Biodiversity | ~5 min read

Setting the foundation for safer cosmetics

Demand for cosmetics and beauty products has led to almost uninterrupted market growth over the last two decades. But growth is accompanied by greater regulatory scrutiny over the potential health impacts.

The global cosmetics and beauty market size is projected to reach USD 556 billion by 2032 – up from approximately USD 335 billion in 2024.1 Three standout trends are behind this growth: rising global wealth, the emerging segments of natural products, male grooming and AI-driven personalisation (eg, virtual colour matching of skin tone), and growth in online sales – over 27% of all global beauty product sales are online.2

Most skincare products are harmless, but certain ingredients may cause allergies or dermatological issues in some users. This has led to calls for restrictions on ingredients. Ensuring product safety and transparency of ingredients is vital for consumer health protection and regulatory compliance.

Saving face

Industry oversight is gaining momentum, particularly around product labelling and Good Manufacturing Processes – an aspect of quality assurance for production and control of medicinal products. Established European Union (EU) regulation on cosmetic product safety requires a product safety report before launch.3 Chinese cosmetics companies must be qualified through the China Cosmetic Registration and Filing process. However, the US is less strict, with generally no requirement for the pre-approvals of beauty products of the kinds that are needed for foods and medicines by the Food and Drug Administration.

Meanwhile, debates are ongoing over restricting per- and polyfluorinated alkyl substances (PFAS) which are used in products such as water resistant make-up and hair colourants. PFAS are banned in Denmark and France4 with the possibility of other EU countries following. The European Chemicals Agency is already leading a proposal to restrict use of PFAS across the EU.

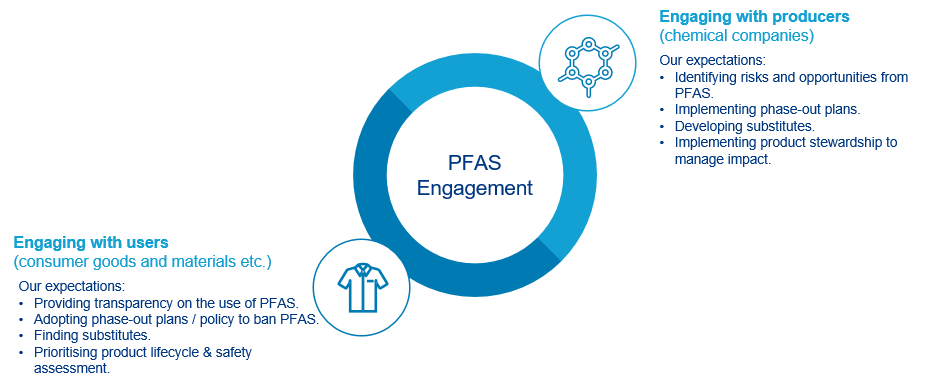

We have developed a specific engagement approach on PFAS – see diagram.

To manage the risks and capture opportunities, in principle, we expect companies in the PFAS value chain to set plans to phase out PFAS gradually as well as finding substitutes.

Time up for toxic chemicals? | AllianzGI, April 2024

Role of investors

As the market continues to grow, further regulation is expected, and investor awareness of the key issues is important. Alongside our PFAS engagements with investee companies, our action on this issue includes:

- Monthly monitoring of sector controversies screenings and inclusion of controversies under “business behaviour” in our Household and Personal Products sector framework, which provides a sustainability profile of this entire sector.

- Lowering a company’s business behaviour score. For example, earlier this year due to evidence of contaminants in cosmetic and personal hygiene products, we significantly lowered a company’s score in this area, ahead of our data provider doing so.

- Assigning high materiality status in our sector framework to the health impacts of cosmetics and carrying out a deep-dive analysis with targeted engagement questions for use in dialogues with investee companies.5

These are just some of the ways that investors can help ensure that the sector maintains a healthy looking “glow”.

1 A compound annual growth rate of 6.64% according to Fortune Business Insights, Cosmetics Market Size, Share, Growth, & Industry Report, 2032

2 L’Oreal 2023 Annual Report

3 European Commission, Legislation - Public consultation on cosmetics products, 2025

4 ChemTrust, PFAS ban passed in France, 2025