Regulation | ~ 3 min read

Critical thinking on raw materials

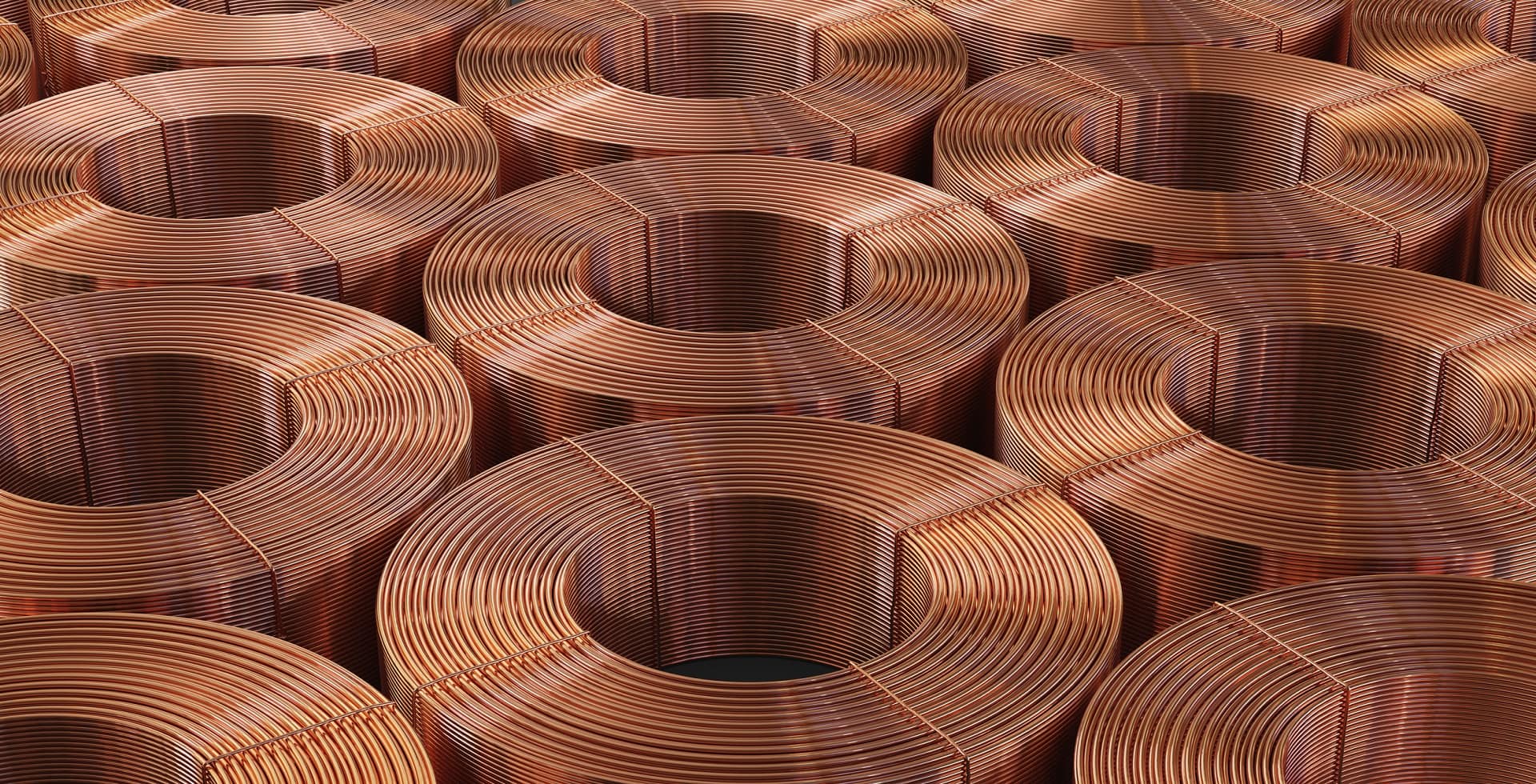

Critical raw materials – such as lithium, cobalt, copper and nickel – are economically and strategically important due to their lack of substitutes. They are essential to the clean energy transition and digital technologies, but global tensions have exposed weaknesses in the supply chain.

Critical raw materials (CRM) are vital for the speed of the clean energy transition because they’re used in solar, wind and electric vehicle technologies. Fuelled by rising demand and rising prices, the market for CRMs doubled in the last five years to USD 320 billion, according to International Energy Agency (IEA) estimates1. With no alternatives to these critical materials they are vulnerable to supply chain risks. Securing their future availability is complicated by the fact that different countries define their own lists of economically-critical materials, and supply is concentrated in only a few countries.

The good news is that current planned critical raw materials projects are expected to meet forecast demand, but what about the longer-term? For renewable energy solutions to support the goal of limiting global warming to 1.5°C by 2030, additional raw materials will be required. With the same IEA report highlighting the existing lack of supply diversity, is there a solution?

Regulating for greater resilience

The goal of the proposed European Critical Raw Materials Act of March 2023 is for the European Union (EU) to secure its own supply of raw materials with less reliance on other countries. This means more than 10% of extraction, more than 40% of processing, and more than 15% of recycling should take place in the EU. For strategic materials – including cobalt, nickel and copper, which have high growth potential and are more complex to produce – the Act aims to reduce reliance on any single country to below 65%.

The proposal also highlights the need to develop a circular economy for minerals to complement the use of new materials. Meanwhile, the European Council has taken a stronger stance, proposing that further targets and the addition of aluminium to the list of materials should be included.

Our take

We welcome the EU focus to build a more resilient CRM supply chain to support the low-carbon transition. But this needs to be complemented by circularity in the use of minerals to minimise negative environmental and social impacts of extraction while meeting market demand.

Look out for our research paper on the circular economy later this year.

Read more from Allianz Economic Research:

“Critical raw materials – Is Europe ready to go back to the future?”