Summary

The coronavirus pandemic applied a sudden brake to China’s growth story, as it did to most economies around the world. But there are signs that China could be ready to lead the way out of the downturn and resume its long-term growth trajectory.

Key takeaways

|

Following the slowdown triggered by the coronavirus outbreak, China’s economic recovery continues to progress as companies get back to work, quarantine measures are relaxed, and people venture outside. A resumption of “business as usual” among Chinese consumers will be essential to any recovery. Domestic demand will be needed to drive Chinese growth, particularly as demand for Chinese exports may remain subdued because of the crisis. While the daily cases of coronavirus infection in China have fallen to single digit levels, many other countries – notably those in south and south-east Asia – are still seeing hundreds and thousands of daily new infections, which is restricting economic demand.

What drives economic recovery from coronavirus?

In China and wider Asian economies, the pace of recovery from the outbreak will be determined by four key factors: the stage of the pandemic, institutional capacity to manage and contain the virus, central banks’ capacity and willingness to provide stimulus, and each economy’s openness towards external trade.

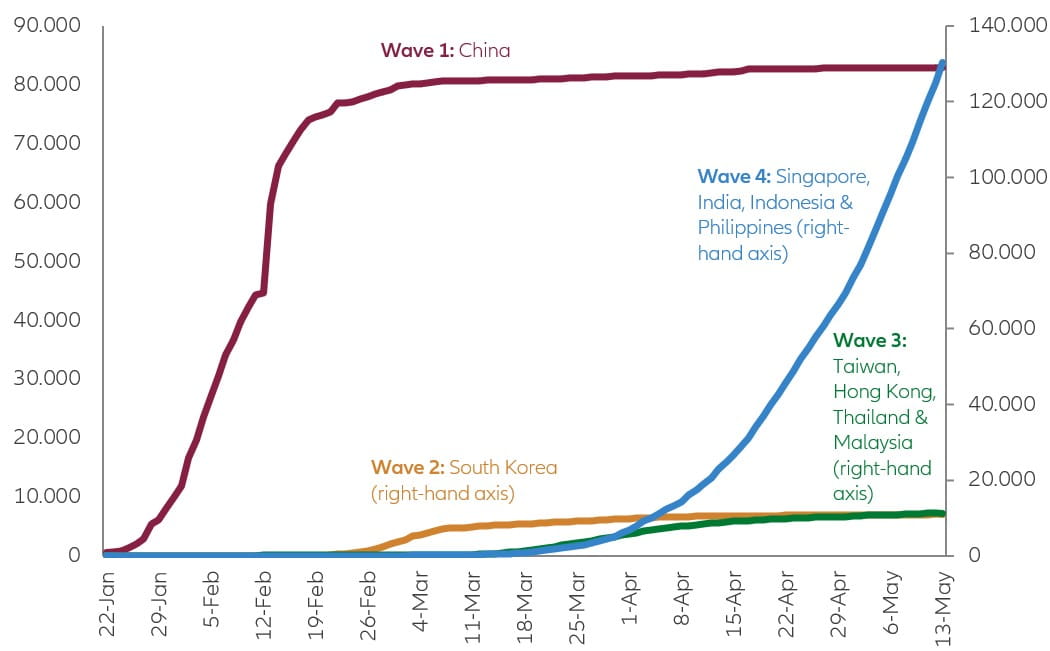

Daily confirmed infection cases in Asia

Source: Johns Hopkins University, MoH, MOPH, KCDC, Worldometers.info, AllianzGI Economics & Strategy, as of May 2020.

As the chart shows, in May the Chinese economy was already at a more advanced stage of the outbreak than any of its peers. Meanwhile, the government has been decisive in acting to bring the virus under control and looks set to continue making policy interventions to support China’s economic recovery. At the annual National People’s Congress meeting in May the Chinese government announced a widened fiscal deficit target to support the economy. In a bid to shore up employment, the government pledged RMB 4 trillion of tax exemptions for factories and retailers, waived contributions to social welfare funds, and reduced bank interest rates and utilities costs.

The government had already announced a new round of fiscal and monetary policy easing, introducing RMB 3.75 trillion of special local government debt and RMB 1 trillion of special treasury bonds. Meanwhile, the People’s Bank of China (PBoC) further lowered the reserve ratio required of banks, to provide greater liquidity and lending to the country’s small and medium sized businesses.

While supportive, these moves fell short of the expected levels of intervention, as China resists taking on too much debt as it did after 2008. However, the government has made it clear that it has further fiscal, financial and social security policies in reserve that it will roll out “without hesitation” if it considers further intervention necessary.

Beyond the coronavirus pandemic, the main risk facing China (as well as wider Asian markets and global trade) could be the resurgence of trade tensions with the US. President Trump may put China at the centre of his re-election campaign. Any heightened rhetoric or increased tariffs could be negative for market sentiment.

How will other Asian economies fare?

Looking at other Asian economies, South Korea and Taiwan are also at an advanced stage of the pandemic, with a low risk of a second wave outbreak. As such, we expect them to follow close behind China as their economies gradually recover. We expect south and south-east Asian economies – in particular India, Indonesia and the Philippines – to endure further difficulties before recovering. This is mostly due to the ongoing spread of the pandemic in those nations, which are still seeing a rising number of new infection cases. We do not think the fiscal stimulus provided by these economies will be enough to offset the drag caused by the coronavirus outbreak.

Stock markets have rebounded, but expect more volatility ahead

Equity performance within each country is likely to be influenced by the expected severity of the pandemic, along with the future likelihood of idiosyncratic risks (such as a systemic credit default), and the risk of a negative geopolitical event with the potential to derail any recovery. Again, China scores well on these metrics, along with Taiwan and South Korea.

However, equity prices within these markets have already recovered significantly since the lows of late March, so investors should exercise caution and expect volatility going forward. When it comes to fixed income investment, we see a low likelihood of restructuring among Asian public debt so would recommend investors to overweight sovereign and quasi-sovereign credit. These securities were sold off due to market concerns, causing spreads to widen above historical levels which offer good value. Again, we are more favourable on the North Asian economies – particularly China – and less so on south and south-east Asian economies.

China set to be “first in, first out” of the coronavirus

Like all economies around the world, China has been impacted by the coronavirus outbreak. However, the Chinese government has taken decisive actions to contain the outbreak, stimulated business activity, and made the necessary policy interventions to support its economic recovery.

Just as it was the first into the crisis, China appears well positioned to be the first out and continue its growth trajectory. Risks remain, but China’s continued establishment as a central hub of the world economy should see it lead the way on the long path to recovery.

1206147

Summary

Despite the impact of the coronavirus pandemic, and continuing tensions with the US, China remains on course to become the world’s largest economy by 2030. This could represent the coming decade’s most transformative development in global financial markets – and a major opportunity for investors.

Key takeaways

|

-

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security.

Some or all the securities identified and described may represent securities purchased in client accounts. The reader should not assume that an investment in the securities identified was or will be profitable. The securities or companies identified do not represent all of the securities purchased, sold, or recommended for advisory clients. Actual holdings will vary for each client. BAT is a widely used acronym for three large cap tech companies in China: Baidu, Alibaba and Tencent.

The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted.

This material has not been reviewed by any regulatory authorities. In mainland China, it is used only as supporting material to the offshore investment products offered by commercial banks under the Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations. This document does not constitute a public offer by virtue of Act Number 26.831 of the Argentine Republic and General Resolution No. 622/2013 of the NSC. This communication's sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of his document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Brazil, Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Pacific Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional/professional investors only, and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide financial services to retail clients in Australia. AllianzGI AP (Australian Registered Body Number 160 464 200) is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of financial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which differ from Australian laws.

This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors U.S. LLC, an investment adviser registered with the U.S. Securities and Exchange Commission; Allianz Global Investors Distributors LLC, distributor registered with FINRA, is affiliated with Allianz Global Investors U.S. LLC; Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG; Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424, Member of Japan Investment Advisers Association and Investment Trust Association, Japan]; and Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan.