Embracing Disruption

India shifts gears – Policy tailwinds set stage for reacceleration

India’s economic narrative is shifting—again. And this time, with more conviction.

GDP data for the fourth quarter of fiscal year 2025 (ending March 2025) came in ahead of expectations, reinforcing our core thesis: India is entering a new phase of cyclical acceleration. But this is not just a story of one quarter’s growth. It’s a sign of a broader inflection—across GDP, corporate earnings, credit, and liquidity—fueled by a decisive pivot in policymaking.

Surprises pointing to strength

This year has yielded three major surprises for investors so far:

- GDP expectations beaten: real GDP growth at 7.4% year-on-year surprised on the upside in the March 2025 quarter, coming in above consensus expectations of 6.8% year-on-year. This was not just a statistical anomaly but a reflection of underlying resilience in consumption and capex.

- Corporate earnings momentum positive: more than half of MSCI India companies have so far reported earnings above expectations this season. Importantly, the earnings outperformance was broadbased—across financials, consumer discretionary and Industrials sectors.

- Policy easing beyond expectations: the Reserve Bank of India (RBI) delivered a 50bps cut to the repo rate (vs. 25bps consensus) in its 6 June 2025 meeting, alongside a surprise 100bps reduction in the Cash Reserve Ratio (CRR), to be implemented gradually in four equal tranches of 25bps each starting from the fortnight beginning September 6, 2025. This signals that policymakers are now squarely focused on supporting growth.

Policy pivot: From risk containment to growth support

Last year, in particular during the period from March to September, Indian policymakers focused on risk containment—tightening norms around unsecured credit and macroprudential controls to avoid overheating. In parallel, slippages in government spending due to the national elections in June 2024, coupled with harsher-than-usual summer weather, further contributed to a transient slowdown in economic activity.

Since February 2025, the stance has decisively shifted:

- Fiscal support: The Union Budget delivered a rare but welcome surprise by lowering income tax rates for the middle class while maintaining fiscal discipline—a move aimed at reviving consumption without compromising credibility.

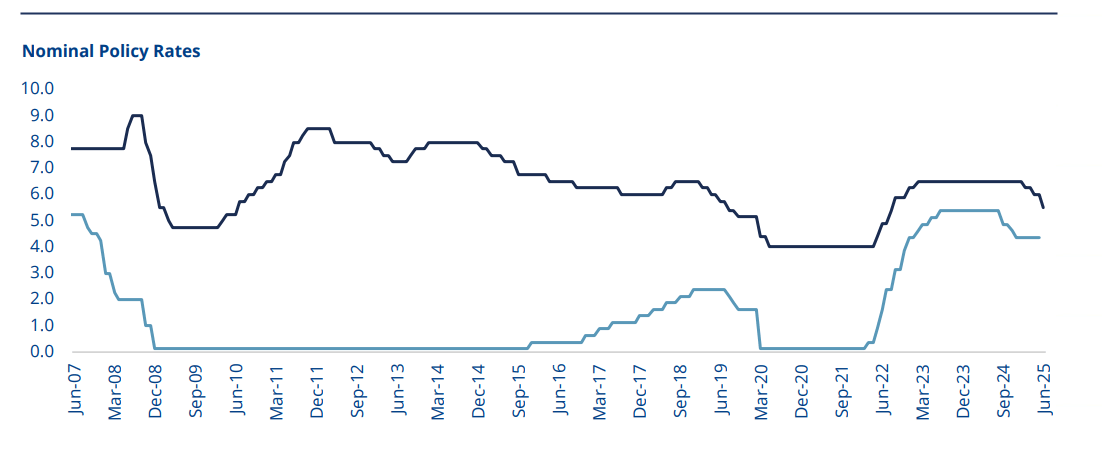

- Monetary easing: With inflation now well below 5%, real interest rates in India have started to moderate— creating room for the RBI to recalibrate policy toward supporting credit growth and liquidity expansion.

- Macro liquidity: the combination of CRR cuts and moderation in government cash balances is improving systemic liquidity, which is already beginning to be reflected in lower interbank rates and a pick-up in loan disbursements.

- Demand recovery is expected to accelerate, with rates across multiple categories—such as mortgages—likely to approach multi-year lows (excluding short-term declines related to the Global Financial Crisis (GFC) and the Covid pandemic).

Exhibit 1: India Repo Rate at multi-year lows (excluding Covid- and GFC-related short term declines, circled)

Source: Allianz Global Investors

The investment implication: India’s reacceleration is underway

Our base case, outlined earlier this year, was that India would enter a “reflationary phase” by mid-2025. That thesis is now playing out. Importantly, valuations remain below their historical peaks despite the improving macro backdrop—offering a rare alignment of improving growth and undemanding valuations.

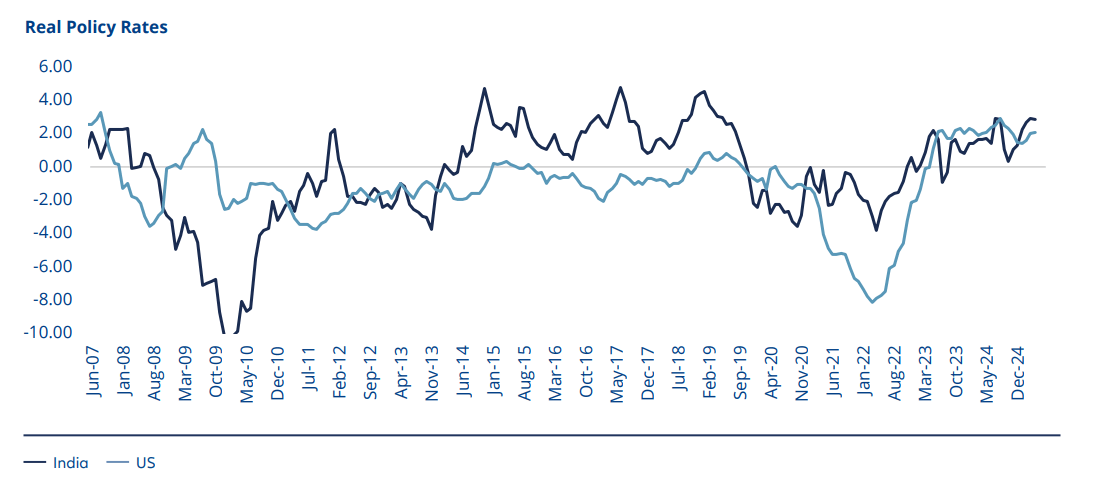

Moreover, India’s nominal and real interest rate differentials vis-à-vis the U.S. and Europe have compressed to multi-decade lows—reflecting a marked departure from historical norms. This shift underscores a growing recognition among global investors that India merits a structurally lower risk premium, supported by strengthened macroeconomic stability, credible policy frameworks, and resilient domestic fundamentals.

Exhibit 2: Nominal and real interest rates in India and the US: differentials compressed to multi-decade lows

Source: Allianz Global Investors

Risks to monitor

Conclusion: Time to lean in

India is not just recovering—it is reaccelerating. With tailwinds from fiscal policy, supportive monetary moves, and improving earnings breadth, the foundations are in place for a multi-quarter expansion. For global allocators seeking both growth and improving macro stability, India stands out. Furthermore, the relatively low correlation of Indian equities to other markets adds diversification in times of global uncertainty.

Our perspective on valuations has been outlined in previous notes available here:

https://www.allianzgi.com/en/insights/outlook-and-commentary/india-a-justifiable-premium

https://www.allianzgi.com/en/insights/outlook-and-commentary/update-on-india-valuations

We thus remain confident about India equity — for the right reasons.