Achieving Sustainability

Rewiring technology for sustainable growth

The rate, scale and breadth of technological advancement is the most extensive it has ever been. While this brings wide-ranging opportunities, technology faces its own sustainability challenges. How does the sector balance rising demand and rapid evolution with an improved sustainability footprint?

Key takeaways

- Use of technology has become intrinsic to our daily lives – particularly since the Covid-19 pandemic.

- Technology is also critical for advancing sustainability goals, particularly for the transition to net zero.

- At the same time, the sustainable credentials of technology are under scrutiny – from automation replacing human workers to inappropriate use of social media.

- Thinking more holistically about sustainability and technology can make for better outcomes for the global economy – and the planet.

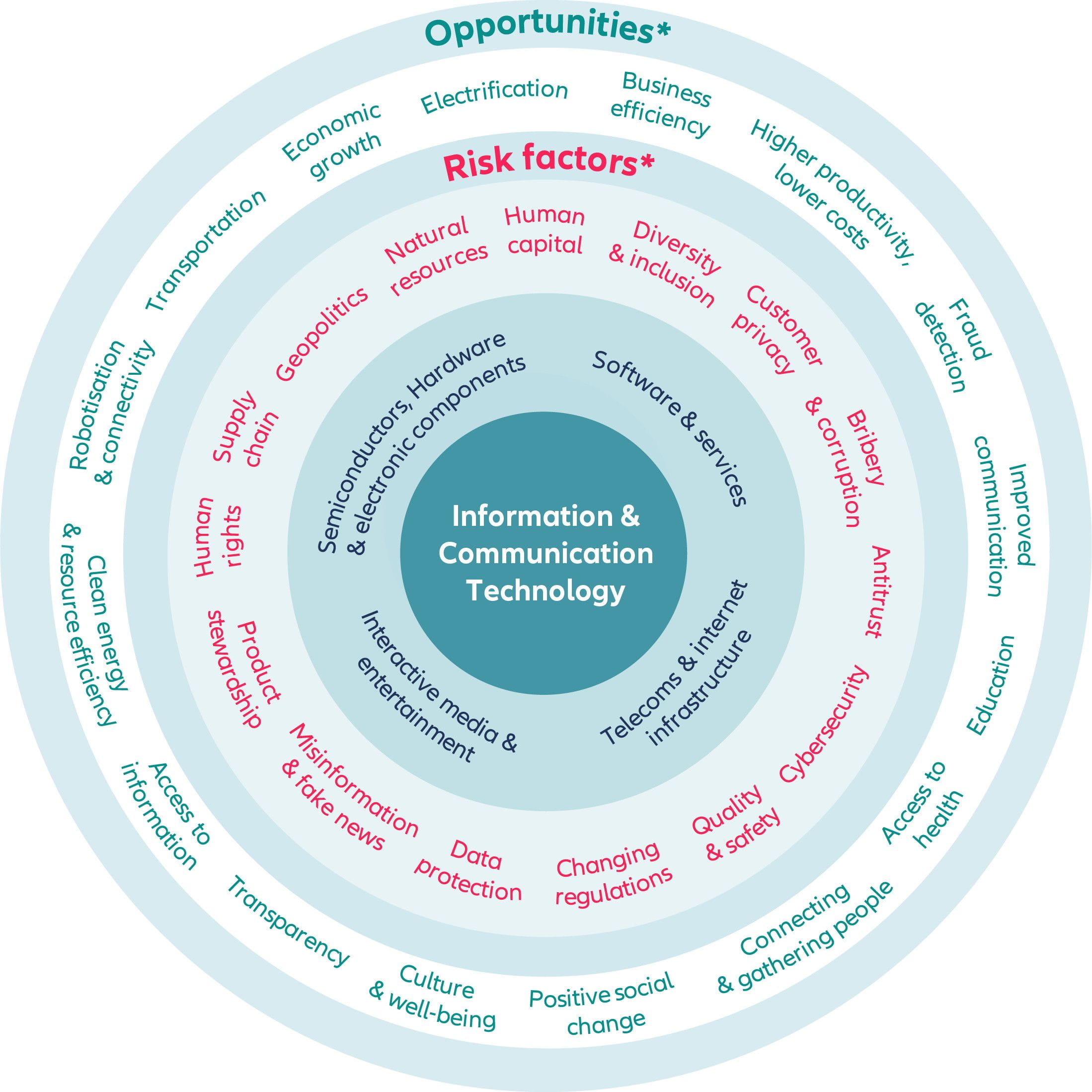

While technology is a broad catch-all term, as investors we focus on the Information and Communication Technology (ICT) sector, which is broadly categorised into four sub-sectors incorporating hardware, software, and services (see inner circle of Exhibit 1). Each of these sub-sectors is exposed to different opportunities and risks.

The ICT sector’s evolution, innovation and contribution to global economic growth is integral to attracting investors, and its attractiveness has been heightened by the Covid-19 pandemic. The sector is estimated to have grown three times faster than overall OECD economic growth in the past decade, reaching 7.6% in 2023 – its highest rate of growth to date.1

Covid-19: a seismic shift for technology

The Covid-19 pandemic transformed the world’s relationship with technology. From home-schooling to cashless payments, technology has been rapidly woven even deeper into our daily lives, becoming a social necessity.

While technology has become a key societal enabler, issues such as technology addiction and cybersecurity risks highlight the flipside of technological progress. Advancements achieved at the expense of the climate, planet or social fabric will increasingly come under scrutiny from politicians, regulators and society.

Developing technology responsibly will be the basis for a resilient and sustained growth trajectory with less vulnerability to setbacks, and it will be the driver supporting the next wave of technological developments and solutions. Exhibit 1 illustrates many of the risks and opportunities to consider across the sector.

Exhibit 1: Technology opportunity and risks

*Risk factors and opportunities are applicable to all four areas of ICT

Source: Allianz Global Investors Sustainability Research, 2024

Powering economic growth

Connecting people, identifying efficiencies, and creating solutions can catalyse progress in business, economies and society. In addition to generating revenues and lowering costs, this can also create resilient and sustained economic growth.

These can help critical sectors – eg, energy, materials, transportation, healthcare and food – adapt to changing climate, planetary and social demands.2 Such innovations include blockchain, cloud computing, machine learning, advanced analytics and control technologies.

Use of such technologies can support economic growth through enabling companies and nations to manage current demands and future higher demands.

The deepening footprint of technology

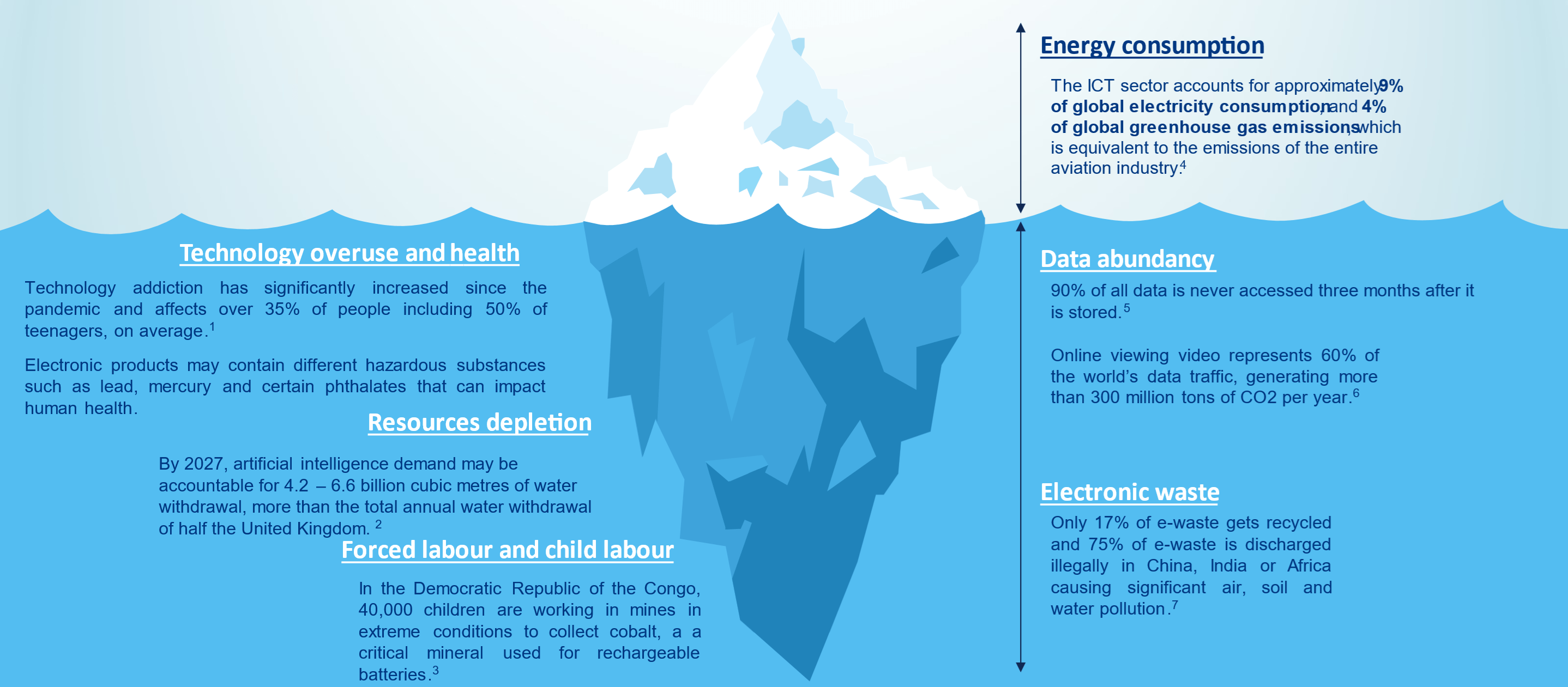

Typically, when thinking about the sustainability impact of ICT, commentators tend to focus on emissions rather than the hidden aspects that we think deserve greater attention. We are frequently asked about the cost, or “harm”, of technological advancements (illustrated in Exhibit 2), and if we consider there to be a net benefit.

Exhibit 2: Examples of hidden sides of technology

Source: 1. The Center for Internet & Technology Addiction, 2024; 2. OECD AI Policy Observatory, November 2023;

3. Amnesty International, 2017; 4. The Shift Project, March 2021; 5. IEA; 6. The Shift Project; 7. WHO, October 2023

Allianz Global Investors Sustainability Research, 2024

The primary costs – or risks – of technology can be categorised into the three dimensions of environmental, social and governance:

- Environmental intensity

Through the lifecycle of ICT products the sector is highly energy intensive, currently accounting for

4-6% of global electricity consumption – a figure that is set to increase by 2030 to 20%.3 Additionally, a vast and under-appreciated amount of water is used – from the sourcing of strategic metals and minerals through to cooling equipment for optimal performance. The extraction of these minerals is also becoming increasingly invasive to ecosystems, in terms of habitat destruction and pollution.Meanwhile, technology products’ contribution to global electronic waste (e-waste) is projected to reach 120 million tons annually by 2050, if current trends persist.4 E-waste is highly polluting,5 a problem exacerbated in lower income countries by illegal dumping. Without a circular economy – to promote continuous use, recycling and repurposing of materials – the unsustainable cycle of extraction, pollution and waste will continue.

Did you know?

A typical semiconductor manufacturing facility uses 2-4 million gallons of ultrapure water6 daily, equivalent to the annual water consumption rate of 10,000 people in the UK.7

- The social contract

The scope for technology to increase inclusion through access and connectivity is significant, but at what social cost? Technology hit the headlines this year when misinformation and disinformation was cited as the most significant short-term global risk by the World Economic Forum (WEF)8 – a rising concern in this heavy election year. Furthermore, technology can be highly immersive for users and generate both mental and physical health issues, including addiction, isolation and exposure to extreme or anti-social content.

Future employment opportunities are in question with increased productivity raising concerns about job displacement by automation. Yet despite the ubiquity of technology, a digital divide exists, with one third of the global population estimated to be falling further behind broader economic growth due to insufficient digital progress and policies.9

- Technological progress needs strong governance

The global economy will achieve its technological potential only if technology can fulfil a digital duty of care in key areas. The first of these is around big tech dominance. Innovation needs disruptors, but does the presence of the “Magnificent 7” crowd out other players?11 The second important dimension is cyber insecurity, highlighted in the recent WEF Global Risks Report 2024, indicating that our economic dependence on technology has not been matched by the development of appropriate user protection. Finally, there is a need for ethical tech standards and regulations to improve the governance of those social risks highlighted above.

Our focus, as investors, is on how technology is being used, and we seek opportunities where it contributes positively to society and to the planet.

Did you know?

The cost of rising scale and sophistication of cybercrimes is estimated to jump from

USD 8.4 trn in 2022 to USD 23.8 trn in 2027.12

How to protect future tech

We believe a resilient, sustained contribution of technological innovation to the global economy requires a comprehensive risk assessment and mitigation framework. Companies and sectors structurally out of sync with customer, regulatory or political expectations will likely face interventions, eg, reputational issues or political action. The industry needs to invest heavily in mitigating risks to protect its existing footprint, not just its future handprint,13 for example:

- Circular solutions: moving from planned obsolescence to circular business models with a more considered approach to frequent tech upgrades.

- Helping consumers: enhancing energy efficiency solutions can drive lower consumption, reducing household energy bills.

- Climate and planet protection: improved geospatial and modelling technologies can help in earlier identification of emerging biodiversity degradation and weather-event vulnerability.

- Health: use of artificial intelligence to support medical diagnoses and more precisely match drugs to patients, bringing social and financial benefits to ease the over-burdened global health system.

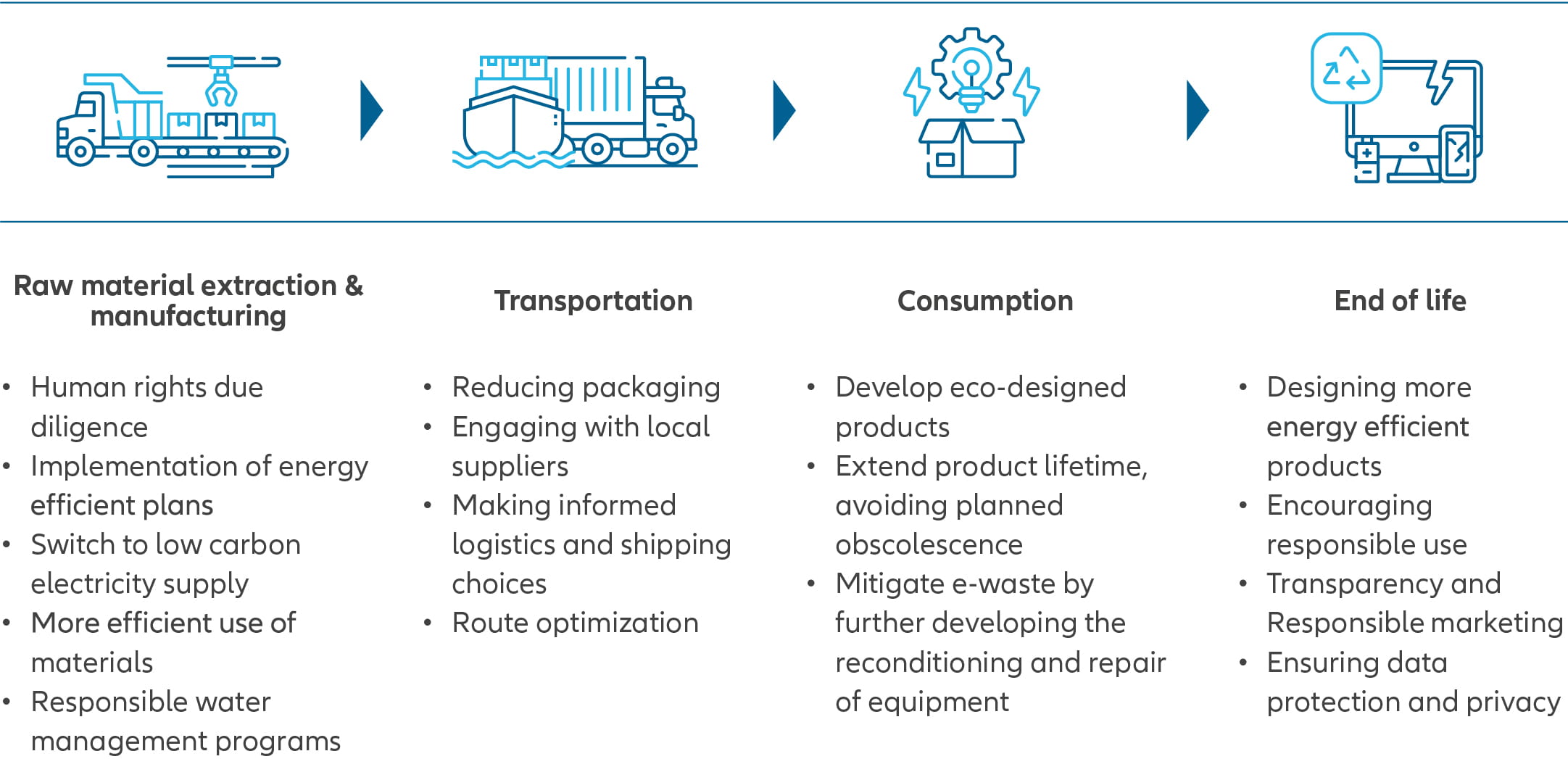

In terms of mitigating the environmental impacts, there are opportunities through each life cycle stage from materials sourcing to product design to consumption. See examples in Exhibit 3.

Exhibit 3: Rethinking the IT value chain

Source: Allianz Global Investors Sustainability Research

Regulation is coming

Rapid technological advancements have outpaced the ability of governments and society to appropriately manage this progress. If technology companies fail to develop with responsibility to the fore, stricter regulations will follow. Further development of legal and regulatory frameworks for technology appears inevitable, but it remains to be seen how restrictive this may be.

We already see regional divergence: Europe and the UK are more geared to risk-based regulation14 than the US, which is home to the largest tech players. However, based on oversight and supply chain concerns, we are seeing impetus for greater safeguards in the US at both Federal15 and Congress16 levels.

Investing in a resilient technological future

The opportunities to invest in the advancement of technology are significant and multi-faceted. They include mitigating the risks of existing technology, as well as maximising opportunities for future tech, for example:

- Fuelling progress: failure to address the resource, energy and water intensity impacts of technology will restrict the “fuel” for the sector’s growth potential. Promoting enablers and adopters of circular systems is one such opportunity. The value of raw materials included in global e-waste was estimated

at USD 57 bn in 2019,17 and yet only 1% of strategic metals and minerals were met by recycling.18 –With e-waste projected to double by 2050,19 the investment case is compelling. - Fixing weak links: the sector must understand and address the huge dependency risks in the supply chain. Opportunities exist to invest in on-shored new ventures through to working with best-practice operators on environmental and social protection.

- Achieving sustainability goals: digital technologies benefit 119 out of 169 (70%) of all UN Sustainable Development Goal targets,20 including climate, health, biodiversity and social goals.

- Be engaging: the size, culture and leadership of major tech players makes engaging on critical sustainability topics more challenging. Using our comprehensive sector and engagement frameworks, we will continue to target material areas for improvement and resilience, thereby supporting economic growth.

We take the view that sustainability and technology are very much interdependent. Together they can thrive with a reimagining of their future and with contributions from both critics and advocates in both areas. We believe that careful consideration by all stakeholders of how these two fields can co-exist will drive resilience and impactful economic and social development globally.

1 OECD Digital Economy Outlook, May 2024

2 WEF, Digital Transformation, Digital Solutions Explorer, 2024

3 IEA, Net Zero by 2050 - A Roadmap for the Global Energy Sector, October 2021

4 WEF, A_New_Circular_Vision_for_Electronics.pdf (weforum.org), January 2019

5 WHO, Electronic waste (e-waste) (who.int), October 2023

6 Ultrapure water has been purified to uncommonly stringent specifications.

7 Ecorise.org Global Water Usage: How Do Countries Compare? (watercalculator.org), April 2023

8 World Economic Forum, Global Risks Report, January 2024

9 ITU, Facts and Figures 2022: Latest on global connectivity amid economic downturn, November 2022

10 McKinsey, Jobs lost, jobs gained: What the future of work will mean for jobs, skills, and wages, November 2017

11 The term Magnificent 7 refers to seven dominant technology stocks: Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla

12 WEF, 2023 was a big year for cybercrime – here’s how we can make our systems safer | World Economic Forum (weforum.org) January 2024

13 Handprint refers to actions taken to have a positive impact, over and above reducing the negative – footprint – impacts.

14 Examples are the General Data Protection Regulation (GDPR) introduced in 2018, the Digital Market Act of March 2024 or the forthcoming EU Artificial Intelligence Act

15 US Government Accountability Office, Federal Regulation: Selected Emerging Technologies Highlight the Need for Legislative Analysis and Enhanced Coordination, January 2024

16 Center for American Progress, Congress Must Take More Steps on Technology Regulation Before It Is Too Late, May 2024

17 UN University, Unitar, ITU, International Solid Waste Association, The Global E-waste Monitor 2020

18 Unitar Global e-Waste Monitor 2024: Electronic Waste Rising Five Times Faster than Documented E-waste Recycling

19 UN Environment Programme, How disposable tech is feeding an e-waste crisis, November 2022

20 ITU, UNDP, SDG Digital Acceleration Agenda_2.pdf (undp.org), 2023