Survey of US Consumers Sheds Light on ‘Generation Z’

Summary

More than 840 people recently spoke to our Grassroots Research team about their spending habits, financial goals and more. Among them were members of generation Z – a young demographic that, at least for now, places a much greater emphasis on lifestyle experiences over retirement savings.

|

Key takeaways

|

Consumers have long been the driving force behind the US economy, powering an estimated 70 per cent of US gross domestic product with their spending. To learn more about what fuels the lifestyle and consumption preferences of US consumers, Grassroots℠ Research – AllianzGI’s proprietary investigative-research team – commissioned interviews with 841 respondents throughout the country.

What we found sheds light on several key differences between generations – including baby-boomers, who are well-understood, and “generation Z”, which is just now beginning to make its preferences known.

Our survey reached people born between 1942 and 1997. For the purposes of this study, we defined baby-boomers as those born between 1942 and 1964, and generation Z as those born between 1991 and 1997.

Notable lifestyle differences between boomers and generation Z

As expected, we found several notable differences between the oldest and youngest survey respondents:

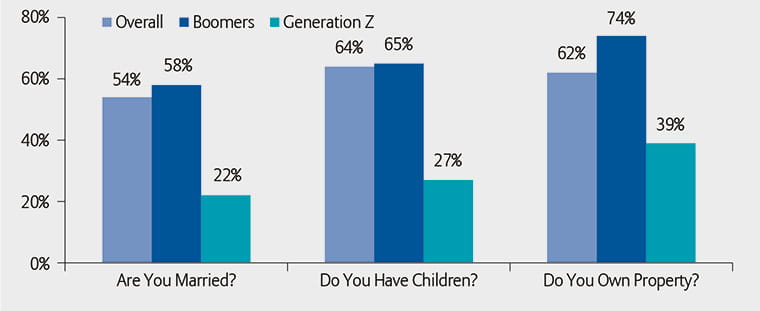

- Marriage – 54 per cent of all respondents, 58 per cent of baby-boomers and 22 per cent of generation Z are married

- Parenthood – 64 per cent of all respondents, 65 per cent of boomers and 27 per cent of generation Z are parents

- Property ownership – 62 per cent of all respondents, 74 per cent of boomers and 39 per cent of generation Z own a house or apartment

How Different Is Generation Z from the Rest?

Survey respondents born between 1991 and 1997 are just starting out their adult lives, as reflected in their lifestyle choices.

Source: GrassrootsSM Research. Data as at August 2017.

Saving for retirement is not yet a priority for generation Z

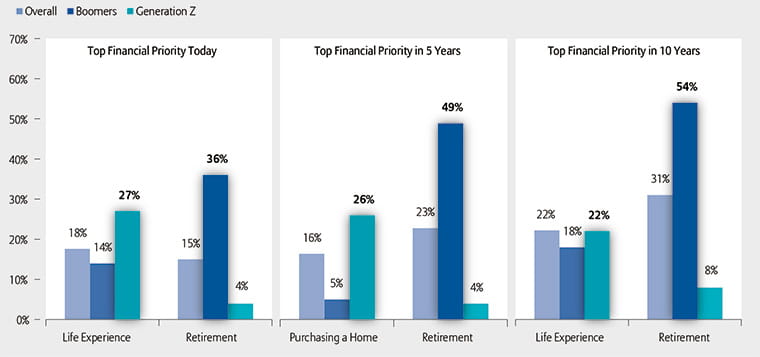

When we asked our survey respondents about their top financial priorities today, we learned that retirement was the most frequently cited concern by only 36 per cent of baby-boomers. About one-quarter of boomer respondents said their biggest priority today had to do with the costs associated with owning a home – such as mortgage costs, association fees, maintenance/upkeep and purchasing furniture.

Meanwhile, 27 per cent of generation Z respondents put the most emphasis on life experiences – such as dining/entertainment, travel and social activities. At the same time, about one-fifth of those in generation Z said paying down student debt was their most important priority. Saving for retirement topped the financial to-do list for only 4 per cent of generation Z members.

To see how their focus shifted over time, we also asked the respondents to tell us about their financial priorities over the next five and ten years.

- Retirement steadily climbed up the priority ladder for baby-boomers, 49 and 54 per cent of whom cited it as their most important financial concern for the next five and 10-year periods, respectively.

- Many of our generation Z respondents, on the other hand, changed their priorities when thinking about the next five years: purchasing a home was the most-cited priority for people we spoke to, topping the list for about one-quarter of respondents.

- When we asked other generational cohorts the same questions, retirement topped the list of financial priorities in 10 years for those born between 1965 and 1973 (46 per cent) and those born between 1973 and 1980 (32 per cent).

Generation Z Not Yet Focused on Retirement

Our survey of 841 respondents asked about their top financial priorities today, in 5 years and in 10 years. The most-cited choices for each time period are marked in bold.

Source: GrassrootsSM Research. Data as at August 2017.

Life-stage progression should lead to a shifting financial focus

To Financial Services Research Analyst Katherine He, this Grassroots℠ Research study shows clear evidence of how consumers’ life stages can shift their financial priorities: “Student debt is a particularly high burden to generation Z, even more so than to the millennial cohort immediately ahead of them. Over the next five years, we can infer that we’ll see increasing home-purchasing activity by millennials as they begin to have children. Meanwhile, generation Z is likely to focus on reducing their debt now before shifting their focus to buying a home – and, even later, to saving for retirement.”

GrassrootsSM Research is a division of Allianz Global Investors that commissions investigative market research for asset-management professionals. Research data used to generate GrassrootsSM Research reports are received from reporters and Field Force investigators, who work as independent, third-party contractors, as well as external research panel providers --all of whom supply research that may be paid for by commissions generated by trades executed on behalf of clients.

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Past performance is not indicative of future performance. Investments in commodities may be affected by overall market movements, changes in interest rates, and other factors such as weather, disease, embargoes and international economic and political developments. Investments in smaller companies may be more volatile and less liquid than investments in larger companies. Investments in emerging markets may be more volatile than investments in more developed markets. Dividends are not guaranteed. Bonds are subject to interest rate risk and the credit risk of the issuer. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security.

The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted.

This material has not been reviewed by any regulatory authorities. In mainland China, it is used only as supporting material to the offshore investment products offered by commercial banks under the Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations.

This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors U.S. LLC, an investment adviser registered with the U.S. Securities and Exchange Commission; Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424, Member of Japan Investment Advisers Association]; and Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan.

311031

Outlook & commentary

What’s fuelling the growing appetite for Asian bonds

Summary

To move past the financial crisis of the 1990s, Asian economies made a host of important structural changes – and Asian fixed income stands ready is positioned to benefit. Not only is there growing demand for Asian bonds from Asian investors, but outside investors are looking to the asset class – particularly sovereign debt – for its potential to enhance returns and reduce risk.

Key takeaways

|