Sustainability | ~ 7 min read

Defence: Your questions answered

In early April, we published our updated defence-related exclusions for most of our Article 8 funds under the EU Sustainable Finance Disclosure Regulation (SFDR).

We recognise different views on armaments’ role in causing or preventing conflict, but we believe a well-governed, well-functioning and resilient European defence and security system is integral to the continent’s socioeconomic development and growth, and indeed to European sovereignty overall.i The finance industry has a critical role to play in shaping this outlook, by engaging both at a policy level on government defence programmes and with individual companies. Given our ongoing discussions with investors, non-governmental organisations (NGOs) and media on this topic, we thought it would be helpful to further clarify the key elements to our approach, in response to some frequently asked questions.

Q. Are you saying the defence sector is sustainable?

A. While the defence industry has a role to play in safeguarding economic and social stability, we think its activities fall short of directly contributing to environmental or social sustainability objectives.

This is why we do not qualify any investments into defence as “sustainable investments”; nor do we assign a Sustainable Investment (SI) share to them. SI share is a core sustainability key performance indicator (KPI) under the EU SFDR. For the avoidance of doubt, our defence exclusions remain unchanged for the strict requirements of Article 9 funds.

The recent changes to our exclusions policy were to avoid companies active in specific defence activities being excluded in general from any funds classified as Article 8 under SFDR. But not excluding a company in general is not the same as actively including it in portfolios. This will be determined by the sustainability KPIs of the fund and ultimately the portfolio manager’s decision.

Our stance regarding qualification of defence investments is consistent with several key EU initiatives – including the removal of the description of the defence industry as “socially harmful” and the rejection of its inclusion in a social taxonomy in 2022ii – and with the aims of the European Commission’s “White Paper for European Defence – Readiness 2030”.iii

Q. Are you including defence in "sustainable funds"?

A. The definition of “sustainable funds” has been further clarified by recent European Securities and Markets Authority (ESMA) guidance for funds naming. We welcome this clarification, which will move the market away from primarily using the SFDR reporting requirements of Articles 8 and 9 as a proxy for fund labelling. ESMA guidelines on using environmental, social, and governance (ESG) terms in fund names clarify that conventional defence is not part of the baseline exclusion criteria for a “sustainable fund”.

We recognise that client expectations for different Article 8 funds will vary depending on the funds’ exclusion criteria and names. The application of our defence-related exclusions recognises and respects these different expectations. Our decision to lift the exclusion of firms that exceed a 10% revenue threshold for military equipment and services and those that undertake nuclear-related activities inside the Non-Proliferation Treaty (NPT) applies to most of our Article 8 funds. Our Article 9 classified funds retain the stricter defence exclusions.

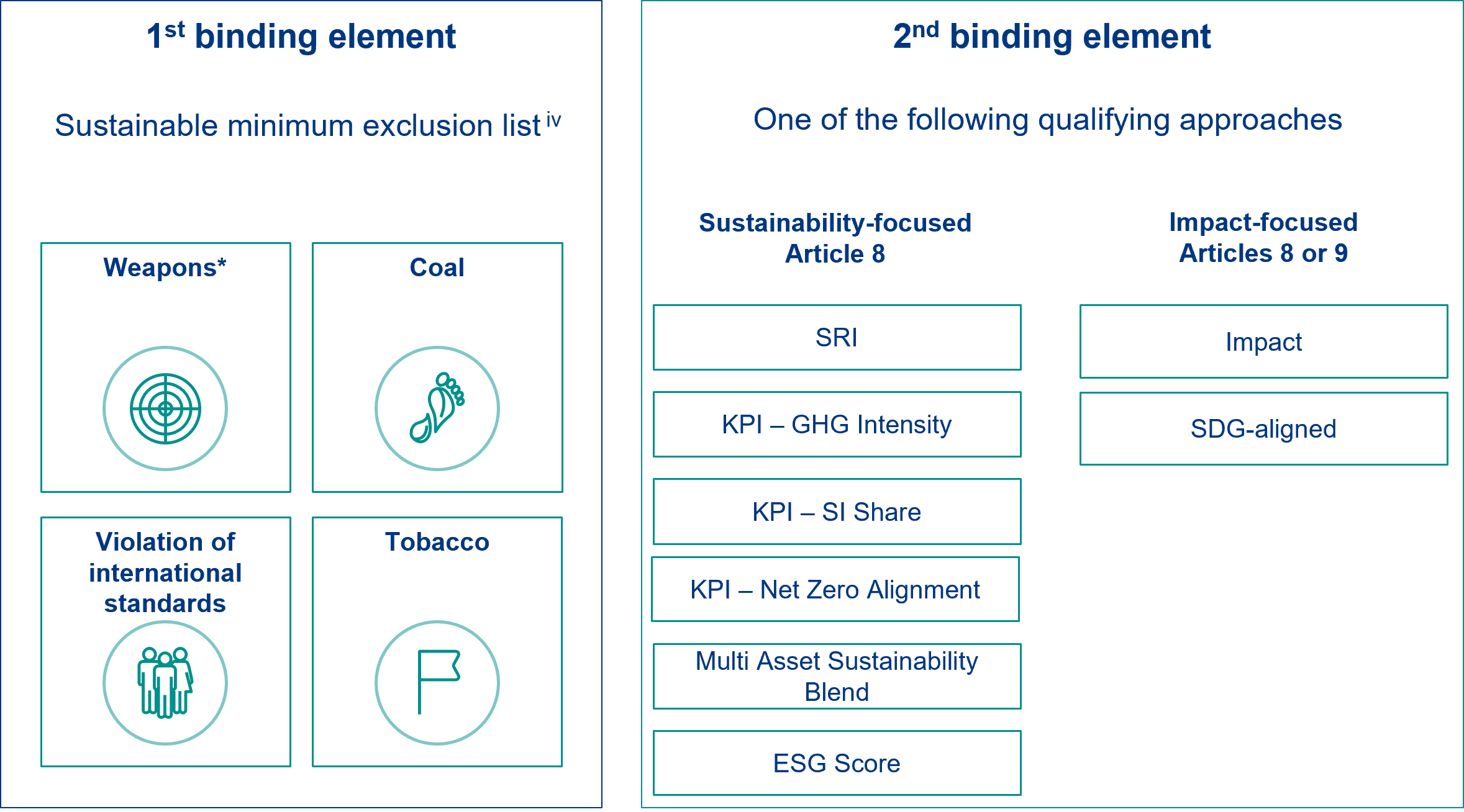

Our two binding elements approach to sustainability-focused and impact-focused funds is part of our commitment to transparency

* See our blog post for full details of recent changes to our exclusions policy.

Q. Have you abandoned your defence exclusions?

A. No. We have removed two criteria related to our fund range specific to the scope of Article 8 under EU SFDR. We retain the existing criteria for select Article 8 offerings and all Article 9 funds. The two criteria removed – the 10% revenue threshold for military equipment and services, and nuclear-related activities inside the NPT – are particularly strict on Western defence companies. Major Western defence development and procurement is undertaken primarily through major, publicly listed defence companies, compared to state-owned entities for several other major economies. Many of these major Western defence companies satisfy other sound ESG screening, although we continue to push for further improvements.

We have made no changes to our exclusion approach for depleted uranium, white phosphorus and banned weapons for all our Article 8 and 9 funds, based on our sustainability conviction. In addition to controversial/banned weapons, both depleted uranium and white phosphorus can have indiscriminate and long-lasting negative impacts on environments and communities, and there are less harmful alternative products. Neither is categorised as a banned weapon, but we felt introducing a revenue-based threshold would be disingenuous in terms of mitigating harm.

Q. Why are you changing your defence criteria now?

A. We undertake annual reviews of our exclusion criteria to ensure that our investment offering is relevant to clients. We initiated a review of defence-related exclusion criteria for Article 8 and 9 funds last autumn. We closely reviewed changing attitudes towards defence in Europe and engaged with key stakeholders.

At this inflection point for defence spend commitments by European NATO members, we believe there is a significant opportunity for private finance to guide the defence industry on activities to be financed and help shape disclosures, supply chain transparency and innovative financing structures. Given stretched fiscal budgets in Europe, aligning policy, regulations and the expectations of a wider investor base will be critical in ensuring the smooth financing of a resilient European defence system.

ii Platform on Sustainable Finance’s report on social taxonomy | European Commission

iii Commission unveils the White Paper for European Defence and the ReArm Europe Plan/Readiness 2030

iv Allianz global investors, March 2025. Private markets use the allianz esg framework rather than allianzgi’s sustainable minimum exclusions policy. for illustrative purposes only. exclusions apply to direct investments. sri: socially responsible investing. kpi: key performance indicator. ghg: greenhouse gas intensity. si: sustainable investment. esg: Environmental, social and governance. AllianzGI supports the United Nations Sustainable Development goals (SDG). Please note that “Sustainability-focused” and “Impact-focused” are Allianz Global Investors product categories. Reference to a fund being within them does not indicate that fund has a “Sustainability Focus” or “Sustainability Impact” label under the United Kingdom’s Sustainability Disclosure Requirements (SDR).

v These include biological and chemical weapons, cluster munitions, anti-personnel mines and nuclear activities outside the NPT.