Sustainability

Defining the rules of engagement to protect biodiversity

Pressure on the private sector to accelerate the protection of nature and biodiversity has increased since last year’s COP 15 Global Biodiversity Framework (GBF) agreement.1 As awareness of biodiversity loss rises, investor engagement with companies is essential to scope the risks and opportunities of this investment theme.

Key takeaways

- Biodiversity issues are highly complex and very sector specific, and investors must prioritise issues within the respective industry sectors.

- Active and targeted investor engagement is needed to influence companies’ strategies in the face of insufficient corporate action on the risk of biodiversity loss.

- The lack of availability, quality and comparability of data is a significant hurdle, but collective initiatives are driving the development of biodiversity frameworks and disclosures – like the Task Force for Nature-related Financial Disclosures.

- Thorough engagement will also help identify the many opportunities for companies that are providing solutions for a nature-positive transition.

Biodiversity loss is happening across all the planet’s ecosystems, causing a species extinction rate that is hundreds of times higher than the average of the past 10 million years – and accelerating.2 This requires urgent action from investors. In October 2021, we published a thematic paper outlining the importance of protecting the world’s natural capital alongside the focus on addressing climate change.3 Since then, weather events and the UN COP 15 Biodiversity Conference have only reinforced the need to deploy investment to this area. Ahead of the COP 16 Biodiversity Conference in 2024, all countries are required to update their National Biodiversity Strategies and Action Plans, and National Biodiversity Finance Strategies in line with the GBF.4 These efforts could lead to more tangible regulations and policies to support biodiversity financing.

Prioritising biodiversity as an engagement theme

Supporting the reduction of biodiversity loss is a priority for Allianz Global Investors, and we developed a structured biodiversity engagement framework as well as a pilot biodiversity engagement project in 2022. The aim of these activities was to better understand how investee companies consider biodiversity-related risks and opportunities, and to push for improved disclosures and explicit strategies on natural capital.5 It was also an opportunity to improve awareness within corporates of this topic and how it has become increasingly incorporated into investment decisions.

This paper introduces our approach to identifying biodiversity-related risks and opportunities. It also highlights strategies to address the associated challenges and presents the preliminary findings of our engagement project.

Understanding biodiversity impacts and dependencies

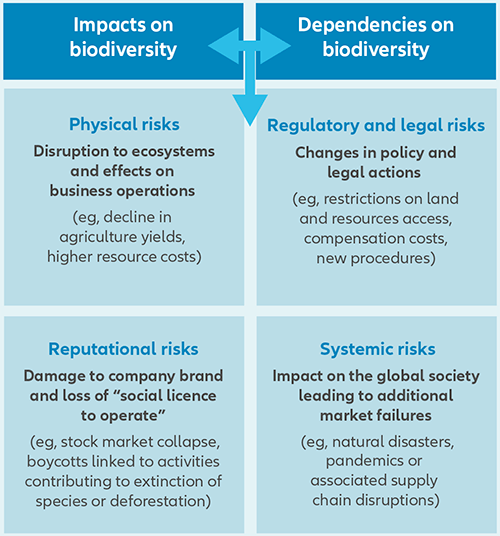

All business activities both impact and depend on biodiversity, whether directly or indirectly. Deficiencies in biodiversity management can translate into different types of risks, potentially affecting business continuity – as shown in Exhibit 1.

For investors to identify and prioritise both the companies to engage with, and the biodiversity issues to engage on, requires their understanding of the risks of nature loss stemming from the operations or business context of investee companies.

Exhibit 1: The double-materiality of biodiversityrelated risks6

Source: Allianz Global Investors

Examples of such risks are commonly grouped into four categories. Below are some examples:

- Physical risks: eg, long-term monoculture farming and overuse of pesticide and fertiliser leading to yield decline.

- Reputational risks: eg, companies with severe environmental incidents, or those that sell products linked to species extinction or ecosystem disruption.

- Regulatory and legal risks: eg, a law requiring companies operating or selling specific products in the European Union to disclose that their supply chains are “deforestation-free”7 has been adopted recently by the European Council and European Parliament with the aim of preventing deforestation.

- Systemic risks: eg, the current drought crisis in Spain threatens businesses that are dependent on water.

Biodiversity materiality by sector and location

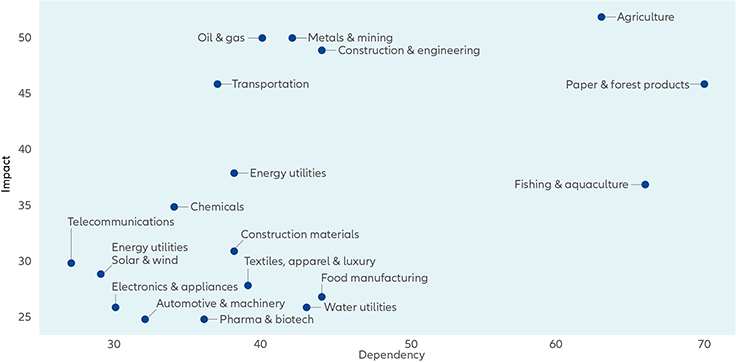

A significant challenge to understanding biodiversity issues is that they vary by industry sector and are highly dependent on how a business interacts with nature. These dependencies include the resources used, production processes and product lifecycle. As shown in Exhibit 2, we apply the WWF Biodiversity Risk Filter to assist in prioritising sectors for engagement that are either highly impacted or highly dependent on biodiversity.

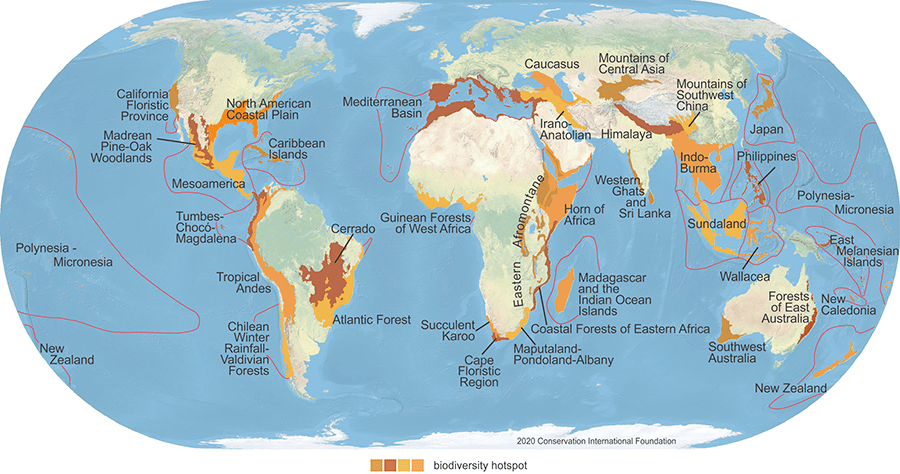

Another special characteristic of biodiversity is that location matters. Biodiversity hotspots and natural resources are highly concentrated in a relatively small part of the world.9 Brazil, Indonesia and South Africa are among 17 of the most biodiversity-rich countries10 that cover only 10% of the Earth’s surface but are home to 70% of species diversity.11 Where a company and its supply chains operate is a key factor in deciding what action plans it should formulate.

Exhibit 2: Analysis of direct and value chain biodiversity dependencies and impacts for selected sectors

The x axis shows weighted industry specific biodiversity dependency factors and the y axis shows weighted industry specific biodiversity impact based on factors in the WWF Biodiversity Risk Filter.

Each factor has a weighting from 0 - 5 where 0 = no dependency/impact and 5 = very high dependency/impact.

Source: WWF Biodiversity Risk Filter Methodology Documentation,8 and Allianz Global Investors

Exhibit 3: Biodiversity hotspots map

Conservation International (conservation.org) defines 36 biodiversity hotspots – extraordinary places that harbour vast numbers of plant and animal species found nowhere else. All are heavily threatened by habitat loss and degradation, making their conservation crucial to protecting nature for the benefit of all life on Earth.

The colors assigned to the hotspots are only used to distinguish adjacent hotspots and have no other meaning. The biodiversity hotspots represent terrestrial biodiversity only.

Source: Conservation International, 2016

With greater understanding of the specificities of biodiversity outlined above, investors can screen for companies with high biodiversity risks and impacts. They can also identify those companies that have managed these risks and impacts poorly. Tools and datasets available to investors for this screening include water and deforestation questionnaires from the Carbon Disclosure Project (CDP), the Nature Benchmark from the World Benchmarking Alliance and the Forest 500 rankings from Global Canopy, as well as biodiversity-related controversies and data.

Corporates need to keep pace with the challenge

Despite evident rising risks posed by biodiversity loss, most companies are failing to address the issue rapidly enough. Many businesses lack a thorough understanding of their dependencies on ecosystems – in particular through their supply chains – and how to manage both risks and opportunities. Boards and senior management need the relevant skills. Drawing on insights from over 2,600 CEOs, the recent UN Global Compact-Accenture CEO Study reveals that only 17% acknowledge their companies’ operational dependence on biodiversity and the extent of its materiality. Additionally, 80% of CEOs recognise the impact of their business on biodiversity but have difficulty in initiating actions.12

Companies that are most advanced and wish to build their resilience are restricted by the lack of both available data and standardised metrics for conservation management and environmental risk assessment. Their motivations are further limited by insufficient political and regulatory support. According to CDP, while almost half of companies have started to make a public commitment on biodiversity, 70% of them do not assess the impact of their value chain on biodiversity.13

Our pilot biodiversity engagement project

While these challenges were confirmed by our pilot biodiversity engagement project in 2022, we also found that more companies have started working with the Taskforce for Nature-related Financial Disclosures (TNFD) and the Science Based Targets Network (SBTN). Although the frameworks developed by TNFD and SBTN have not yet been finalised, our engagement project has revealed that companies are participating in such initiatives to explore an industry-specific biodiversity approach. One example from our engagement activity is a paper and forest products company that has worked with the SBTN to develop indicators for assessing biodiversity impacts; it will require its suppliers to report on these. Over the next few years, we expect more alignment on such assessments and better-quality biodiversity data to become available.

Progress in this direction is likely to be accelerated by another positive trend identified from our engagement activity: more companies committing to the global goals of Nature Positive by 2030. This initiative seeks to reverse the current declines in biodiversity.14 Additionally, the recent launch of SBTN’s first methodologies to set science-based targets for nature also offers further guidance for companies.15

We further find from our research and engagements that despite these fast-evolving frameworks and methodologies, companies need to make greater efforts to align corporate governance structures with biodiversity targets and strategy. This includes building internal accountability and ensuring consistency of business action to reverse nature loss and environmental degradation. Investors can use the TNFD governance and strategy recommendations to guide assessment and engagement with investee companies. This can help with raising questions on issues such as board oversight, and how the consideration of biodiversity risks and impacts are integrated into corporate strategy. Furthermore, elements of the CDP water and deforestation questionnaires also provide useful guidance to aid investors.

The challenges of biodiversity are multidimensional. They require a solid coordination mechanism to address issues holistically. This includes realigning actions and exploring synergies and trade-offs between biodiversity protection, climate change mitigation, and inclusive development. Considering climate and biodiversity as part of the same crisis while also considering the highly interlinked social impacts is crucial to ensure coherence in policies and actions.

Developing a framework for biodiversity engagement

Our sector-specific approach to biodiversity engagement identifies target sectors. The biodiversity impacts and dependencies as well as our exposure to them is considered for each sector. Based on this we have prioritised the following five sectors in our engagement framework:

- Food and agriculture

- Paper and forest products

- Metals and mining

- Chemicals

- Utilities

We also seek to integrate biodiversity aspects into our established climate engagements with companies in additional sectors, such as the energy and financials sectors.

Generally, our engagement is framed by the following pillars where we recommend that companies gradually implement frameworks and demonstrate action on biodiversity:

- Sound governance: implementing adequate governance of biodiversity risks and impacts including oversight by boards and senior management, and a strong biodiversity policy.

- Thorough assessment and metrics: conducting regular biodiversity assessments and identifying and collecting relevant and robust data.

- Strong commitment: setting ambitious and clear goals and targets.

- Comprehensive actions: building expertise and implementing action plans to manage material biodiversity risks and reduce biodiversity impacts.

- Transparent disclosure: reporting regularly on biodiversity and endorsing TNFD.

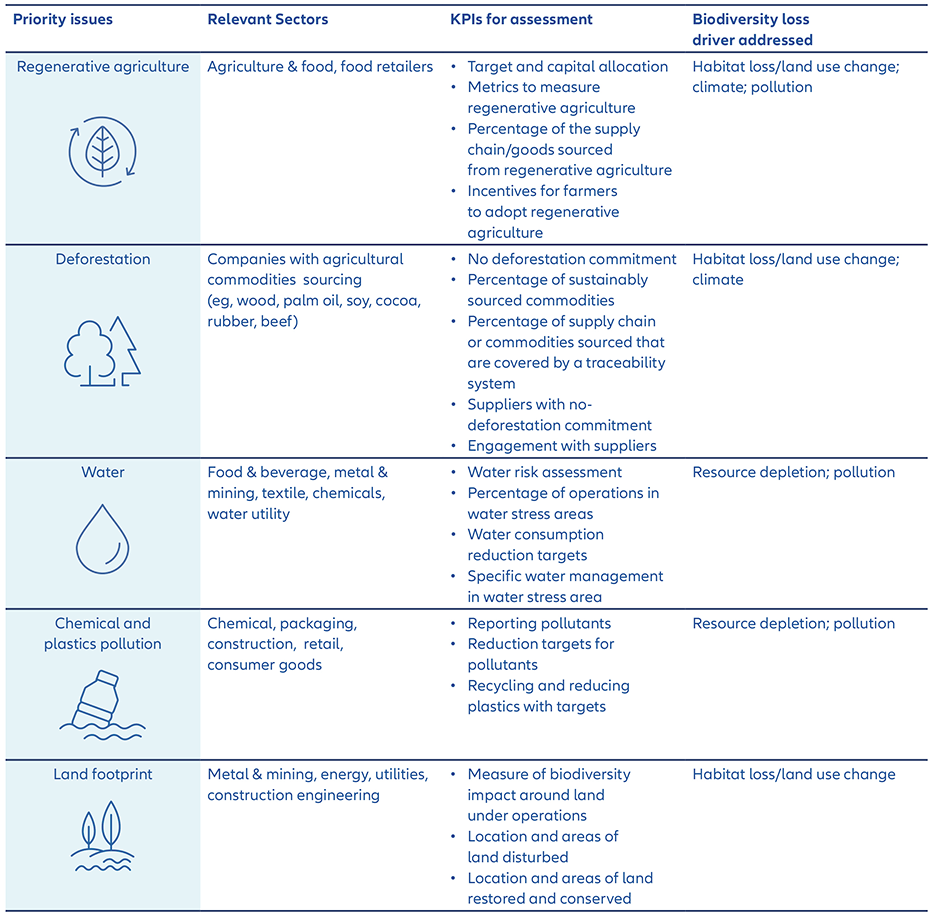

Exhibit 4: Priority biodiversity issues and relevant key performance indicators

The highly sector-specific nature of biodiversity also means that there is no formulaic approach especially when it comes to taking actions, hence investors will need to understand key biodiversity issues associated with different business activities to be able to assess the performance of investee companies. To this end, we have identified the priority biodiversity issues to discuss with investee companies during engagements - as shown in Exhibit 4.

With better biodiversity management and data quality in future, we anticipate being able to leverage the use of biodiversity-related data for engagement, including exploring the use of geographical data.

Case study: biodiversity engagement with a food company

The agri-food sector poses the greatest threat to nature

Agriculture alone is responsible for 80% of global deforestation16 and 70% of water use worldwide.17 Regenerative agriculture, where the primary objective is to improve soil health and fertility, is an emerging sustainability strategy for agri-food companies. However, we observe a considerable discrepancy between companies’ growing commitments to be nature-positive and the relative lack of quantified targets on regenerative agriculture, which gives rise to the risk of greenwashing. According to the FAIRR investor initiative, nearly 60% of the agri-food companies they assessed mentioned regenerative agriculture as a part of their sustainability strategies but, only 33% have set targets.18

In our engagement with an international food company

Our key objectives were to gain clarity on its regenerative agriculture claims, encourage commitment on deforestation-free supply chains, and understand the effectiveness of its water management stewardship.

Examples of questions asked in the engagement process:

- How does the board and top management oversee biodiversity?

- Do you conduct biodiversity impact and dependency assessments?

- How do you ensure yield when promoting regenerative agriculture?

- What do you expect from regenerative agriculture?

- When will you consider committing your supply chains to being fully deforestation-free?

- How do you manage water impact especially in water stress areas?

From this engagement, we learned that the company considers biodiversity as an essential element for achieving its net-zero goal. Furthermore, the topics that we raised with this company are core to its biodiversity strategy, while on water and deforestation it is more advanced although challenged in leveraging this further across its entire supply chain. The company’s approach to regenerative agriculture is still at an early stage, but it has ambitions to provide more guidance to farmers based on its findings and data. It has also committed to regular disclosures on progress.

The role investors can play

The financing gap to restore biodiversity by 2030 is estimated to be USD 711 billion per year.19 Thus, integrating biodiversity into investment strategies means directing capital flows towards companies contributing positively to biodiversity and nature restoration. This can translate into a combination of different approaches for investors including:

- Mitigating negative impacts through risk identification using impact and dependency screening. Protection and restoration of biodiversity is one of the six environmental objectives defined in the EU taxonomy20 and is reflected in the application of Principal Adverse Impacts to comply with the Do No Significant Harm requirements.21

- Excluding companies exposed to biodiversity-related controversies.

- Supporting activities that have a positive impact on biodiversity protection and restoration – known as handprint investing.

- Identifying biodiversity contribution to the UN Sustainable Development Goals (SDGs).22 While directly contributing to SDG 14 and 15, biodiversity plays an essential role in achieving most of the 17 UN SDGs.23

A global challenge requiring a truly global approach

Climate and planetary goals can be achieved only with a global and coherent approach to biodiversity. We believe that increased awareness, the implementation of the Global Biodiversity Framework agreed at COP 15, improvements in disclosures and data, and more clearly aligned biodiversity investment opportunities will help direct the necessary scale of financial capital needed to protect the world’s natural capital.

The nature-positive transition is currently at an early stage, yet accelerating rapidly. In our view, the investors and companies to act first will be best-positioned to capture the opportunities and benefits of preventing biodiversity loss.

1 Source: UNEP, COP 15 ends with landmark biodiversity agreement, December 2022

2 UN, Species Extinction Rate Hundreds of Times Higher Than in Past 10 Million Years, Warns Secretary-General Observance Message, Urging Action to End Biodiversity Loss by 2030 | UN Press, May 2022

3 Allianz Global Investors, Beyond climate: it’s time to integrate biodiversity into investment processes (allianzgi.com), October 2021

4 European Commission, EU at COP 15 global biodiversity conference (europa.eu), December 2022

5 Natural capital is another term for the stock of renewable and non-renewable resources (eg, plants, animals, air, water, soils, minerals) that combine to yield a flow of benefits to people, as defined by the Natural Capital Coalition in 2016

6 Double materiality in this context refers to both how businesses are impacted by the risk of biodiversity loss and how their own operations present a risk to biodiversity

7 European Council of the European Union, Council adopts new rules to cut deforestation worldwide – Consilium (europa.eu), May 2023

8 WWF Biodiversity Risk Filter Methodology Documentation, January 2023

9 UN WCMC, Biodiversity a-z, December 2020

10 WWF Biodiversity Risk Filter Methodology Documentation, January 2023

11 World Atlas, The World’s 17 Megadiverse Countries

12 United Nations Global Compact-Accenture CEO Study, 2022

13 Carbon Disclosure Project, New data shows companies recognising biodiversity risks but majority not turning commitments into action, November 2022

14 Nature Positive

15 Science Based Targets Network, The first corporate science-based targets for nature are here – Science Based Targets Network, May 2023

16 WWF Living Planet Report 2020

17 OECD Managing water sustainably is key to the future of food and agriculture

18 FAIRR, Regenerative Agriculture: The Topic of the Moment, April 2023

19 Paulson Institute, The Nature Conservancy, Cornell Atkinson Centre for Sustainability, Financing Nature: Closing the Global Biodiversity Funding Gap, 2020

20 European Commission, EU taxonomy for sustainable activities

21 The PAI indicators related to biodiversity are: activities negatively affecting biodiversity-sensitive areas, emissions to water, hazardous waste ratio and violations of UN Global Compact principles and OECD guidelines

22 UN Sustainable Development Goals, https://sdgs.un.org/goals

23 Convention on Biological Diversity, Biodiversity and the 2030 Agenda for Sustainable Development