Sustainability | Impact investing

Managing and measuring impact in private markets

As more capital is allocated to impact investing in private markets, measuring the delivery of impact in a robust and credible way is essential. Defined frameworks for doing so can be built into the investment process. This article outlines Allianz Global Investors’ principles and components for effective impact integration.

Key takeaways

- Flows into private market impact investments are growing rapidly, as 2021 rising AUM and record new fund launches show

- Yet further growth in impact investing requires defined processes for frameworks to assess and measure impact

- Allianz Global Investors (AllianzGI) has developed a proprietary framework, aligned with industry best practice, for measuring and managing impact generation in private markets

Impact investing is fast growing out of its niche. The increased awareness and urgency of climate change, as well as social issues such as unequal access to healthcare highlighted by the COVID-19 pandemic, has driven substantial interest and capital flows into private market impact investments. In 2021 more than 130 private market impact funds launched.1

Yet this success must be matched by progress in developing robust, transparent, and credible impact measurement and management. The Global Impact Investing Network’s (GIIN) Annual Impact Investor Survey 2020 found that advancing impact measurement and management was impact investing’s second most significant challenge.2 Furthermore, in addressing expectations for future challenges to the industry over the next five years – by far the highest proportion of respondents (66%) confirmed “impact washing” as the key challenge.

In 2021, we introduced the AllianzGI impact framework to facilitate the due diligence and selection of investments that contribute to material and positive impact. The approach supports rigorous measurement and management of impact over the lifecycle of the investment to ensure that impact is being delivered.

The AllianzGI impact framework is applicable across private equity and debt investments. The diversity of our investment products across asset classes required a framework that not only provided a consistent definition of impact across all, but also had sufficient flexibility for tailoring to the specific characteristics of each.

Four elements of the AllianzGI impact framework

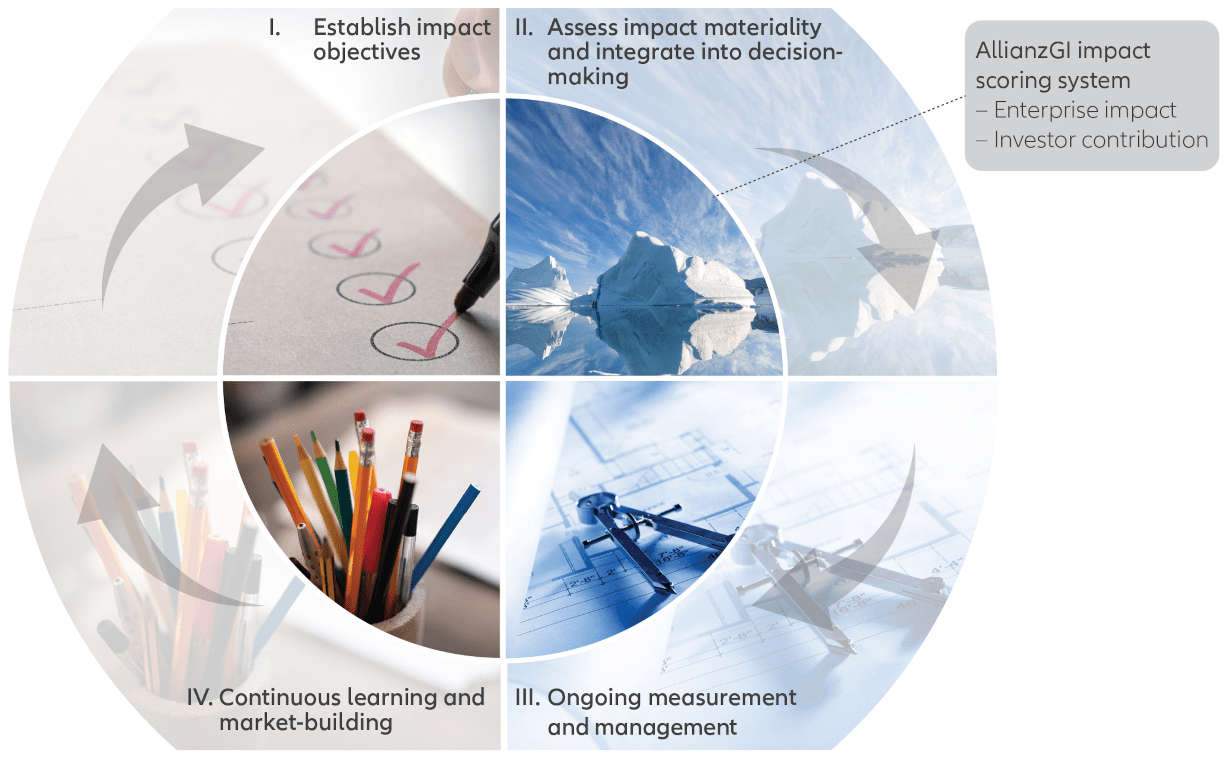

Our approach to managing and measuring impact aligns with the industry’s leading principles and standards and is integrated across our investments’ lifecycles. (see Exhibit 1):

I. We establish impact objectives that target key societal challenges in line with the United Nations Sustainable Development Goals (UN SDGs).

II. We assess the impact materiality and additionality of potential investments by applying our impact scoring system (more below), which is aligned with the five dimensions of impact as defined by the Impact Management Project.3 In order to inform our impact decision making, we have integrated this impact scoring assessment into our investment committee’s investment selection process. This has the potential to contribute significantly towards targeted impact objectives.

III. We identify core impact key performance indicators to measure and report against, where possible, aligned with the UN SDGs and the Global Impact Investing Network’s IRIS+.4 Our intention is to demonstrate impact delivery, as well as to communicate our active engagement with investees in ways that generate greater impact where feasible.

IV. We are committed to continuous testing, learning, and market-building to strengthen our approach to impact generation. Through partnering with leading impact measurement organisations such as 60Decibels, we are testing impact measurement approaches, and support market-building efforts. For example, we are participating on the UK CFA Institute’s Impact and Investing Panel to develop a pioneering impact investing qualification. As we continue to implement our impact framework across our strategies, we are learning from our experience and advancing our process and methodology on behalf of clients

Exhibit 1: Key components of the AllianzGI impact framework

Source: Allianz Global Investors

Principles of the AllianzGI impact scoring system

- Consistency of the impact assessment process, incorporating the flexibility to adapt to different private market asset classes and strategies.

- Considering both potential positive and negative impacts

- Application of data and evidence to increase our confidence around impact generation

- Enabling comparisons of impact materiality and additionality across investments

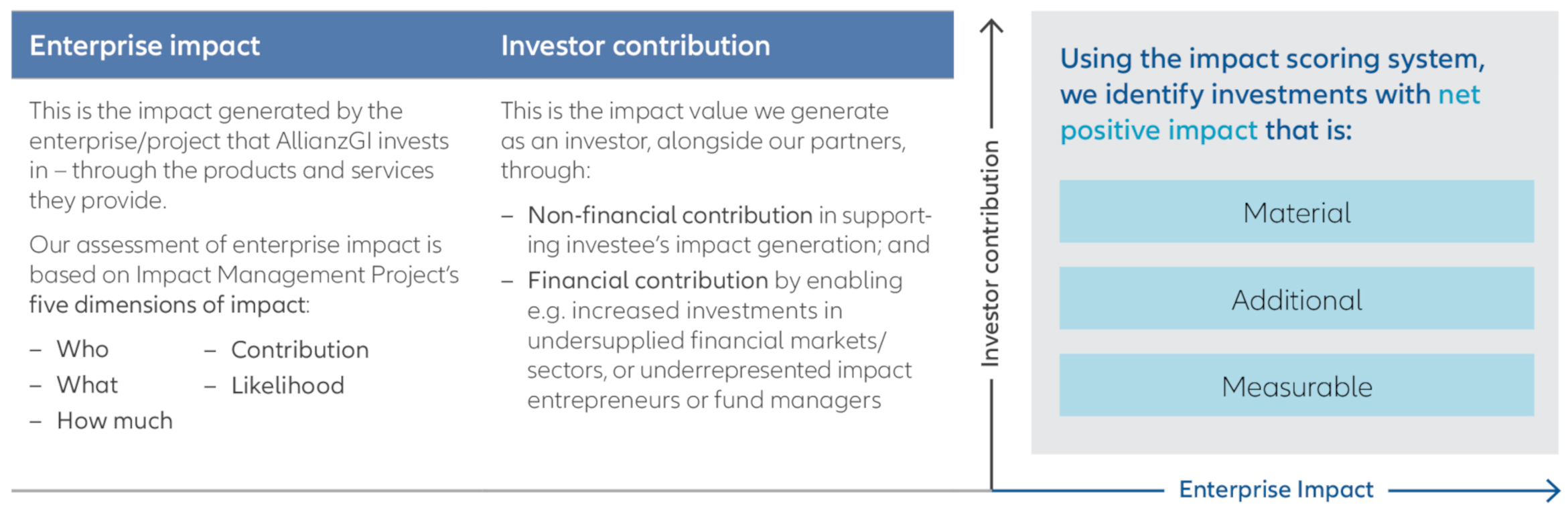

We consistently assess impact contribution across two key components:

– Enterprise impact: An enterprise or project’s social and/or environmental impact. This focuses on whether the enterprise/project’s core business model makes a positive, material, and measurable difference – either by meeting a proven need in society or by delivering a clear environmental benefit.

– Investor contribution: The ways in which investors contribute to the impact generated by their investments differ across asset classes and strategies. For this reason, we tailor our impact scoring system to provide different incentives for us as an investor to contribute to impact generation.

For example, as a limited partner investing indirectly via a private equity impact fund manager, our additionality may be achieved by engaging with the fund manager on impact topics as part of the Limited Partners Advisory Committee (LPAC) or as part of an Impact Advisory Council. When we invest directly in debt, we may contribute through negotiating use-of-proceeds and impact reporting requirements that are then embedded within the loan agreement. These requirements ensure that loans are made for impactful activities and that their impact is measured robustly.

For our blended products, which AllianzGI typically manages in partnership with a development finance institution (DFI), the partner may apply its own impact assessment framework when performing impact due diligence on potential investment opportunities. In this case, we work together to ensure broad alignment of impact objectives and assessment frameworks to be confident in our investments’ ability to deliver a material impact. When it comes to financial contributions, AllianzGI’s expertise in structuring investment vehicles with different risk tiers enables commercial investors to co-invest alongside DFI partners in emerging markets. Consequently, this additional capital contributes towards narrowing the annual gap in financing the UN SDGs.

Exhibit 2: Components of the impact scoring system

Source: Allianz Global Investors

It is important to identify both positive and negative impact pathways, and to appropriately account for potential material negative impacts in our impact assessments. Consider a skills training programme that improves employability and, ultimately, wage levels for its students, but strains them financially due to its expense. We would apply a lower impact scoring relative to an affordable yet high quality skills training solution.

Alongside implementing our impact approach, we also assess and manage environmental, social and governance (ESG) risks as part of our risk assessment, and we continue to monitor these after investing.

Depending on the quality of the product or service being offered by a potential portfolio company and the implementation context (eg, focus geography, target population), investments within the same thematic area can have highly differentiated impact. That is why we go beyond selecting purely promising thematic areas (eg, education), towards applying investment-specific data and evidence where possible to assess impact potential (eg, is there evidence to indicate that this education product can deliver better outcomes for students?). The most important impacts generated by an investment are not always intuitive. Leveraging best available data and evidence where feasible – independent studies, product-specific life cycle assessments6, service-specific customer surveys, and sector benchmarks – help increase our confidence that the investment can deliver impact.

We want to understand not just whether an investment has the potential to generate net positive impact, but also the impact’s materiality and how additional that impact is to society. To assess the level of materiality, we quantify where possible the degree of potential impact using best available data and evidence, as aligned with the impact pathways identified (eg, estimated tonnes of CO2 emissions cut/waste reduced/water saved for environmental pathways; or number of students reached and percentage improvement in learning gains or earnings increase for education outcomes pathways).

We also consider impact additionality by assessing the level of competition in the market for similar products or services, and the degree of market maturity and penetration. The more differentiated the product or service offered from an impact generation perspective, and the lower the penetration rate of similar products or services in the specific implementation context, the higher the potential additionality. This analysis equips us to compare investment opportunities to see how we can generate the most impact, alongside targeted financial returns.

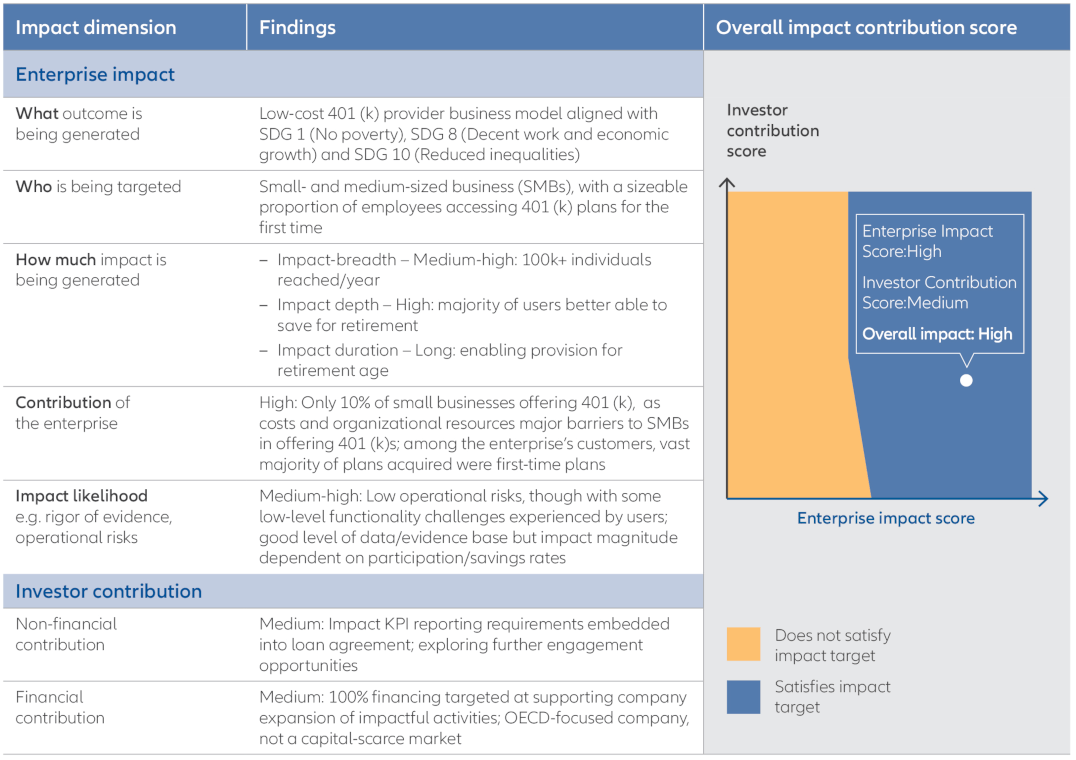

Illustrative example: applying the impact scoring system

During the due diligence process, our assessment of a) the enterprise or project’s social and/or environmental impact and b) the investor’s contribution towards impact generation are aggregated into an overall impact contribution scoring. This is integrated into the investment committee’s decision-making, alongside financial considerations.

Exhibit 3: Impact scoring system in practice – financial inclusion-focused investment

This impact assessment process enables us to better understand the relative impact merits of potential investments. Over the life of the investment, we update our impact assessment based on the latest evidence and data, which allows us to track our portfolio’s progress in delivering impact. By identifying which of our investments are excelling – or falling short – in impact delivery, we can work with our fund managers and portfolio companies to address challenges and build our impact knowledge for future investment opportunities.

Allianz Global Investors’ Private Markets Impact teams has created this impact framework in a commitment to delivering tangible real-world impact through direct and indirect private equity and debt investments, as well as blended-finance vehicles. We seek to generate positive and measurable environmental and social outcomes across our three sustainability and impact focus areas: climate change, planetary boundaries, and inclusive capitalism.

1 Bloomberg, Buyout Giants Rebrand as Forces for Good While Seeking Profits, November 2021

2 Global Impact Investing Network ((2020). Annual Impact Investor Survey.

3 Impact Management Project. Five Dimensions of Impact.

4 IRIS+ is the generally accepted system for impact investors to measure, manage, and optimize their impact, Global Impact Investing Network. IRIS+ System.

5 Even pre-pandemic, there was an annual $2.5 trillion funding gap for sustainable development in developing countries. COVID-19 is projected to increase the SDG financing gap by an additional USD 1.7 trillion (Global Outlook on Financing for Sustainable Development 2021, OECD).

6 A life cycle assessment (LCA) is the systematic analysis of the potential environmental impacts of products or services during their entire life cycle.