The China Briefing

Building your dream

Please find below our latest thoughts on China:

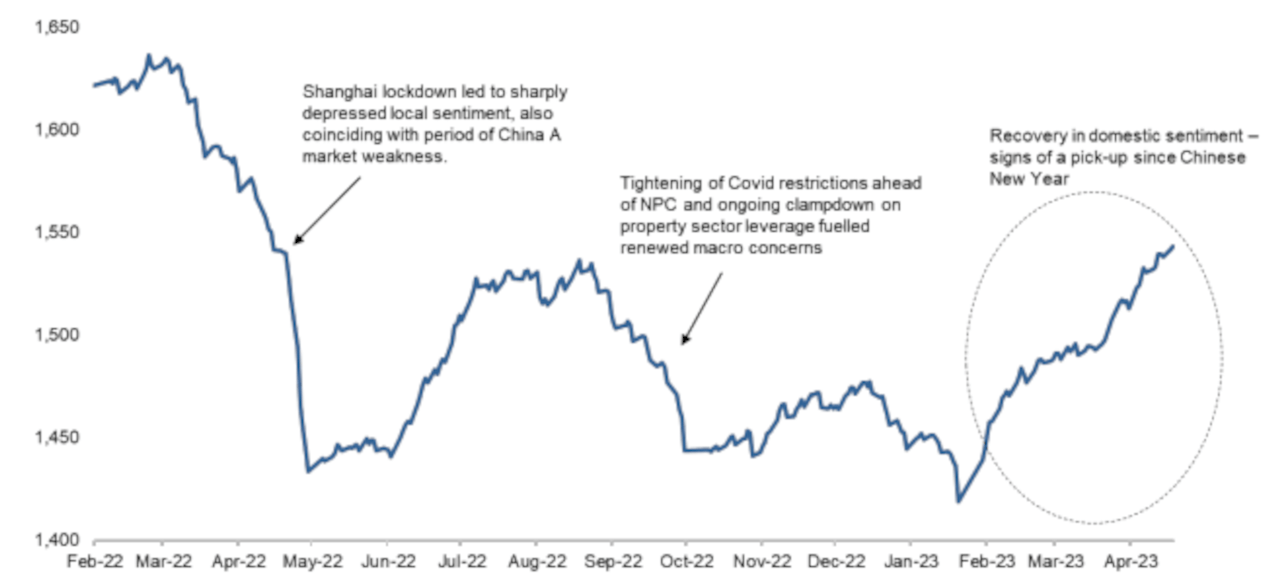

- There have been signs of a reawakening of animal spirits in China’s A-share markets in recent weeks.

- The MSCI China A Onshore Index is up by around 5% over the last month.1 This has been accompanied by rising daily turnover as well as a notable pick-up in margin transactions – a useful real-time indicator of domestic sentiment.2

- There have been several catalysts, mostly based around the macro environment.

Chart 1: Margin trading outstanding balance in China A-Shares (CNY billion)

Source: Wind as at 18 April 2023

- China’s credit growth started to accelerate decisively in February and last week’s figures for March continued this trend, delivering an important signal that easier monetary policy is finally getting some traction in the real economy.

- The outlook for the property sector also continues to improve, albeit from a very low base.

- Daily property sales volume in 30 major cities rose 44% year-on-year in March after averaging a 13% decline in January and February. Prices in a majority of big cities are also rising again, and price expectations among households have turned positive.3

- The Q1 GDP growth of 4.5%4, announced this week, also beat expectations and has resulted in some sell-side houses raising their full-year numbers again. Overall, we typically see forecasts in the range of 5.5% to 6.5% for 2023 GDP compared to China’s official target of “around 5%”.

- However, looking behind the headlines, the recovery is quite uneven. The majority of the Q1 growth came from a rebound in services, as areas such as restaurants, catering, entertainment and domestic tourism surged once the Covid lockdowns ended.

- More broadly, though, the risk appetite in consumer and manufacturing sectors remains subdued. A central bank quarterly survey of 20,000 households in 50 major cities reported that 58% of households are planning more saving (rather than more consumption or more investment).5

- This also helps to explain the distinct shift in the tone of government policy supporting private enterprises, such as the media coverage on Alibaba founder Jack Ma’s return to China for the first time in more than a year. Clearly a key goal is to restore private sector business confidence, which was badly bruised during the Covid lockdowns.

- While this will inevitably take some time, our view is that a more broad-based economic recovery will unfold in coming months.

- The upcoming Golden Week holiday in the first week of May will be a good test of consumer confidence. It is the first multi-day holiday since January’s Covid “exit wave”. And as international travel is still quite restricted due to barriers such as flight shortages, this should be a boon to domestic tourism.

- Indeed, the early signs are promising. Domestic bookings on Qunar – China’s equivalent of Skyscanner – have already exceeded 2019 levels.6

- Another big event in China in recent days has been the Shanghai auto show, one of the biggest events of its kind in the world, and the biggest in China since 2019.

- The event has served to underline how China is leading the way in electric vehicles (EVs). While a hall showing off EVs from dozens of Chinese companies was packed with visitors, another area nearby with gasoline-powered cars by foreign brands barely got a look in.

- Volkswagen were even moved to make a bold forecast that, within two years, half the cars sold in China – the world’s largest auto market – will be electric, up from only 6% in 2020.7

- Underlining the increasingly mass-market appeal of EVs, auto manufacturer BYD (originally standing for “build your dreams” and made famous globally by Warren Buffet’s investment) showcased its latest EV model dubbed the “Seagull”. It will sell from around only USD 11,000.

- As well as facing pricing competition, foreign brands may also struggle to compete with some of the unusual local designs and branding. The wheels are nearly at the corners for many Chinese models.

- And while the branding of a recent new entrant to the UK market might sound unusual – the “Ora Funky Cat” made by China’s Great Wall Motors – you know you’re making progress when you get to be on Top Gear: Ora Funky Cat First Edition - long term review 2023 | Top Gear.

1 Source: Bloomberg, 18 April 2023

2 Source: Wind, 18 April 2023

3 Source: Gavekal, 11 April 2023

4 Source: National Bureau of Statistics, 18 April 2023

5 Source: Gavekal, 11 April 2023

6 Source: HSBC, 18 April 2023

7 Source: The New York Times, 19 April 2023