Transforming Infrastructure

Private Markets for all? It’s not easy to be “evergreen”

The last decade has been an exciting one for private markets. Once the traditional domain of institutional investors, who were often invested in closed-end funds with a very long-term investment horizon, the asset class has changed.

Evergreen funds - but for whom?

Private markets have long been marketed as closedended funds via feeder structures by some banks and wealth managers to their wealthy private clients who could be classified as professional or semi-professional. Over time, however, the focus of wealth managers and providers has increasingly shifted towards so-called “semi-liquid” or “evergreen” funds. The definition is not always entirely consistent, but one can say that evergreen funds typically receive investor inflows at regular intervals and - under certain conditions - allow regular redemptions. The number of semi-liquid products has almost doubled in the last five years to 520 funds at the end of 2023. As not all funds have disclosed their volumes, we can assume a market volume of at least USD 350 billion2.

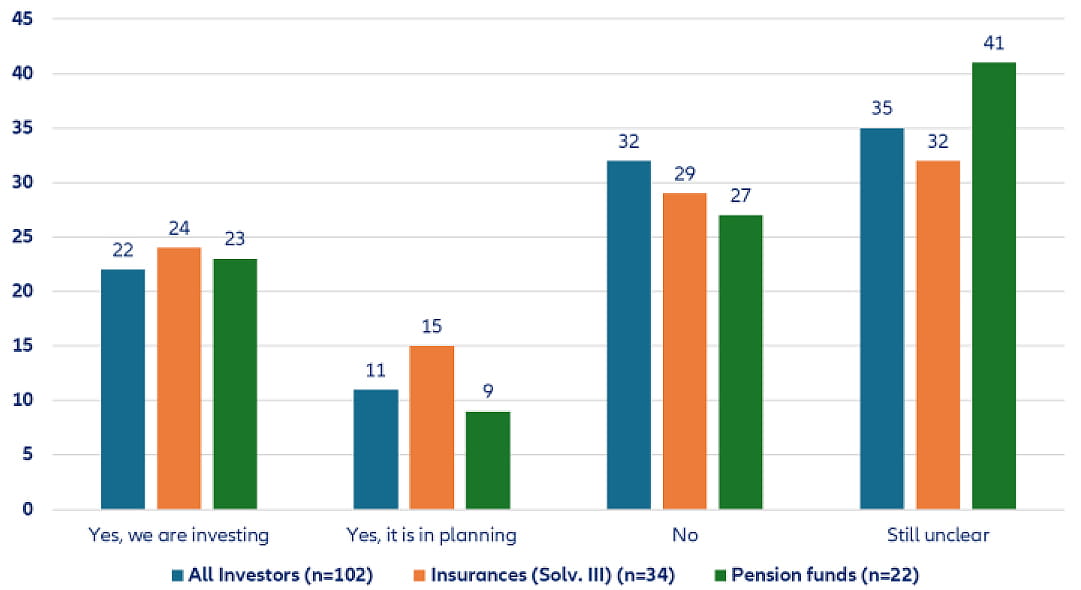

However, the evergreen market is not only interesting for wealth managers. Only recently, the BAI published a guide to private markets evergreen funds and surveyed institutional investors. Open-ended core infrastructure funds have long been commonplace in the institutional sector, but recent market developments have opened up many more opportunities across all asset classes. While just under a third are currently ruling out an investment, many institutional investors are still unsure whether evergreen funds are an option for them, such as 41% of the pension funds surveyed. Generally speaking, interest in such funds is increasing and is being taken up by many asset managers.3

BAI Investor Survey: Are you planning medium-term private markets investments via evergreen/semi-liquid funds?

Source: BAI, BAI survey of German institutional investors in late summer 2024.

However, evergreen fund providers are not only focusing on investors classified as professionals. The ELTIF 2.0 regulation has made private markets easier to invest for all types of investors, including retail investors. The result is a significant increase in the range of products on offer, coupled with hopes of high growth on the provider side. It can be assumed that the increasing involvement of private investors in ELTIFs will increase the transparency of the market in the medium to long term, e.g. through publicly accessible reporting and performance comparisons on various platforms. This should sharpen competition in the long term and improve the offering for investors.

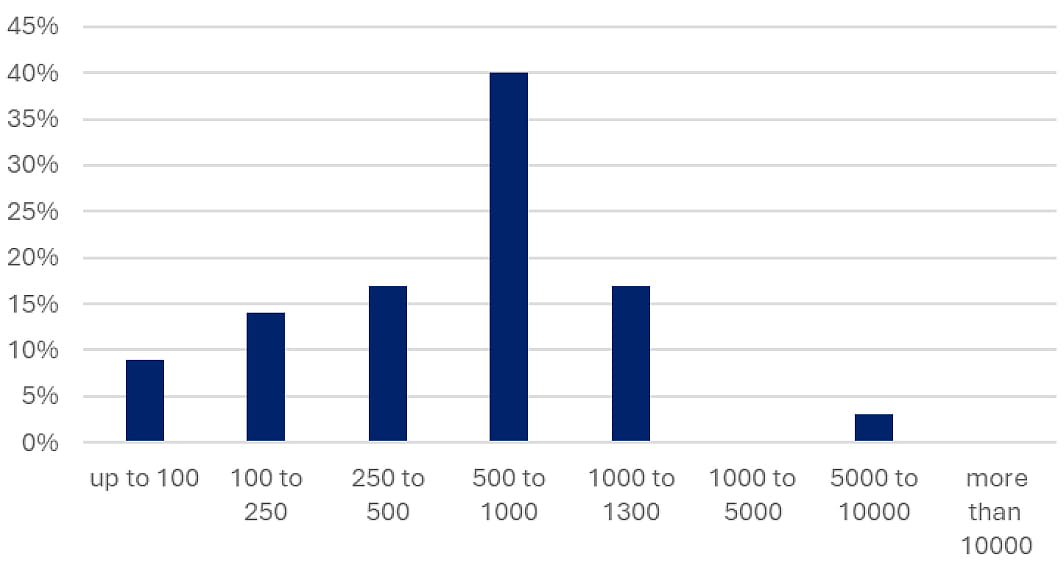

Expected company's ELTIF assets growth in Europe in millions of EURO by the end of 2027

Source: Scope Fund Analysis, 2025

Focusing on infrastructure

Whether closed-end or evergreen structures, the infrastructure asset class is an interesting and constantly growing area in private markets - with good reason. The demand for private capital is very high. According to a study by the Global Infrastructure Investor Association, only 38% of respondents worldwide were satisfied with the infrastructure available to them in 20234. Some experts say that up to 70% of the infrastructure of 2050 does not yet exist today5. The development of new infrastructure is crucial for Europe’s future. The decarbonization of many industries, securing the energy supply and the digital participation of the population cannot wait. Now a broader section of the population can contribute to this themselves, for example with the ELTIF. At the same time, society’s high need for investment is matched by return opportunities for investors.

Friedrich Merz also emphasized this in a speech on 12 October: “There are 2.8 trillion euros in German bank accounts, savings accounts, and current accounts. Imagine for a moment that we were able to mobilize just 10 percent of this - at a reasonable interest rate, for public infrastructure in Germany.”6

Institutional investors can now make infrastructure investments more easily. In February 2025, the Federal Ministry of Finance implemented significant changes to the Investment Ordinance (AnlV)7. A new infrastructure quota allows regulated investors to invest up to 5% of their security assets separately in infrastructure projects. This is a clear move to incentivise private capital to flow into infrastructure projects, expanding the scope for both direct and indirect investments. It will be interesting to see if this also leads to more investments in evergreen structures in the future.

The sector is set to receive a significant boost from the long-awaited German public infrastructure fund of EUR 500 billion. This fund will make one of the largest investments in Germany’s infrastructure since the war, tackling urgently needed projects from road to rail, from education to the energy transition and climate protection.

ELTIF - opportunities and risks

The ELTIF provides a regulated framework for investors to allocate capital to long-term investment opportunities. These long-term investment opportunities encompass a wide range of options, including stakes in unlisted companies, bilateral loans, infrastructure projects, and property development projects. The ELTIF provides a comprehensive investor base with access to previously inaccessible illiquid investments, enabling them to capitalise on illiquidity and complexity premiums. In the context of real assets, such as infrastructure, there is also a certain degree of inflation protection.

Investors’ interest in ELTIFs is driven by their capacity to deliver an appealing risk-return profile, exhibiting reduced correlation to equity and bond markets while fostering economic growth. For private clients, the ELTIF investment vehicle offers the opportunity to accumulate long-term wealth and diversify their portfolio.

However, it should be noted that investments in private markets are not without risk: Illiquid investments require a long-term capital commitment. It is therefore important to note that semi-liquidity should not be interpreted literally. Investors should adjust the level of allocation to their own wealth plans with the expectation that the investment will not be sold for the next 10 years or so, even if a sale would be possible under certain circumstances. Investors should also be aware of the risks specific to each asset class, including project development risks and regulatory risks for real assets. As with liquid investments, a high level of diversification is important in order to avoid excessive concentration risks. When selecting ELTIFs for investment, it is crucial to consider the number of underlying investments, as this can influence the overall risk profile of the portfolio.

Robust liquidity management, which balances the interplay between deal flow and the long-term nature of investments on the one hand and customer inflows and outflows on the other, is a key area of expertise for the management of evergreen funds. This needs to be modelled internally and agreed between portfolio management and risk management, as well as discussed externally with the regulator. Robust systems and processes are necessary to ensure the smooth operation of the ELTIF. An important success criterion for the ELTIF is the careful handling of these challenges. It is crucial to educate investors and distributors about the benefits and risks of investing in ELTIFs. In particular, this requires the provision of clear and transparent information and advice to help investors make informed decisions.

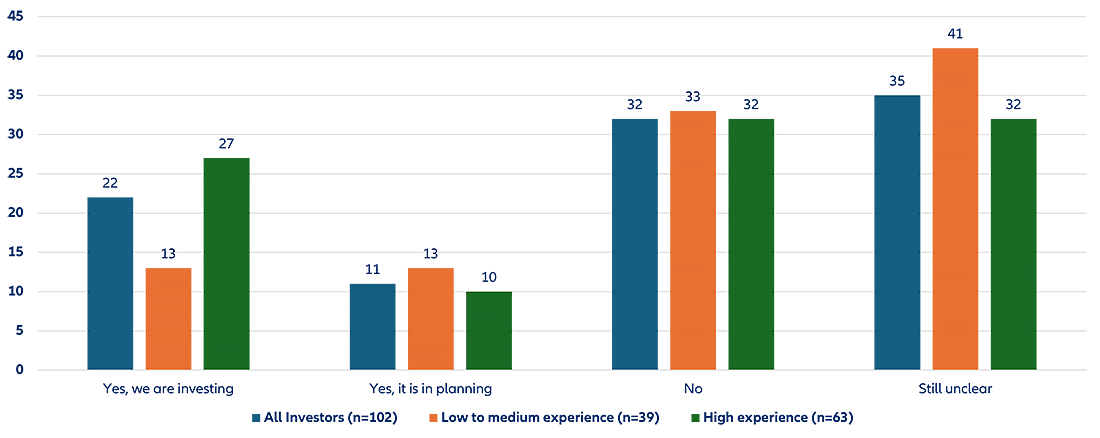

BAI Investor Survey: Are you planning medium-term private markets investments via evergreen/semi-liquid funds? (in %)

Source: BAI, BAI survey of German institutional investors in late summer 2024.

Experience is the key for evergreens

The more experienced, the more likely an evergreen investment? As the BAI survey shows, 37% of institutional investors with a lot of experience in alternative investments have already invested or are planning to invest in evergreen/semi-liquid funds. There are several reasons for this. According to the BAI survey, advantages in liquidity management and investment timing flexibility are the main reasons for most institutional investors surveyed to invest in semi-liquid/evergreen private markets funds. Contrary to the assumption that ‘semiliquid’ products make illiquid investments liquid, these solutions are about more efficient and convenient access to investments in the private markets sector:

- To start with, there are no capital calls that the investor has to service promptly and invest profitably until then. J-curve mitigation, i.e. the reduction of negative returns that tend to occur at the beginning of an investment period, thus becomes the manager’s task.

- In many cases, a portfolio is (almost) fully invested in private markets from day one.

- It is important that the portfolio manager uses the right tools to successfully manage the J-curve: for illiquid investments, this means prioritising secondary market transactions (secondaries) or co-investments (where you make an investment alongside a fund) at the start of the investment period or using your own balance sheet (e.g. as part of warehouse solutions). In this case, a portion of the manager’s own invested portfolio is transferred to the vehicle. In the case of liquid investments, some semi-liquid private markets vehicles that are already fully invested can function well as interim investments.

- With the elimination of capital calls, the performance is automatically a time-weighted return and no longer an internal rate of return (IRR), making it comparable to the performance of liquid investments for investors.

- It is also possible to invest at any time (usually at the end of the quarter), not just in certain fundraising cycles.

- At the same time, it is possible to redeem when capital is required, even if the assets are illiquid - of course subject to certain conditions such as the lock-up period (minimum holding period), the notice period and/or gating. This should be seen by the investor as a possibility under certain circumstances and not as a guarantee.

- In addition, improved liquidity compared to closed-end funds makes it easier for investors to allocate their private markets exposure somewhat more dynamically.

Examples for Cross-Asset-Strategies (Multi Private Markets)

The decision to invest in semi-liquid solutions is not an easy one for investors. A particularly diversified solution, if one wants broad exposure to private markets, can be multi private markets portfolios to which the advantages of evergreen funds apply. They offer potential returns across all asset classes in the private markets universe and ensure balanced portfolios that are consistent in themselves and can adapt the investment strategy to changing market opportunities. Multi private markets solutions can provide a unique level of diversification across asset classes, geographies, sectors, vintages, and investment managers. With these so-called ‘one-stop-shop’ solutions, clients can easily cover all or a large part of private markets in one product in their portfolio: for example, a multi-private markets evergreen fund could be invested in the asset classes private equity, infrastructure equity, and private credit (corporate and infrastructure) in a very broadly diversified portfolio that covers the entire private markets universe well with almost no J-curve.

Understanding potential

A long-term investment horizon meets semi-liquidity/evergreen – there is still a great need for education so that investors understand how they can best leverage these private markets solutions for their needs. Evergreen structures do not replace closed-ended funds but rather expand the existing investment offering.

They can offer both institutional and private investors new opportunities in private markets through flexible investment strategies. It is encouraging to note that an increasing number of investors are currently exploring these opportunities.

1 Scope, ELTIF-Studie 2025, ELTIF-Markt nimmt Fahrt auf – Rekordzahl neuer Fonds - ScopeExplorer

2 Preqin, Evergreen capital funds hit record high at $350bn on private wealth demand

3 BA_Leitfaden_Evergreen.pdf

4 https://giia.net/news/new-infrastructure-attitudesstudy-flags-urgent-need-investment

5 https://www.siemens.com/de/de/unternehmen/stories/in frastruktur/2019/zukunft-der-staedte-interview-mitmartina-otto-nep.html

6 Angst vor Enteignung auf TikTok: Merz fordert Privatinvestitionen in Infrastruktur und geht viral | MDR.DE

7 Bundesgesetzblatt Teil I - Achte Verordnung zur Änderung von Verordnungen nach dem Versicherungsaufsichtsgesetz - Bundesgesetzblatt