The China Briefing

Changing the Consumer Mindset

Having recovered from Liberation Day tariff-induced shock, China markets have been in wait-and-see mode.

Please find below our latest thoughts on China:

- Since recovering from the tariff-induced volatility post “Liberation Day” in early April, China’s equity markets have gone into something of a lull.

- To an extent this has been caused by uncertainty over the direction of ongoing China-US negotiations, and the prospects of a more substantive trade deal or otherwise. We are around two weeks into the 90-day discussion period, so this uncertainly may last a while yet.

- The other key unknown is to what extent China’s government policy will be ramped up to offset the weakness in exports, a key driver for the economy in recent years and an important contributor to China achieving its closely watched GDP growth target.

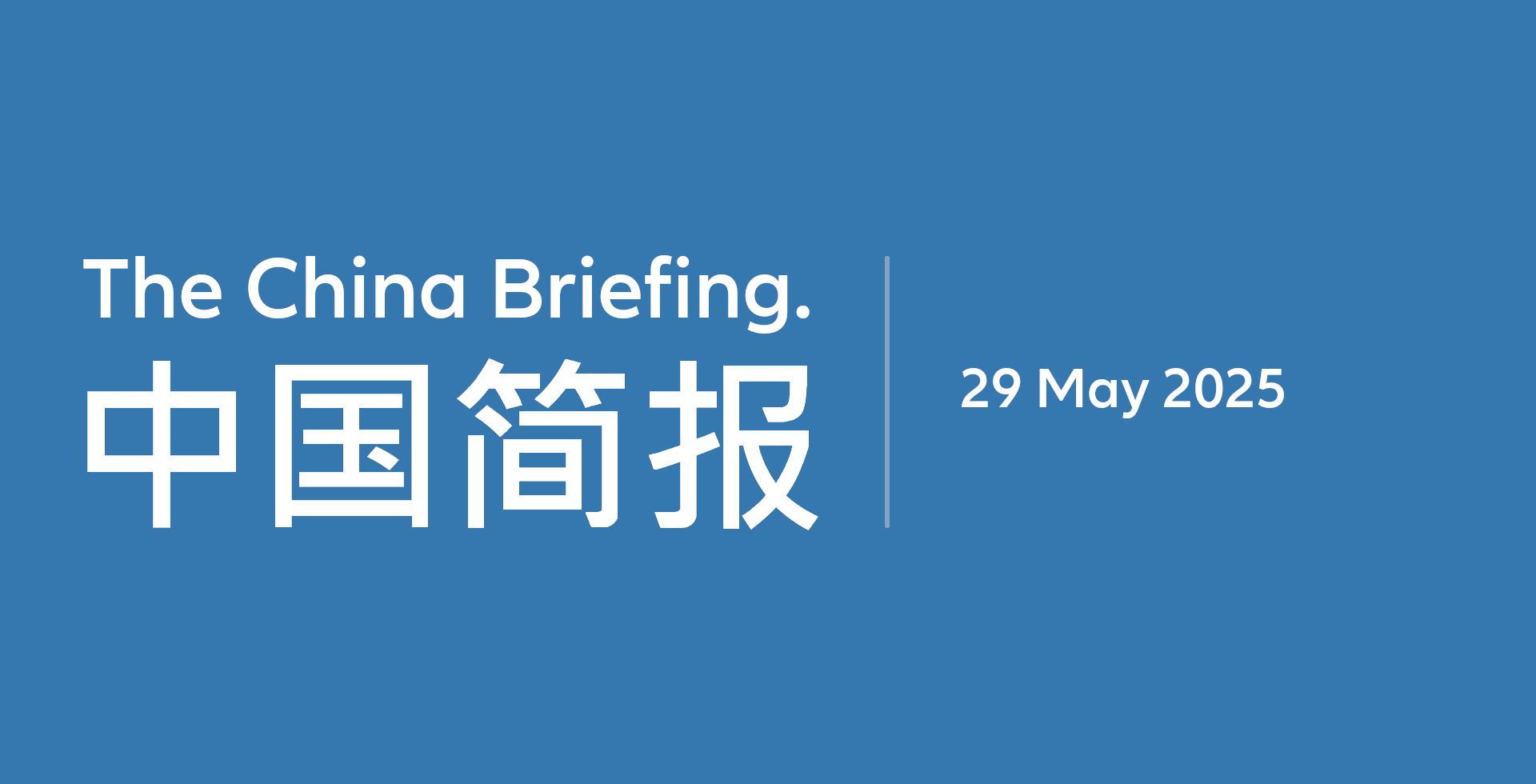

Chart 1: China Consumer Confidence Index

Source: Bloomberg, Allianz Global Investors, as at 28 February 2025.

- There are a number of factors at play in our view, not least that the extent of the downturn in exports – and therefore the degree of further government stimulus required to offset this with stronger domestic demand – is challenging to gauge.

- Nonetheless, given that policymakers have reiterated this year’s growth target, of around 5%, several times since “Liberation Day”, it is in our view a question of when, not if, we see further policy measures.

- This is especially the case given that the latest housing market data was modestly weaker, and showed an ongoing, albeit mild, decline in property prices.

- A key issue is rebuilding consumer confidence, which took a major hit in 2022 as a result of Covid policies, a weaker employment outlook and the downturn in the property market.

- China’s consumer confidence index is based on a scale of 0 to 200, where 200 indicates extreme optimism, 0 extreme pessimism, and 100 neutrality.1

- In the years before Covid, China’s consumer confidence index typically tracked a level close to 120. The latest reading is 88.4, which at least marks a pick-up from the low point last year.2

- This weaker confidence is reflected in how spending patterns have changed in recent years, resulting in a surge of household bank deposits to more than USD 20 trillion.3 Mobilising these resources will be an important part of China’s domestic demand recovery.

- Changing the consumer mindset and encouraging a more “risk-on” allocation of capital is no easy task. This explains why the private sector, which accounts for around 90% of employment in China, is getting a serious amount of political attention these days.

- As part of this, tech and AI are featuring prominently. Earlier this month, the People’s Daily published an article, “How did China become cool?”. A high-profile trip by American YouTuber “iShowSpeed” (38 million followers) showed how he got to dance with a humanoid robot, ride in a flying taxi and order KFC via delivery drone.

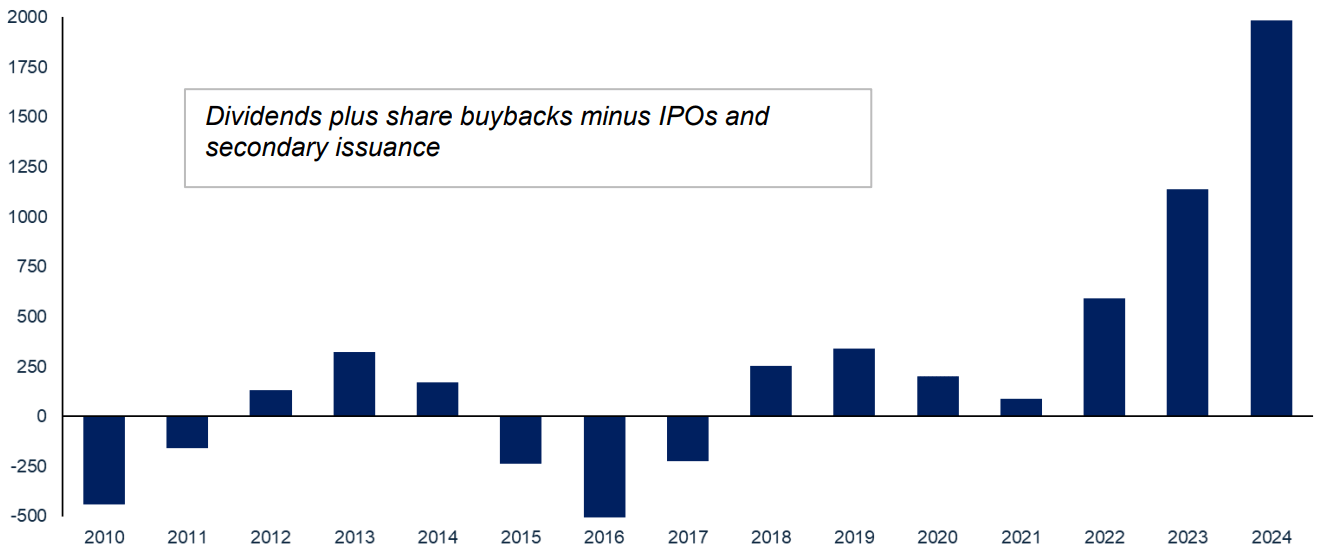

Chart 2: China A-Shares Net Liquidity (RMB Billion)

Source: Wind, Gavekal, as at 31 December 2024

- While the timing of a recovery in the feelgood factor within China is hard to predict, our view is the direction of government policy will continue to be supportive for equities.

- As part of this, an important structural factor helping to underpin markets has been a major increase in onshore market liquidity.

- Historically, a heavy supply of equity in China A markets has been a structural drag on share prices. However, that dynamic has changed significantly.

- In previous years, the return of cash to shareholders (via dividends and share buybacks) has been around the same as total equity supply (IPOs and secondary issuance) in China A markets.

- In 2024, however, the “net liquidity” surged to RMB 2 trillion (USD 275 billion).4 Both sides of the equation improved.

- The majority of cash returned to investors was in dividends. However, share buybacks also doubled in 20245 as regulators nudged companies and the People’s Bank of China (PBoC) launched a refinancing programme.

- Similarly, there was a clampdown on equity issuance, which previously had averaged around 1-2% of total market capitalisation.6

- Combined with the strong state support for domestic equities in the form of direct buying of ETFs, we believe the downside in China A-shares remains quite limited.

1 Tradingeconomics.com, 28 February 2025

2 Bloomberg, 28 February 2025

3 Goldman Sachs, 14 April 2025

4 Gavekal, 25 May 2025

5 Gavekal, 25 May 2025

6 Wind, 31 December 2024