Embracing Disruption

Leveling up – gaming going mainstream

The history of gaming is nearly as old as recorded human history itself, with archaeologists having found evidence of dice and gaming dating from over 5,000 years ago. The earliest video games can be dated back to the mid-twentieth century, while the 1970s saw the first steps in the commercialization of this new industry.

Now, over half a century on from the release of the first commercially successful games, gaming has become a massmarket form of entertainment. The video games industry is thus reaching a level of maturity and market significance that makes it impossible for equity investors to ignore.

The state of play

After decades of steady growth, the total number of active gamers was estimated at around 3.3 billion people in 2024, set to reach 3.5 billion in 2025 – nearly half the global population. This represents a growth of over one billion gamers over the last nine years. While these figures have certainly been driven by the advent of mobile gaming on smartphones, we have also seen the growing ubiquity of platforms such as Steam, Switch and PlayStation across many households.

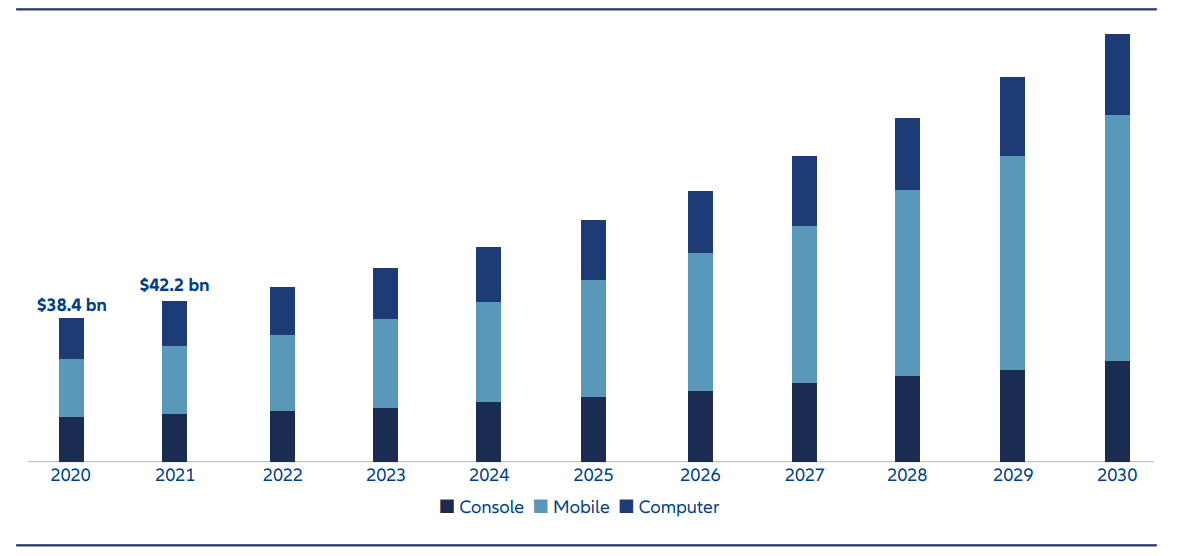

This growth has led to the global video games being worth an estimated USD 200 billion, forecast to grow to around USD 500 billion by 2030 – 50% bigger than in 2013. Indeed, in the US alone, the sector is forecast to enjoy compounded annual growth of 12% in the coming years.

Alongside this, games developers have been successfully diversifying income streams through live services, while the industry price point for AAA games – those that are typically produced with a high budget and distributed via major publishers – has now reached over USD 70.

Keystone launches

Several contemporary examples highlight the size and importance – and earning power – of the contemporary video gaming industry.

June this year saw the much-anticipated launch of the Nintendo Switch 2, with 3.5 million units being sold globally in just four days. This compares extremely favourably with its predecessor, which shifted around 2.7 million units in its first month in March 2017. While the launch was set to be the highlight of the year in this sector, the Switch 2’s success nevertheless surprised many analysts with raising their forecasts for software sales in the coming years, and thus also their outlook for Nintendo itself. Indeed, conservative guidance here may leave even more room for expectations to be further beaten in the coming years.

Looking at a purely gaming software company, TakeTwo Interactive – publisher of the acclaimed Grand Theft Auto (GTA) franchise is preparing for the next installment, GTA VI, scheduled for release in May next year. It is anticipated that it will provide the kind of industry focal point for 2026 that the release of the Switch 2 did for 2025. Anticipation around GTA VI is unprecedented for this sector, with the game’s trailer reaching 475 million views within the first 24 hours of its release. Indeed, the launch of this game – and its subsequent fortunes – will likely provide a watershed moment in terms of the gaming industry’s ascent to mass market maturity.

Exhibit 1: US video game market, size by device 2020-30 (USD billions)

Source: Boston Consulting Group, 2023

Promising growth

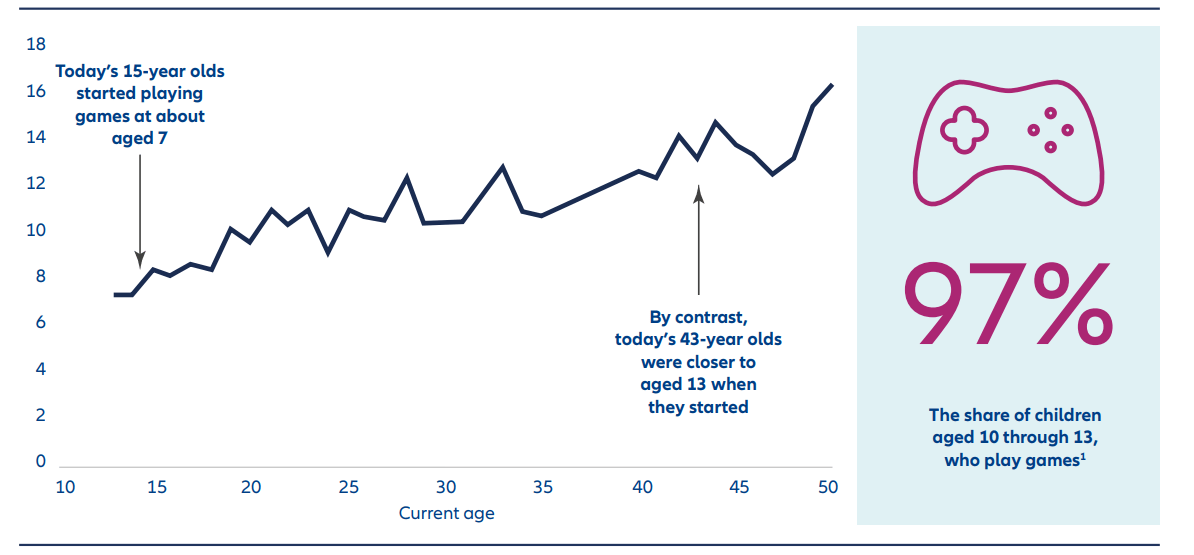

While tastes and trends in any entertainment or artistic industry can be highly fickle, the two examples given show the contemporary significance of the sector, both in terms of its current earnings power and its growing cultural significance. And we believe that trends and tailwinds supporting industry growth are set to continue unabated for some time. For instance, adults that began gaming as children are increasingly carrying the pastime with them into adulthood, while children are beginning gaming at ever earlier ages.

These trends bode well for continued future growth and equity investors would be wise to continue paying close attention to this industry – if they’re not doing so already.

Exhibit 2: Starting age for playing games

Source: Boston Consulting Group, 2023