Navigating Rates

Get active: five ways to capture returns in volatile markets

Agility is more critical than ever in unpredictable markets. We have five ways active management can unlock returns for multi asset portfolios as markets diverge, norms shift, and mispricing persists.

Key takeaways

- In our view, greater divergence across economies and companies, a fracturing in the traditional relationship between bonds and stocks and mispricing risks in US equities can reinforce the value of an active approach to investing.

- Managing the duration of bonds and taking advantage of escalating differences in yield across yield curves can help to mitigate a portfolio’s economic risks stemming from changing interest rates – duration is a factor in determining risk and yield.

- Hedging can manage the impact of shifts in currency markets (such as the US dollar’s recent slide) and volatility; in equity markets, we see value in pivoting between investment styles as market conditions evolve.

- Rebalancing portfolios can ensure they stay aligned with an investor’s financial goals, while adding new sources of diversification can add value as markets question the future of some safe havens.

The merits of active investing are well known. But the current environment serves as a reminder of the value of active management in seeking strong risk-adjusted returns.

We identify three primary reasons why an active approach to managing a multi asset portfolio is essential in unstable markets.

Greater divergence across economies and companies

First, we see diverging paths ahead for many economies and companies. In part, the divergence will stem from the impact of trade deals. Countries have agreed different tariff rates with the US that could lead to diverging inflation and growth trends.

Economies will face different pressures and will pursue different fiscal and monetary policies as a result. Similarly, the profitability and performance outlook of many companies is also becoming less clear-cut because of tariffs and their wider impact and, for some US firms, the possibility of revenue-sharing deals with their government. In short, greater uncertainty over the longer-term outlook for the global economy and many companies widens the range of potential outcomes ahead. Conditions may reward active risk takers.

Upending of traditional investment norms

Second, we see signs of a fracturing in the negative correlation between bonds and stocks.

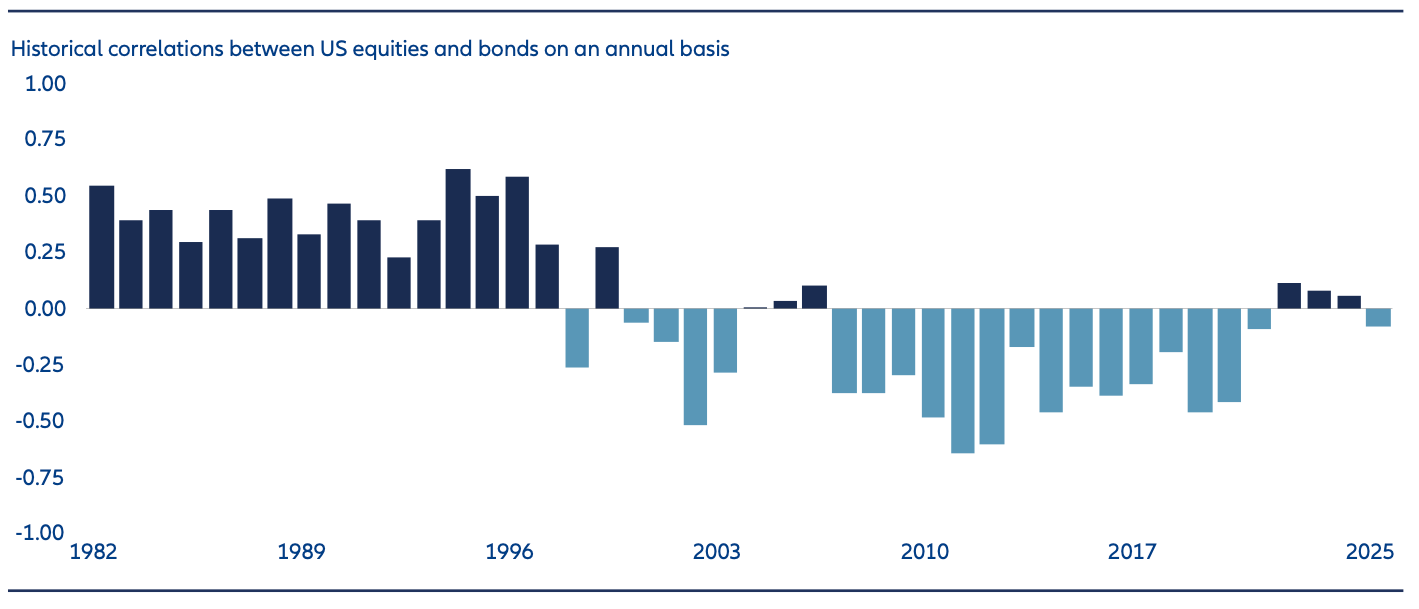

Traditionally, holding government bonds and equities in a portfolio allows for a better risk-adjusted return. In recent decades, the negative correlation between the two has helped keep a portfolio balanced because when one performs well, the other tends to struggle and vice versa. However, since 2022 we are seeing increasing signs of bonds and equities moving in the same direction (see Exhibit 1), potentially reducing the diversification benefits of holding both.

The current environment has also challenged traditional notions of safe havens. The US dollar has struggled in 2025 and the outlook for US Treasuries may be less certain.

Exhibit 1: The negative correlation between equities and bonds may be less certain than in the recent past

Source: Allianz Global Investors, Bloomberg Finance, US-Equities via ES1 Index, ie, generic first S&P 500 E-mini Future and US-Treasuries via US1 Comdty, ie, generic first US Treasury Bond Futures, daily rolling 63-days-correlations of daily returns, own calculations; as of 31 July 2025. Past performance does not predict future returns.

Mispricing risks from herding

Third, current equity market dynamics underline the value of active management.

The S&P 500 and other US market cap-weighted indices continue to be disproportionately driven by the so-called Magnificent 7 group of large tech firms.

Huge inflows into passive US equity portfolios in recent years have inflated the prices of market cap-weighted indices, and especially those of their biggest constituents (such as the Mag 7).

The danger is that the halo effect of high Mag 7 valuations leads to the mispricing of stocks in other sectors. Active managers can aim to use their skills to outperform the market benchmark and adjust allocations to reduce the potential for losses from significant exposure to a single stock, sector or market.

Active management in action

How do we as active multi asset investors realise the emerging opportunities?

We see at least five ways:

1. Navigating macro risks via fixed income exposure: one way of adapting to a changing economic outlook is by managing the duration of bonds within a portfolio. The duration of fixed income within a portfolio can determine how sensitive the portfolio is to changes in interest rates. Fund managers choose the duration of bonds to align with their interest rate outlook. A shorter duration generally means less risk, but typically lower yield. A longer duration tends to increase risk, but it can boost yield.

Some of our strategies give fund managers the flexibility to adjust the duration between zero and nine years or even use derivatives (like interest rate futures or swaps) to hedge duration to protect capital in the event of an anticipated rise in interest rates. In the current environment, we avoid taking long duration and like steepener trades that take advantage of escalating differences in yield across the yield curve.

2. Balancing equity exposure: shifting market conditions call for a flexible approach to managing equity exposure. Fund managers can respond with a careful selection of sectors, regions and individual stocks. For example, European defence stocks may be more enticing in anticipation of a ramp-up in military spending. Fund managers can also pivot between investment styles. Our managers use systematic and fundamental signals to determine the optimal level of exposure to a range of styles, such as:

a. Growth: those stocks expected to beat the market average in revenue and earnings.

b. Value: more established firms that trade at lower values to their growth peers but potentially offering steadier earnings growth.

c. Revisions: those companies whose earnings estimates have been recently revised by analysts, either upward or downward.

d. Momentum: companies whose stocks have shown a recent and significant upward trend.

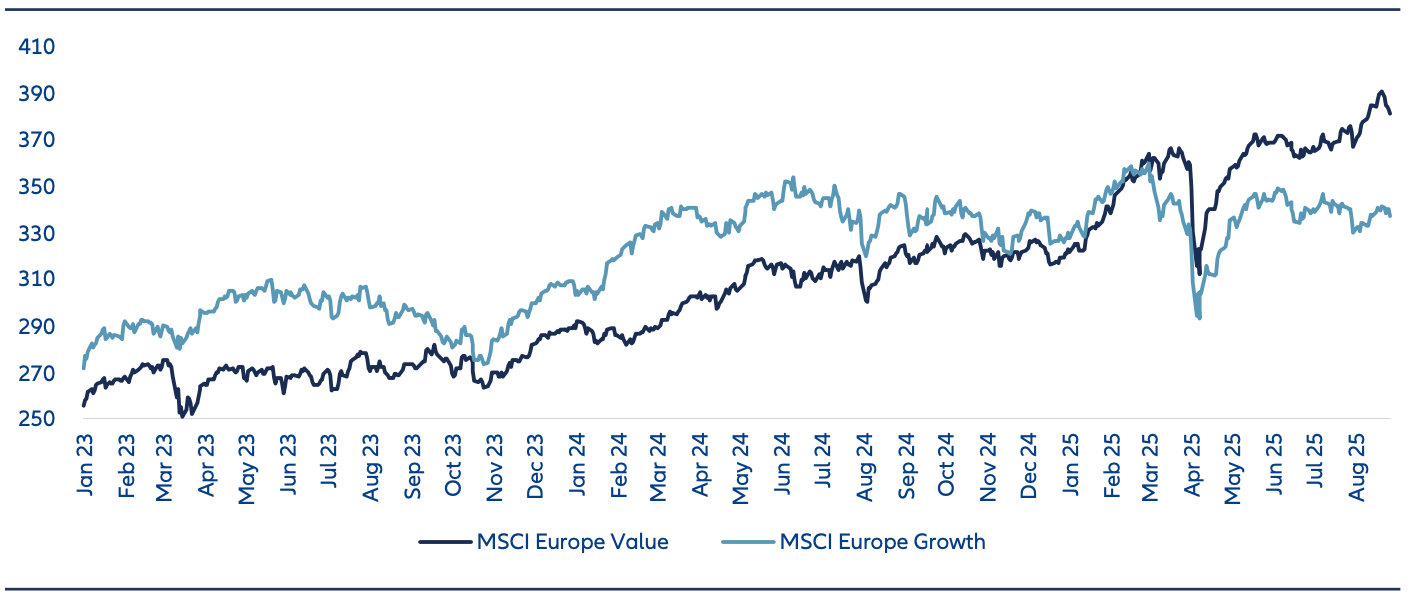

In recent months, many investors in European equities have favoured greater exposure to value stocks due to the relative weakness of growth stocks (see Exhibit 2). In contrast in the US, growth stocks have strongly outperformed value stocks for much of the past decade1. But as monetary and fiscal policy shifts and there’s a recovery in investor appetite for risk in Europe, the outlook for growth stocks in Europe could improve. Our strategies offer the agility to adapt by region, style and sector.

Exhibit 2: European growth stocks have underperformed European value stocks in recent months

Source: Bloomberg. Data as of 29 August 2025.

3. Hedging risks: a slide in the US dollar against most other major currencies and a rise in the euro has proven challenging for many European and other non-US investors this year. Dollar weakness has added pressure on holdings denominated in the currency, affecting overall portfolio values especially as many investors only partially hedge the currency risk on their equity holdings. Our fund managers can adjust hedge ratios according to their outlook for the dollar. High market volatility can also harm a portfolio’s performance. Equity market volatility, as measured by the Vix Index, touched its highest since Covid-19 in the aftermath of Donald Trump’s “liberation day” (to mark the announcement of a new trade policy) before returning to significantly lower levels.

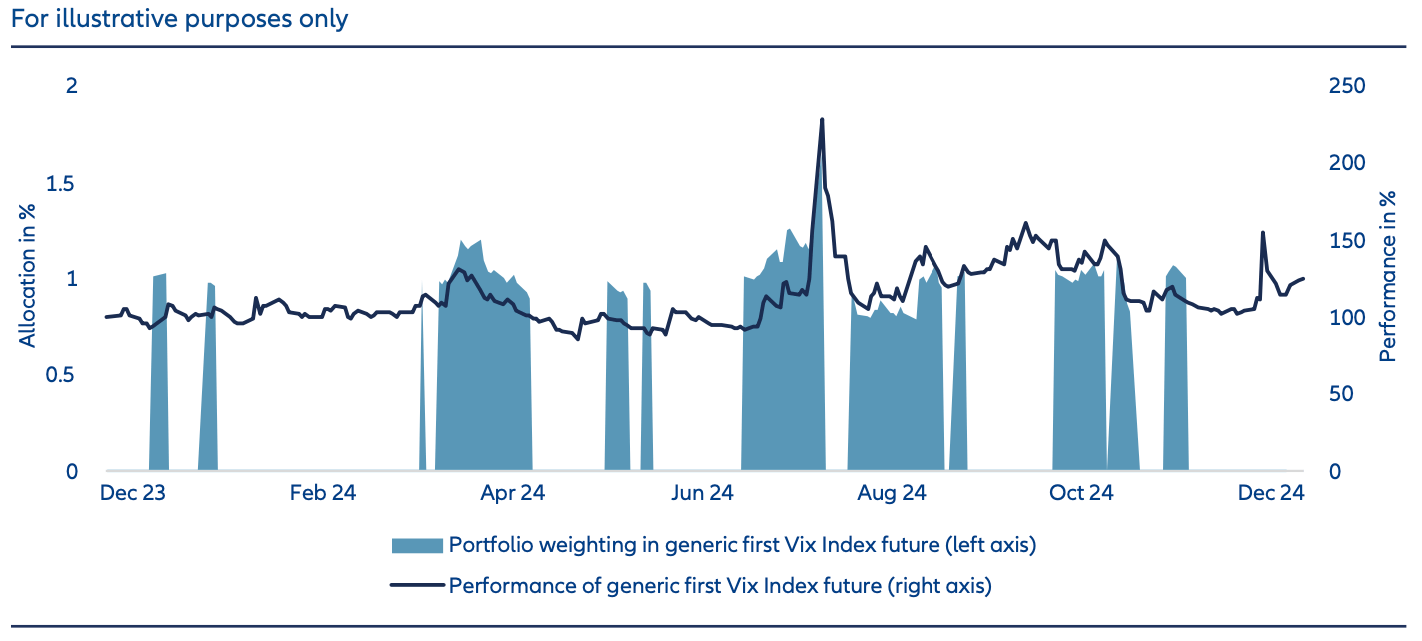

Fund managers may use volatility futures to offset the impact of higher volatility on portfolios, buying Vix futures at a low price (when volatility is low), then selling them later at a higher price (once volatility has spiked) – see Exhibit 3. Finally, fund managers might also buy put options on equity markets opportunistically to guard against the risk of sharp falls – potentially useful during high market valuations and in anticipation of market turmoil. Put options allow the holder to sell a security at a guaranteed price, even if the market price of that security is lower.

Exhibit 3: Hedging a portfolio’s allocation via Vix futures can be beneficial ahead of volatility spikes

Source: Allianz Global Investors, IDS, Bloomberg; December 30, 2024. Portfolio weighting and performance based on generic first Vix Index future. Generic first Vix index future is a generic index that rolls futures automatically into the first contract with the highest liquidity. Past performance does not predict future returns. The securities mentioned in this document are for illustrative purposes only and do not constitute a recommendation or solicitation to buy or sell a specific security. These securities will not necessarily be held in any of our portfolios at the time of publication of this document or at any time thereafter.

4. Adjusting portfolios: for some multi asset strategies, dynamic asset allocation techniques are used to shape the portfolio mix. For more static portfolios, rebalancing is a sensible way for an investor to ensure portfolios stay aligned with their financial goals and risk tolerance, while mitigating volatility. Over time, market fluctuations can cause a drift in the weightings of different assets within such portfolios, leading to a deviation from the original allocation.

We take a strategic approach to rebalancing to ensure the portfolio remains on track with its investment objectives. In our view, the timing of the rebalancing can be as important as the actual rebalancing in driving the portfolio’s overall performance. For example, the timing can aim to take advantage of the “end-of-month effect” in equity markets, a pattern of recovery that occurs at the end of a month after sharp price declines. A successful rebalancing can boost a portfolio’s performance without significantly changing its volatility.

5. Securing new sources of diversification2: as markets question the future of other safe havens, faith in gold as a store of value remains intact. The yellow metal is our top commodity conviction, continuing to benefit from robust central bank demand and global macro uncertainty.

Our fund managers also seek out less traditional sources of diversification, including emerging market debt and catastrophe (cat) bonds. We have added more emerging market bonds into our portfolios due to strong improvements in economic and financial metrics. Cat bonds, issued by insurers and governments to reduce their exposure to the most extreme risks they face, have grown from a niche instrument to a burgeoning asset class. Investors also have the option to add additional sources of alpha through relative-value strategies which target returns that are uncorrelated with the broader market. Such strategies deploy long/short structures, which might, for example, offset long positions on certain stocks with short positions on other stocks in the same sector. Finally, some portfolios may seek to add private market exposure as the asset class can offer an illiquidity premium, and diversification benefits due to the generally long-term nature of investments and their low correlation to public markets.

Active management: building a resilient portfolio

We think combining a range of active techniques can create a portfolio that can adapt as economies and markets change. Blended with the expert insights of specialists across equities, fixed income, currencies and economics as well as deep data analysis, and the result is a more stable, and more robust portfolio with greater potential to perform over the long-term.

1Source: Refinitiv Eikon, September 2025.

2This is for guidance only and not indicative of future allocation. Diversification does not guarantee a profit or protect against losses.