With mid-terms over, markets may feel relief

Summary

Although the Democrats now control half of the US Congress, we believe President Trump’s economic agenda is unlikely to be significantly altered. A divided government could also give equities a bounce, particularly now that election-related uncertainty has been removed.

Key takeaways

|

The US mid-term elections on 6 November resulted in a divided Congress – commonly referred to as “gridlock” – that has several economic implications:

- President Donald Trump’s economic agenda – centred around tax reform, de-regulation and renegotiated trade deals – will likely not be altered materially. However, we now see the passing of a second tax reform bill as unlikely.

- Governing via executive orders and executive branch actions will likely continue. This implies that while we may see Democrats become more vocal in pushing back on over-reach in the President’s trade agenda, it is unlikely that Congress will achieve the bipartisan support needed to alter his approach officially.

- As 2020 draws closer, the work of Congress will shift gears increasingly toward the presidential, House and Senate elections, putting major legislative initiatives closer and closer to the back burner. As a result, we may not see much progress on either party’s agenda, as they will not want to give the other a “win” prior to presidential elections.

Some expected results, some surprises

At the time of this writing, the Democratic Party has won a majority in the House of Representatives, though some elections are unresolved. Democrats won 221 of the 435 seats up for election, flipping 27 seats from Republican to Democrat (with 16 races still undecided). Meanwhile, the Republican Party maintained control of the Senate, winning 10 of the 35 seats up for election (with 4 left undecided) and bringing the total number of Republican seats to 51 out of 100 (likely extending to 53 seats).

While the overall result of a split Congress was not surprising, what was perhaps somewhat unexpected was the extent to which the Democrats won in the House – extending their majority well beyond the 23 seats required. Also unexpected was the Republicans extending their majority in the Senate, moving from a simple 51-seat majority to a likely 53 seats.

Other notable aspects of the 2018 mid-term election race include:

- Record numbers of women and minorities were elected. In the House, women won 96 seats and counting, surpassing the prior record of 85 seats, and Congress saw the election of its first Native American and Muslim representatives.

- Voter turnout was high. It is estimated that 114 million votes were cast in the 2018 mid-term elections, compared to 83 million four years ago.

- A record amount of money was spent. The total amount spent on mid-term election campaigns is estimated at a record USD 5.2 billion, a 35% increase from four years ago.

Policy impact

One of the biggest takeaways from the elections is that a Democratic House now provides some checks and balances to a Republican president and Republican Congress – or at least more vocal opposing views.

While the Democrat-controlled House could also increase its focus on legal proceedings related to President Trump – notably ahead of the 2020 presidential elections – we do not ultimately believe Democrats will push for impeachment. Impeachment would require support from two-thirds of the Senate, which is highly unlikely.

There may be certain policy areas that may see a modicum of progress:

- Infrastructure. Both parties had indicated they wanted to put an infrastructure package in place. The total will likely now be less than the USD 1 trillion proposed by the Democrats, and there may be debate on how to fund such a bill. However, this could be one of the few areas that appeals to both parties and their constituents.

- Drug pricing. Health care is an issue on which many Democrats based their elections, and both President Trump and Democrats generally favour lower drug prices. Implementing this policy would not only support the lower- and middle-income US consumer, but appeal to President Trump’s base as well; it would however negatively impact certain pharmaceutical and drug companies.

- Government spending. We may see less defence spending under a mixed Congress, as President Trump may have to compromise to get a spending bill in place in 2019. However, the Democrats may favour higher spending in general, which seems in line with the President’s overall philosophy as well.

- Social issues. Legislators may focus more on key social issues, including gun control, addressing the opioid crisis and immigration reform. Of these, the President has expressed interest in managing the opioid epidemic and has shown some, albeit wavering, support for incremental gun control legislation.

Market impact

Generally, we believe that the markets – particularly US equities – were well-positioned heading into the mid-term elections, given that the S&P 500 Index had already experienced a 7% correction in October. This is in line with the historical narrative that the markets tend to be volatile prior to mid-term elections, and then outperform in the 6-12 months after elections.

Outlook for equities

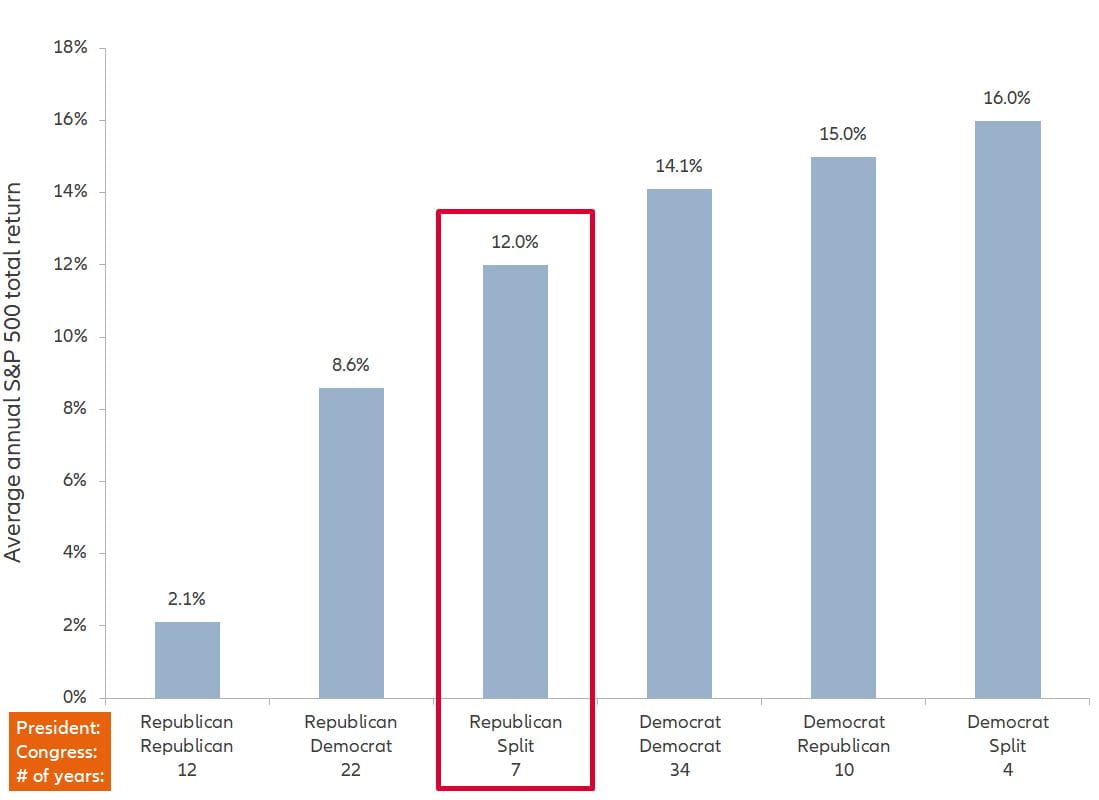

Gridlock could be positive for equities. The fiscal stimulus of tax reform and much of the deregulation agenda is already “locked in” and the Democrats may push back on some of President Trump’s trade policy proposals that have weighed on markets. As noted in the accompanying chart, markets historically moved upwards by an average of 12% in the 12 months after elections resulted in a split Congress and a Republican president.

Stocks have historically gained 12% per year under a Republican president and divided Congress

Average annual S&P 500 total returns based on control of White House and Congress (1928-present)

Source: Bank of America Merrill Lynch Research, Allianz Global Investors. Data as at 2017. Past performance is no guarantee of future results. The above graph is illustrative in nature and should not be considered a recommendation to purchase or sell a specific security, strategy or product.

Among the sectors that may fare well:

- Industrials and materials, if infrastructure reform is enacted

- Technology, if trade tensions dissipate

- Health care, since gridlock reduces the risk of major policy overhauls (excluding pharmaceutical/drug companies if reduced drug pricing is enacted)

Among the sectors that may feel pressure:

- Financials, if rates soften and Democrats push back on deregulation

- The defence sector, if Congress reaches a compromise to restrain spending (although we may get some compromise here as well, if Democrats favour overall increased spending)

Effect on rates/currencies

We believe increased gridlock in Washington will likely dampen investors’ appetite for risk, putting downward pressure on rates. It essentially eliminates the chances of additional tax cuts, and could also portend higher spending and a regulatory environment that is less favourable for business. This would likely reduce the long-term growth outlook and create downward pressure on the US dollar.

Impact on emerging markets

Gridlock could give a small boost to developing markets, since the US dollar could soften or stabilise under the policy uncertainty created by a split Congress. The rhetoric from the Democrats may not be as protectionist in nature, particularly with regard to US allies.

What’s next after the elections?

Now that the uncertainty around mid-term elections has been resolved, we believe investors will refocus on the key issues at hand for 2019. Chief among them are the Federal Reserve’s normalisation path, the potential escalation in tariffs in January (or perhaps a positive resolution at the G20 meeting in November), and whether the US decoupling from a softening global economy is sustainable. These may be the primary market drivers in the near future.

Investment implications

- Equities have historically done well after mid-term election uncertainty has been resolved, and markets may be set up well for solid year-end performance – albeit with ongoing volatility

- Markets tend to like gridlock, which generally means the status quo will be maintained

- Sectors that may fare well: industrials, materials, technology, health care

- Sectors that may feel pressure: financials and possibly defence

- Emerging markets could get a modest boost from a softer US dollar

- Investors will soon refocus on broader economic issues: the Fed, trade and global growth

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Bond prices will normally decline as interest rates rise. The impact may be greater with longer-duration bonds. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security.

The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted. This material has not been reviewed by any regulatory authorities. In mainland China, it is used only as supporting material to the offshore investment products offered by commercial banks under the Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations.

This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors U.S. LLC, an investment adviser registered with the U.S. Securities and Exchange Commission; Allianz Global Investors Distributors LLC, distributor registered with FINRA, is affiliated with Allianz Global Investors U.S. LLC; Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG, licensed by FINMA (www.finma.ch) for distribution and by OAKBV (Oberaufsichtskommission berufliche Vorsorge) for asset management related to occupational pensions in Switzerland; Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424, Member of Japan Investment Advisers Association and Investment Trust Association, Japan]; and Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan.

652681

Summary

If trade tensions continue, the US and China could lock each other out and create their own tech ecosystems, forcing the rest of the world to choose one over the other. With the global economy already becoming less synchronised, investors will need to use greater skill and agility to navigate the markets successfully.

Key takeaways

|