The Big Question

How could climate change impact my expected portfolio returns?

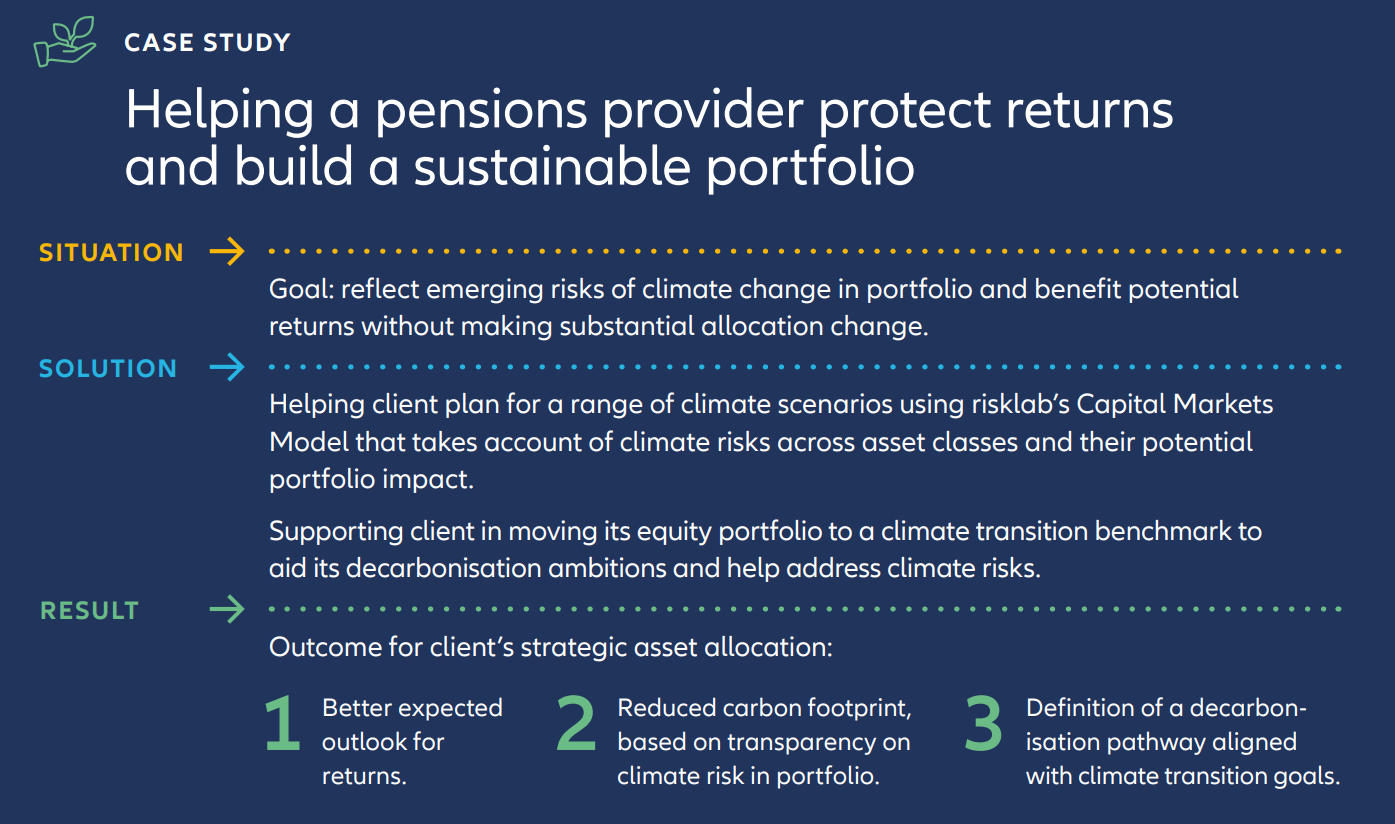

More extreme weather is making many investors ask how the potential impact on portfolios can be measured and mitigated. In this new series focused on the big questions for investors, risklab has three ideas for future-proofing your portfolio against climate change – without making radical changes.

The global climate is changing. But uncertainty over how much it will change over the coming years and decades makes it difficult to assess the potential impact on investments. How can you gauge possible future returns if you’re unsure how the climate may change – and what that may mean for asset values?

As a starting point, it is worth considering the two major sources of risks associated with climate change: physical risks and transition risks. Physical risks are caused by extreme weather events and higher temperatures. Transition risks are associated with how companies and economies manage to lower greenhouse gas emissions or adapt to climate change’s impact.

Both these risks may impact the returns of the main asset classes – equities and bonds – at the broad market and individual security levels. The potential result? Climate change may lead to reduced investment returns as physical and transition risks lead to higher costs and reduced revenues for many companies. But the impact is likely to differ significantly from firm to firm.

To better plan, it can be helpful to consider a range of possible climate scenarios to assess the risk portfolios are likely to be exposed in the future. These scenarios are not exact projections of the future, but we believe that they can help us evaluate climate risks.

Range of climate scenarios

Need to know

Q. How much climate risk is currently reflected in market prices?

A. Each country signed up to the Paris Agreement must detail its climate action plan to cut greenhouse gas emissions and adapt to climate impacts. Economies and companies are incorporating these pathways in their forecasts, so we assume their impact is starting to be priced in by the market. However, the pricing of climate risk will evolve as global warming, extreme weather events, climate policy, green technology, and other factors influencing financial markets change over time.

Policymakers and international organisations have developed various climate scenarios that can guide us. The best-known are those from the Intergovernmental Panel on Climate Change, the International Energy Agency and the Network for Greening the Financial System (NGFS), a group of central banks and financial supervisors aiming to accelerate the scaling-up of green finance.

We think the climate scenarios developed by the NGFS are the most useful to quantify climate risk in an investment portfolio. Their advantage is that they incorporate both physical and transition risks. For the purposes of this research, we are focusing on two:

- Orderly climate scenarios assume there is timely and smooth implementation of climate actions. Transition risks are medium in magnitude in these scenarios. In the Net Zero 2050 scenario, the world achieves the greenhouse gas reduction goals of the Paris Agreement.

- The disorderly climate scenario involves an uncoordinated transition where policy responses differ across countries, with the transition not beginning until 2030 (Delayed Transition). These involve high transition risks. Both the Orderly and Disorderly scenarios assume that temperature rises by 2050 are limited and physical risks are kept in check.

Quantifying climate risk

Looking across these scenarios, we have developed a methodology to quantify the impact of climate risk on portfolio returns in the various climate scenarios. We call our analysis Climate Navigator.

Our findings show climate change will affect asset class returns on two levels. First, the performance of each asset class is subject to developments in individual economies that can impact macroeconomic and financial factors. Second, companies have different business models, sources of revenue and costs, so company-specific climate costs play an important role in determining the returns of individual stocks and corporate bonds. For example, a utility company generating a significant proportion of its revenue from thermal coal power generation could face a significantly higher cost of transition than a competitor that uses wind as its main power source.

Based on our in-depth analysis of climate risk, we have projected returns for a broad range of asset classes. Here, we’ll focus on euro zone bonds and equities assuming targets agreed at the 2015 Paris Agreement are met for two of the NGFS scenarios – Net Zero 2050 and Delayed Transition.

Analysing climate impact on returns

According to our analysis, the best outcome for euro zone fixed income returns would be for the world to achieve the greenhouse gas reduction goals of the Paris Agreement by 2050 (Net Zero 2050).

Transitioning to a lower-carbon world is expected to impact the economy under all scenarios, with a negative effect on GDP growth and a rise in inflation and higher long-term interest rates affecting bond returns. However, the economic impact will likely be more pronounced under the Delayed Transition scenario. For equities, the results outlook is negative for both scenarios, as we explain below.

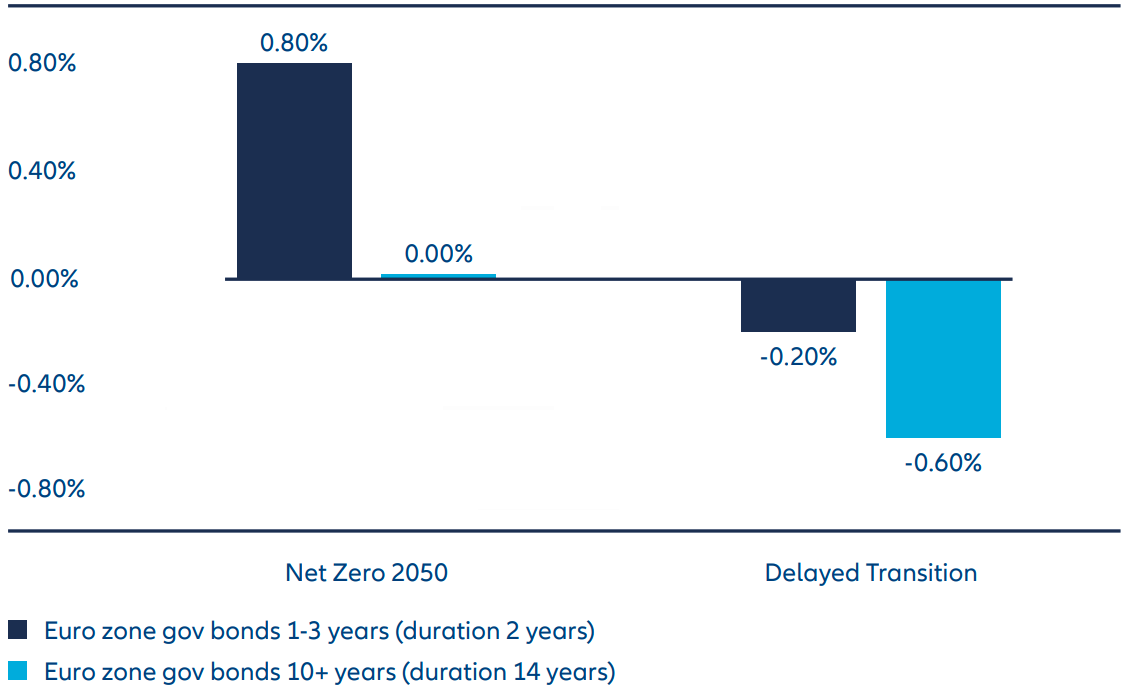

- Euro zone government bonds – Under both scenarios, the main factors determining government bond returns are coupon income – known as carry – and the valuation. In the Net Zero 2050 scenario, interest rates rise more immediately than under Delayed Transition, giving investors the opportunity to reinvest maturing bonds at a more favourable rate over a longer time period, boosting expected returns (see Exhibit 1). The later rise in interest rates under Delayed Transition lowers the potential opportunity for carry, leading to a bigger hit to returns.

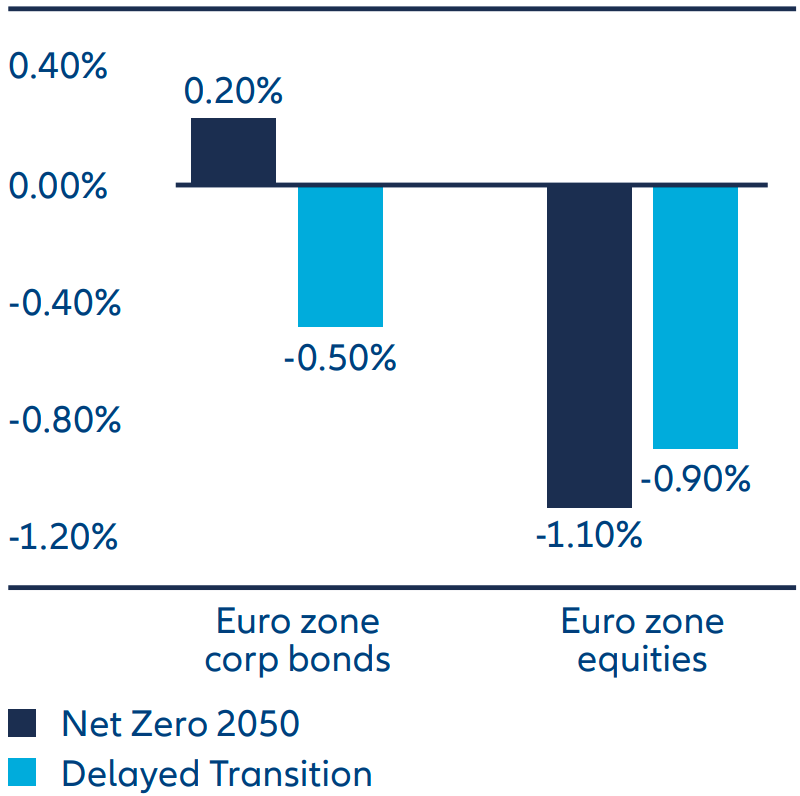

- Euro zone corporate bonds – We expect returns to perform best in the Net Zero 2050 scenario (see Exhibit 2) as the path of interest rates would be higher than in the Delayed Transition. The earlier rise in rates would allow more opportunity to reinvest maturing bonds at a higher interest rate (as in the case of euro zone government bonds). But the company-specific climate risks inherent in corporate bonds mean anticipated returns are likely to be lower than for government bonds.

- Euro zone equities – Our findings show equities are likely to face a bigger hit to returns than bonds (see Exhibit 2). This is because company-specific risks are usually higher for stocks than for corporate bonds as we assume that equity shareholders will generally have to foot much of the bill for future climate costs.

Overall, our analysis suggests that government bonds returns are likely to hold up better in the face of climate change than equities or corporate bonds.

Exhibit 1: Euro zone government bond returns are likely to be better if the world meets Net Zero 2050

Change in expected annual return over the next 10 years

Source: Holdings data from Allianz Global Investors. Holdings data as of 29 September 2023. Input data from NGFS Scenarios Portal, MSCI. Input data as of 30 November 2023. Forecasts do not predict future returns. Future performance is subject to taxation which depends on the personal situation of each investor and which may change in the future. The hypothetical performance and simulations shown are for illustrative purposes only and do not represent actual performance; they do not predict future returns. Please see important information above the end disclaimer. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on management's current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. We assume no obligation to update any forward-looking statement.

Exhibit 2: Euro zone corporate bonds are expected to fare better than equities

Change in expected annual return over the next 10 years

Source: Holdings data from Allianz Global Investors. Holdings data as of 29 September 2023. Input data from NGFS Scenarios Portal, MSCI. Input data as of 30 November 2023. Forecasts do not predict future returns. Future performance is subject to taxation which depends on the personal situation of each investor and which may change in the future. The hypothetical performance and simulations shown are for illustrative purposes only and do not represent actual performance; they do not predict future returns. Please see important information above the end disclaimer. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on management's current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. We assume no obligation to update any forward-looking statement.

Reducing the impact of climate risk on an investment portfolio

Whichever scenario prevails, we believe that risks associated with climate change are likely to result in reduced asset class return expectations. As such, portfolio returns may be negatively affected over the coming years and decades. How can investors respond? In our view, there are three choices to reduce the climate risk that an investment portfolio is exposed to. We take the Delayed Transition scenario as our basis for considering the options as we consider this the most likely outcome at the current time.

1. Adjust the portfolio’s allocation

An important step in building a portfolio is optimisation, the aim of maximising net gains depending on risk tolerance. One way this could be done is by adjusting the portfolio allocation to incorporate climate risks. Given our analysis above on the relative performance of asset classes in the face of climate change, this could mean adding more government bonds. Such a move may help to bolster the portfolio’s resilience but would require a substantial shift to government bonds.

2. Alter the interest rate sensitivity

A second possibility would be to reduce the interest rate sensitivity of the portfolio’s fixed income holdings by lowering the duration. Interest rates are expected to rise in the longer term due to the higher demand for capital resulting from the investment spurred by the energy transition.

However, shortening a portfolio’s overall duration from medium term to short term would lead only to a moderate change in its interest rate sensitivity. What’s more, for liability-driven investments with long-term liabilities, shortening the duration would potentially make it more difficult to safeguard the funding ratio, the difference between available assets and liabilities.

Need to know

Q. What are climate aware strategies?

A. Such strategies are designed to help investors reflect the changing risks posed by climate change in their portfolios – with a view to benefiting potential returns. They incorporate specific carbon reduction targets and objectives related to the transition to a low-carbon economy through the selection and weighting of underlying constituents.

3. Use climate-aware investment approaches

The third option is to keep the portfolio’s asset allocation and interest rate sensitivity unchanged but switch to climate-aware strategies within each asset class. This could involve reducing the proportion of high emitters from sectors such as energy and utilities or lowering the portfolio’s effective carbon footprint in all sectors. The starting point for this approach would be following a certain greenhouse gas emission reduction pathway over time, which would naturally increase the weight in companies with lower future climate costs, or taking climate risk-related metrics explicitly into account in the construction of the benchmark. When adopting this approach it is important to avoid significant deviations in sector weights and idiosyncratic risks, such as excessive concentration in a single company’s stocks or bonds.

Adopting this kind of climate-aware investment approach may not compensate for the return shortfall completely. But it might help to reduce it without changing the asset allocation substantially. We think this option might be the easiest to adopt.

Quantifying the potential impact of climate change on portfolio returns is indeed one of the big questions for investors. Our findings show that, over the next 10 years, the effect of climate change on economies and companies may weigh on expected portfolio returns. But there are potential answers: our analysis of potential climate scenarios can help you begin to future-proof your portfolio without making radical changes.

For more insights, download risklab’s research paper

on climate risk and investment returns