Navigating Rates

Trade finance: a portfolio staple?

Trade finance funds much of the commerce economies are built on and it is also becoming an increasingly crucial part of many investors’ portfolios. In the shorter-term, it can help investors plot a path through a shifting landscape of higher interest rates and slowing growth. And longer-term, the asset class can provide a compelling proposition for several reasons ranging from its lack of correlation to other asset classes to its low volatility.

Key takeaways

- Providing a bridge between the delivery of products and payment, trade finance helps keep commerce moving – and global demand for the funding is huge, estimated at USD 2.5 trillion.1

- For investors, trade finance can serve a variety of roles – from an alternative to traditional credit assets to a strategic cash position, offering favourable returns compared to money market funds.

- Higher interest rates mean investors can expect a higher yield than in years when rates were near historic lows, while the asset class is also benefiting from inverted yield curves.

- In a fluid economic environment, trade finance’s typically short-term horizon allows flexibility as conditions change, while in the longer run the asset class’s potential for stable returns and low volatility make it an attractive option.

How to negotiate a changing economic landscape while meeting long-term goals: that’s the challenge facing many investors. So, where to turn? Trade finance, a USD 4 trillion asset class2 funding a broad array of commerce, may help a range of investors meet their objectives.

In a shifting economy, trade finance stands out as a resilient option. It provides stability and a low correlation to traditional asset classes – vital during swings in public markets. And the higher yield it offers, may help boost portfolio performance in the long term. Finally, the asset class’s versatility is also a boon, serving as an alternative to short-dated fixed income, private debt or as a strategic cash position.

What is trade finance and how does it work?

Trade finance funds much of the commerce that economies are built on. Think of it as a short-term line of credit from a third-party financier that helps companies fund the buying and selling of goods. It enables suppliers to receive money straight away before their buyers are required to make payment. But the asset class can fund a much broader range of transactions that can be divided into four main categories:

- Payable finance – Supporting a buyer by facilitating payments to its suppliers when invoices are raised.

- Receivable finance – Providing money to a single supplier in advance of its receiving invoice payments from several customers.

- Working capital facilities – Loans to one supplier repaid by receivables from several customers.

- Documentary credits – Common instruments used by companies to finance specific trade flows and payments under commercial contracts, including letters of credit, bills of exchange and trade loans.

Is there more to trade finance than funding the movement of goods?

Most of the goods criss-crossing the globe are funded by trade finance. In fact, an estimated 80-90% of trade relies on it. But the asset class doesn’t just fund the international movement of everything from microchips to melons. Domestic commerce also relies on the funding tool, including the trade in services as well as goods. And beneficiaries can range from large conglomerates to start-ups. Some examples of non-traditional areas of trade finance include:

- Media finance – Secured loans to media production companies. Collateral – an item of value pledged to secure a loan – can include money owed from the government or film distribution companies.

- Lending to small and medium-sized enterprises (SMEs) – Financing to growing small businesses with income from the lending high enough to compensate for expected defaults.

- Football finance – Funding for buying and selling players between football clubs, as well as working capital facilities for clubs.

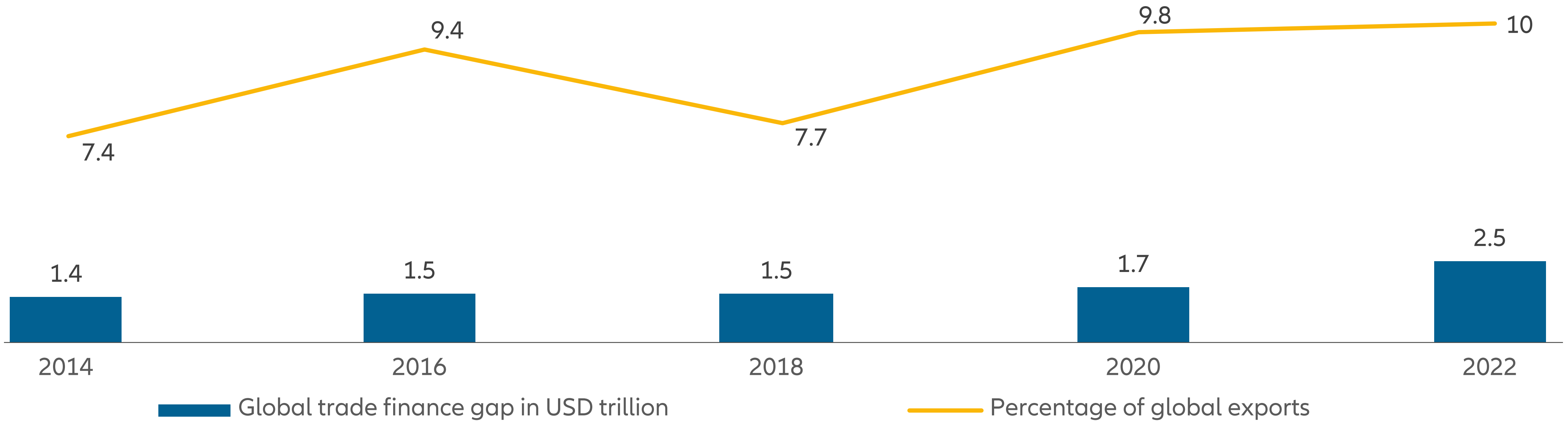

Exhibit 1: The global trade finance gap is rising

Sources: Asian Development Bank. 2023 Trade Finance Gaps, Growth, and Jobs Survey—Banks; and World Trade Organization. WTO Data. https://data.wto.org/ (accessed 19 July 2023).

What’s the investment case for now for trade finance?

In today’s environment, investors face a challenging mix of high interest rates and slowing economic growth. We think the asset class can help investors navigate both risks:

- In a high interest rate environment

Higher interest rates mean investors in the asset class can expect a higher yield than in years when rates were near historic lows. The asset class is also benefiting from inverted yield curves as short-term credit is providing more income than longer-term instruments of the same credit risk profile. In addition, investors are mitigating the extra risk from holding longer-dated credit. The ultra-short duration of deals – typically, transactions have a life cycle of between 60 and 120 days – helps offer protection from fluctuations in interest rates. - In a slowing economy

The short-dated nature of the financing tool can be beneficial during an economic slowdown, allowing flexibility on investment decisions as conditions change. Also, trade finance’s spreadduration3 can lead to lower mark-to-market losses if credit spreads widen. With trade closely linked to the performance of the economy, any downturn in growth will inevitably impact demand for credit. But the scale of the trade finance gap is still vast: the Asian Development Bank estimated a difference between requests and approvals for financing of USD 2.5 trillion in 2022 (see Exhibit 1).4 Even a moderate slowdown in commerce would still leave a significant amount of funding required. A downturn may create openings for investors as other players (such as credit insurers and banks) may pull back from the market. While default risks may rise during a downturn, default rates and recovery rates – the amount recovered from a borrower in the event of a default – are often higher than for similarly-rated public market instruments (see Exhibit 2).

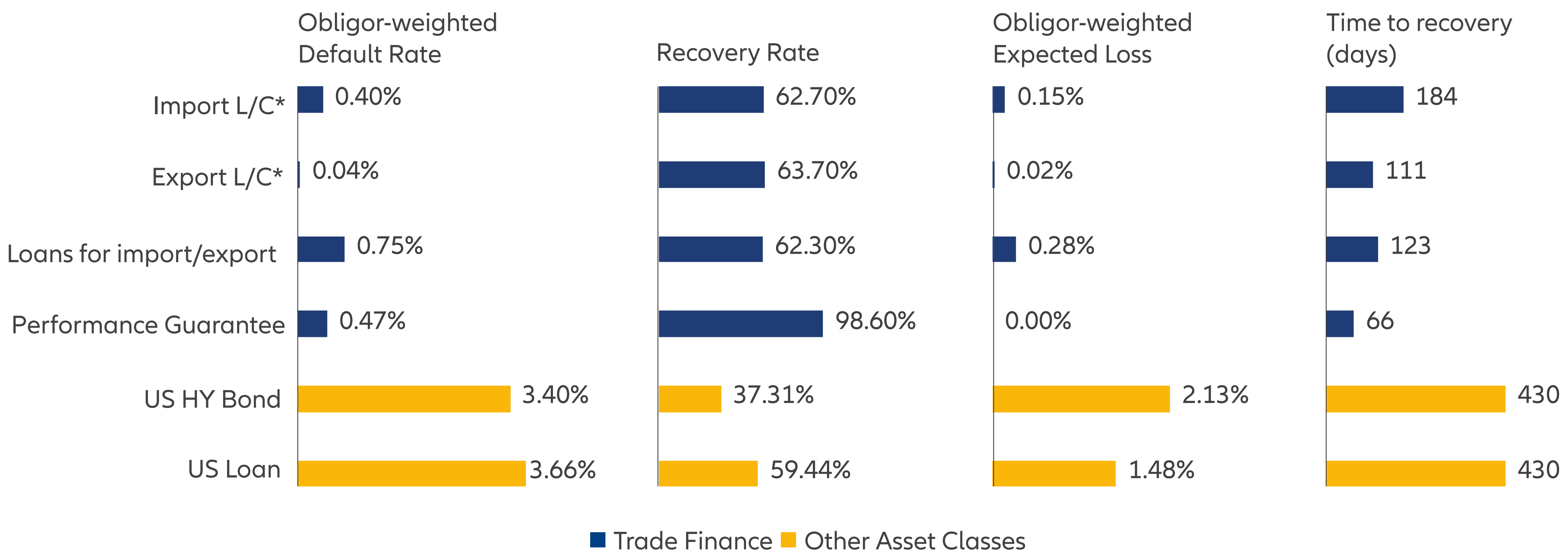

Exhibit 2: Trade finance tends to have lower default rates and higher recovery rates than public credit

Comparison of trade finance to other asset classes, 2008-2021

Sources: Trade finance data is from the International Chamber of Commerce Trade Register Report Global Risks in Trade Finance, 2021; 2021 ICC Trade Register report: Global risks in trade finance (iccwbo.org); The 2008-2021 loss data is from 25 major trade finance banks. US Bond/Loan data is from Moody’s Investors Service; J.P. Morgan, Notes: Recovery rates are issuer-weighted and based on price 30 days after default date. 2009 Adj. recoveries are based on year-end prices.

Historical defaults or losses are not a reliable indicator of future losses. The statements contained in the above studies may include statements or assumptions that are not directly applicable to the investment strategy.

* L/C = letters of credit. HY = high yield.

What about the longer-term investment case?

Trade finance can serve as an asset class to search for opportunities while waiting for longer-dated credit markets to reset. But once the reset happens, it can still offer a compelling proposition:

- Low volatility – Market swings in bond and equity markets do not have a major effect on the short-dated corporate operating payment claims that make up trade finance portfolios. Trade finance strategies therefore tend to experience less volatility than their public market peers.

- Complexity premium – Specialist skills are required to source, select and structure deals, and this complexity means only a limited number of trade finance providers exist and demand outstrips supply. These factors are reflected in a yield premium that is sometimes higher in comparison to public credit default swaps and bond spreads for the same issuer.

- Low correlation to other asset classes – As the instruments are not publicly traded and short term, the asset class has a low correlation to public markets, including equities and fixed income (see Exhibit 2). The low correlation can help investors to diversify their portfolio or improve its efficiency.

- No trading losses – Trade finance’s ultra-short-term maturities allow for any underperforming positions to be exited at par – or face value – when they mature. Unlike in bond markets, those assets do not have to be sold at the then lower market price, thereby avoiding trading losses.

- Stable returns – The asset class benefits from a relatively high Sharpe ratio, meaning the potential returns of an investment outweigh the risk. The asset class also benefits from limited risk of loss from nonpayment or changes in interest rates.

- Semi-liquidity – The ultra-short-term maturities of investments – typically, portfolios mature within three months – allow investors relatively easy access to funds, a boon at a time when economic uncertainty means they may want to stay agile.

How might trade finance fit within a current portfolio?

Trade finance can provide multiple uses. The asset class’s versatility makes it an attractive choice for institutional investors – ranging from public and private pension funds to family offices and insurers. As investors look beyond the main asset classes to diversify return streams, trade finance can offer an attractive diversification option:

- As an alternative to traditional credit assets such as asset-backed securities (ABS) and short-dated corporate bonds because of its higher margins.

- As a replacement of government bonds holdings as the asset class offers the possibility of stable returns and low sensitivity to rate changes.

- As a strategic cash position, offering favourable returns compared to money market funds. The financing tool’s semi-liquid structure gives investors the ability to shift or reallocate portfolios. That ensures trade finance can provide a potential funding source for private market capital calls. For insurers, the short-duration nature of the asset class, combined with its attractive spread premium, makes it capital efficient.

Trade finance: driving commerce and portfolios

The asset class is helping more investors build portfolio returns. In an environment of heightened geopolitical tensions, volatile bond yields and stubborn inflation, trade finance can offer the flexibility and potential returns to help investors navigate the uncertain global outlook.

Structural changes are paving the way for institutional investors to enter the market. A scaling back of bank funding, the traditional key suppliers of trade finance, has opened the door to new entrants. Financial technology companies have brought innovation to the field, reducing unit costs and making small financing volumes economical.

Together, these factors are contributing to the asset class’s growing appeal. In short, we think trade finance can strengthen its increasingly pivotal role in commerce and portfolios.

1 Source: Global Trade Finance Gap Expands to $2.5 Trillion in 2022, Asian Development Bank

2 Source: Global Trade Finance Market Size, 2023, Mordor Intelligence

3 Spread duration is a measure of an asset class’s price sensitivity to changes in its credit spread

4 Source: Global Trade Finance Gap Expands to $2.5 Trillion in 2022, Asian Development Bank