Embracing Disruption

China Biotech’s DeepSeek Moment

While healthcare stocks globally have faced headwinds, China’s pharmaceutical sector is staging a notable resurgence. Leading this recovery are the country’s biotech companies, which have evolved rapidly to become a global force. Chinese firms are now at the forefront of developing targeted cancer therapies and are expanding their pipelines to include treatments for autoimmune and rare diseases.

Just as DeepSeek’s breakthroughs in AI revealed how quickly China is closing the gap in frontier technologies, a series of recent partnerships between Chinese biotech firms and global pharmaceutical giants has underscored the sector’s underappreciated progress. These developments are not sudden; they are the result of years of strategic investment, policy reform, and talent cultivation.

Following previous articles in this ‘Created in China’ series on ADAS (advanced driver assistance systems) and artificial intelligence, we explore the rise of China’s biotech industry as another example of the country’s broader ascent in technology-driven sectors.

Demographics and China’s healthcare challenges

China is undergoing one of the fastest demographic transitions in history. By 2035, the elderly population is expected to exceed 400 million, accounting for over 30% of the total population.1

The country has also gone through a period of rapid urbanization, which has resulted in shifting lifestyles and a profound reshaping of dietary habits. This has contributed to a surge in chronic diseases. Today, China has the highest number of people with diabetes in the world, and one of the highest obesity rate among children, with close to 30% of children in age of 6-18 being obese.2

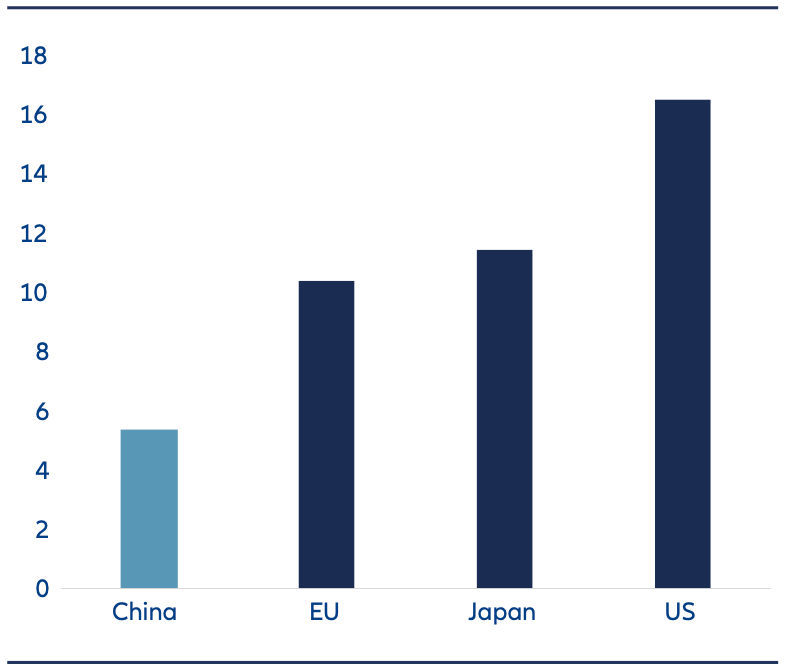

As a result, China’s healthcare system is facing unprecedented challenges. This is especially so with investment in healthcare having previously lagged other major economies. As an example, China spent USD 5.4% per capita in health care in 2022. This is equivalent to less than half of the U.S. (Exhibit 1).

With the existing healthcare infrastructure under pressure, this has translated into urgency for public health reforms and preventive care strategies. Policies have focused on making healthcare more affordable. Around 5,000 new hospitals have been opened in the last five years. China is also embracing AI, smart imaging, and digital health platforms to improve diagnostics, reduce costs, and expand care to underserved regions.

It is against this background that China’s biotech sector is playing a transformative role in addressing the country’s healthcare challenges, particularly those driven by rapid aging, uneven resource distribution, and rising chronic disease burdens.

The rise of China’s biotech sector

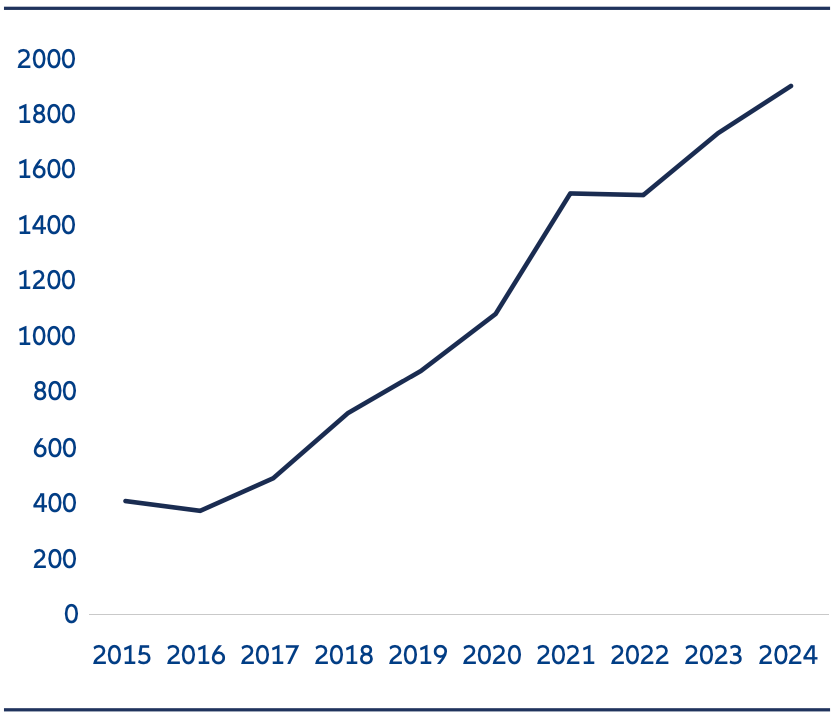

The biotech sector was first deemed to be a national priority in the early 2000s, but it has been mainly in the last decade that real progress has been made. In 2015 less than 350 ‘innovative’ drugs were developed in China. By 2024 that number had risen to 1,250 drugs. This level has surpassed Europe and is rapidly catching up with the US.3

Exhibit 1: Percent of GDP spent on healthcare – China compared to EU, Japan, US

Source: Healthcare expenditure – World Bank database, as of 31 December 2022

This surge reflects the impact of regulatory reforms, improved access to capital, and a growing talent pool – we believe these factors combined have propelled China to the forefront of life sciences innovation.

Regulatory reforms

Starting in 2015, biotech was included as one of the ten critical sectors for development under “Made in China 2025” policy. More recently it was also established as a pillar of China’s “new-quality productive forces”, which is focused on driving economic growth through innovation in frontier technologies.

Key changes have included:

- Timelines for trialing new drugs have been shortened.

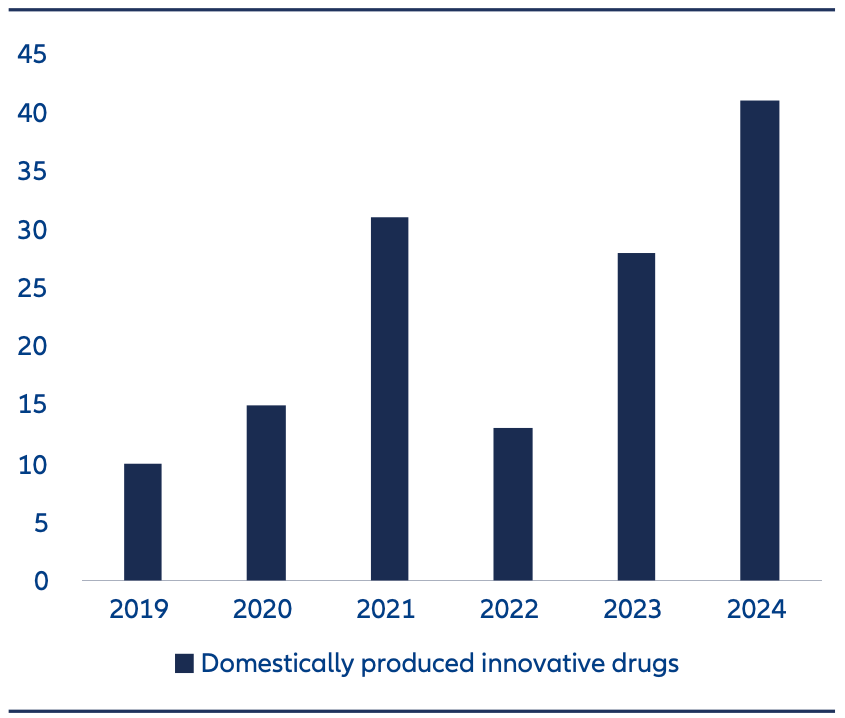

- Approvals for new innovative drugs have accelerated (Exhibit 2).

- New drugs have been added to domestic insurance purchase lists, so that they qualify for reimbursement under government-supported health insurance schemes.

- Chinese drug trial standards have been harmonized with international standards which has led to more licensing deals with global pharmaceutical companies.

Financing – improved access to capital

One of the most significant accelerators for China’s biotech sector has been the sweeping reforms in capital markets that unlocked new funding pathways for early-stage innovation. A major breakthrough came in 2018, when the China Securities Regulatory Commission introduced fast-track IPO approvals for high-tech “unicorns,” signaling strong policy support for innovation-driven industries.

Around the same time, the Hong Kong Stock Exchange relaxed its listing rules, allowing pre-revenue biotech firms to go public and thus providing startups with access to international capital even before generating sales. Complementing these changes, the launch of the Shanghai STAR Market introduced mechanisms to facilitate early-stage investor exits, further boosting liquidity and confidence.

Together, these reforms triggered a surge in private equity and venture capital activity, with early-stage biotech funding skyrocketing from USD 2 billion in 2017 to USD 16 billion in 2021.4

Although the level of private funding declined during the Covid years, nonetheless the significant rally in public markets combined with a wave of out-licensing to global pharmaceutical companies has again created a healthy funding environment for the sector.

Exhibit 2: Number of approvals of biopharma and innovative drugs are on the rise

Source: Mercator Institute for China Studies (MERICS) as of April 2025

Human capital – a growing talent pool

Another key driver of rapid growth has been a growing talent pool of STEM (science technology engineering maths) graduates and a wave of Western-educated Chinese scientists returning home since the early 2000s.

China produces around 5 million STEM graduates a year, creating a deep bench of scientists, engineers, and biotech professionals. On the back of this, China’s basic research has improved quickly. Chinese biotech researchers now rank second in the world behind the US in the number of high-quality papers published, far ahead of the UK, Germany, and Japan.5 A further outcome of this abundant supply of human capital is that labour costs in China are significantly lower than other markets such as the US.

Exhibit 3: Number of clinical trials for innovative drugs

Source: Pharmcube, HSBC as of 31 December 2024

Out-Licensing deals – global validation and credibility

Recent years have been notable for high profile deals whereby established global pharmaceutical companies have licensed the rights to commercialize products under development in China for sale around the world.

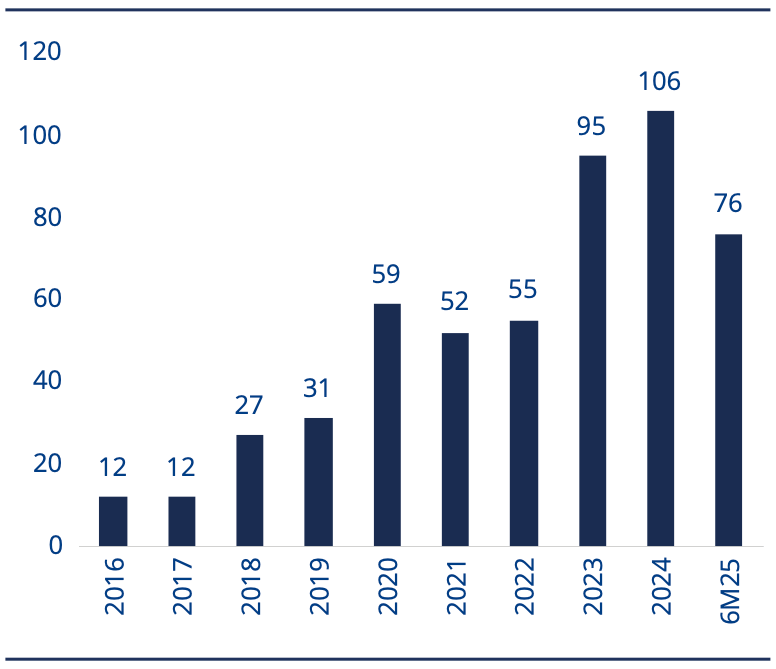

The wave of China out-licensing began in 2023, when 74 deals worth up to US $42.5bn were reached. In the first half of 2025, 64 deals worth up to US$68.3bn were signed.6

Household names such as Merck, Pfizer and AstraZeneca among others have all inked deals with China biotech. Many of these pharmaceutical companies face upcoming patent expirations and intensifying price pressures. Hence such licensing provides additional optionality for future growth.

Meanwhile out-licensing deals offer several strategic and financial benefits to Chinese biotech companies, especially as they seek to scale globally and navigate capital- intensive drug development. Upfront revenue payments help sustain R&D operations without requiring full scale commercialization infrastructure, for example. The deals allow Chinese firms to tap into the global distribution networks and regulatory expertise of their partners. And partnering with established pharma companies also enhances the credibility of Chinese biotech innovations. This, in turn, can further attract capital and talent, reinforcing the innovation ecosystem.

Exhibit 4: Number of China Out Licensing deal trends

Source: Morgan Stanley, GBI as of 30 June 2025. Please note 2025 data is 1H25 only.

A growing opportunity set for investors in China

China’s listed biotech sector has a relatively short history. There were few listed companies only a decade ago. After a period of strong performance spurred by financial market reforms, the sector then fell under a cloud during and post the Covid years.

While fundamentally the sector continued to see rapid development, it has only been more recently that this has started to be reflected in a more positive equity market environment.

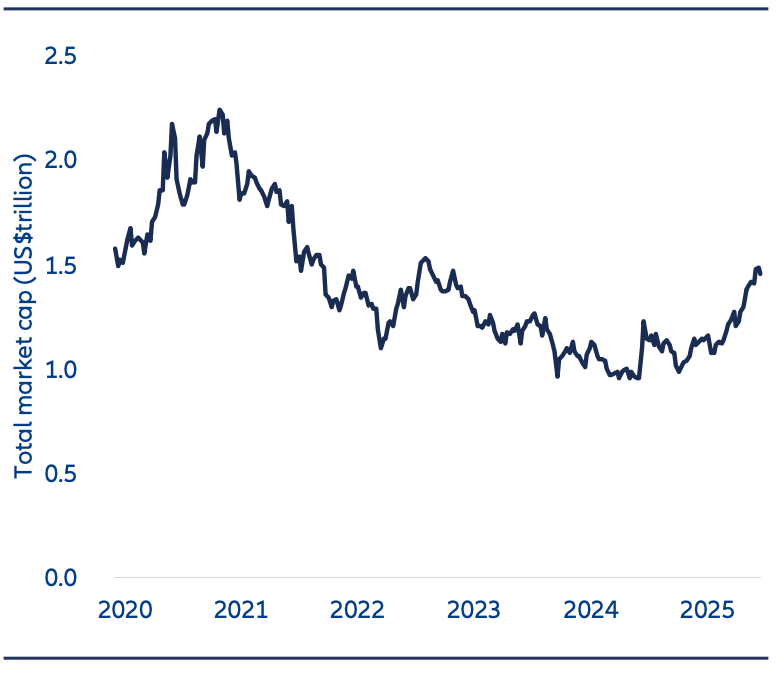

Today there are over 400 China biotech companies listed across mainland China, Hong Kong, and U.S. stock exchanges, with a combined market capitalization of USD 1.5 trillion (Exhibit 5).7,8,9

However, even though there has been a recovery year to date, the total market cap of the China healthcare sector remains well below peak levels in 2021. And in terms of a global comparison, the market cap of US-listed healthcare stocks is around USD 3 trillion more than in China.10 There is a long potential runway for growth, in our view.

Exhibit 5: Total Market Cap of China Healthcare in (US$ trillions)

Source: Jefferies, Factset, 29 August 2025. Note: China Healthcare refers to broader China companies under healthcare sector (GICS Level 1).

Summary

Like biotech markets globally, investing in China’s biotech sector comes with risks. The attrition rate in early-stage clinical trials remains high, and geopolitical tensions –particularly around access to the U.S. market – pose additional hurdles. Yet, the trajectory of China’s biotech industry is increasingly defined by progress rather than promise.

The volume and quality of drug candidates emerging from China are rising sharply, with Chinese firms now accounting for roughly one-third of global out-licensing deal value – a clear signal of growing international relevance.11

Looking ahead, the domestic landscape is supportive. China boasts a deep talent pool, improving research standards, a favorable regulatory environment, and increasingly accessible financing. Together, these elements form a robust foundation for sustained innovation.

In our view, biotech is not only a strategic growth sector – it is a compelling example of China’s advancing leadership in technology-driven industries. It is also an area where we expect to see continued breakthroughs, global partnerships, and long-term value creation.

1Xinhua News, 10 Jan 2025

2“Epidemiology of obesity and influential factors in China: a multicenter cross-sectional study of children and adolescents,” 1 August 2024

3Norstella, Bloomberg, 14 Jul 2025

4Gavekal, 28 July 2025

5Nature Index, 31 Dec 2024

6PharmaDJ, Gavekal, 28 Jul 2025

7“Chinese Companies Listed on Major U.S. Stock Exchanges,” U.S.-China Economic and Security Review Commission, March 7, 2025

8“Report on Hong Kong-Listed Biotech Companies,” Skadden, Arps, Slate, Meagher & Flom LLP, June 2024

9Jefferies, FactSet, 29 August 2025

10Jefferies, FactSet, 29 August 2025

11Gavekal, 28 Jul 2025