sector and credit selection provided by an active manager may be an important driver of returns in the coming months – building a portfolio by ratings band alone is no longer enough. Higher rated companies are trading tight, in our view, so we currently see more value in “second tier” companies in the BB and higher B rating brackets that we think can withstand the coming economic pressures.

Active management is also an important consideration when considering sustainability. The high yield market has a reputation for funding companies with less robust ESG credentials, and while this is gradually being shed there remains a broad spectrum of issuers. Hence carefully researched name selection is critical. While the post-pandemic reopening trade has rewarded some of the weaker credits on carbon footprint such as cruise operators and airlines, as the cycle normalises these tailwinds for carbon-heavy sectors should fade and thus investors can be more demanding in their ESG demands with less fear of missing out.

Beyond providing healthy income, a high level of outright yield can also help provide a buffer against potentially weakening credit metrics, since the income can help to offset losses that might occur from defaults. With a current yield of 8.22% at the index level, we calculate the high yield default rate would have to rise to just below 13% for the index to experience a negative absolute return in the next 12 months.

Exhibit 2: Historically high carry can help absorb rising default rates

Source: ICE BofA Indices, AllianzGI, data as at 30 November 2023. Past performance, or any prediction, projection or forecast, is not indicative of future performance.

Incremental allocations can avoid “missing the boat”

In the current environment of macro uncertainty, some may feel it is premature to add high yield exposure. However, historically one of the best times in the cycle to start adding to high yield has been just as recession is starting to register in the data and peak default rates are being priced in. Therefore, we think it is important to be nimble and proactive in adding to high yield to capture opportunities – scaling into the allocation incrementally could help avoid “missing the boat”.

In our view, high yield bonds – whether through pure high yield strategies or multi asset credit strategies that can also allocate to more defensive assets – can play an important role in portfolios at this stage of the cycle.

With recession still a material risk as the impact of higher rates plays out, it could be some time yet before we have more clarity on the macro outlook. However, with careful credit selection, high yield bonds offer the prospect of being paid to wait.