Proxy voting season 2023: four key takeaways

Proxy voting allows shareholders to influence a broad range of issues at companies they are invested in. While the standard governance topics have typically dominated the voting agenda, we are seeing an increasing relevance of environmental and social aspects – the E and S of ESG – such as climate and diversity. We round up this and other trends from the 2023 voting season.

Summary

- We have been building out environmental and social considerations in our voting policy, and the recent voting season confirms the importance of these topics.

- With support for Say on Climate resolutions declining, holding boards accountable is becoming a key lever for material environmental and social issues we have observed in companies.

- Shareholder resolutions in the US continue to reflect a highly dynamic agenda with resolutions on reproductive rights gaining importance this season.

- While management should be incentivised to incorporate material sustainability matters into corporate strategy, we look closely at how companies craft environmental, social, and governance (ESG) key performance indicators to be meaningful.

Most resolutions at company general meetings concern typical governance issues, such as the election of board members, appointing auditors or approving remuneration policies. However, environmental and social issues have become increasingly important in voting decisions.

Within our comprehensive voting policy we have been building out environmental and social considerations in line with our three pivotal sustainability themes: climate change, planetary boundaries, and inclusive capitalism. For example, we developed voting guidelines to assess companies’ climate strategies.

Shaping sustainability through voting

We consider proxy voting an important tool to hold boards and management accountable for their sustainability policies and practices - because ambitious sustainability goals are nothing without strong governance.

Sustainability finds its way into voting decisions via different channels. Some resolutions allow investors to express their views directly through the likes of a vote on a company’s climate transition strategy put forward by management (Say on Climate) or via a shareholder resolution relating to climate lobbying or emissions reporting. However, there are other, more indirect approaches. For example, in considering environmental and social performance when voting on remuneration policies, we expect companies to include ESG key performance indicators (KPIs) in their remuneration policies. Moreover, director elections have emerged as the main agenda item for investors to express discontent on sustainability performance. This could be where the board demonstrates insufficient sustainability competences, or gender or ethnic diversity is deemed unsatisfactory.

From the 2023 proxy voting season, we have identified four key environmental and social takeaways.

1. Say on Climate: resolution numbers fall

We consider Say on Climate a helpful tool for holding companies accountable for their climate ambitions (see our article, Say on Climate: does it measure up?). Following a significant increase in Say on Climate resolutions in 2022, there were significantly fewer in the first half of 2023. We believe this decline reflects some notable institutional investors resisting Say on Climate on the basis that management, rather than investors, should be accountable for climate strategy. But there’s a diverging trend. France is considering making Say on Climate mandatory, reflecting the strong support for climate issues across the French institutional investor base.

We voted on approximately 50 Say on Climate resolutions in 2022, but only 23 in the first half of this year when typically most of these votes take place. In Europe, most Say on Climate resolutions are still being tabled by UK and French companies, with few resolutions in other countries. Outside of Europe, the most prominent market for Say on Climate is Australia, whereas in the US it has not gained traction due to continued scepticism from domestic investors.

This is the third year of voting on climate strategy and progress reports. We observed issues with how companies are dealing with low vote-turnouts on Say on Climate and with their responses to investor concerns more broadly. Additionally, ad hoc amendments to company climate plans after they have been submitted to a shareholder vote is another emerging issue we have seen.

We generally expect a company to be responsive to investor concerns and to state how they will be addressed. An example of this is our engagement with an Australian company. Following low support for its Say on Climate resolution in 2022 we identified a lack of effective board oversight on sustainability. Given its lack of progress we subsequently decided to vote against the re-election of three members of the Sustainability Committee to hold directors accountable.

We also consider it good governance practice to put a material amendment to a climate strategy or climate targets to a shareholder vote, even if a Say on Climate resolution received decent support in previous years. In 2023, we decided to reinforce our concern by voting against directors on these grounds.

2. US shareholder resolutions: strong focus on environmental and social topics

In the US, sustainability-related issues typically find their way on to the agenda of a general meeting via shareholder resolutions (see our article, Shaping US practice through shareholder resolutions). This year has seen a record number of shareholder resolutions, but also generally lower levels of support ‒ dropping to about 21.6% from a peak of 33.3% in 2021.1

There are many reasons for this trend, including a more cautious approach from some asset managers on the back of anti-ESG developments in the US. In addition, with more resolutions the quality of the resolutions is more varied. There’s also a rising number of anti-ESG proposals (about 10% of total) with an overall low level of support (2.4%).2

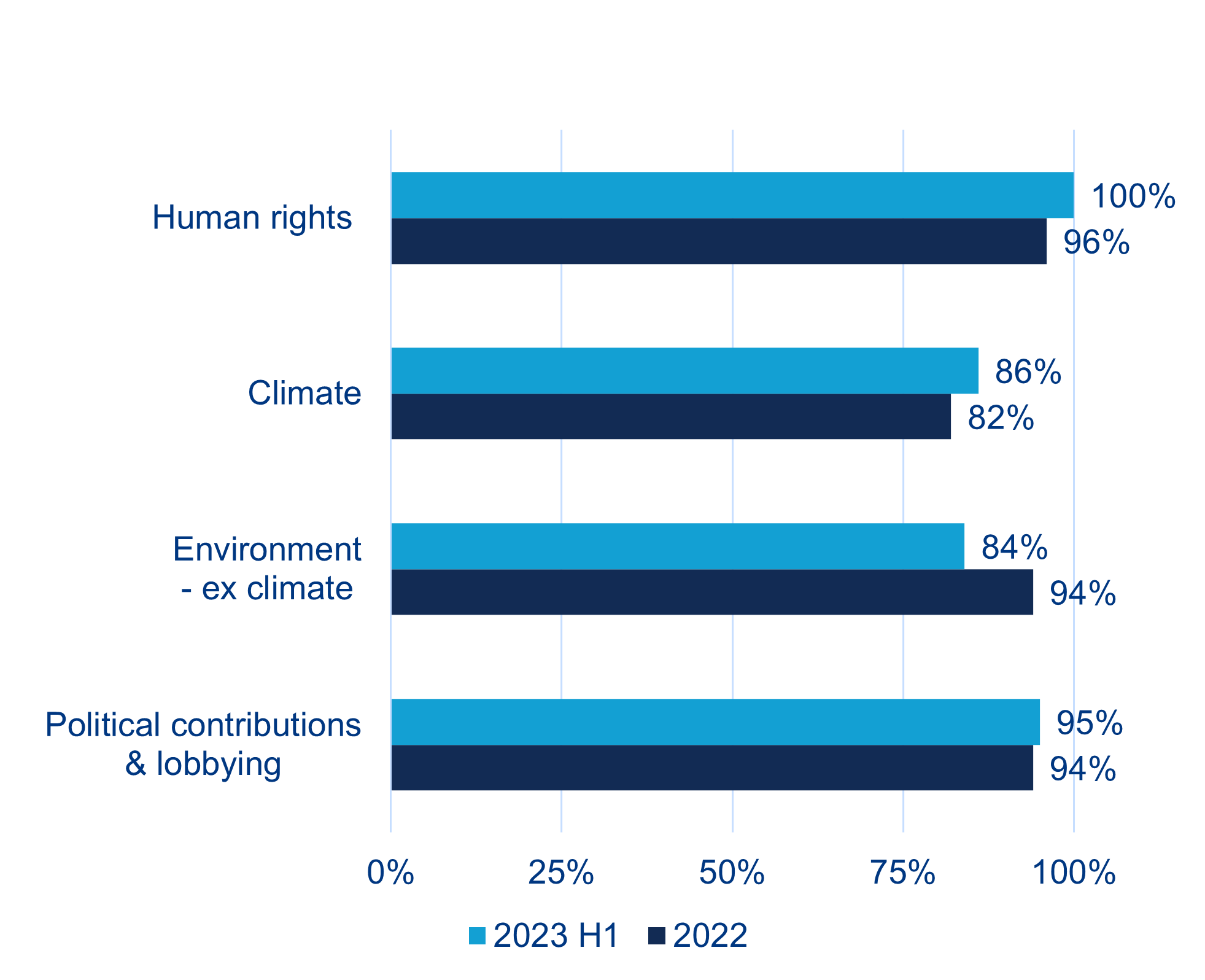

Our approach is to vote consistently on shareholder resolutions across our holdings globally, generally supporting a resolution if it is in shareholders’ interest and not overly prescriptive. Our voting statistics show high support for human rights-related resolutions as well as proposals focusing on environmental and climate concerns including lobbying (see Exhibit 1).

Although climate, political influence and human rights still dominate the range of themes, shareholder proposals continue to reflect a dynamic agenda. For example, in 2023 we saw a large increase in shareholder resolutions relating to reproductive rights. This followed the US Supreme Court’s June 2022 repeal of its 1973 ruling in the case of Roe versus Wade. These resolutions took different angles on the issue of reproductive rights including potential workforce risk, data privacy and misalignment of political spending. We were generally supportive of many of these resolutions as a means of mitigating unequal health impact on employees. We also observed an increasing number of resolutions with an anti-ESG tenor. While we assessed and voted on these based on our policy, our expectation is for filers of resolutions to remain within the scope of requests relevant to investors.

Exhibit 1: Our support for US shareholder resolutions

Source: Allianz Global Investors, as at 30 June 2023

3. ESG KPIs: the norm at large European companies

In 2022, we announced our expectations for large European companies to include ESG KPIs in management board remuneration plans. For example, high-emitting companies should include greenhouse gas reduction targets as a KPI, incentivising management to act immediately on climate change. Companies should generally include ESG KPIs that are material to the business and thus relevant to their strategy. Reviewing our 2023 voting statistics we find it reassuring that most large European companies have included ESG KPIs in their remuneration plans.

However, we still see room for improvement. We expect companies to set clear, transparent and measurable KPIs – which so far are often not implemented. An example of this is specific gender diversity KPIs which are preferrable to a scorecard approach where the underlying KPIs are not clear. Moreover, we ask companies to report transparently on KPIs, the underlying targets, and achievements, for investors to understand whether payouts are justified.

We expect the same transparency standards for sustainability and financial KPIs. This is particularly important as sustainability KPIs should not evolve into a “guaranteed payout” when financial targets have not been achieved. Finally, management should only be rewarded for ambitious goals and not for actions that are part of their usual tasks, such as putting a sound compliance framework in place.

4. Gender and ethnic diversity: a mixed picture

We believe governance that genuinely embraces diversity – demonstrated through appropriate gender representation and a broad spectrum of skills and experience – is likely to achieve better outcomes for investors. This is why we introduced voting guidelines on gender and ethnic diversity, with the latter limited to the UK and North America. We vote against chairpersons of the nomination committee if the share of female members on the board is below 30%.

We have observed good progress on board-level gender representation in the UK, France and Italy – also reflecting regulation and listing rules – while countries such as Sweden and Switzerland still have significant gaps in board diversity, thereby triggering vote action. However, some countries such as France and the UK are setting the bar even higher having introduced requirements or recommendations for 40% female representation on boards.

The Parker Review has brought ethnic diversity on to the agendas of UK companies in recent years. Progress has been significant with only a few UK companies in our voting universe lacking representation of at least one member from a minority ethnic background on the board. By contrast, more work remains to be done in North America. In line with our policy, we voted against 12 nomination committee chairpersons this year due to insufficient ethnic diversity on their boards and will continue to engage on this topic. Ethnic diversity is also hugely relevant in other countries. However, some locations face regulatory-driven restrictions over the transparency of their diversity data which does not allow investors to implement voting rules more broadly.

Looking ahead

In line with the rising importance of sustainability in investment decisions, we are increasingly reflecting environmental and social issues in our voting guidelines and actions. We consider this important as we believe that boards should be held accountable for material sustainability issues, and that management should be incentivised to incorporate these issues into corporate strategy and targets. Where we assess progress to be insufficient, we have become more vocal this year by pre-announcing our votes for the first time. We selected companies in line with our three sustainability themes – climate change, planetary boundaries and inclusive capitalism – voicing concerns on weak climate commitments and failure to respect fundamental labour rights. Looking ahead to 2024, we are considering embedding climate considerations into our voting policy for a larger set of companies. We are also looking to strengthen our voting rules on gender diversity.

1Sustainable Investment Institute https://siinstitute.org/ as of July 2023

2Sustainable Investment Institute https://siinstitute.org/ as of July 2023

3FCA Listing Rules set out some of the rules applicable to companies listed (or seeking to list) on the London Stock Exchange.

4The Parker Review, https://parkerreview.co.uk/