Modi’s narrow victory stays the course towards a New India

From 19 April to 1 June 2024, Indians went to the ballot box in the world’s largest democratic exercise. Prime Minister Narendra Modi and the NDA coalition, led by his BJP party, won a majority in these general elections, albeit a narrower one than predicted by pollsters. Modi’s victory, and the continuation of the reform agenda his government has embraced, should further strengthen the trajectory towards an ‘Emerging New India.’

Background

The BJP’s strategy of balancing welfare policies with fiscal conservatism, while promoting infrastructure, manufacturing, and technology growth, continues to resonate with voters. Traditional influences such as cash handouts, religion, and caste are gradually becoming less significant.

Other than the election, other recent news flow has continued to be supportive. India’s credit rating has received positive assessments from international agencies – S&P upgraded the sovereign rating outlook towards the end of May - and the most recent quarterly GDP data showing growth of 7.8% has significantly exceeded expectations. Combined with the longer term reforms underway, this sets the scene for further meaningful progress in the years ahead.

In our view, India will continue to offer attractive stock-picking opportunities, driven by gains from digitization, ongoing reforms, and a recovery in traditional sectors.

Modi’s First Two Terms (2014-2024): A decade marked by significant reforms

Narendra Modi’s first two terms in office as Prime Minister have been marked by sustained economic growth, fiscal conservatism and structural reforms aimed at increasing India’s competitiveness. The most significant reforms included:

Real Estate and Banking Sector Reforms: Initiatives like the Real Estate (Regulation and Development) Act (RERA) have brought improved transparency and accountability, while banking sector reforms have contributed to stabilization of financial markets and expanded financial inclusion.

GST and Tax Reforms: The Goods and Services Tax (GST) reform simplified a complex tax structure, enhancing compliance and increasing revenue. Further tax incentives for new facilities have bolstered investment.

Digital Expansion: India added approximately 500 million internet subscribers over seven years, dramatically enhancing productivity across government, corporate, and consumer sectors.

Production-Linked Incentives: Aimed at boosting domestic manufacturing through import substitution, these incentives have encouraged significant investment in local production capacities.

In addition, the Modi government has introduced several other significant policy changes across various sectors:

Agricultural Reforms: Introduction of Farmers’ Produce Trade and Commerce (Promotion and Facilitation) Act, which aims to create an ecosystem where farmers and traders can enjoy freedom of choice relating to the sale and purchase of farmers’ produce. Designed to streamline agricultural marketing and increase earnings for farmers by reducing middlemen.

Education Reforms: Implementation of the New Education Policy (NEP) that emphasizes making education more holistic and flexible, and reducing the emphasis on rote learning. Intended to revolutionize the Indian educational system and make it more aligned with global standards.

Healthcare Reforms: Introduction of the National Digital Health Mission aimed at developing the necessary support for the integration of digital health infrastructures across the country. Unique health ID for every citizen that secures medical history records and enhances the efficiency of the healthcare system.

Fintech Reforms: Promotion of financial technologies through initiatives like the establishment of a regulatory sandbox by the Reserve Bank of India. Live testing of new products and services in a controlled regulatory environment, fostering innovation in the financial services sector.

Energy Sector Reforms: Increased use of renewable energy sources as part of government’s commitments to the Paris Agreement, aiming to reduce carbon emissions and promote sustainable energy use in the country.

Recent elections and path forward

The recent elections have produced an interesting outcome; even though the overall vote share for Mr. Modi’s party remained at 37%, the same as in the previous election in 2019, their shares of seats fell. This was due to regional dynamics primarily in two large states, Uttar Pradesh (UP) and Maharashtra (MH). While the eventual outcome is the BJP falling short of an absolute majority in the Lok Sabha (the Indian lower house) and forming the government with the support of a pre-poll alliance, coalition governments at the center mostly last a full term.

From an economic standpoint, we don’t foresee India’s growth trajectory being impacted. The country is expected to remain the fastest-growing emerging market democratic economy, benefiting in particular from:

- Productivity Gains Through Digitization: Enhanced efficiency across various sectors through increased digitization.

- Demographic Advantages: A growing labor force providing a robust workforce.

- Capital Growth Driven by Foreign Direct Investment (FDI): Significant inflows of FDI along with a healthy domestic saving rate driving capital growth.

Politically, the election results should also have a limited impact on administrative and legislative changes, and we expect fiscal consolidation to continue:

- Constitutional amendments will be harder, but changes in laws are possible, especially with victories in the states of Odisha and Andhra Pradesh (AP) helping the BJP’s position in the Rajya Sabha (the Indian upper house).

- Regional coalition partners rarely disrupt the national agenda; some ministries given to alliance partners could also continue to deliver.

- Fiscal consolidation should continue: expectations are for the fiscal deficit to fall to around 4.9% for FY25 in the July budget, and to be lower again in FY26.

Overall the fundamentals remain strong, fueled by productivity gains from digitization and reforms, along with a revival in the real estate sector. These factors, coupled with supportive capital flows, are driving economic growth and maintaining market stability.

Expected Policy Focus of Modi-3 government

With the previous reflections in mind, we believe that the following policy areas will be in focus for the upcoming administration and could be particularly relevant from an investor perspective:

Economic Expansion: Targeting a 5 trillion USD economy by 2027-28, reforms planned in taxation and corporate laws should attract further business investment and enhance economic activity.

Labour and Land Reforms: New labour codes and potential land acquisition reforms are likely to stimulate job creation and ease business operations.

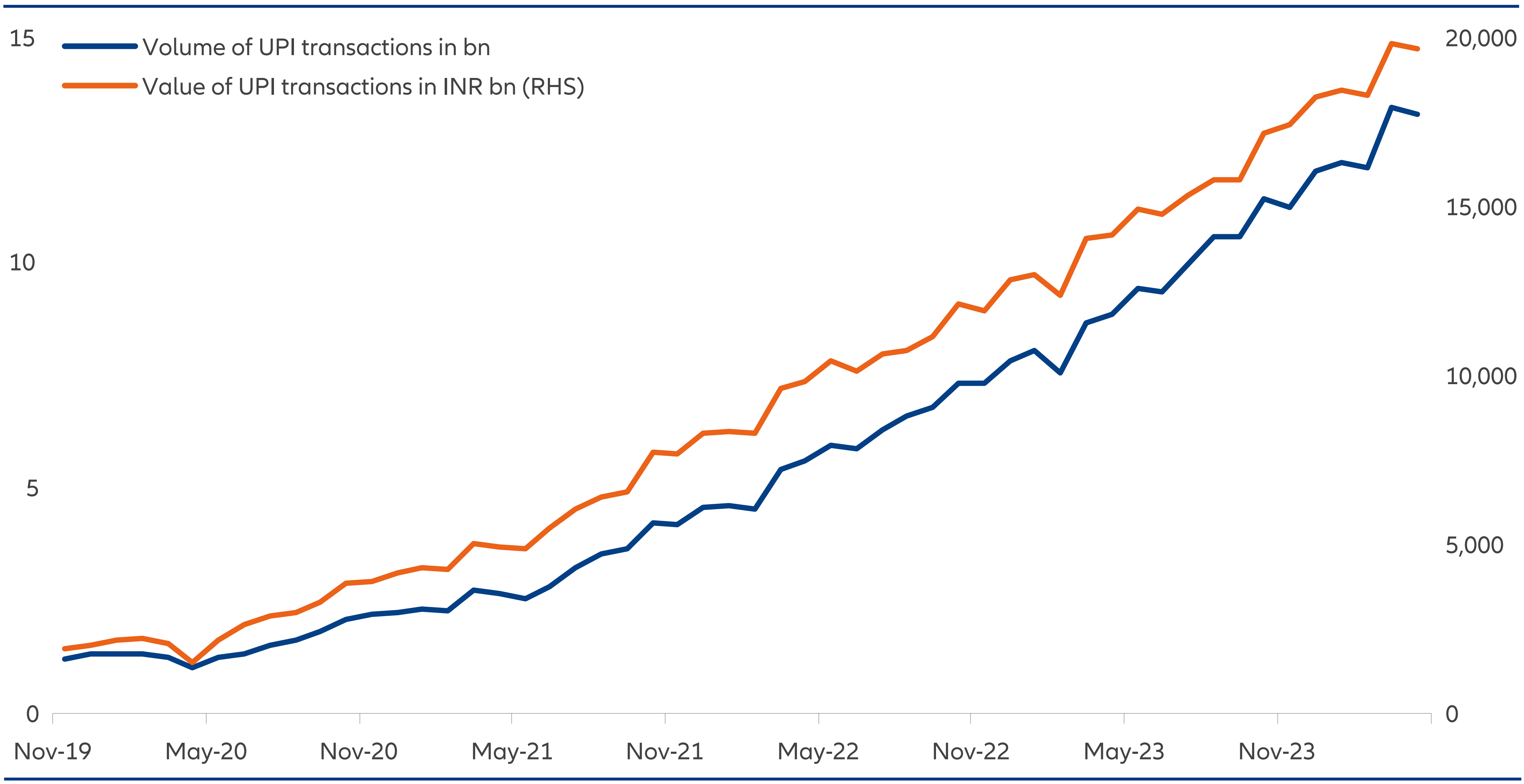

Digital and Financial Inclusion: Expanding the UPI framework (“Unified Payments Interface” real-time payment system) will boost digital transactions and financial inclusion, both domestically and globally.

Infrastructure Development: Accelerating infrastructure projects will be essential for economic growth and job creation, particularly in the transportation and energy sectors.

Healthcare and Education: Scaling up initiatives like the Ayushman Bharat national health care system and improving educational infrastructure are key to leverage India’s demographic dividend.

Foreign Policy and Defense: Strengthening defense capabilities and public diplomacy will be prioritised in order to navigate international challenges, particularly with neighbouring countries and global powers like China.

Energy and Sustainability: With Indian cities suffering from air pollution and the effects of global warming (temperatures in Delhi reached 49°C in May 2024), emphasizing clean energy projects, with significant investments in solar energy and electric vehicles, will be key to create a more sustainable economy.

Exhibit 1: Unified Payments Interface (UPI) transactions in India continue to rise

Source: RBI, Elara Capital, as of 30 April 2024.

Staying the course towards “New India”

The vision for an emerging New India is grounded in robust economic reforms, strategic foreign policies, and inclusive growth initiatives. This vision, which we expect to be maintained following these elections, is poised to enhance India’s global standing and boost its economic trajectory.

The importance of sustainable development in India’s growth strategy cannot be overstated. As one of the fastest-growing economies, India faces the dual challenge of maintaining its growth trajectory while ensuring environmental sustainability. The government’s focus on renewable energy sources such as solar and wind energy illustrates its commitment to reducing carbon footprints and promoting green technologies. This approach not only aligns with global environmental goals but also opens up new avenues for job creation in the green tech sector.

Education reform is another cornerstone of the emerging New India. The National Education Policy (NEP) introduced by the government aims to overhaul the Indian educational system, making it more holistic, flexible, and aligned with the needs of the 21st century. The emphasis on vocational training and integration of technology in education are steps towards creating a workforce that is not only skilled but also adaptable to the evolving job market. These educational reforms are expected to further empower the youth, enabling them to contribute more effectively to the nation’s economy.

Furthermore, the government’s push towards digital infrastructure is revolutionizing the way services are delivered across the population. With initiatives like e-governance, digital health missions, and online education platforms, there is a significant reduction in bureaucratic red tape and an increase in transparency and efficiency. The digitization efforts extend beyond urban centers, reaching rural areas, thus helping to bridge the digital divide and fostering a more inclusive digital economy.

Ultimately, the policies and reforms articulated under the banner of Emerging New India are not just about economic growth; they are about building a resilient and inclusive society that can better withstand global economic fluctuations and internal challenges. The path forward for India involves leveraging its vast human capital, embracing technological innovation, and committing to sustainable development to not only become a global powerhouse but also to ensure the well-being of its citizens.

Investment Implications

India’s reform-driven economic agenda has set the stage for financial investment opportunities. The Indian equity market is growing rapidly, with the number of stocks in the MSCI India index having nearly doubled over the last 10 years. The investment universe overall should continue to expand given the ongoing strength of the IPO pipeline.

While Indian equities have traded at a premium rating to other regional and global emerging markets for some time, in our view Modi’s re-election should help to support valuations by reinforcing India’s potential for sustained long term growth prospects. We assess market valuations through the same lens as individual companies: fast-growing companies support higher price targets, and factors like quality of earnings, sustainability of cash flows, management know-how, and improving corporate governance contribute to superior valuations.

We remain mindful of certain risks when creating portfolios. A slowdown in global economies could impact export opportunities. Additionally, any resurgence of the pandemic could pose significant challenges. Furthermore, litigations within the democratic framework could delay the implementation and outcomes of incremental reforms.

Nonetheless in our view, India stands at the forefront of emerging markets, offering a unique combination of high growth potential, a robust legal framework, and a vibrant ecosystem for innovation. With ongoing economic reforms and proactive government policies designed to facilitate foreign investment, India presents an opportunity for global investors looking to expand their portfolios and tap into one of the world’s fastest-growing economies.