Navigating Rates

UK election: Things can only get better?

With inflation seemingly under control and the growth outlook improving, we believe July’s election will offer many investors a chance to reevaluate UK equities, where valuations are attractive and return prospects look strong.

Key takeaways

- With the economy turning a corner, we think UK equities offer some of the best investment opportunities in developed markets today.

- Depressed valuations and a potential reversal of outflows from UK assets are two factors boosting return prospects for UK equities.

- With the opposition Labour party ahead by nearly 20 points in the polls, they look likely to win a clear majority in the general election that Prime Minister Rishi Sunak has called for 4 July.

- Radical spending plans have been absent from the Labour campaign and fiscal headroom is limited, meaning this election poses far less risk to markets than previous ones.

On 22 May, UK Prime Minister Rishi Sunak announced a general election for 4 July. As Sunak made his surprise announcement in a rain-soaked speech outside 10 Downing Street, protestor Steve Bray blasted out D:Ream’s Things Can Only Get Better in the background – the theme music to the opposition Labour party’s landslide victory in 1997.

As investors, our thoughts immediately turn to what the outcome might be and what it could mean for UK assets. In our view, with the UK economy turning a corner and valuations looking cheap versus other markets, the same song title could easily be applied to UK equities.

Why did Sunak go early?

There are likely a few factors behind Sunak’s surprise decision to go to the country early in a summer election, despite his party trailing Labour heavily in the polls. Recent data showed the UK economy returned to positive growth in Q1 2024 after eight quarters of stagnation, as well as a significant drop in inflation to 2.3%. Perhaps Sunak and his advisors are concerned the economic picture will only deteriorate between now and the autumn when most commentators had expected the election to be called.

The Conservatives have been in power since 2010. Historically, they have styled themselves as the party of sound economic management. However, having delivered Brexit – the UK’s departure from the European Union – the results have disappointed: UK exports to EU and non-EU countries have declined, trade negotiations have not been material, and investments have seen steady outflows.

Since the Conservatives came to power the UK has seen five different prime ministers, seven different foreign ministers and seven finance ministers. The current government disapproval rating stands at 69% and election polls show the Conservatives trailing Labour by nearly 20 points. The reality is that the Labour party is likely to win a clear majority.

Would a Labour government rattle UK markets?

Here the parallel with the 1997 election is interesting. Tony Blair and his finance minister Gordon Brown cemented a reputation for fiscal prudence with careful budgets for their first few years. The indication from Labour is that its leader, Sir Keir Starmer, and his shadow finance minister, Rachel Reeves, have studied their history – radical spending plans have thus far been absent from their campaign.

Meanwhile, the UK’s current fiscal position gives the next government limited room for manoeuvre: Liz Truss’s brief and volatile period as prime minister demonstrated the power of the bond markets to rein in politicians’ fiscal ambitions. Thus, we believe this year’s election poses much less risk to markets than previous ones.

Things are getting better

It is a very different situation in the rest of the world. There are many significant elections coming over the next 12 months. Several, not least the US, have outcomes that are difficult to predict, and may lead to more extreme outcomes and policies. By contrast the UK is soon likely to look like a haven of safety and predictability. Investors often crave predictability and avoid uncertainty, and we think this means the UK stock market’s attractions will become more apparent over the coming months.

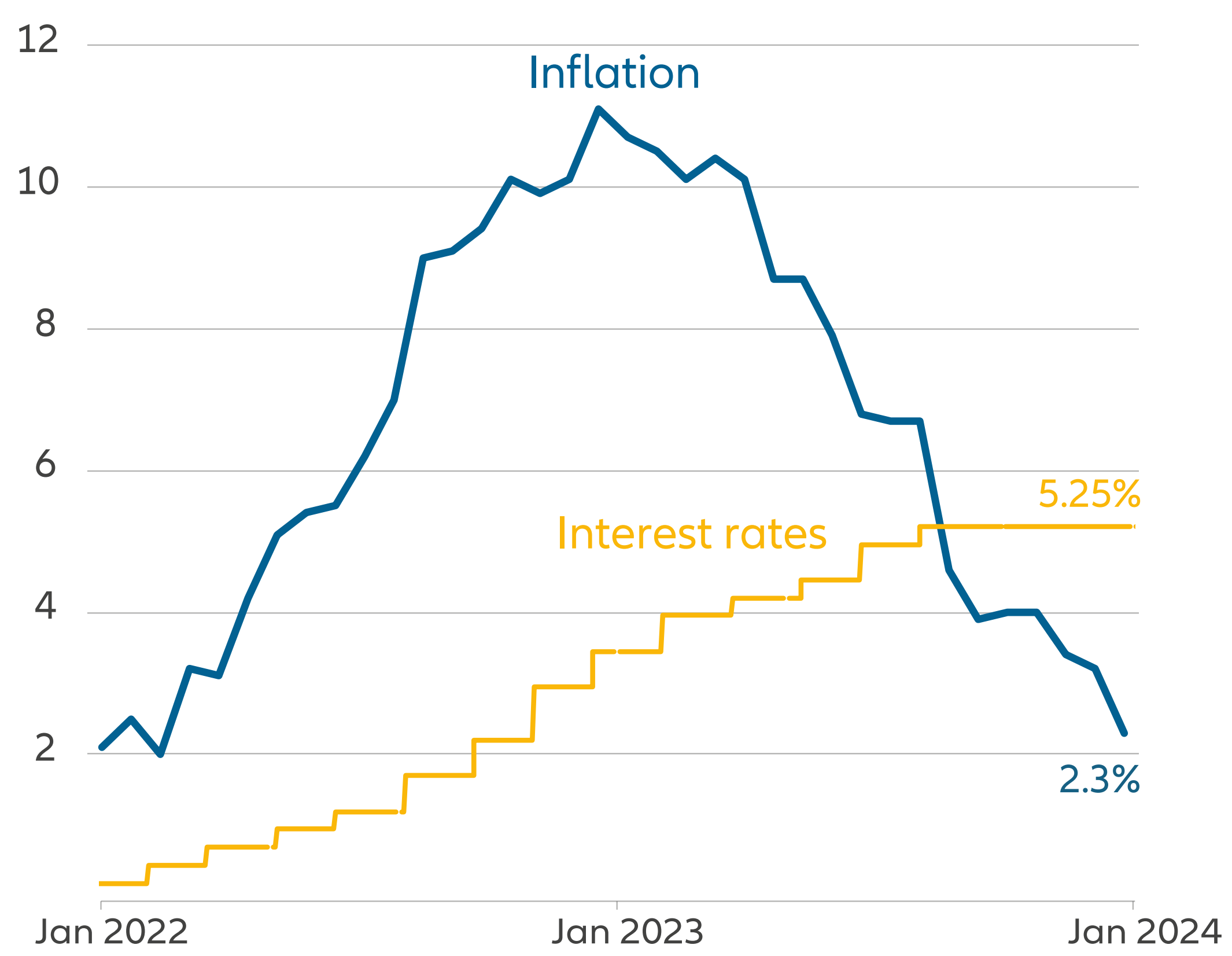

Additionally, the UK economic outlook is improving. We believe the economy is turning a corner in terms of growth compared to other G7 members. Forwardlooking indicators such as Purchasing Managers’ Index (PMI) and consumer confidence data are improving. Inflation in the UK had been significantly higher than its European counterparts, but it has now rejoined the pack (see Exhibit 1). Supply side pressures, including energy costs, are dissipating. The talk now is of when, rather than if, the Bank of England will decide to cut interest rates.

Exhibit 1: UK inflation and interest rates

Source: ONS, Bank of England, 22 May 2024

UK equity return prospects look excellent

From this starting level, we believe the outlook for UK equities is attractive. In fact, we think the UK offers some of the best investment opportunities in developed markets today. The absolute quality of the companies in the investment universe has rarely felt this strong, and UK valuations look much cheaper than many other markets (see below).

We see external validation of this from the increasing number of takeover bids being launched for UK listed companies, from giants like miner Anglo American to minnows like electrical component maker XP Power. The takeover trend extends to other sectors such as retail (Elliott Advisors’ bid for Curry’s, albeit unsuccessful) and homebuilders (Barratt Developments’ merger with rival Redrow).

All these points help to build our confidence in the prospects for the UK equity markets, but two factors in particular are worth noting:

Valuations are compelling versus other markets

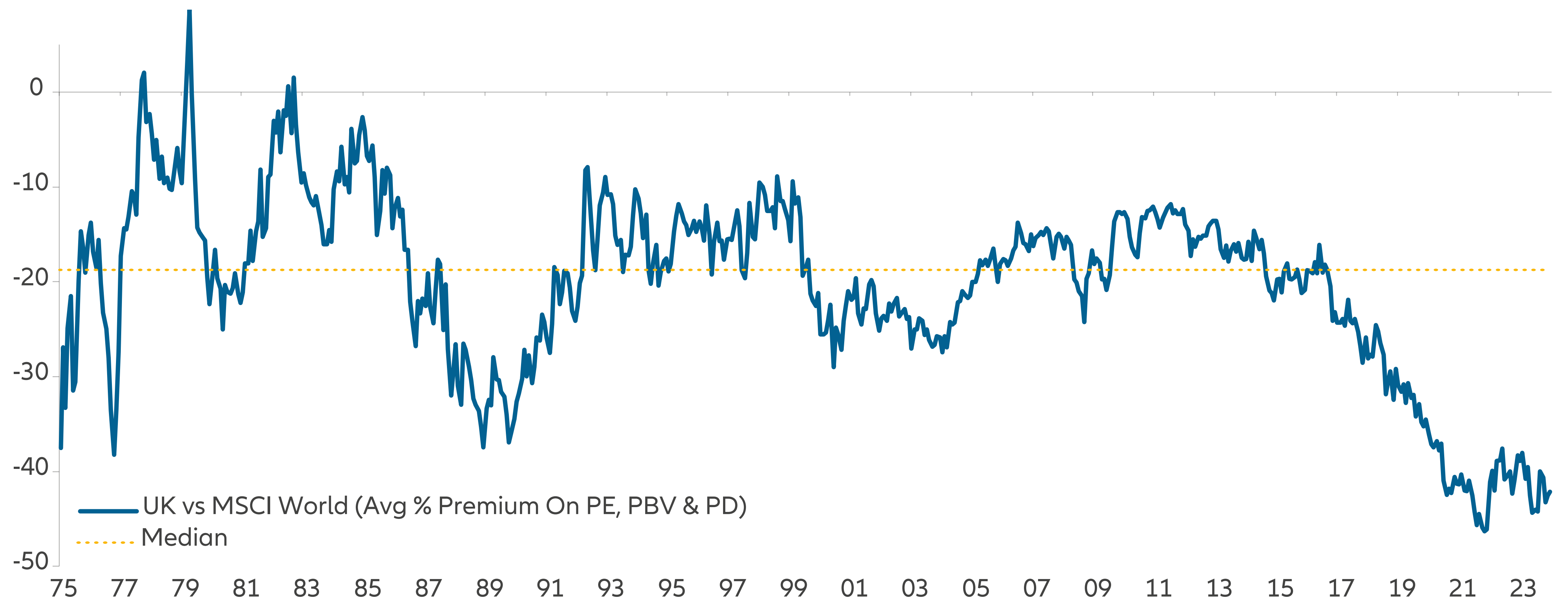

The last few years have seen huge pressure on UK equities, with a material de-rating relative to the world index since 2016 (see Exhibit 2). There are welldocumented reasons for this, including concerns over Brexit, former Labour leader Jeremy Corbyn as a possible prime minister, Covid-19 (which hit the UK hard just as political uncertainty was abating), the war in Ukraine (which impacted the whole of Europe disproportionately), and the market chaos of the Liz Truss government.

Exhibit 2: UK versus MSCI World average valuation premium

Source: Morgan Stanley, January 2024

Flows into UK equities have been negative but sentiment is turning

The UK has witnessed a significant and dramatic outflow of funds from equity-focused investments, creating a prevailing sentiment of negativity across the market. However, there are indications that this sentiment is undergoing a shift (see Exhibit 3), with growing scepticism about the portrayal of the UK as an unequivocal negative outlier.

Things can only get better? Investors in UK equities may have some good reasons for thinking so.

Exhibit 3: Annual flows into UK-focused equity funds (USDbn) split between active and passive funds

Source: BofA European Equity Quant Strategy, EPFR Global, January 2024.