Achieving Sustainability

Powering down to power up - energy efficiency explained

Shifting to cleaner energy is vital, but using less energy is just as important and can unlock new avenues for growth. Amid surging energy demand and a limited carbon budget, energy efficiency must become a priority.

Key takeaways

- Energy efficiency – ie, achieving the same outcome but using less energy – is the fastest and most cost-effective decarbonisation strategy but remains underdeveloped.

- Being more energy efficient requires minimising energy lost at every stage of the value chain – from raw inputs to end use.

- A spectrum of solutions present investment opportunities, from those reducing energy demand to shifts in business models and innovative financing structures.

While adopting cleaner energy sources is essential to the climate transition, using energy more smartly is also key to achieving net-zero emissions1 – particularly with energy demand set to rise. Energy efficiency – using less energy to deliver the same services – is an underused lever for decarbonisation2 and is an important element of the climate transition.

Referred to as the “first fuel” by the International Energy Agency (IEA) because it reduces demand before a new energy supply is needed, energy efficiency provides some of the fastest and most cost-effective emissions reductions available and is a powerful enabler of resilient, lower-carbon growth.

What is energy efficiency?

Energy efficiency is often seen in terms of simple upgrades like replacing incandescent bulbs with light-emitting diodes (LEDs). However, the concept of reducing the demand for more energy – while at the same time delivering the same services – is broader and more powerful. It is distinct from the idea of reducing the use of services, eg, switching off lights – which is known as “energy sobriety”.

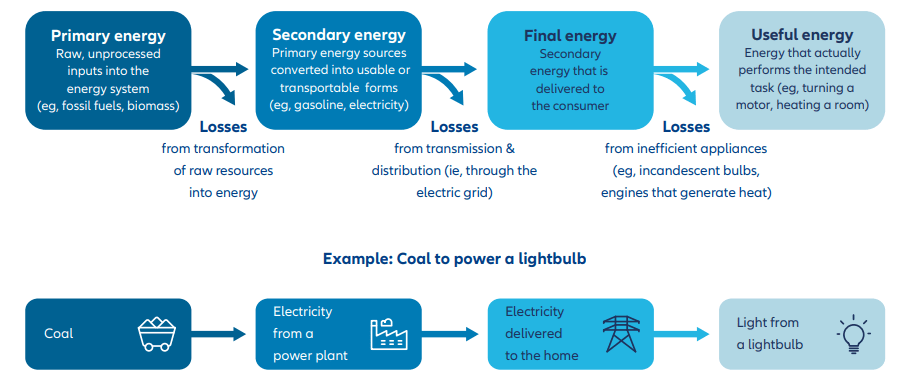

When considering the efficiency of energy, we also need to understand energy inefficiency – how much energy is lost at each stage of production, as shown in Exhibit 1.

Today’s energy system is astonishingly wasteful: more than two-thirds of primary energy is lost before it ever becomes a useful service such as room heating.3 Even the best-performing power plants can lose over a third of their input energy as heat,4 with a further 8-15% lost in transmission and distribution.5 Only a fraction of primary energy delivers economic value.

Exhibit 1: Producing “useful” energy

Source: Adapted from OurWorldInData.org and P. Peura Allianz Investment Management SE, The inefficiencies of our current energy system – smells like opportunity! 2024

Did you know: Less than 20% of the electrical power delivered to an incandescent bulb is converted into visible light. In contrast, LED bulbs convert 80-90% of energy into light.6

The “primary energy fallacy”

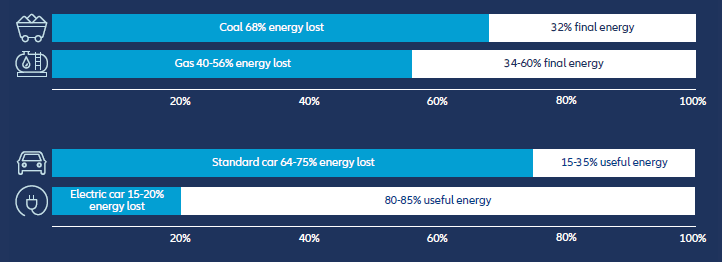

There is a well-documented misperception – called the “primary energy fallacy” – that we must replace all primary energy from fossil fuels with an equivalent amount of renewable energy.

In actual fact, fossil fuel systems can be highly inefficient in energy conversion, while renewable energy systems can achieve much lower energy losses. For example, the electrification of transport and heating can reduce final energy demand by up to 40% simply by using more efficient energy sources.7 Electric vehicles can be three-to-five times more efficient than petrol or diesel-powered cars – as shown in Exhibit 2.

Exhibit 2: Energy loss through energy generation and transfer

Sources: U.S. Energy Information Administration and Boston University Institute for Global Sustainability, Power plant efficiency since 1900, July 2023

EnergyBot 2025, What is the efficiency of different types of power plants

US Department of Energy. https://www.fueleconomy.gov/feg/atv-ev.shtml, 2025

More growth, less energy demand

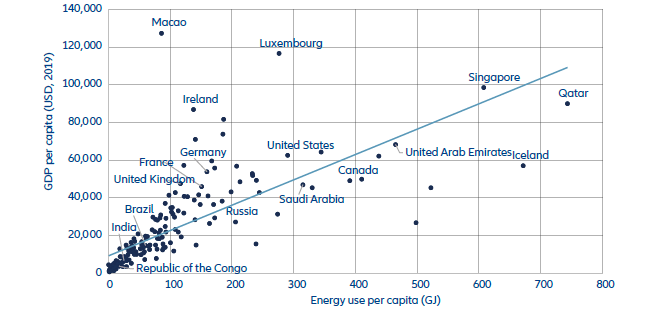

Energy efficiency can also reshape how we think about economic growth. Historically, economic growth has been tightly coupled with rising energy demand – as Exhibit 3 shows. But if we are to decarbonise fast enough and meet net-zero targets, we have to rethink the old assumption that more growth requires more energy and prioritise using less energy overall, alongside shifting to cleaner energy sources.

This doesn’t necessarily mean sacrificing productivity or growth. Modern energy efficiency solutions – from smarter industrial processes to digital building controls and heat recovery systems – allow us to achieve more with less energy. They unlock potential emissions reductions right away, without waiting for new infrastructure or technological breakthroughs.

The IEA estimates that accelerating energy efficiency improvements could deliver over a third of all CO2 reductions needed by 2030 in a net-zero scenario.8

Exhibit 3: The relationship between energy use and income

Source: Adapted from U.S. Energy Information Administration and Boston University Institute for Global Sustainability, What is the relationship between energy use and economic output?, May 20252025

Inflection point

While there is a clear case for energy efficiency, progress has been slow. Global energy intensity9 fell by approximately 2% a year in the 2010s, but this rate of decline slowed to 1% in 2023.10 This is far short of the 4% annual improvement required for the IEA’s Net Zero Emissions by 2050 scenario11 – a goal reaffirmed in 2023 at COP 28, where over 120 countries pledged to double the global rate of energy efficiency improvement by 2030. On the positive side, improvements have been made in areas such as buildings, transport and power generation.

These improvements have helped to stabilise or reduce electricity demand to support continued GDP growth in advanced economies, but the link between energy use and economic growth remains strong in emerging markets.12 In these regions, rising incomes drive energy demand, for example for powering appliances, cooling and mobility.

If countries at the bottom left of the graph in Exhibit 3 continue to follow historical trends of increasing energy use per capita as their economies grow, future demand for energy could be exponential.13 But with more efficient systems, the demand for “useful” energy would increase by only 32% by 2050, with primary energy demand increasing by just 9%.14

The energy efficiency conundrum

Even with many proven benefits like cost savings and emissions reductions, many energy efficiency measures remain under utilised. Why? We believe this is due to:

- Behavioural inertia: people stick with what they know.

- Information gaps: lack of visibility into energy use or payback periods.

- Split incentives: one party pays for upgrades (e.g., an apartment owner) while another enjoys the benefits (e.g., the tenant).

- Short-termism: preference for upfront cost savings over potentially bigger returns that take longer to materialise.

- Rebound effect: efficiency savings are offset by increased use.

Understanding the investment case

Despite the strong economic and environmental case for energy efficiency, investment remains well below what is needed to meet global targets. Barriers include:

- Behavioural inertia: people stick with what they know.

- Information gaps: lack of visibility into energy use or payback periods.

- Split incentives: one party pays for upgrades (eg, an apartment owner) while another enjoys the benefits (eg, the tenant).

- Short-termism: preference for upfront cost savings over potentially bigger returns that take longer to materialise.

- Rebound effect: efficiency savings are offset by increased use.

The issues around raising capital to fund energy efficiency are particularly pertinent in emerging markets, and these must be addressed globally to secure the USD 1.9 trillion annual investment required to meet the COP 28 goals.15

We see momentum towards greater investment coming from the following areas:

Regulation and increasing demand for energy are likely to be the key catalysts to boost financing. We believe that policy and market forces can drive momentum in the right direction. For example, efficiency standards such as requirements in building codes, appliance regulations, and vehicle emissions standards, set minimum performance thresholds that manufacturers and builders must meet.

Programmes like the EU Ecodesign Directive and the US Energy Star label go a step further by providing clear benchmarks and recognisable labels that signal superior energy performance to consumers and businesses. This encourages manufacturers to improve efficiency, while also making it easier for consumers to choose energy-saving options. In addition, financial incentives like tax credits and retrofit grants help offset the upfront costs of adopting more efficient technologies, making it easier for households and businesses to invest in efficiency upgrades.

Rising energy demand and growing pressures for smarter and cleaner power will drive energy efficiency solutions. Such solutions are necessary to meet the projected global acceleration in electricity demand of approximately 4% a year to 2050 under a net-zero scenario.16 Notably, emerging markets will account for 85% of this growth.17

Energy efficiency investment opportunities currently exist as outlined in Exhibit 4, and we anticipate scaling and expansion within these three areas:

Exhibit 4: Opportunities to invest

• Efficiency solutions: eg, smart meters, high-efficiency motors, heating, ventilation and air conditioning (HVAC), and insulation

• Infrastructure and retrofit projects

• Utilities with strong demand-side management programmes

• Building materials and smart infrastructure firms

• Electrical equipment

• Green bonds

• Sustainability-linked loans

• Performance-based

financing18

The global goal to reduce energy intensity by 4% annually, presents different opportunities in different regions. For example, innovations such as artificial intelligence (AI)-based energy management, smart thermostats and advanced building materials are enabling rapid scaling up of energy efficiency solutions with low capital intensity.

Additionally, new business models like energy-as-a-service – similar to a subscriber model for commercial energy users – are reshaping the consumption and financing of energy. In fixed income, around 40% of thematic bonds have energy efficiency as a use-of-proceeds19 or a sustainability key performance

indicator.20

Power of investor stewardship

Investors can also push for strategic commitments and disclosures from investees on energy efficiency – this is where active stewardship is a powerful tool that we have used to engage with both corporates and with sovereigns. For example, in Egypt – a sovereign debt issuer – we began an ongoing dialogue with government stakeholders last year on the challenges and goals of energy transition in the country and the specific issue of energy efficiency.

In our engagements with corporates we are looking for energy intensity metrics and clear strategies for reducing energy demand to become the norm, especially in energy-intensive sectors like real estate, manufacturing, transport and technology. Where data on a company’s energy use is immature, engagement is our route to understanding its approach to managing risks and seizing the evident opportunities. Driving progress on efficiency is not only good stewardship – it’s smart risk management for investors.

In summary, while investing in energy efficiency will bring cost savings, it’s also an essential catalyst for future resilience, real decarbonisation and financial returns for investors.

To learn more about the future of energy, read our earlier paper: Energy transition: time to clear the air | AllianzGI

1 Net-zero means cutting carbon emissions to a small amount of residual emissions that can be absorbed and durably stored by nature and other carbon dioxide removal measures, leaving zero in the atmosphere

2 Decarbonisation refers to reducing greenhouse gas emissions across the economy.

3 U.S. Energy Information Administration and Boston University Institute for Global Sustainability, Power plant efficiency since 1900, July 2023

4 U.S. Energy Information Administration and Boston University Institute for Global Sustainability, Power plant efficiency since 1900, July 2023

5 CHINT Global, How Much Power Loss in Transmission Lines , August 2021

6 Future Energy Solutions, Incandescent vs. LED Light Bulbs: What is the difference? 2023

7 New Energy World, What is the primary energy fallacy? January 2025 What is the primary energy fallacy?

8 IEA, Energy efficiency 2024

9 Energy intensity refers to the amount of energy needed to produce each dollar/euro of economic output (GDP). Lower energy intensity means greater efficiency.

10 IEA, Energy Efficiency Progress Tracker, June 2025

11 IEA, Energy Efficiency Progress Tracker, June 2025

12 IEA, Global Energy Review, 2025

13 Economic development could lead to a 75% increase in demand for electricity – BloombergNEF, New Energy Outlook 2025

14 BloombergNEF, New Energy Outlook 2025

15 IEA, World Energy Investment Report 2024

16 BloombergNEF, Global Electricity Demand Forecast to 2050, 2024

17 IEA, Electricity 2024

18 Investment structures where repayments are tied to the actual energy savings achieved. These are commonly used in energy performance contracts for building retrofits and industrial upgrades Innovative products and schemes - European Commission, 2025

19 Thematic bonds finance projects that have a positive impact on the environment and/or society, including: green, social and sustainability bonds, in addition to sustainability-linked bonds. Use of proceed bonds have their sustainability credentials assessed at instrument level vs. sustainability-linked bonds where sustainability credentials are measured at issuer level.

20 Thematic bond data sourced from Mainstreet Partners, May 2025