Embracing Disruption

Opportunities in Asia beyond China

The past decades have witnessed the rise of China to second-largest economy in the world, its pivot towards innovation and tech and the emergence of its stock market as an asset class in its own right. Yet, in the shadow of China’s phenomenal development, other economies in Asia have matured and now offer equally interesting opportunities. We believe that the time has come for investors to cast an eye on Asia beyond China.

Asia: a continent of megacities and growing affluence

It’s hard to comprehend the immense size of Asia. The continent comprises around 60% of the world’s population. By 2050, Asia’s population will be equivalent to the size of the world’s population 1990. Two countries – China and India – make up 60% of this population, but they are on diverging demographic paths. China’s population is ageing and declining; India has recently overtaken China as the world’s most populous country (with 1.4 bn people), and has a young and growing population.

Asia is an increasingly urban continent. Twenty of its cities harbour over 10 million people. China has 23 cities with over 5 million inhabitants; India currently has seven, but is rapidly urbanising. But megacities dot the landscape beyond China, India and Japan. Other metropoles include Seoul, Manila, Taipei, Bangkok, Jakarta, Singapore, Dhaka, Kuala Lumpur and Ho Chi Minh City.

Urbanisation tends to go hand-in-hand with increased affluence, and Asia already accounts for the largest consumer market in the world, both in terms of population as well as in terms of spending. By 2030, it is expected that two out of three global consumers will be Asian.

Yet while the first two decades of this century were driven by rise of the Chinese middle class, this decade will be belong to South Asia. Investors should expect the middle classes of India, Pakistan and Bangladesh to deliver 1 bn new consumers by 2030. Asia’s growing affluence is also reflected in its financial wealth, which stands at USD 180.6 trillion (as of 2021), and represents ~40% of global wealth.

The dynamism of Asia’s economies beyond China

Asian economies beyond China have become major drivers of global growth. They are expected to contribute one third of global growth in 2024. Besides the demographic dividend of their (mostly) young populations, and the above-mentioned emerging consumer base, other structural growth factors are underpinning their economies: the reorganization of global supply chains, technology and increased drive for reform.

India is the posterchild of this new Asia. Its young and dynamic population benefits from a STEM-focused educational system. Indian computer scientists and IT specialists are sought after beyond its borders, and lead major global tech firms. The Indian government has furthermore embarked on an ambitious reform agenda, aiming not only to ease business by cutting down the infamous “Licence Raj”, but also to build world-class infrastructure to facilitate trade both within the country and between India and its export markets. India’s efforts are being increasingly recognised. FDI has increased as global companies implement a “China + 1” supply chain strategy, and consider India as a manufacturing location.

The geopolitical tensions afflicting the China-USA relations, as well as the disruptions caused by the covid pandemic, have led corporates to also relocate parts of their supply chains to South East Asia. Vietnam, Malaysia and Indonesia have particularly benefited from this realignment of global supply chains – a strong secular trend we don’t expect to abate. Vietnam, given its strategic proximity to China, is rapidly increasing its role in the global supply chain as a lower cost, reliable and quality source of parts, materials and manufactured components; the country is fast becoming a hub for electronics and textile products. Malaysia, Indonesia or the Philippines have attracted investors with political stability and reformoriented governments. Indeed, these economies may end up as the beneficiaries of the continued trade tensions between China and the US: open to trade with both blocks, they will bridge the gaps that have emerged between the two largest economies in the world.

These South East Asian economies, but also Taiwan and Korea, are further benefitting from a favourable economic cycle driven by restocking. The Taiwanese semiconductor industry, for instance, has entered a cycle of recovery. The global boom in AI favours Taiwanese and Korean hardware component vendors and chip designers.

Another trend investors will welcome is an increased focus on corporate governance. Political leaders in Seoul, for instance, are keen to eliminate the “Korean discount” that opaque governance practices have burdened its stock market with. A follow-through implementation of their “Value Up” agenda should improve the attractiveness.

Sustainability, finally, is being taken increasingly seriously across Asia. In Bangladesh, farmers are switching from raising chicken to raising ducks, given the rising risks of major floods that climate change is bound to inflict on the riverine country. Countries across Asia are focusing on the energy transition. Taiwan is centering its efforts on increasing renewable energy (solar, offshore wind) in its energy mix, thus creating growth opportunities for companies along the value chain (such as key material and component makers). Traditional industries with high carbon emissions, like the shipping and airline industries, are decarbonizing by adopting new technologies and using sustainable aviation fuel (SAF), benefitting associated industries.

Opportunities for international investors

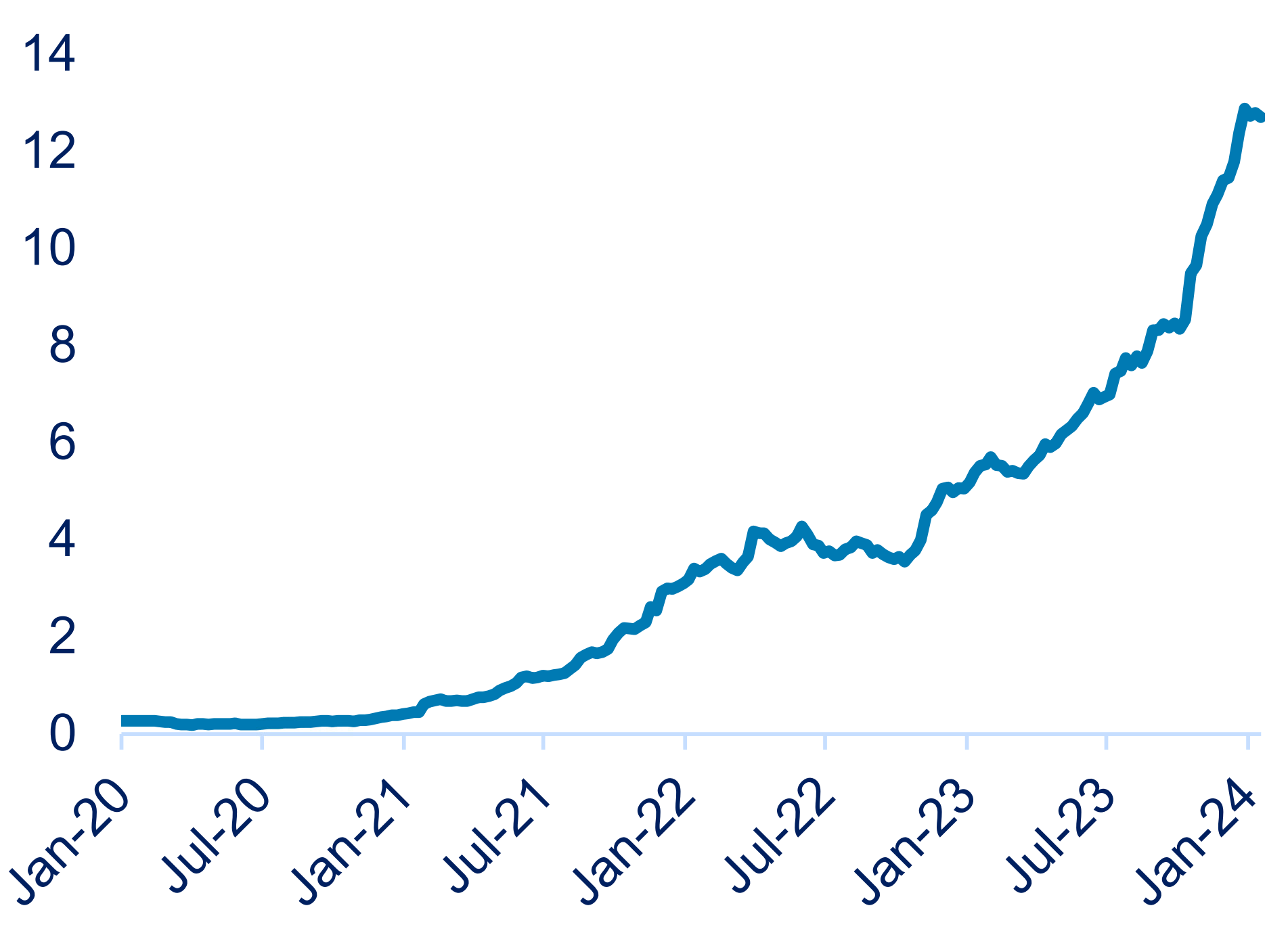

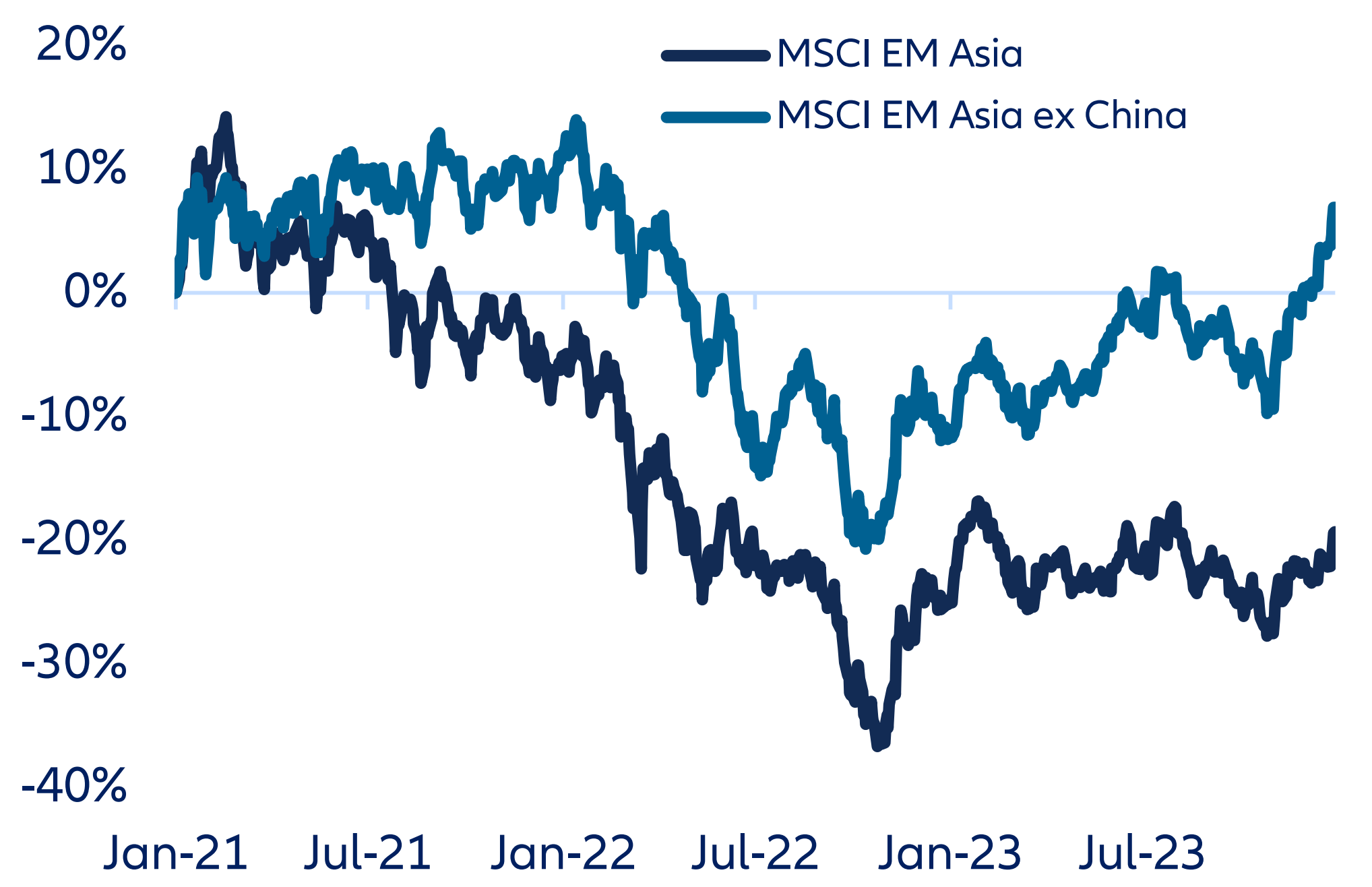

Investors are recognizing the attractive prospects of Asia’s new economic powerhouses. Assets under Management in Emerging Markets or Asia ex China strategies have reached over USD 12.5 bn (in January 2024). As economic paths diverged between China and its Asian neighbours, so did their stock markets. Indices excluding China have fared better over the past three years, highlighting the decoupling of China and other Asian economies.

AUM growth of EM and Asia ex China funds (USD billion)

Source: JP Morgan Equity Research, 31. January 2024.

MSCI Emerging Asia compared to MSCI Emerging Asia ex China – since end of 2020 (USD)

Source: Bloomberg, MSCI, Allianz Global Investors, as of December 31, 2023. The above is for illustrative purposes only and is not a recommendation or advice to buy or sell. Past performance, or any predication, projection or forecast, does not predict future returns..

Investors should not interpret this decoupling as a rejection of China’s stock markets – instead, we believe they should recognize that China has truly become its own asset class following its own economic trends, but adding investments in “Asia ex China” will help to balance and diversify their portfolios.

As with all investments in Emerging Markets, “Asia ex China” investments come with certain risks. While the Asian economies stand to benefit from the geopolitical tensions between China and the US, this also makes them vulnerable to volatility in the Chinese economy and to changes in the US interest rate cycle. Domestic consumption is bound to become a major pillar in these economies, but over the short term demand may in certain cases fall behind expectations.