Summary

Much like last year's underdog, the stock markets faced some obstacles going into 2019—plenty that would give them reason to extend their end-of-2018 slide. But also like the Cinderella team, stock markets overcame adversity and rallied last month, continuing to build on their impressive gains since the start of the year.

With US men’s basketball NCAA March Madness underway, I’m reminded of an historic moment from last year’s tournament, where the University of Maryland, Baltimore County (UMBC) pulled off a stunning upset victory over the University of Virginia (UVA). It was the very first time in tournament history that a team with the lowest-ranking seed (no. 16) beat a highest-ranking seed (no. 1)—a true Cinderella story by all accounts.

Going into the historic game, it was clear UMBC had the odds stacked against them. UVA was a better team on all measurable fronts, boasting a nearly undefeated record and a notably strong defense. UMBC was a little-known school that had only made the tournament by the skin of their teeth, ranked 63 out of a field of 68 teams. But in a situation where defeat was all but a foregone conclusion, UMBC emerged from the game victorious by a wide margin, out-strategizing UVA’s defense with speed and agility.

Much like UMBC last year, the stock markets faced some obstacles going into 2019—plenty that would give them reason to extend their end-of-2018 slide. But also like the Cinderella team, stock markets overcame adversity and rallied last month, continuing to build on their impressive gains since the start of the year.

If the face of adversity for UMBC was a stronger, more accomplished team, what did the face of adversity for the stock markets look like? If I had to put it in one word, it would be this: earnings.

A company’s earnings don’t necessarily tell the whole story of financial health (or lack thereof), but they give the market something to react to—and the recent news hasn’t been encouraging. Earnings surprises—the degree by which earnings beat estimates—came in considerably lower than the last two years, and also below the historical median.

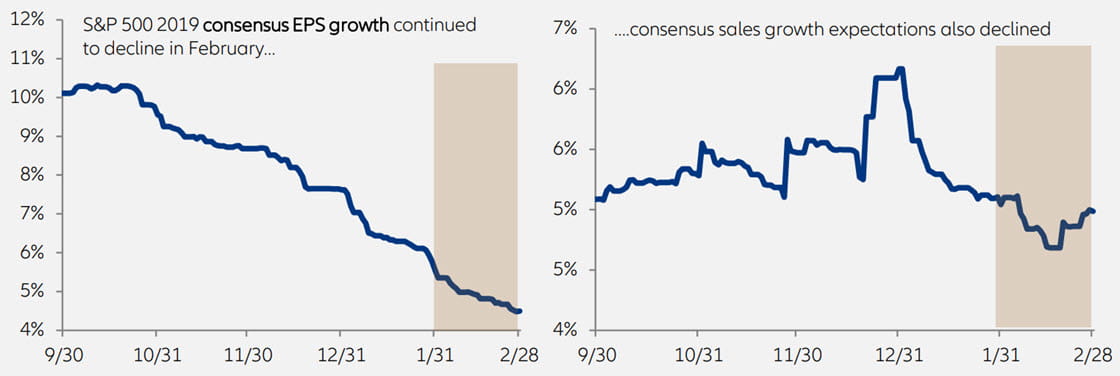

And that’s just a look in the rearview—the look ahead also painted a dreary picture. Analyst expectations for earnings growth have more than halved since September, and less-than-stellar sales are at least in part to blame.

Increased risk of earnings recession in the US

In the last four months, earnings growth estimates have precipitously declined.

Source: Bloomberg. Data as at March 2019.

You might be thinking this gloomy news can’t possibly bode well for the stock markets, and if earnings were the only factor in play you’d be right. But we’ve watched two other trends unfold over the past couple of months, both of which you might have heard a few things about.

First, as tensions over the US/China trade deal continued to ease, renewed investor optimism gave stocks a boost. And the second boon for the stock market came from the Federal Reserve (the “Fed”)—that entity holding the reigns of monetary policy—which had previously been on a (potentially stock market-crushing) track to continue its interest rate hikes. The Fed instead declared a more patient stance on raising rates, bolstering overall confidence in markets.

If we again reflect on UMBC’s tournament run, we can try to glean some future learning. Just two days after their historic first round victory, UMBC lost steam and fell to Kansas State, putting an end to their historic March Madness run. If this turn of events tells us anything, it’s that past performance is truly not indicative of future results, and there’s a chance the same could also ring true for stock markets—particularly if earnings headwinds persist.

While consensus among analysts implies that we’ll see earnings growth pick up again in the second half of the year, we think this may still be lofty and maintain a neutral view on US stocks. We’ll continue to keep an eye on earnings expectations for later in the year, and see whether stocks can again make like UMBC—prevailing in the face of earnings adversity.

806112

Active is: Navigating geopolitics

European election results provide relief – for now

Summary

While the pro-European vote held up in many countries, the result will likely be a more fragmented European Parliament that may slow decision-making. Most challenging for European leaders could be the signs of increasingly polarised electorates.

Key takeaways

|

-

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security. The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted.

This material has not been reviewed by any regulatory authorities. In mainland China, it is for Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations and is for information purpose only. This document does not constitute a public offer by virtue of Act Number 26.831 of the Argentine Republic and General Resolution No. 622/2013 of the NSC. This communication's sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of his document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Brazil, Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Pacific Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional/professional investors only, and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide financial services to retail clients in Australia. AllianzGI AP is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of financial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which differ from Australian laws.

This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG; in HK, by Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; in Singapore, by Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; in Japan, by Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424], Member of Japan Investment Advisers Association, the Investment Trust Association, Japan and Type II Financial Instruments Firms Association; in Taiwan, by Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan; and in Indonesia, by PT. Allianz Global Investors Asset Management Indonesia licensed by Indonesia Financial Services Authority (OJK).