Embracing Disruption

Fragmentation in the global village: adapting to a shifting world in an age of AI and Digital Darwinism

As the world continues to digest the profound changes of the past decade – driven by, among other factors, China’s ascension to the “G2”, massive technology advancements, the Covid pandemic and Russian military actions in Ukraine – it is now clear that we are undergoing a period of profound transformation. The post-cold war era of globalization, marked by growing interconnectedness and economic efficiency, is dying and giving way to a new landscape where fragmentation and multipolarity are returning. While a great deal still remains uncertain, it is clear that the rules of engagement are being rewritten: economic power is shifting, rival technological ecosystems are emerging, and many market participants will thus need to recalibrate their outlooks and approaches.

Power in transition

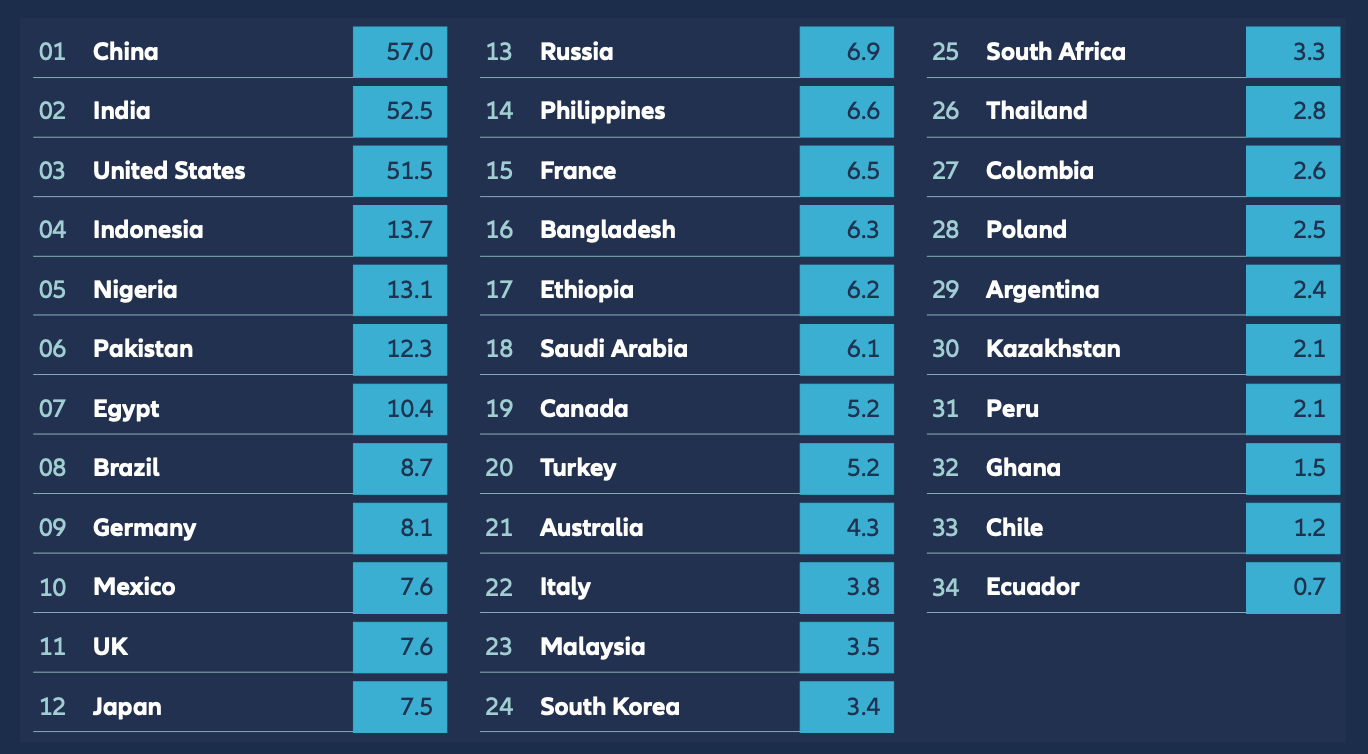

Today, the “G2” economies of China and the US account for nearly 40% of global GDP and trade. However, within several decades, the world’s economic hierarchy is set to look very different. The global population is increasingly concentrated is Asia, with China and India representing over a third of humanity. These two giants will surpass the US in the GDP, while other countries such as Indonesia, Egypt and Nigeria, among others, will emerge as major players in the global economy.

Yet these changes are not just about numbers: the evolving hierarchy will also come alongside growing soft power for these countries, as their burgeoning influence begins to be felt more keenly across the world, and this influence is leveraged to achieve political and economic goals.

World’s biggest economies in 2075 ($ tn)

Source: Goldman Sachs, May 2025

Axes of fragmentation

While it would certainly be foolish to try and predict with certainty how the political and economic landscape will look in the coming decades, we can nevertheless identify several axes of fragmentation that are currently shaping our trajectory.

First, and possibly most profound, is geopolitical realignment. The convergence seen in the wake of the cold war is ending, leading to the rise of blocs such as the BRICS, reordering in the Persian Gulf and broader Middle East, and an uncertain future place in the global system for Russia and its satellites. Furthermore, interdependence can now be used as a weapon, as we are currently seeing with the ongoing tariff wars, and restrictions on trade in rare earths and cutting-edge semiconductors. The recent surge in global defence spending to over USD 2.7 trillion is testament to these changes.

Second, we are also seeing divergence along ideological lines. On one level, this is manifest in a crumbling of the consensus around certain ESG values, as the EU pushes forward with its “Green Deal”, the US tracks back on some commitments, and many nations in the Global South take a more pragmatic approach. More profoundly, the purported liberal consensus of the post-cold war years is now very much in disarray, with populism raising its head – even in some established democracies – and previously accepted truths of political liberalism increasingly being questioned. In this respect, the “End of History” may have to wait.

Third, technological splintering is a practical outcome of these more abstract changes that is already being felt. We are seeing the emergence of competing AI ecosystems on either side of the Pacific, and – accelerated by a lack of shared standards and lagging digital governance – this fracturing of the innovation landscape is set to continue as sovereigns seek to pursue their own tech ambitions amid the background of the types of geopolitical and ideological realignment mentioned above.

Digital Darwinism: a guiding theme

As uncertainty grows and established truths and ways of working fall by the wayside, the ability to quickly “adapt and adopt” will be crucial to success in the new corporate landscape. Indeed, we are already seeing AI and automation reshaping some industries, with the laggards suffering the consequences and those who are more agile, innovative – and able to attract the best talent – pulling ahead.

This Digital Darwinism – the struggle to adapt and evolve in a rapidly changing tech environment – will also be complicated by the rise of sovereign AI and disparate tech ecosystems, something that is presenting both an opportunity and a risk for corporates and investors. For instance, this environment certainly has the ability to foster local innovation and resilience – as we saw with the headline-making debut of China’s DeepSeek earlier this year. However, it also threatens global cooperation and interoperability, raising the question of whether there will be costs for the pace of innovation outstripping than of integration.

The implications of Digital Darwinism and the potential difficult decisions it is presenting are also becoming apparent in the greentech segment. While the costs of climate inaction are likely to be staggering – by some estimates, wiping out 15% of global GDP by 2050 – the segment is becoming increasingly geopolitical, as regions diverge and political differences slow progress. In this respect, market participants will have to make choices regarding which road they take and whether or not to align with sovereign capital. Here, as ever in our new world disorder, broader geopolitical and trade considerations will serve to further complicate decision making.

A new playbook for investors?

Our new fragmented world means investors should rethink some traditional strategies. Key among these will be taking a geostrategic approach to capital allocation, as some regions benefit from supply chain realignment and sovereign tech investment. In this respect the ascent of Asia – not just China – will play an outsize role as countries such as India, Vietnam, Singapore, and the UAE are well positioned to benefit from their focus on AI. Digital Darwinism will lead to success for AI enablers and adopters, and companies with resilient forward-looking business models that invest in operability.

Looking to specific sectors, AI is already transforming entertainment and content creation, driving monetization and audience engagement, while geopolitical uncertainty will continue to benefit cybersecurity and defence technologies. For Europe, in particular, the ongoing global reordering offers an opportunity for the continent to reassert its political and economic sovereignty, and champion its corporate leaders in key strategic sectors.

While the sum of these changes is certainly profound, it would be incorrect, as many seem keen to do, to herald the end of globalization. Instead, what we are seeing is the emergence of a more contested, “intelligent” – anchored in AI – and adaptive global order, that presents both risk and opportunity for investors and corporates. Those who best understand the forces of fragmentation – and adopt the principles of Digital Darwinism – will be best placed to thrive.