Navigating Rates

Managing the cost of currency hedging for fixed income investors

Our risklab team developed an innovative FX overlay strategy to manage the rising cost of currency hedging, especially for US dollar assets.

Key takeaways

- At current prices, euro area investors switching from Bunds to US Treasuries will likely receive zero to negative yield premiums after fully hedging their US dollar exposure.1 It is similar for investors in the UK and Japan.

- To strike the optimal balance between risk reduction and cost savings, it may be necessary to actively manage the hedge ratio – the amount of FX exposure that is hedged.

- The FX Overlay (FXO) strategy, developed by our risklab team, can cut hedging costs by 50-60% over three to five years.

Despite headlines concerning a range of US trade, fiscal and de-dollarisation risks, US fixed income remains one of the most compelling destinations for capital, especially in terms of depth and liquidity. But for investors whose base currency is not the US dollar, what matters are total returns after accounting for currency fluctuations. The US dollar has sharply depreciated this year, and at the same time the cost of currency hedging has spiked.

We have developed a cost-efficient solution to this conundrum – an innovative FX overlay strategy developed by our risklab team.

Currency hedging is crucial, but expensive, for many institutional investors

While some investors may choose to invest in unhedged US bond portfolios, some amount of currency hedging is essential for many large institutions. Consider insurance and pension plans, where stable income payouts to policyholders are a requirement. At times of global monetary policy divergence and elevated FX volatility, unhedged currency risks can have a significant impact on portfolio income and growth. However, as global interest rate differentials grow and FX volatility spikes, so can the cost of currency hedging. For example, at current prices, euro area investors switching from German Bunds to US Treasuries will likely receive zero to negative yield premiums after fully hedging the US dollar exposure back to their home currency.2 The same is true for UK Gilts. For Japanese investors, the negative yield premium outcome after FX hedging is even greater.

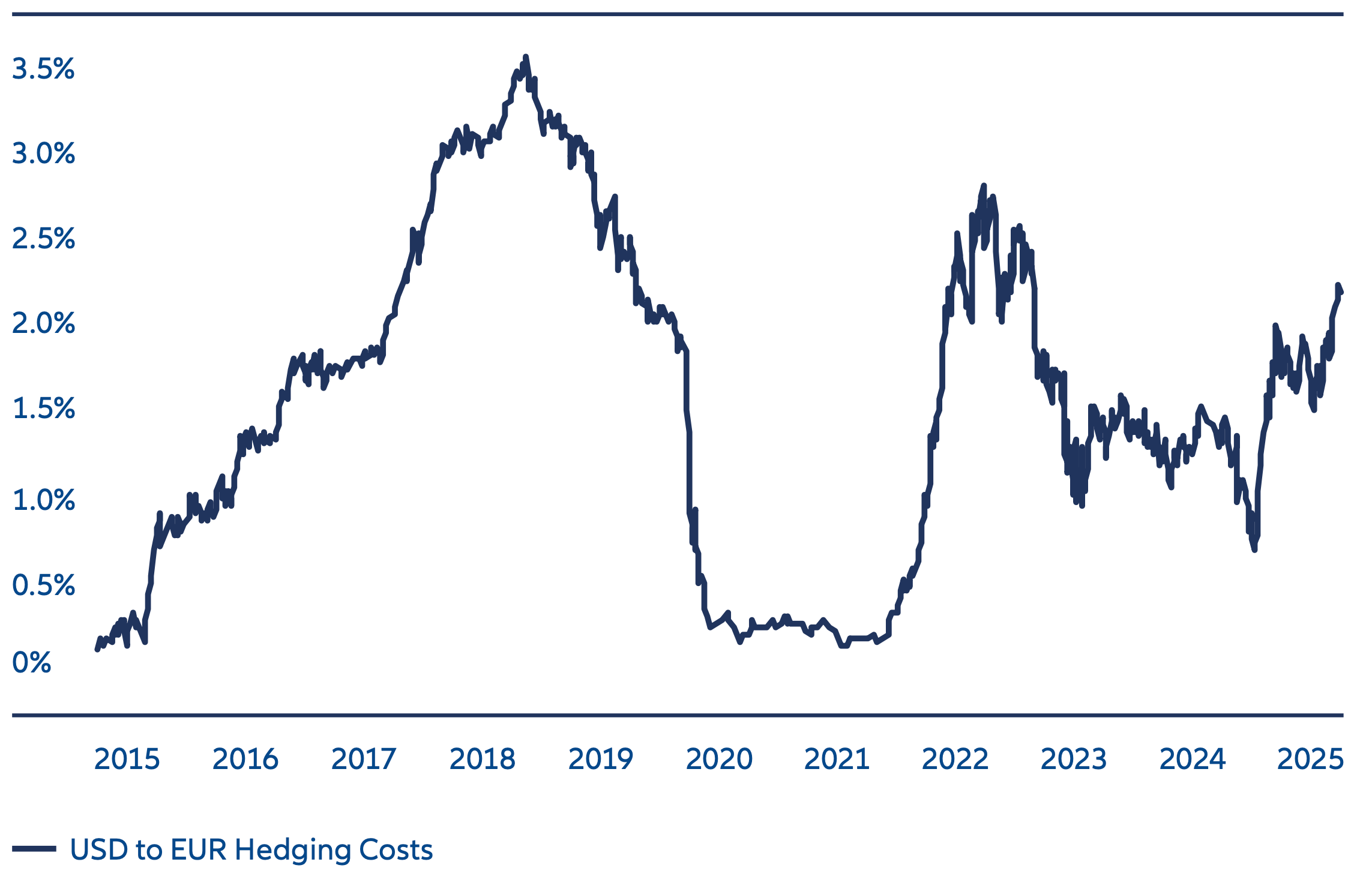

Exhibit 1 illustrates variations in the hedging cost of a US dollar- denominated portfolio, fully hedged to the euro over a period of one year, using standard FX forward contracts. Over the past decade, these costs amounted to an average performance drag of 1.8% a year. Currently, hedging costs for one year onwards are about 2.3% and may rise further.

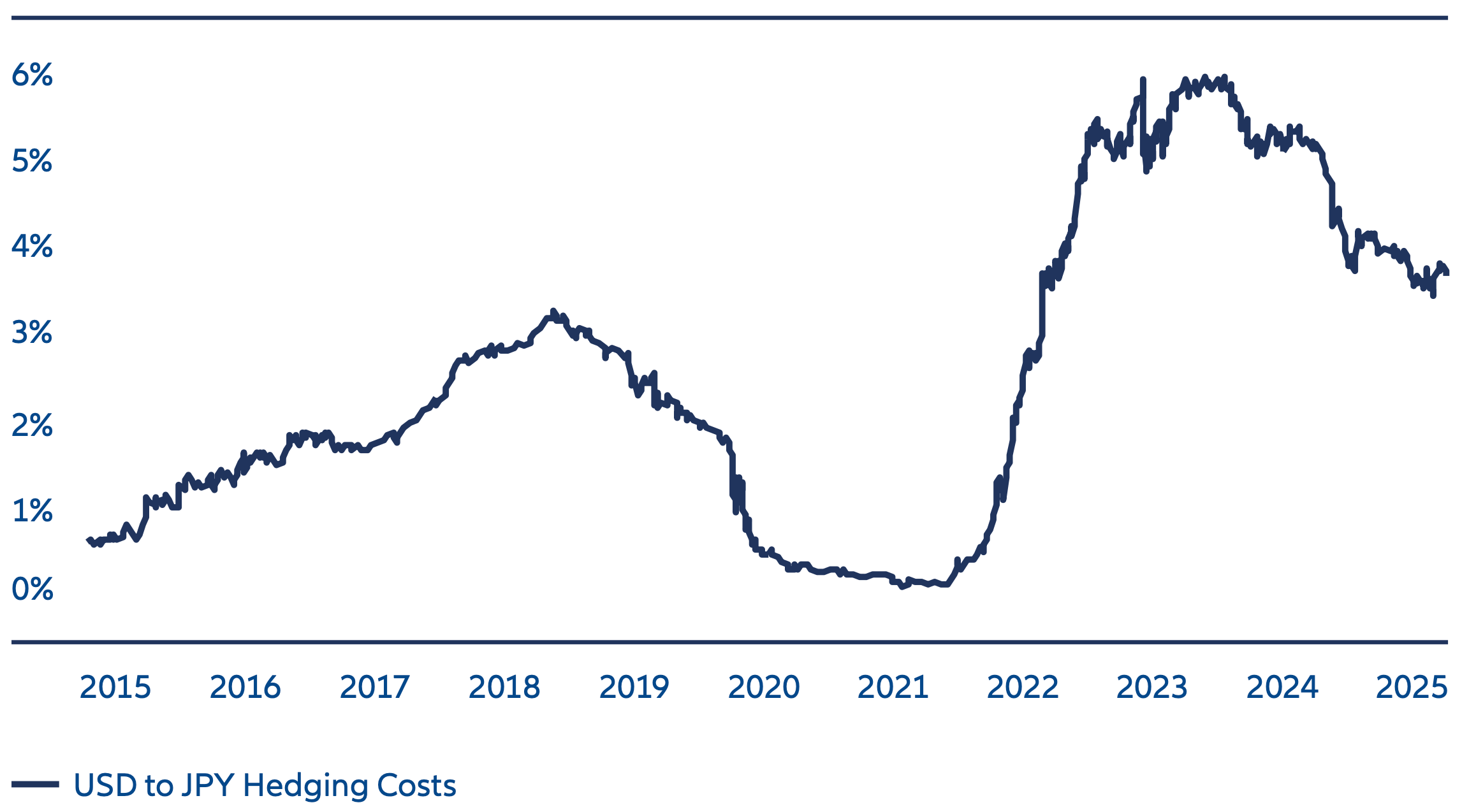

Exhibit 2 demonstrates the hedging costs of a US dollar-denominated portfolio fully hedged to the Japanese yen. Here we see an average cost of 2.6% over 10 years. Even after a recent pick-up in yields on Japanese government bonds, hedging costs for one year onwards are around 3.6%.

Because of the cost of currency hedging, many institutional investors choose to hedge only part of their FX exposure. The amount of FX exposure that is hedged – the hedge ratio – can have a significant impact on returns, so for large institutions, it makes sense to manage it carefully in response to market events.

Average hedging ratios can vary significantly over time. For instance, the Bank of Japan reported a decline in hedge ratios among major Japanese life insurers from about 60% in 2021 to 40% in 20233. (The recent US dollar sell-off may have seen those hedge ratios rise.)

It is not always easy to achieve the optimal hedge ratio, however, especially if investors are using only standard hedging practices involving static hedging with FX forward contracts. The main objective of our risklab-powered FX Overlay (FXO) strategy is to help investors solve this problem, by striking an optimal balance between risk reduction and cost savings. We do this using a dynamic currency hedging approach.

Exhibit 1: Cost to hedge 100% of a US dollar position to euro for one year using only forwards (2015–2025)

Source: Bloomberg, Allianz Global Investors

Exhibit 2: Cost to hedge 100% of a US dollar position to Japanese yen for one year using only forwards (2015–2025)

Source: Bloomberg, Allianz Global Investors

How the FXO strategy can cut the cost of currency hedging

The basic approach of the FXO strategy is to use a “collar”, which combines put and call options. To understand how this works, it may be helpful to clarify some of the terms:

FX forwards. These instruments are “fixed” in that they come with an obligation to exchange (buy or sell) one currency with another, at a certain guaranteed exchange rate, on an agreed date in the future. A difference in the interest rate of two currencies in an FX forward can raise the cost of these contracts. Hedging US dollar exposures is a case in point, particularly for euro and yen investors, as rates in the US have been higher than in the euro area and in Japan for a prolonged period.

One alternative to FX forwards is FX put options. As their name implies, buying put options affords the right (not the obligation) to sell a specific amount of foreign currency by an expiration date at a pre-agreed exchange rate, ie, once the prevailing market rate hits that pre-agreed level (“strike” price). The advantage of options over forwards is that they are not binding. If you buy a put option to protect against the US dollar weakening, but, in the meantime, it strengthens, you can choose not to exercise the option and ultimately reap the US dollar gains. The disadvantage of a put option is that, whether you use it or opt out, you pay a non-recoupable premium, whereas forwards have no upfront cost.

Forwards and options are traded as over-the-counter (OTC) derivatives – as opposed to exchange-traded, standardised instruments such as futures (though, futures are not as easily customised to investors’ specific needs). Unwinding OTC derivatives, or entering into new ones before their maturity date, involves additional costs and complexity. In addition, dynamic strategies require frequent monitoring and oversight which makes it even more complex. As a result, it is common for investors simply to choose a static solution using forwards and to hedge their whole FX exposure. As we have seen, however, the ideal hedge ratio is one that strikes a balance between risk reduction and cost savings. It is unlikely that a 100% ratio is optimal in the long term, and this could eat into returns.

Our FXO approach aims for an optimal dynamic hedge ratio through time. It is based on a carefully constructed portfolio of many collar strategies, where we calibrate the parameters of the strategy to seek to optimise the risk-return outcome for the underlying investment and hedged currency.

Foreign investors are heavily exposed to US fixed income

Foreign holdings of US Treasury securities rose to a record USD 9.05 trillion in March of this year.4 Japan remains the single largest overseas holder, though the euro area countries and the UK hold more in aggregate. Foreign investors hold 27% of US corporate debt.5

How a collar strategy can achieve cost-effective currency hedging

The combination of carefully chosen collar strategies is crucial for our hedging approach. In simplified terms, a collar strategy works by paying an upfront premium to “buy” or go “long” a put option that protects against a weakening foreign currency. We have the right not to exercise this option and simply reap the gains in the event of a stronger foreign currency if we wish.

At the same time, we “sell” or go “short” a call option on the same currency pair, usually with the same expiration date and suitable strike price. A call option has the same mechanical features of a put option but offers the right to buy rather than sell a foreign currency. As sellers of a call option, we could lose money if the foreign currency appreciates above the strike price, but we would still be able to participate in the appreciation up to that strike price.

Collar strategies are effective because, as sellers of a call option, we receive an upfront premium which we carefully choose to most efficiently offset the cost of buying a put option. This is possible because the currency derivatives market generally offers similar (or even higher) premiums for call options than comparable put options. This approach can therefore provide more cost-efficient currency hedging over the long run than a standalone FX forward strategy – as long as the interest-rate differential is positive in favour of the hedged currency.

The way we implement this collar strategy is dynamic in that we calibrate the hedge ratio depending on changing levels of volatility and hedging costs associated with the currency pair. The collar provides a range in which the FX exposure is allowed to move freely until a certain loss (“floor”) or gain (“cap”) is reached. A combination of collar profiles with different strike prices and expiration dates can help to reduce hedging costs and improve volatility-adjusted returns.

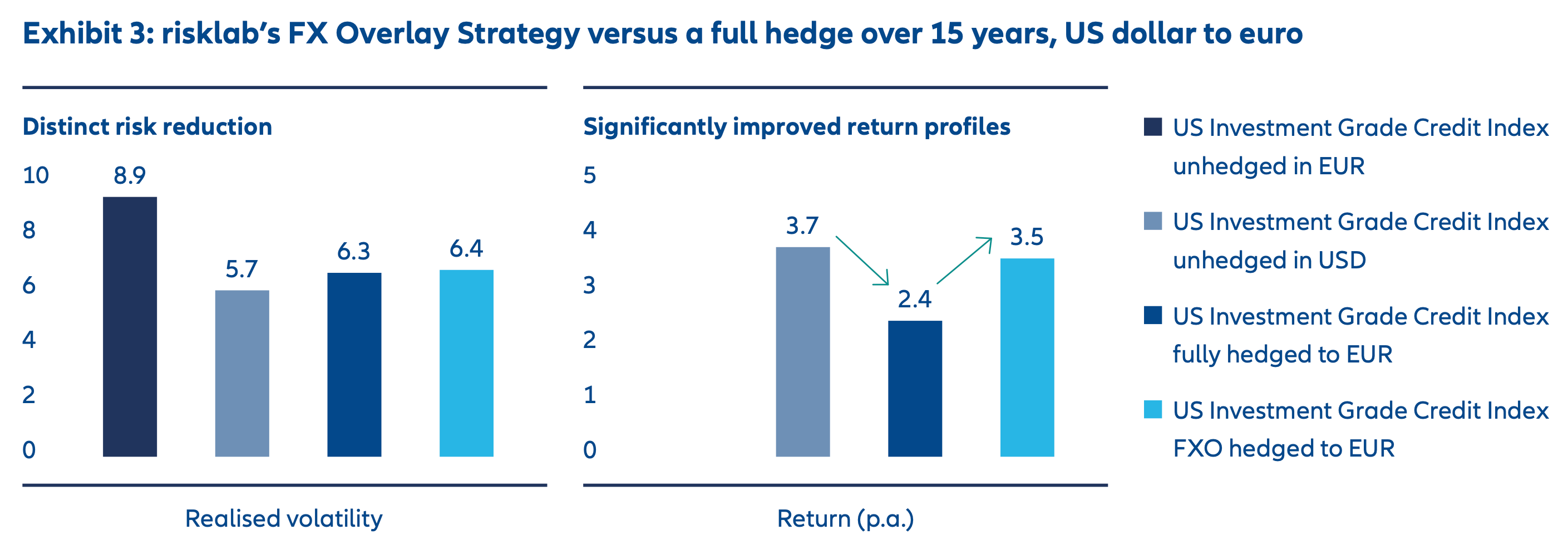

An example based on US investment grade corporate bonds will illustrate the benefits of this strategy. Our backtest analysis over the past 15 years is based on a widely used US investment grade credit market index and compares the performance of the risklab FXO strategy versus a 100% hedge strategy using only FX forwards (see Exhibit 3). It shows a similar FX risk reduction from both approaches when hedging the US dollar to the euro. However, as the cost of our FXO strategy is significantly lower than the cost of the 100% FX forward hedge, the FXO strategy achieves a superior risk-adjusted return.

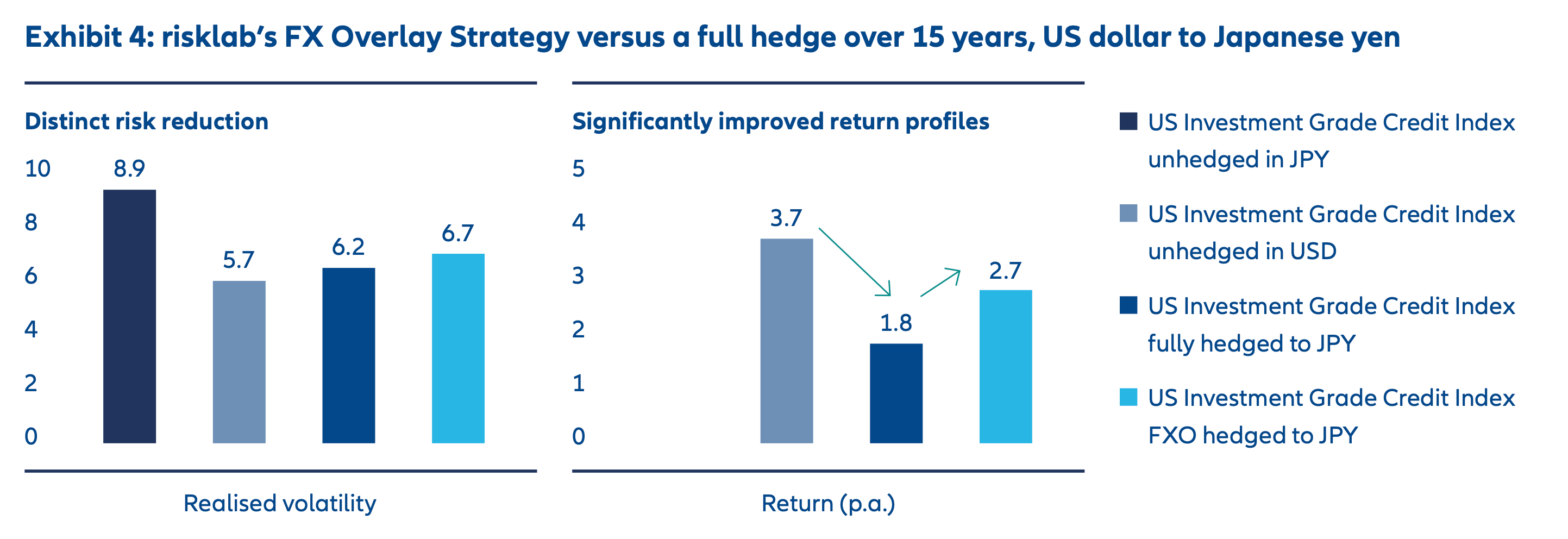

We would expect our FXO strategy to reduce hedging costs by about 50% to 60% over a three to five-year period. Over the period analysed in this chart, our FXO strategy even succeeded in fully recouping the associated hedging costs. Exhibit 4 shows similar results for the US dollar versus the Japanese yen.

Exhibit 3: risklab’s FX Overlay Strategy versus a full hedge over 15 years, US dollar to euro

Exhibit 4: risklab’s FX Overlay Strategy versus a full hedge over 15 years, US dollar to Japanese yen

Our FX overlay strategy offers a solution to investors’ needs

Asset managers typically offer hedged share classes in various base currencies for their mutual fund strategies. However, these hedged share classes are generally constructed to be fully hedged and managed in an outsourced fashion by custodians, with little to no active input from portfolio managers. This approach presents mutual fund investors with a binary choice – fully hedged or fully unhedged – meaning they are denied the benefits of a more active approach using a managed hedge ratio.

Our risklab-powered FXO strategy solves this problem. We believe it offers a convenient way for investors to invest in US assets while controlling for US dollar volatility in a cost- effective way.

1 Source: Bloomberg, Allianz Global Investors, as at 27 June 2025.

2 Source: Bloomberg, Allianz Global Investors, as at 27 June 2025

3 Bank of Japan, Financial System Report, October 2024

4 US Treasury Department, Treasury International Capital (TIC) data for March 2025, released 16 May 20255

5 US Treasury Department, Foreign Portfolio Holdings of US Securities as of 28 June 2024, released 30 April 2025