Navigating Rates

Challenging today, promising tomorrow

Key takeaways

- Equity markets strong performance despite limited progress on trade agreements and a looming August 1 tariff deadline, as well as emerging signs of investor complacency, suggest that a resurgence in market volatility may lie ahead as trade partners engage in tough negotiations. Nevertheless, we would view any near-term market weakness as an opportunity to increase exposure to European equities, particularly as we look toward what is likely to be a more constructive backdrop in 2026.

- European Sovereignty – many European countries have launched initiatives to increase spending on defense and cybersecurity.

- In addition to these areas, there is growing emphasis on modernising critical infrastructure and supporting strategic sectors essential to European sovereignty, such as technology and healthcare.

- A meaningful convergence in earnings growth between Europe and the U.S. anticipated for 2026 may justify a reduction in the pronounced valuation gap currently observed between the two markets. Strengthening investor sentiment and ongoing asset reallocation toward the region are likely to serve as further tailwinds.

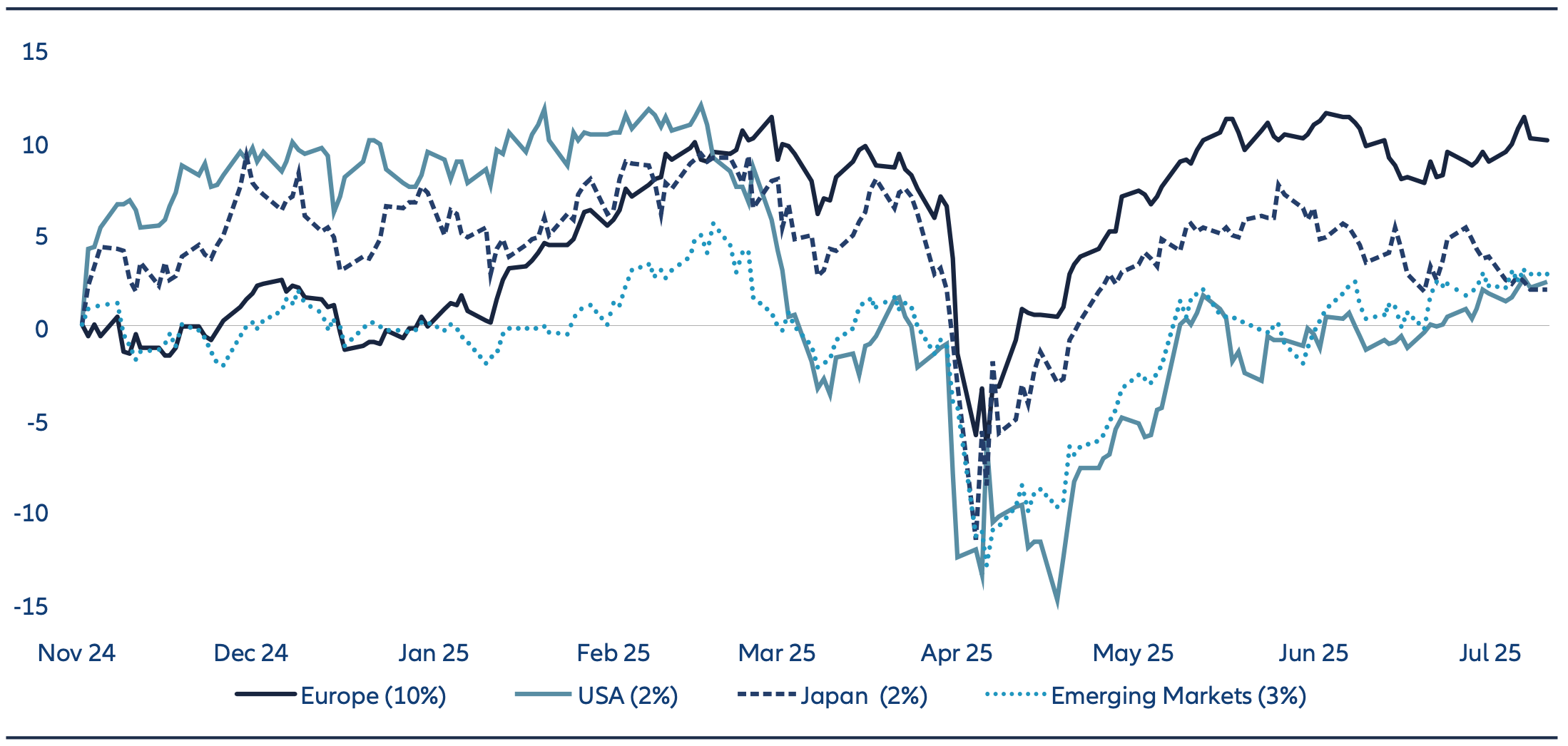

Strong market recovery from ‘Liberation Day’ correction

Global equity markets have staged a swift recovery to new highs following the challenges of “Liberation Day”. At the time of writing, the MSCI Europe is up 16% from its April lows, while the S&P 500, the Magnificent 7 and the MSCI Emerging Markets even rebounded by 25%, 38% and 24%, respectively.

This shouldn’t be interpreted as a sign that risks have disappeared or that the global economy has regained strength – on the contrary, new challenges such as the flare-up in the Middle East have emerged. However, uncertainties surrounding trade and geopolitics may have peaked – particularly as U.S. President Donald Trump has repeatedly postponed the implementation of import tariffs, signaling a strong preference for negotiating ”deals”, although progress on these has remained notably sluggish.

Given the recent market recovery, the looming August 1 deadline – under which the EU faces the threat of a 30% tariff following Trump’s recent announcement – combined with implied equity volatilities (with VIX and V2X once again well below 20) suggesting a degree of investor complacency, a resurgence in market volatility cannot be ruled out. So far, markets have largely assumed that trade agreements will be reached before critical deadlines, and that sharp reactions in Treasury or equity markets would once again act as a moderating force on Trump. We share this view, while acknowledging the inherent uncertainty in predicting the U.S. President’s actions, as well as the potentially more profound longer- term implications on the economy and corporate profits.

Given the improving medium-term outlook for earnings and the macroeconomy – supported by monetary easing and front-loaded fiscal stimulus in Germany – we would view any market weakness as an opportunity to increase exposure to European equities.

Chart 1: Regional equity market performance since US presidential election

Source: Total return in Euro for MSCI indices from LSEG Datastream as of 14 July, 2025

Special topic – European sovereignty – “Yes, we can!”

Geopolitical tensions and uncertainty surrounding U.S. support for Ukraine and NATO’s collective defense principle present both a challenge and an opportunity as the EU and key European countries, including the UK, have responded with a robust and forward-looking strategy:

- Defense commitments: All NATO member states have pledged to increase defense spending to 3.5% of GDP by 2035, alongside additional investments in infrastructure. Germany has adopted a “whatever it takes” approach to defense spending, aiming to reach the 3.5% target as early as 2029.

- Germany’s fiscal strategy: With government debt at approximately 63% of GDP – compared to 122% in the U.S. – Germany maintains strong credit metrics and has room for fiscal stimulus. The new German government can rely on so called “Sondervermögen” to invest EUR 500bn over 12 years. This will be used to upgrade infrastructure (including digital infrastructure), modernize public administration, and invest EUR 100 billion (of the 500 billion) in climate protection measures.

- Industrial and technological leadership: Beyond defense, cybersecurity, and infrastructure, the EU and its member states are actively promoting industrial champions and technology leaders. Initiatives include support for startup ecosystems and the development of a European cloud and AI data infrastructure. The EU aims to mobilize EUR 200 billion for AI-related investments.

- Regulatory simplification: The EU is also working to reduce bureaucratic burdens. A key example is the EU Omnibus Regulation, which seeks to streamline or adjust the scope of various directives, including the Corporate Sustainability Due Diligence Directive (CSDDD) and the Corporate Sustainability Reporting Directive (CSRD).

- European champions: In sectors such as semiconductor lithography, enterprise resource planning (ERP) software, and digital industries, European companies are global leaders and play a vital role in strengthening European sovereignty.

- Aerospace leadership: In the aircraft manufacturing duopoly, Airbus continues to outperform Boeing in key performance indicators such as new deliveries and order intake – reinforcing the strength of the broader European aerospace “ecosystem”.

- Financial sovereignty: The EU’s Capital Markets Union and Savings & Investment Union remains high on the political agenda and are central to advancing Europe’s financial sovereignty.

European sovereignty is set to become a key investment theme in the coming years, with positive implications for sectors such as capital goods, financials, healthcare, and technology. Reducing strategic dependencies and fostering innovation leadership are top priorities across the continent.

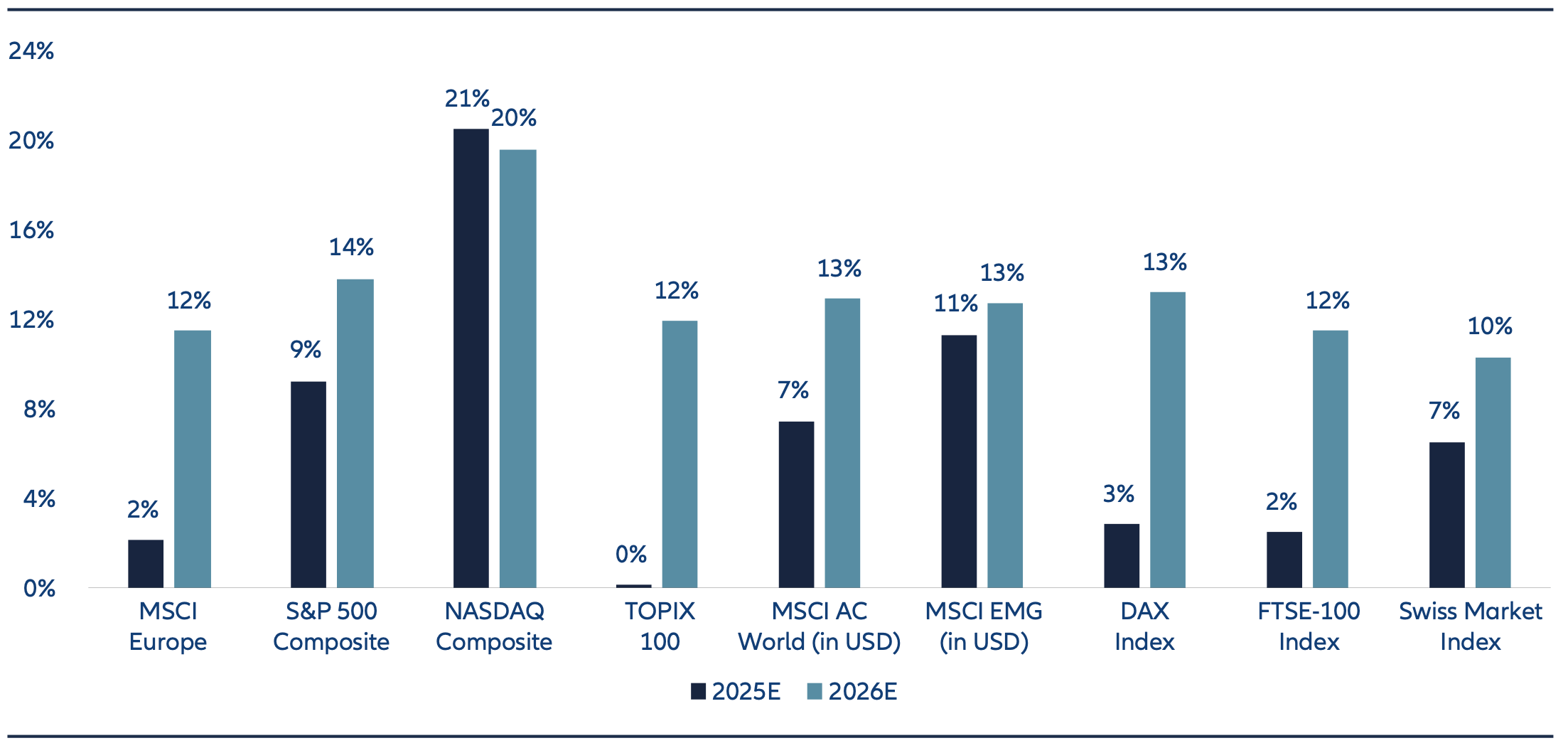

Earnings growth in Europe is catching up

As expected, the increasingly subdued global macroeconomic outlook – reflected in the latest consensus downgrading the 2025 global GDP growth forecast to just 2.7% – combined with the U.S. administration’s imposition of substantial import tariffs and subsequent retaliatory actions by key trading partners, has impacted corporate profits. Additionally, with roughly 25% of revenues of MSCI Europe companies being generated in the US, the weakness of the U.S. dollar has posed a further challenge for profit expectations. Consequently, since the start of the year, analysts have revised down their earnings forecasts for European firms by an average of 7%. Despite the recent downgrades, earnings in Europe are still projected to grow modestly by 2% in 2025. More importantly, growth is expected to accelerate significantly to 12% in 2026, supported by an improving macroeconomic environment, the diminishing impact of tariffs due to countermeasures, and the normalization of currency effects.

Earnings growth in the U.S. is also expected to accelerate in 2026, though to a lesser extent than in Europe. Consensus forecasts project S&P 500 earnings to rise by 9% in 2025 and by 14% in 2026. However, the fact that over 70% of U.S. corporate revenues are generated domestically—within an economy expected by consensus to grow at a below-trend pace of just 1.6% in 2026—acts as a constraint. Moreover, the tailwind from a weaker U.S. dollar seen in 2025 is unlikely to repeat again. As a result, the earnings growth gap between the U.S. and Europe seen in recent years is narrowing sufficiently (albeit partially for cyclical reasons), attenuating a key argument why European equities should trade at a large discount to the U.S. and challenging the view of “U.S. exceptionalism”.

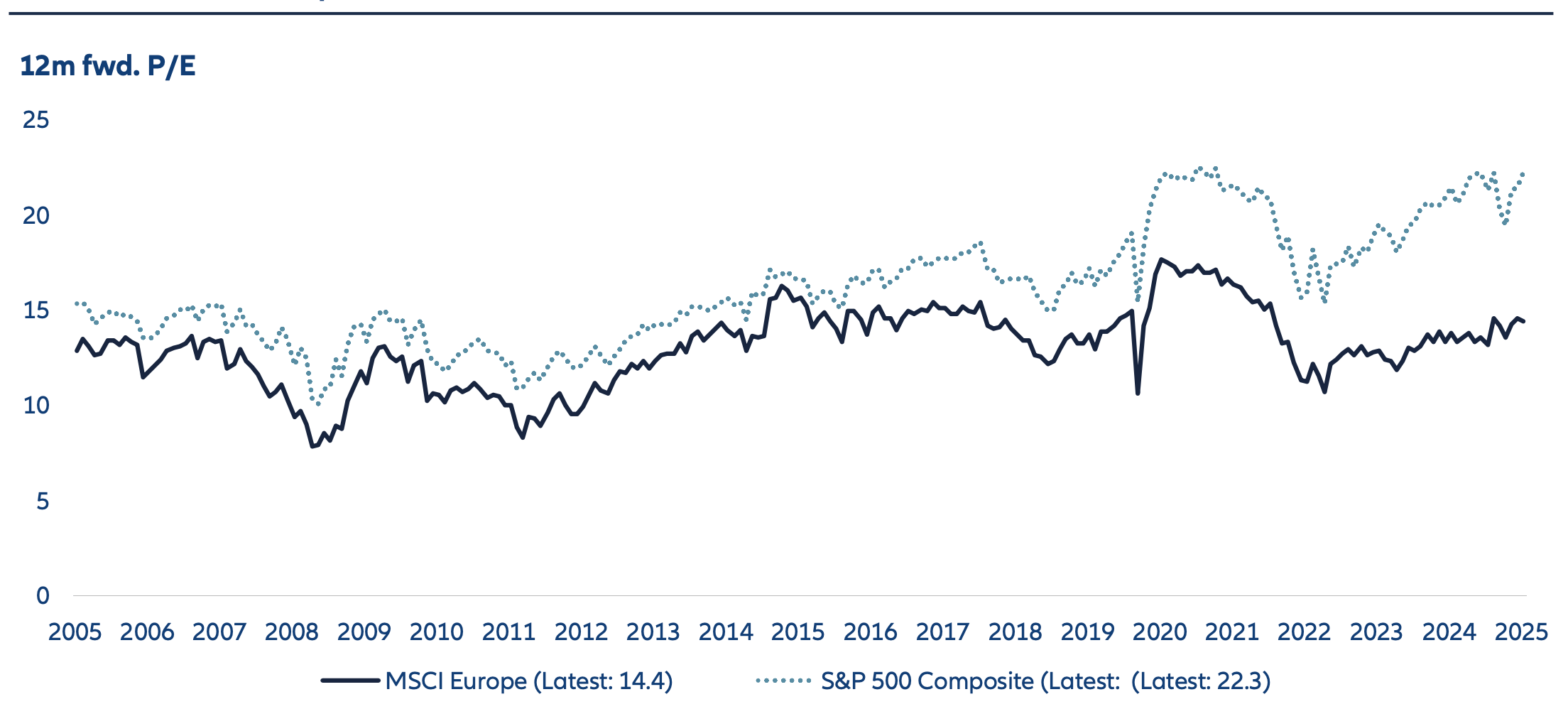

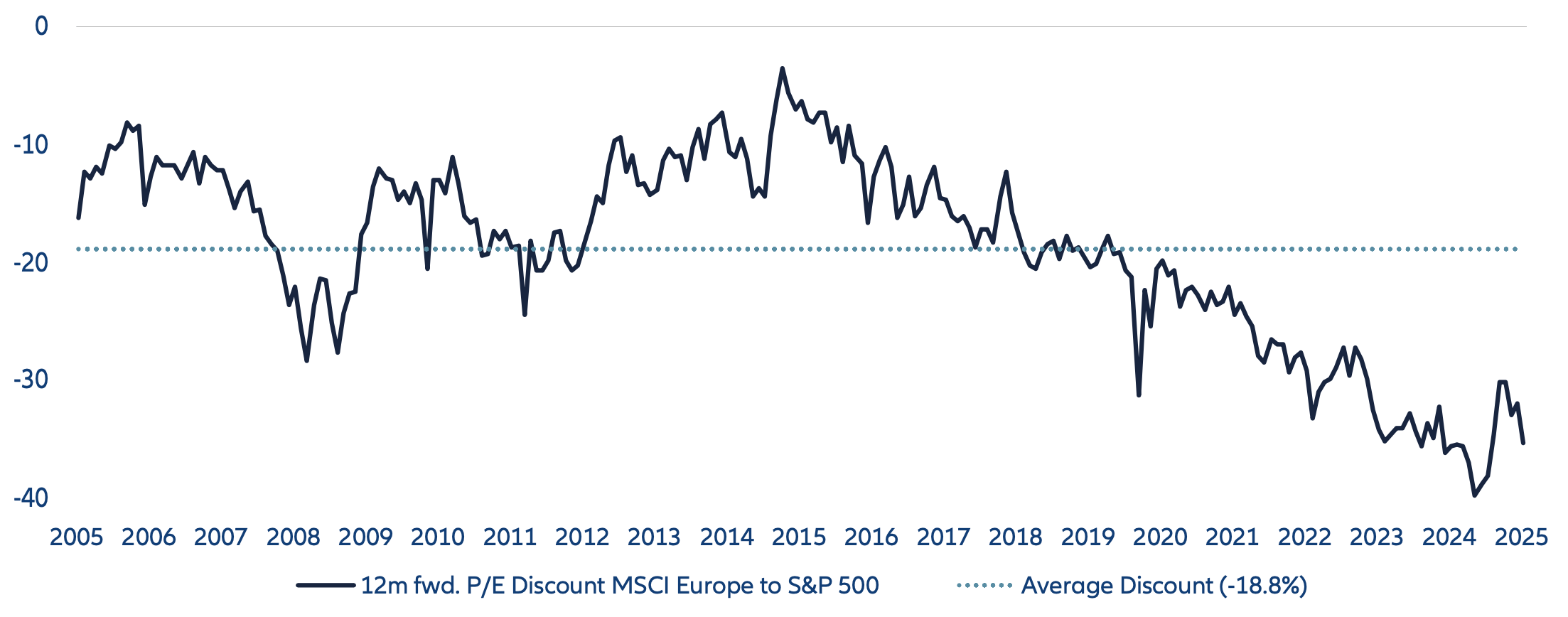

European equities with room for further outperformance

Although European equities have outperformed the U.S. market by approximately 15% year-to-date in euro terms and are not cheap in absolute terms, valuations in Europe remain compelling relative to the U.S. The S&P 500 is trading at 22 times forward earnings – an elevated level by historical standards – while the MSCI Europe trades at just below 15 times, representing a 35% discount to the U.S. market. This gap is significantly wider than the 20- year average discount of 19%, and Europe’s substantial undervaluation persists even after adjusting for differences in sector composition. While valuation alone may not be sufficient to drive continued outperformance, we believe supportive investor sentiment and positioning should continue to favor European equities.

From a sentiment perspective, we anticipate continued improvement in global investor confidence toward Europe. We view the theme of “European sovereignty” – along with the associated investment opportunities outlined above – as both compelling and enduring. Adding to this is a growing concern among global asset allocators: is it still appropriate to maintain a ~70% equity exposure to a politically and fiscally less stable U.S. – reflecting its weight in the MSCI World – and, by extension, to the U.S. dollar, especially when over a quarter of that exposure is concentrated in just five stocks? It is worth noting that the United States represents c46% of the combined GDP of developed economies (which form the MSCI World).

In terms of positioning, while some asset rotation out of the U.S. and reallocation to Europe has occurred in recent months, especially by hedge funds and tactical asset allocators, it’s clear that investor exposure to European equities remains well below historical levels after years of outflows which started with the conflict in the Ukraine – suggesting that further shifts toward Europe could continue to support its equity markets. Moreover, average cash levels in European mutual funds remain well above historical norms – indicating that there is still ample dry powder available to support markets further.

Chart 2: EPS growth (local currencies)

Source: LSEG Datastream as of 10 July, 2025

Chart 3: Valuation Europe vs. U.S.

Source: LSEG Datastream as of 14 July, 2025

Relative valuation

Source: LSEG Datastream as of 14 July, 2025