Embracing Disruption

How to sustainably quench the thirst of data centres?

Investments in sustainable water cooling solutions are needed to quench data centres’ increasing thirst.

Key takeaways

- With the proliferation of artificial intelligence (AI), demand for water to cool the growing number of hyperscale data centres from overheating rises continuously.

- Data centres operating in already water-scarce regions are particularly under heightened pressure to reduce their water usage significantly.

- Investments in sustainable watercooling solutions are needed to quench data centres’ increasing thirst.

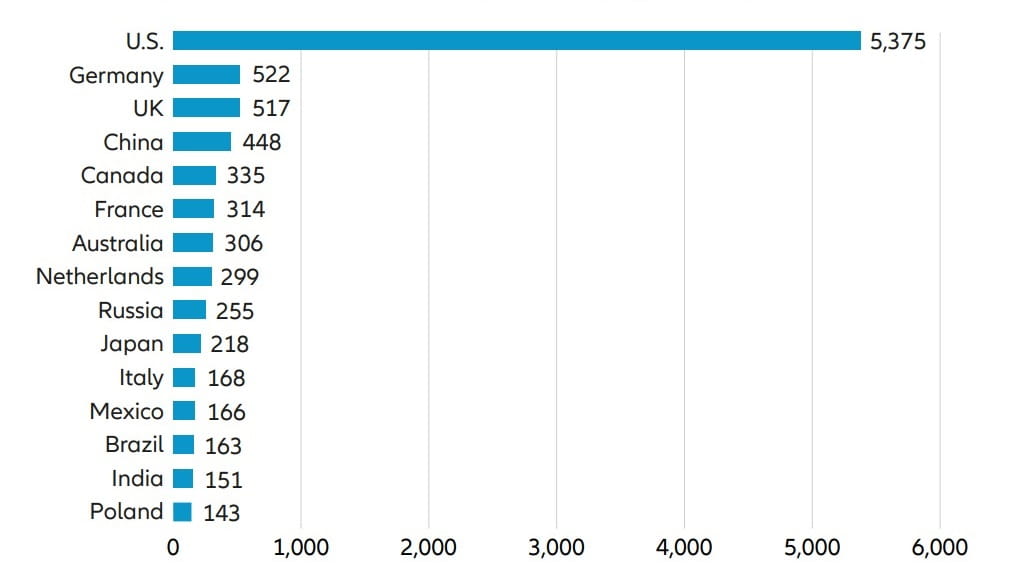

While data streams represent the lifeline of technological innovation, the global flow of water keeps the world running, not least by cooling the continuously growing number of heat-generating data centres around the globe. As of September 2023, there were over 9,000 of these data processing facilities worldwide, more than half of them located in the US.1

Number of data centers worldwide in 2023, by country

Source: Statista. As of September 2023

“[In the US] one-fifth of data centre servers direct water footprint comes from moderately to highly water stressed watersheds, while nearly half of servers are fully or partially powered by power plants located within water stressed regions.4 ”

In step with this increasing appetite for computing capacities – in part stimulated by the training of (large) artificial intelligence applications – and with our increasing reliance on a digital infrastructure, comes the demand for huge amounts of energy. In 2020, around 1-2% of the overall electricity need around the world was consumed by data centres, with more than 40% of it deployed for cooling purposes.2

In parallel to this massive rise of cooling energy consumption goes the demand for cooling water. According to recent studies3, “operational water withdrawal of global AI may reach 4.2 – 6.6 billion cubic meters in 2027”, representing “4 – 6 times more than the total annual water withdrawal of Denmark or half that of the United Kingdom”.

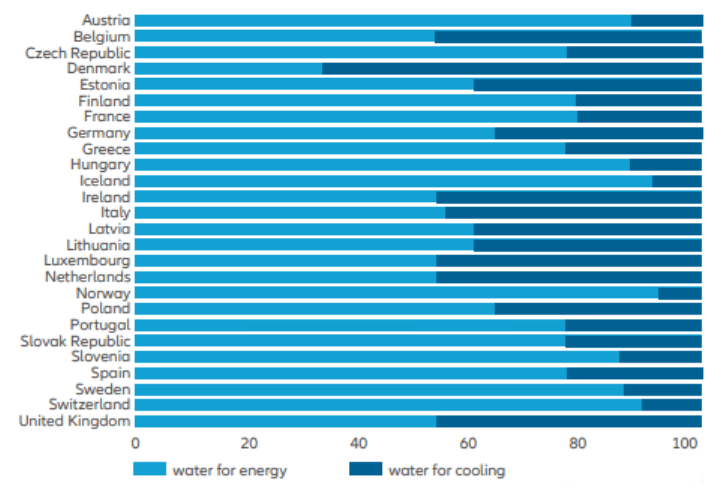

A look at selected OECD countries and the composition of their corresponding data services’ water demand further highlights the crucial role of water for keeping data streams flowing.

Share of energy-related water consumption in annual total water consumption for data usage (in %)

Source: Javier Farfan, Alena Lohrmann: Gone with the clouds: Estimating the electricity and water footprint of digital data services in Europe. ScienceDirect. As of August 2023.

Abundant data, scarce water

Water-scarce communities and regions are putting pressure on data centre operators to reduce their water usage significantly and to implement solutions that ensure a more efficient use of water for cooling purposes. To address the acute conflict especially between communities in arid regions with already strained local water supplies on the one side and operators of data storage facilities on the other, innovative, and sustainable water-preserving technologies are needed. This applies even more when considering that water-cooled data centres consume around 10% less energy and therefore discharge approximately 10% less carbon emissions than many air-cooled data centres.5

How innovators can help quench the thirst of data centres

- Treating and using reclaimed water to lower freshwater demand

A worldwide operating company specialised in providing technologies, products and services for both cooling water and wastewater processing offers advanced water treatment solutions that allow the use of reclaimed water for data centre cooling systems. Using reclaimed and/ or highly treated water as a costeffective and sustainable alternative to potable water transfers into the preservation of already scarce local water resources and significantly reduces the withdrawal of fresh water.

In addition, the firm also engineers sophisticated membrane and chemistry technologies that remove (unusual) contaminants from potable and reclaimed water.

Having these technologies available is vital to treat unevaporated water (“blowdown”) that is high in minerals and discharged form data centre cooling systems into municipal sewers.

- Water cooling solutions to reduce power and emissions

A global provider of heat transfer, separation and fluid handling products offers a free water-cooling solution where a combination of natural cool water sources (e.g., rivers, lakes, oceans, meltwater) and chiller-produced cold are used to prevent data centres from overheating, coupled with an isolated chilled water loop that protects sensitive equipment from corrosion. As a sustainable side-effect this method can efficiently reduce the need for mechanical cooling, resulting in less power consumption and emissions.

- Lowering the risks of leakages through monitoring

A globally operating manufacturer and provider of water protection products offers, amongst others, connected and fully automated water monitoring and water shut-off solutions that providing 24/7 real time leakage and overflow detection. This helps data centre operators to prevent costly operational shutdowns and avoid repair and maintenance delays.

- Decreasing relative humidity results for significant water savings

Besides temperature and airflow, Relative Humidity (RH) is an essential figure for keeping an ideal operating environment for data centres. A California-based multinational technology group in a pilot project lowered minimum RH from 20% to 13% resulting in water savings of around 40%6 .

- Optimising data centre design to save water

In addition to on-site measures to reduce water usage, data centres can be optimised for more sustainable water consumption during the design process. European signatories to the Climate Neutral Data Centre Pact (CNDCP) for instance, pledged that all new data centres at full capacity in cool climates using potable water will be designed to meet a maximum water usage effectiveness (WUE) of 0.4 L/kWh in water-stressed areas by 1 January 2025. By the end of 2040, existing data centres that replace a cooling system must meet the CNDCP water usage effectiveness target of 0.4 L/kWh7.

Water Usage Effectiveness (WUE) is a metric used to put water usage of a data centre into relation to its energy consumption. The formula to calculate a data centre’s WUE reads as follows:

WUE = Data Centre Water Consumption (in litres, L)

IT Equipment Energy (in kilowatt hours, kwh)

The general rule is that the lower a data centre’s WUE ratio is, the more

efficient is its use of water resources.

Investing with a sustainable mindset: a “manometer” to promote water-conserving solutions

The parabolic rise of data consumption reflects structural megatrends – like AI adaption and ongoing digitisation – and means the trend for new data centres will likely move in the same direction. This development goes hand in hand with the increased need for both energy to run data centres and water to help cool them. With each of these resources in high demand globally, identifying and investing in innovative companies that are prioritising water conservation efforts and adopting innovative data centre cooling solutions can help preserve the most precious of our natural resources.

In addition, investors can actively engage with companies and encourage them to disclose not only water withdrawal figures, but also what percentage is withdrawn from areas with water stress, thus fostering more transparency and pushing companies to identify solutions to reduce water consumption.