Diverging paths ahead

Diverging economic and monetary policy paths are feeding through to government bond markets, presenting risks and opportunities for investors. In the second of four articles exploring ways that investors can reset bond allocations, we discuss ideas for navigating the divergence in central bank policy, inflation, currency risks and economic performance.

Key takeaways:

- Economies and policies are shifting from broadly in-sync to deeply out-of-sync

- Investors should watch out for divergent recession risks, a possible blowout in riskier bond yields in the euro area, and the chance of stagflation in the UK

- Fear of inflation becoming entrenched is motivating some central banks to frontload rate hikes

- Investors could consider flexible bond strategies and adding incrementally to core rates markets likely to benefit from flight to safety

From Germany to Brazil and the UK to China, economies are moving at different speeds as monetary policy and growth begin to diverge in the wake of the turmoil created by the Covid-19 pandemic. This contrasts with the Covid-19 pandemic era when central banks across advanced and emerging-market economies converged in their willingness to over-loosen policy and let inflation overshoot for a while to bring down unemployment.

But we are now seeing a divergence in banks’ resolve to over-tighten, to bring down inflation at the expense of economic growth and jobs. The division is creating risks, but also opportunities for those investors prepared to be flexible, as well as seek out potential safe havens.

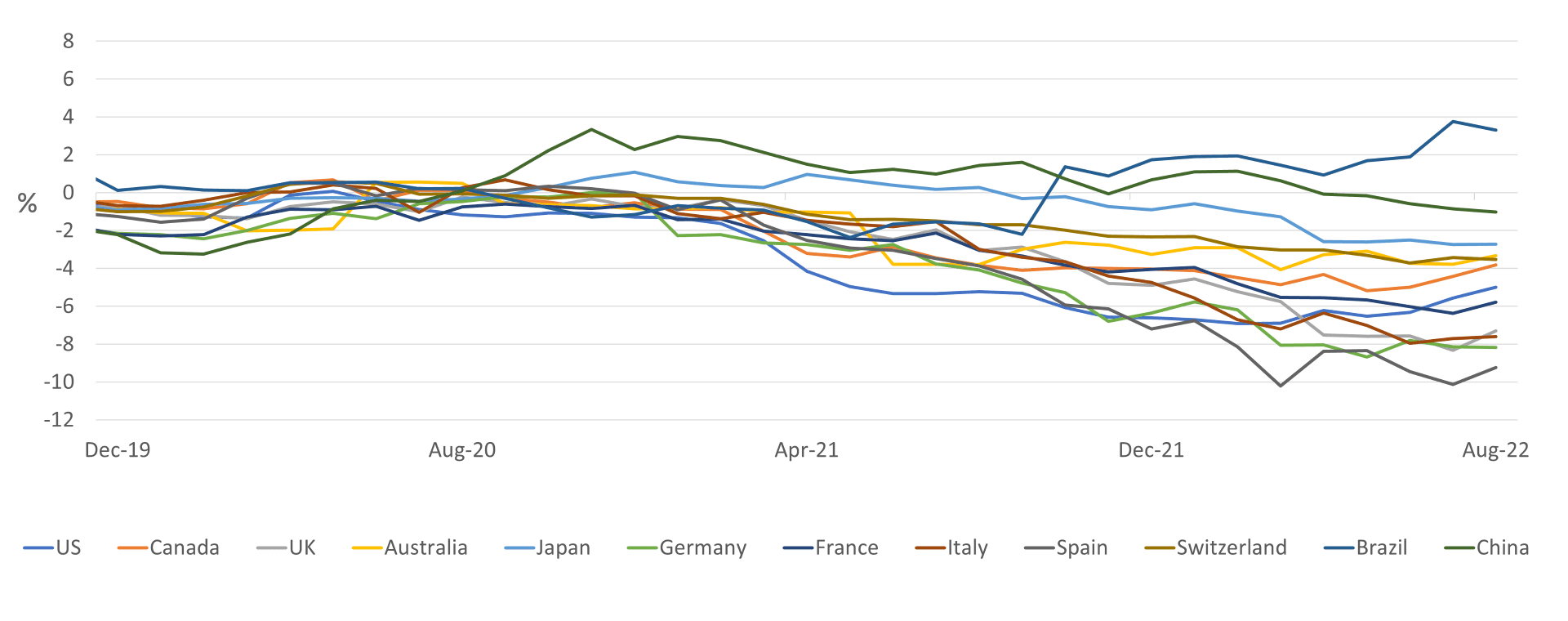

There’s now a stark contrast in after-inflation (real) yields across many government bond markets. Consider the more than 3% yield for Brazil’s local currency bonds at the end of August, compared to the -9% for Spain’s equivalent after relatively little yield difference during the pandemic’s onset (see Exhibit 1).1 This mixed picture suggests that economies and policies are becoming deeply out-of-sync regarding how and when they might exit the current inflation-led regime.

One reason for this divergence is that the range of economic outcomes differs materially across borders.

Exhibit 1: month-end 1-year government bond yields (local currency) adjusted for monthly headline consumer price inflation (year-on-year, not seasonally adjusted)

Source: Bloomberg. Allianz Global Investors. Yield data as at 31 August 2022. Latest available official inflation data for the month of July 2022

Euro area vs North America

A deeper recession in the euro area looks greater in likelihood and magnitude than in energy-rich economies like the US and Canada, where the chances of reining in inflation without a hard landing may look better. The difference is largely because of Europe’s outsized dependency on natural gas supply from Russia – which could be unilaterally turned off for a prolonged period due to the geopolitical tensions surrounding the war in Ukraine. Euro-area real rates remain deeply negative as the European Central Bank (ECB) has been slower to raise rates than the Federal Reserve, even as the region’s annual inflation figures surpassed those in the US. This also explains why we see more yield curve steepness in the euro area. In contrast, 2/10-year curves for the US and Canada have inverted due to the frontloading of rate hikes pushing up yields much more at the front-end.

The euro area also faces the additional challenge of having one currency and one policy rate, yet still plenty of economic divergence between euro-area countries. The official flash estimate for euro-area annual inflation in August came in at 9.1%, up from 8.9% in July,2 and showed the biggest dispersion between member states since the euro’s introduction. Estonia’s inflation came in at 25.2%, compared to 6.5% in France.3 The ECB has been trying to partially offset its “one-size-fits-all” policy rate by reinvesting proceeds from its maturing debt holdings issued by euro-core countries to buy euro-periphery debt. Without such support, the spread between 10-year German and Italian bond yields would probably have widened further past the 235-basis-point level seen at the end of August.4 It remains to be seen whether the ECB’s new “anti-fragmentation” bond-buying programme will be officially activated and can succeed in preventing a blowout in riskier euro-area yields.

UK stagflation risks

Asia asymmetry

Emerging markets are ahead in the tightening cycle

Currency casualties

Flexibility and flight to safety may help investors

1) Source: Bloomberg. Allianz Global Investors. Yield data as at 31 August 2022. Latest available official inflation data for the month of July 2022

2) Source: eurostat, 31 August 2022

3) Source: eurostat, 31 August 2022

4) Bloomberg, 31 August 2022

5) Source: Bank of England, August, 2022

6) Bloomberg, 31 August 2022

7) Source: Japan Ministry of Internal Affairs and Communications

8) Bloomberg, 31 August 2022

9) Bloomberg, 31 August 2022